Brankas and CRIF jointly launch APAC's first ever open banking credit score product

SINGAPORE,Oct. 19,2022 --Brankas,the leading open finance technology provider in Southeast Asia and CRIF,a global leader in credit bureau,business information,and credit risk solutions,announced today a strategic partnership to launch the APAC region's first open finance credit score product,'New Evaluation Open Suite' (N.E.O.S). The N.E.O.S credit scoring system analyzes alternative data sources to provide more accurate assessments of potential borrowers and improved credit risk management for financial institutions.

Brankas Indonesia's Country Manager,Husni Fuad commented: "Borrowers that could be financially strong but without credit history can be excluded from accessing credit by lenders' credit policies mainly relying on traditional credit data. As such,lenders lose out on thousands of these potential borrowers every month. To resolve this,Brankas and CRIF have joined forces to co-create N.E.O.S. This move will improve financial inclusion,decisioning automation and customer experience,supporting financial institutions to reduce credit risk and generate enhanced customer insights through open banking technology solutions and analytics."

Added Simone Lovati,Managing Director,Asia of CRIF: "Financial institutions are lacking data to build critical knowledge and valuable insights to expand their market reach and serve the new-to-credit population. Brankas and CRIF's open banking suite will allow banks and fintech players to fill this gap,enabling them to make relevant and reliable credit decisions,while improving the upselling potential to existing customers. The alternative credit scoring revolution has just begun."

What is the Product?

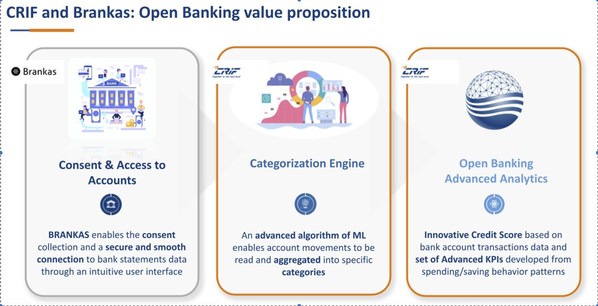

N.E.O.S is a risk score based on verified customer identity and transaction data from bank accounts all powered by CRIF's world class categorization engine. N.E.O.S is an essential lever for financial inclusion,unlocking credit access for applicants with a limited credit history such as micro-entrepreneurs,freelance and gig economy workers,and more.

How does it work?

New Evaluation Open Suite(N.E.O.S)

Brankas enables the consent collection and a secure and smooth connection to bank statement data and other alternative data sources through a simple and secure user experience. CRIF then applies an advanced machine learning algorithm that enables an innovative credit score. Brankas' open banking secure data sharing solutions unlock next generation alternative credit scoring. As a result,you benefit from instant and automated statement retrievals over a secure and compliant platform.

How can it benefit your industry/company?

With over 400 KPIs (Key Performance Indicators) that are developed for the assessment of credit worthiness and business opportunities,businesses would be able to derive any red signals much earlier and thus improve default prevention.

Lenders would get access to up to 12 months' worth of income and expense data,and help understand the customer spending behavior across categories such as groceries,electricity bills,investments,memberships,insurance,loan repayments,and subscriptions in a much reduced overall turnaround time.

Be an early adopter

Be the first financial institution in Southeast Asia to benefit from a credit agency open banking score,increasing HB competitive advantage. We are looking for early adopters who can benefit from this product and companies would be given a free of charge trial period!

Interested in learning more about this product? Email us atsales@brankas.com.

About Brankas

Brankas is the leading open finance technology provider in Southeast Asia. We provide API-based solutions,data and payments solutions for financial service providers (like banks,lenders and e-wallets) and online businesses. Brankas partners with banks to build and manage their open finance infrastructure,producing APIs for real-time payments,identity and data,new account opening,remittances,and more. With Brankas' secure open banking technology,online businesses,fintech companies and digital banks can use Brankas APIs to create new digital experiences for their users.

About CRIF

CRIF is a global leader in credit bureau,and credit risk solutions. Established in 1988 in Bologna,Italy,CRIF operates in 40 countries across four continents. Over 10,500 banks and financial institutions,82,000 business clients and 1,000,000 consumers use CRIF services on a daily basis. Since 2016,CRIF has been included in the prestigious IDF FinTech Top 100 Rankings.

CRIF has a strong presence in Asia with regional headquarters in Hong Kong and Singapore,as well as in key cities including Beijing,Bishkek,Cebu,Dushanbe,Hanoi,Ho Chi Minh City,Jakarta,Kaohsiung,Kuala Lumpur,Manila,Mumbai,Pune,Shanghai,Shenzhen,Taipei,Taichung,Tashkent,and Zhongli. For more information on CRIF Asia,please visitwww.crifasia.com.

Media Contact:

Balasubramanian

Head of Community & Engagement

bala@brankas.com