Kantar, Worldpanel Division Launch: What to expect in Festive 2020

JAKARTA,Indonesia,Sept. 17,2019 -- Ramadhan holds a very special place in the hearts of most Indonesians,with most consumers looking forward to this festive season. Each year's festive season creates an uplift in FMCG market performance,thanks to several unique factors such as the combination of monthly salary and THR bonus (13th month salary). This year,many moments tone up the festive season,such as the presidential election that happened during 2019 Pre-Festive period,and a longer school holiday from Eid-Al-Fitr to the new academic year. Fanny Murhayati,Marketing Director of Kantar Indonesia,explained,"The momentum of Ramadhan provides a great opportunity to grab consumer's heart. This is reflected that the uplift in this year's festive were captured in all consumer's segments (upper,middle and lower). This year,Ramadhan was also able to uplift higher consumption than the previous year."

Venu Madhav,General Manager of Kantar Indonesia,Worldpanel Division,highlighted,"There are several key trends to win in Festive 2020,which include how to maximize the moment and offer promotions that attract more consumers; how the role of bigger pack-size will help gain more business growth; how gifting has always been a popular trend in this holy season,and how to win consumer hearts through digital world during Festive."

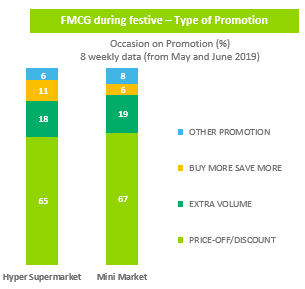

1. Attracting consumer through promotions in minimarket

Not only during festive,in overall minimarket always attract more consumers by offering more aggressive consumer promotions. In this year's festive season,minimarket enjoyed more than 10% value growth. The most typical promotion offered in this channel are "price off","buy more save more" and "extra volume". Having these promotions enables better access to middle and lower SES to make their purchases in modern trade channels such as minimarkets.

Types of promotions and their performance based on the number of occasions during the festive period.

2. The role of bigger pack-size during festive

Different pack-sizes capture different consumers behavior. Consumers indicates buying bigger size (upsizing trends) for these categories e.g. biscuit and CSD.

Biscuit

The driver of the biscuit market growth this festive,is driven by Festive Items (Can and Jar format). These formats can recruit more new buyers especially compared to last year's Festive.

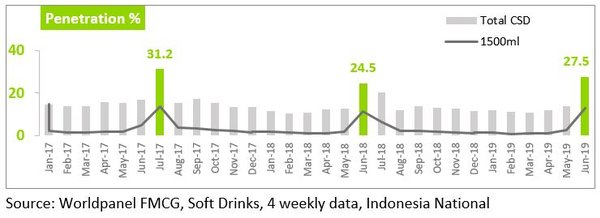

Carbonate Soft Drink category

Larger pack was also driving soft drink uplift performance. Communication to increase the brand awareness is also adding the success story of the top brand performance.

Uplift performance of the Total CSD category in terms of penetration.

3.Give more gifting

The gifting trend has always been a popular trend or tradition during Indonesian festive season. The value of the gifting occasion in this year's Ramadhan has grown above the level from the previous year. This higher level is driven mainly by necessity categories.

The top gifting categories in the 2019 Festive period.

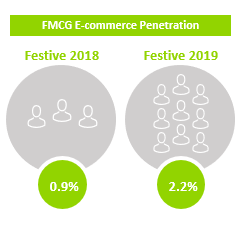

4.Winning in Online

Indonesian consumers are living in a multi-screen environment: Winning the consumers' hearts through e-commerce is also one of the key strategies during festive,as it is showing significant growth. Promotion isn't the key main driver of e-commerce,but rather it is convenient. As the Indonesian lifestyle is becoming more convenience-oriented,investment in e-commerce could be a great growth driver especially during festive periods.

Based on Kantar,Worldpanel Media data,60% of Indonesian households are using the internet and more people are exposed to online experiences. Moreover,during festive only,e-commerce has achieved a significant penetration of 2.2%,growing from last year's 0.9%.

FMCG E-commerce penetration in Indonesia in 2019 compared to 2018.

About Kantar: Kantar is the world's leading data,insights and consulting company.We understand more about how people think,feel,shop,share,vote and view than anyone else. Combiningour expertise in human understanding with advanced technologies,Kantar's 30,000 people help the world's leading organisations succeed and grow.

Notes to editors: These findings are based on Worldpanel FMCG data. In Indonesia,Kantar monitors in home and also out of home consumption,in the FMCG front.We track household purchases of over 90 different FMCG categories across food and non-food,every single week. Our in home data represents 53 million of Indonesia Urban and Rural Household population.Our out of home data represents 29 million of Indonesia Urban household population.

For further information,please visitus at and follow our twitter

http://twitter.com/K_Worldpanel

http://www.kantarworldpanel.com/id

http://www.kantarworldpanel.com/global

http://www.kantar.com/

https://www.linkedin.com/company/kantar-worldpanel/

Photo - https://photos.prnasia.com/prnh/20190916/2581585-1-a?lang=0

Photo - https://photos.prnasia.com/prnh/20190916/2581585-1-b?lang=0

Photo - https://photos.prnasia.com/prnh/20190916/2581585-1-c?lang=0

Photo - https://photos.prnasia.com/prnh/20190916/2581585-1-d?lang=0

Logo - https://photos.prnasia.com/prnh/20190611/2492962-1logo?lang=0