Collaborating with 6 Indonesian banks, PrivyID provides contactless credit card application solution

JAKARTA,Indonesia,Aug. 13,2020 -- PrivyID,Indonesia's first legally binding digital signature provider,becomes the only digital signature provider that succeeded in passing Bank Indonesia's regulatory sandbox program. PrivyID's success is attributed to its capability of integrating their digital signature technology with the online credit card application system of six prominent consumer banks in Indonesia,namely Bank Mandiri,BRI,BNI,BNI Syariah,CIMB Niaga,and Bank Mega. Within a year,this collaboration has successfully improved online credit card application experience for over 50 thousand customers.

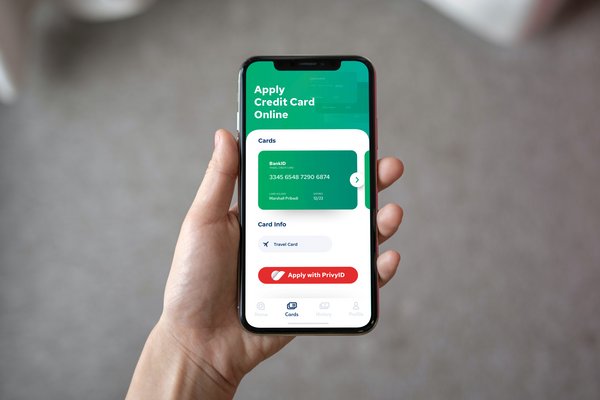

An illustration of online credit card application using PrivyID's digital signature.

PrivyID has also been registered as Financial Technology Support Provider at Bank Indonesia since 2018. Bank Indonesia's regulatory sandbox itself was developed as a framework to enable startups and other innovation providers to conduct live experiments within a controlled environment under Bank Indonesia's strict monitoring and evaluation on their innovation,products,services,technology,and business models. Startups who passed this program are deemed to have appropriate products or services that are safe to be used by the wider population.

Marshall Pribadi,PrivyID's founder and CEO,said,"We are honored to have the opportunity to collaborate with six banks and assist them in running Indonesia's digital economy."

He also expressed his concern about the importance of having a financial solution that is still accessible without having to have physical meetings amidst the current pandemic.

"Digital signature is as legally binding as a traditional signature," he explained.

Marshall continued,"By using digital signature on online credit card application,customers no longer need to go to public spaces,such as malls,to sign up for a credit card membership. Digital signature provides a viable contactless solution for financial service providers".

Apart from bearing a safer health protocol,digital signature implementation on online credit card application also resulted in a higher rate of satisfaction among customers. Based on a survey by Macromill Southeast Asia,96% of respondents who have tried using digital signature on their credit card application find that the digitized process is easier compared to the manual process.

Moreover,the majority of respondents also felt that the process is more secure because their personal information is directly integrated to the bank without having to go through a third-party. High level of convenience and trust among customers are of course among the most important factors to push the potential for the growth of credit card transaction volume in Indonesia.

Hardian Chandrakusuma,Senior Manager Card Product Management Bank Mandiri,"PrivyID has successfully helped Bank Mandiri in improving our operational and business process for our credit card products."

This condition is reflected from the result that Bank Mandiri acquired during their time engaging with PrivyID in Bank Indonesia's regulatory sandbox program. "Our average volume of applications grows three-fold compared to our existing acquisition model. Additionally,we are also grateful that PrivyID's digital signature could enable us in reducing face-to-face meetings for credit card application during the COVID-19 pandemic," he added.

Contacted separately,Riski Aji,Business Analyst BRI,also expressed a similar satisfaction. "We trust PrivyID's solution and services. PrivyID has assisted BRI in providing a digitized financial service that is both more reliable and easier for our customers,all the while maintaining a high prudential",he concluded.

About PrivyID

PrivyID (PT Privy Identitas Digital) is Indonesia's first digital identity and legally binding digital signature solution provider. They are the first Regulatory Technology (Regtech) startup to get official recognition from the Ministry of Communication and Information Technology of the Republic of Indonesia as a certified electronic signature provider. PrivyID is also the first and only Indonesian company to become a member of the FIDO Alliance,an international industry association whose mission is to create global authentication standards.

Since its founding in 2016,PrivyID has been trusted by more than 6,8 million users and 507 companies in Indonesia,including five out of seven Book IV Banks with core capital of over 30 Trillion Rupiah and other leading companies such as Telkom,XL,Indosat,Unilever Indonesia,BCA Finance,Gramedia,Akulaku,and Kredivo.

PrivyID's regulatory-compliant and ISO27001-certified solutions enable the company to perform undisputed e-KYC processes for their customers. PrivyID is an official partner of Indonesia's Directorate General of Population and Civil Registration. PrivyID is also officially certified and acknowledged by Indonesia's Ministry of Communication and IT,the central bank of Indonesia,and the Financial Services Authority.

PrivyID's CEO,Marshall Pribadi,is the chairman of the Indonesian Regtech and Legaltech Association (IRLA),member of the Endeavor Entrepreneur,and one of the recipients of Forbes' Asia 30 Under 30.

For more information,please visit www.privy.id.Or contact our Marketing Communication team:

Naufal Arie(Marketing Communication Assistant - Jakarta)

Email: naufal@privy.id

Fauzi Juni Putra(Marketing Communication Assistant - Yogyakarta)

Email: fauzi@privyid.tech

Photo - https://photos.prnasia.com/prnh/20200813/2884637-1?lang=0