Global Fab Equipment Spending Projected to Log Record High in 2022 to Mark Third Consecutive Year of Growth, SEMI Reports

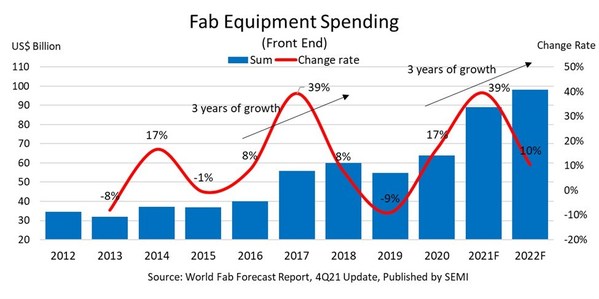

MILPITAS,Calif.,Jan. 11,2022 -- Global fab equipment spending for front end facilities is expected to rise 10% year-over-year (YOY) in 2022 to a new all-time high of over US$98 billion,marking a third consecutive year of growth,SEMI highlighted today in its quarterly World Fab Forecast report.

SEMI_Fab_Graph

The fab equipment spending increase in 2022 would follow a 39% jump in 2021 and 17% in 2020. The industry last saw three consecutive years of growth from 2016 to 2018,more than 20 years after logging a three-year run in the mid-1990s.

"The semiconductor equipment industry has enjoyed a period of unprecedented growth with increased spending in six of the past seven years,as chipmakers expand capacity to meet secular demand for a wide range of emerging technologies including artificial intelligence,autonomous machines and quantum computing,"said Ajit Manocha,president and CEO of SEMI. "The capacity buildout extends beyond the robust demand during the pandemic for electronics vital for remote work and learning,telehealth and other applications."

Spending by Sector

The foundry sector is expected to account for 46% of total spending in 2022,a 13% YOY increase,followed by memory at 37%,a slight dip from 2021. In memory segments,spending for DRAM is forecast to decline while expenditures for 3D NAND will edge higher.

Microcontroller (with MPU) spending is expected register a staggering 47% surge in 2022. Power related devices are also projected to show strong growth of 33%.

Spending by Region

Korea is expected to rank at the top of equipment spending,followed by Taiwan and China,combining to account for 73% of all fab equipment spending in 2022.

After a dramatic increase in 2021,fab equipment spending in Taiwan is expected to rise at least 14% this year. Spending in Korea also showed a sharp increase in 2021 and is projected to climb 14% in 2022. China is expected to decrease spending by 20%.

Europe/Mideast,the next largest spending region in 2022,is projected to see remarkable 145% growth for the year. Japan is expected to grow by 29%.

The SEMI World Fab Forecast report lists 27 fabs and lines that began equipping in 2021,most of them in China and Japan. Twenty-five fabs and lines are expected to begin equipping in 2022,with Taiwan,Korea and China accounting for most of the equipping starts.

The World Fab Forecast report lists 1,422 facilities and lines globally,including 138 future facilities and lines with various probabilities that are expected to start volume production in 2021 or do so later.

About SEMI

SEMI® connects more than 2,400 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials,design,equipment,software,devices,and services that enable smarter,faster,more powerful,and more affordable electronic products. Electronic System Design Alliance (ESD Alliance),FlexTech,the Fab Owners Alliance (FOA)and theMEMS& Sensors Industry Group (MSIG) are SEMI Strategic Association Partners,defined communities withinSEMIfocused on specific technologies. Visit www.semi.orgtolearnmore,contact one of our worldwide offices,and connect with SEMI onLinkedInandTwitter.

Association Contacts

Michael Hall/SEMI

Phone:1.408.943.7988

Email:mhall@semi.org

Christian G. Dieseldorff/SEMI

Phone: 1.408.943.7940

Email:cdieseldorff@semi.org