More Indian Distressed M&A Deals on the Horizon

Kroll provides answers to key questions and insights on M&A trends as distressed dealflows in India increase and opportunities open to global investors

HONG KONG,Oct. 29,2018 -- Kroll,a division of Duff & Phelps,a global leader in risk mitigation and response solutions,and Mergermarket,the leading independent M&A intelligence service,today released Distressed M&A in India: A risk worth taking? This 15th issue in Kroll's Spotlight Asia series provides insights and answers to the questions on the minds of investors contemplating distressed asset opportunities in India.

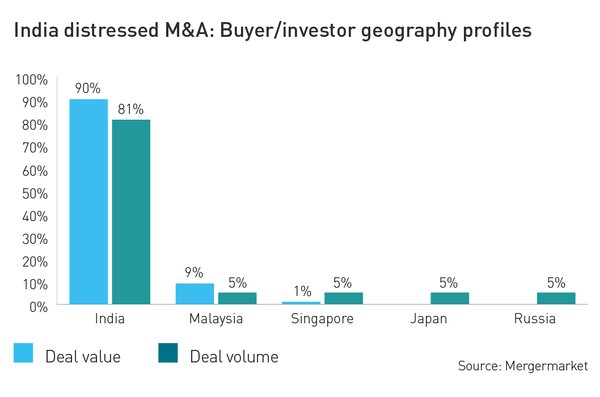

India distressed M&A: Buyer/investor geography profiles

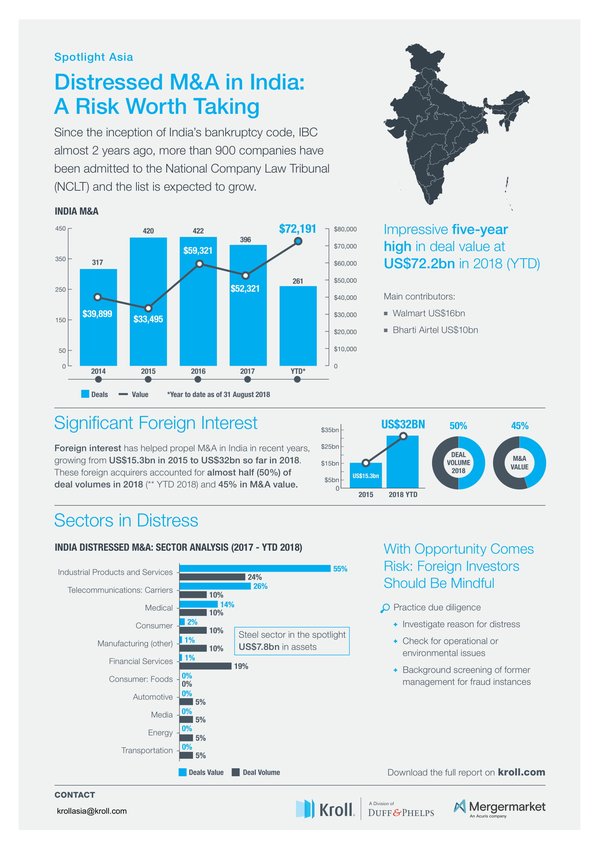

Infographic Distressed M&A in India: A risk worth taking?

Since the inception of India's Insolvency and Bankruptcy Code (IBC) more than two years ago,distressed M&A* values in India have totalled US$14.3bn and a promising pipeline of opportunities continues to build. What has been unclear is which sectors will provide the most opportunities for investors-- particularly international funds and corporations-- and which best practices should be adopted to navigate the oftentimes complex Indian market.

In addition to a full market analysis of distressed M&A trends,the publication features expert tips and guidance from Tarun Bhatia,Managing Director and Head of South Asia,Kroll and Varun Gupta,Managing Director and India Country Leader at Duff & Phelps,on navigating the market and factors to consider before and after investments have been made.

Describing the evolution of the IBC,Bhatia says,"Initially,there was concern that the Indian Insolvency and Bankruptcy Code (IBC) would lack firepower; however,while there have been some hits and misses,on the whole,the IBC has been very much a positive for the Indian market and is opening the door to a new investment class: distressed assets."

Bhatia continues: "The risks for investing in these distressed assets are not much different than those in any other M&A deal. As long as you have an effective strategy and the right people and resources in place,distressed opportunities can prove to be very valuable pursuits."

Elaborating on the steps necessary to mitigate distressed asset risks,Gupta explains that a good place to start is by analysing the genesis of the distress. "In some cases,this may simply be business risks playing out. For example,the company or asset may have been over-leveraged,anticipating a demand-supply cycle that didn't materialize. It is not that the asset itself is necessarily 'bad' but rather that certain unfortunate circumstances led the asset into turbulent waters. In such cases,the right investor with the right resources may be able to buy the asset and turn around operations."

Bhatiaadds,"winning bids for these assets is not just a matter of putting the most money on the table. Courts are deciding many of these deals based on the best resolution plans: developing a believable blueprint to turn around the business."

Gupta has an additional word of advice for financial investors:"Capital is just one piece of the puzzle. Expertise and best minds to build and scale the company is another,as well as performing due diligence to root out any other risks."

Key trends in this market that are further explored and analysed in the publication include:

M&A totals and foreign interest: Indian M&A has had an impressive year,with deal values launching to a five-year high at US$72.2bn. Foreign interest has helped propel M&A in India in recent years,with foreign investment M&A in India more than doubling from US$15.3bn in 2015 to US$32bn so far in 2018.

Distressed M&A: Since 2017,distressed M&A values in India have totalled US$14.3bn,12% of total M&A value. Two-thirds of distressed transactions were classified as "direct" where the asset itself was distressed,while the remaining one-third of "indirect" transactions resulted in a sale because the parent organization was in distress.

Steel sector in the spotlight: Stressed steel assets have accounted for significant deal value. Through three acquisitions,US$7.8bn in assets have changed hands since 2017,accounting for 55% of distressed asset values and 14% of distressed asset volumes.

Other distressed sectors: Since 2017,distressed deals have focused predominantly (by value) on the industrial products and services (55%),telecommunications (26%) and medical (14%) industries. Significant deal volume,however,was seen in the industrials (24%) and financial services (19%).

Investor profile: Indian investors accounted for 90% of distressed deal value and 81% of deal volume. Foreign buyers have played a more silent role thus far; however,PE majors such as KKR,Blackstone and other international firms have indicated interest.

The full newsletter is available for viewing here:

http://bit.ly/2CG186P

*For the purposes of this analysis,"distressed M&A" is defined as any transaction involving sale of a company directly in distress or where the transaction was carried out where the parent group/company was in distress.

About Kroll and Duff & Phelps

Kroll is the leading global provider of risk solutions. For more than 45 years,Kroll has helped clients make confident risk management decisions about people,assets,operations and security through a wide range of investigations,cyber security,due diligence and compliance,physical and operational security,and data and information management services. For more information,visit www.kroll.com.

Duff & Phelps is the global advisor that protects,restores and maximizes value for clients in the areas of valuation,corporate finance,investigations,disputes,compliance and regulatory matters,and other governance-related issues. We work with clients across diverse sectors,mitigating risk to assets,operations and people. With Kroll,a division of Duff & Phelps since 2018,our firm has nearly 3,500 professionals in 28 countries around the world. For more information,visit www.duffandphelps.com.

About Mergermarket and Acuris Studios

Mergermarket is an independent Mergers and Acquisitions (M&A) intelligence service with an unrivalled network of dedicated M&A journalists based in 62 locations across the Americas,Europe,Asia-Pacific,the Middle-East and Africa. Unlike any other service of its kind,Mergermarket specializes in providing forward-looking origination and deal flow opportunities integrated with a comprehensive deals database-- resulting in real revenues for clients. Visit www.mergermarket.com.

Photo - https://photos.prnasia.com/prnh/20181025/2279247-1-a

Photo - https://photos.prnasia.com/prnh/20181025/2279247-1-b

Logo - https://photos.prnasia.com/prnh/20181025/2279247-1logo