Offload and programmable adapters drive Ethernet adapter revenue surge

LONDON,Oct. 28,2020 --The total ethernet adapter market hit $585 million in Q2 2020 according to Omdia's latest Ethernet Network Adapter Equipment Market Tracker.

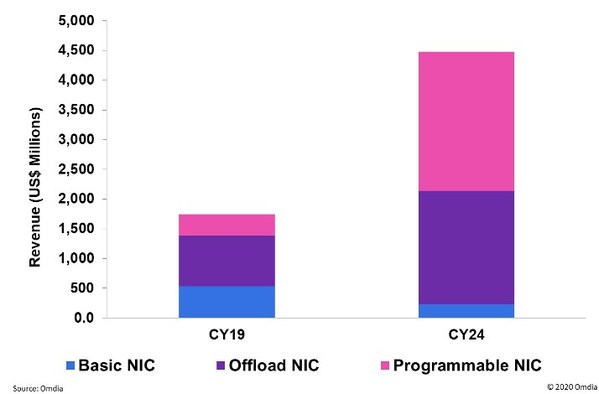

Ethernet Revenue 2019-2024

For the first time,the majority of ports shipped was comprised of Ethernet adapters capable of on-card processing of protocols (Offload NICs) deployed by enterprises,cloud service providers (CSPs) and communication service providers (Comm SPs). The persistent demand for cloud services from consumers as well as enterprise prompted CSPs to continue investing in servers and Ethernet adapters.

Manoj Sukumaran,senior analyst for data center compute,at Omdia,commented:"Vendors catering to the Comm SPs and enterprise markets saw an uptick in programmable NIC revenue. Enterprise customers in banking,financial services,and trading deployed programmable adapters to handle increased network traffic by offloading compliance,forensics,and cybersecurity functions to these adapters."

Fast-growing AI and analytics workloads require a large volume of data to move through the network,driving a need for increased server bandwidth.

In the second quarter of 2020,shipment of 100GE ports grew by 80% QoQ with a strong uptick across all market segments and they crossed the 250,000 mark. 25GE ports accounted for over one-third of all ports shipped in 2Q20,surpassing both 10GE and 1GE. The share of 1GE ports is below 25% for the first time in the second quarter of 2020,as reported by Omdia'sEthernet Network Adapter Equipment Market Tracker.

The data center Ethernet adapter revenue outlook

Omdia forecasts data center (DC) Ethernet adapter equipment revenue to grow 28 percent in 2020 with growth accelerating through 2024,driven by server shipments and the adoption of higher speed offload and programmable adapters. This market is poised to hit $4.5 billion by 2024.

Ethernet adapters that have an onboard field programmable processor such as a field-programmable gate array (FPGA) or system on chip (SoC),will account for over half of the total market revenue in 2024,or $2.3 billion. Offload adapters that can provide complete on-card processing of network,storage or memory protocols,data-plane offload or that can offload server memory access will account for about 43 percent of 2024 adapter revenue,totaling about $2 billion. Adapters that only provide Ethernet connectivity will make up a minority share of the market,at just $232 million in 2024.

Additional Ethernet adapter market highlights for the second quarter of 2020:

NVIDIA (Mellanox) was number one in revenue share with 23.3%,Intel was second with 21.7%,and Microsoft,moved up to the third spot with 13.1% as they accelerated the deployment of Catapult programmable NICs based on Intel Arria 10 FPGA

Offload NIC port shipments crossed 50% of all ports shipped,for the first time in second quarter of 2020

Open compute NIC revenue grew by 16% compared to first quarter

AboutOmdia

Omdia is a global technology research powerhouse,establishedfollowing the merger of the research division of Informa Tech(Ovum,Heavy Reading and Tractica)and the acquired IHS Markit technology research portfolio*.

We combine theexpertiseof over 400 analysts across the entire technology spectrum,analyzing 150 markets publishing 3,000 research solutions,reaching over 14,000 subscribers,and covering thousands of technology,media & telecommunications companies.

Our exhaustive intelligence and deep technologyexpertiseallow us to uncover actionable insights that help our customers connect the dots in today's constantly evolving technology environment and empower them to improve their businesses – today and tomorrow.

Omdiais a registered trademark ofInforma PLCand/or its affiliates. All other company and product names may be trademarks of their respective owners.Informa PLC registered in England & Wales with number 8860726,registered office and head office 5 Howick Place,London,SW1P 1WG,UK.Copyright© 2020 Omdia. All rights reserved.

*The majority of IHS Markit technology research products and solutionswere acquiredby Informa in August 2019 and are now part of Omdia.

Photo: http://cusmail.com/res/2023/07-24/22/41c08f74624274bdfb7a71c4b1e1f641.jpg