The Ticking Time Bomb of Bad Data and AML Compliance

PITTSBURGH,Pa.,April 15,2019 --Poor quality data poses the biggest challenge to successful anti-money laundering (AML) compliance screening. In a recent survey,63% of compliance professionals reported lacking confidence in their data. The irony is that compliance officers have no control over the quality of their data,yet are responsible for the consequences of bad data- namely,too many false positives,unnecessary due diligence,and the ultimate risk of missing a true hit,which can lead to huge fines and reputational damage.

To combat data issues and empower compliance professionals to take control of their results,Innovative Systems announces FinScan®Premium*,an AML screening platform developed from artificial intelligence and algorithmic learnings gained from scanning 100 billion+ data points annually and five decades of experience in improving data. The result is data that is compliance-ready for watch list screening.

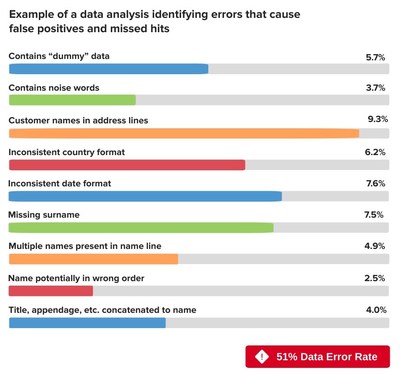

FinScan Premiumaddresses data quality problems such as duplicates,inconsistent formats,dummy data,and customer names misplaced in non-name fields,thereby reducing false positives and the risk of missing true hits by an average of 50%. Watch video

Many compliance departments must rely on data quality controls in the organization’s enterprise systems,but those systems typically do not deliver data that is good enough for an effective AML compliance screening program.

"Increasing volumes and quality issues within data make sanctions screening a challenge," said Martin Schofield,AML compliance and financial crime expert. "FinScan Premium's ability to reduce risk and false positives through clean data means that valuable compliance resources can be dedicated where they are truly needed. It allows compliance professionals to take control of their data,and thereby the overall success of their compliance programs."

Randal Skipper,President,Worldwide Field Operations at FinScan said,"Compliance officers are amazed when we show them actual examples of their data errors that are creating false positives and potential risk. This happens even with data quality controls in their enterprise systems. Their data might be fine for other purposes,but it's nowhere near good enough for an effective compliance screening program. To help the compliance community address the source of this problem,we are announcing The FinScan Challenge."

Click here to take the FinScan 'False Positive' Challenge

FinScan's False Positive Challenge provides an opportunity for compliance leaders to see how optimizing their data for compliance screening drastically reduces false positives and associated risk and cost. www.finscan.com

*Premium is a bundle of software modules from Innovative Systems' FinScan and Enlighten®product lines.

Photo - http://cusmail.com/res/2023/07-24/14/f782cb108ba82a56303db3ecedc88784.jpg