Euroclear delivers a strong Q1 performance

BRUSSELS,April 27,2022 --Euroclear today provides an update on its financial and operational performance in the first quarter of 2022.

Financial Summary

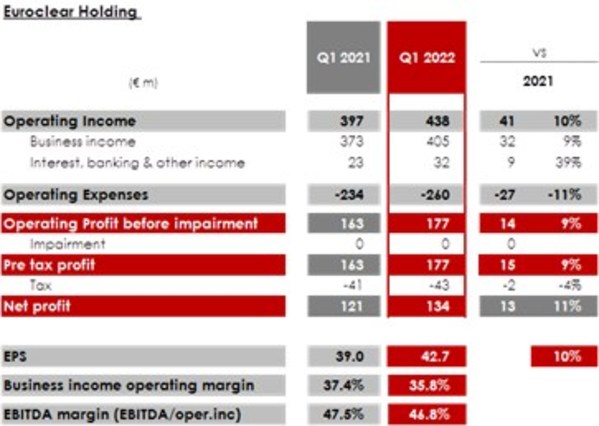

Euroclear delivered a strong financial and operational performance in Q1 2022. Net profit increased +11% to EUR 134 million.

Operating income was up +10% year-on-year to EUR 438 million driven by strong business income growth,up +9% to EUR 405 million and Interest,Banking and Other income up 39% to EUR 32 million.

We increased our investments in technology in line with our strategy. Operating expenses increased to EUR 260 million,up 11% compared to Q1 2021.

Chart 1

Note: 2021 figures have been restated to include MFEX pro forma,in order to allow for like-for-like comparison.

Operational highlights

Throughout the first quarter,Euroclear continued to make strategic progress,while remaining focused on our responsibilities as a critical financial market infrastructure. This is reflected in the key operating metrics shown below:

Q1 total

% change vs Q1 2021

Assets under Custody

EUR 37 trillion

+8%

Number of Transactions

80 million

+5%

Turnover

EUR 270 trillion

+13%

Fund assets under custody

EUR 3 trillion

+12%

Collateral Highway

EUR 2 trillion

+18%

The integration of MFEX is progressing to plan as we combine MFEX's established fund distribution platforms with Euroclear's post-trade expertise to create a new end-to-end funds offering.

We have also made two strategic investments during the first quarter.

Firstly,we have further advanced Euroclear's digital strategy through our investment in Fnality,an international consortium of global banks and financial market infrastructures focused on building regulated payment systems to support the adoption of tokenised assets and marketplaces.

Secondly,we have progressed our sustainable finance and ESG strategy through an investment in Greenomy,a Belgium based sustainable finance technology platform. Greenomy helps corporates,credit institutions and asset managers comply with new European Union sustainable finance legislation by digitalising the data capturing and reporting processes.

As part of our commitment to ESG,we are pleased to announce that Euroclear has taken the important step to reduce its global carbon footprint by committing to the Science Based Targets initiative (SBTi). We will now set CO2 reduction actions with the commitment to achieve net-zero value chain Green House Gas (GHG) emissions by no later than 2050.

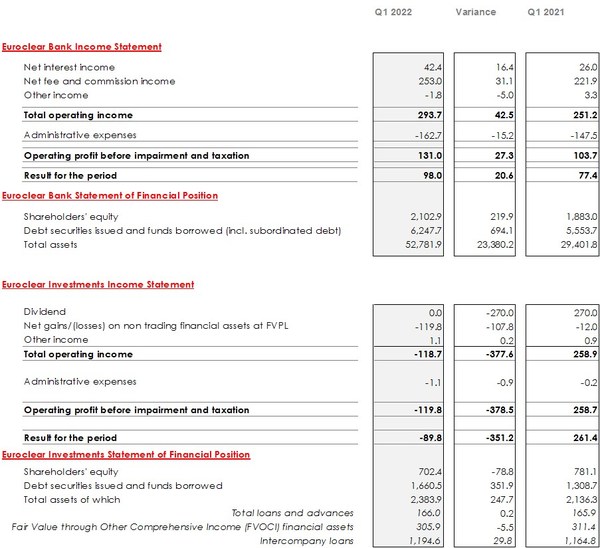

Appendix: Financial Statements for Euroclear Bank and Euroclear Investments

Chart 2

About Euroclear

Euroclear Group is the financial industry's trusted provider of post trade services. Euroclear provides settlement and custody of domestic and cross-border securities for bonds,equities and derivatives to investment funds. Euroclear is a proven,resilient capital market infrastructure committed to delivering risk-mitigation,automation and efficiency at scale for its global client franchise.

The Euroclear Group comprises Euroclear Bank,the International CSD,as well as Euroclear Belgium,Euroclear Finland,Euroclear France,Euroclear Nederland,Euroclear Sweden and Euroclear UK & International. The Euroclear Group settled the equivalent of EUR 992 trillion in securities transactions in 2021,representing 295 million domestic and cross-border transactions,and held EUR 37.6 trillion in assets for clients by end 2021. For more information about Euroclear,please visit www.euroclear.com