Global Total Semiconductor Equipment Sales Forecast to Reach Record High in 2022, SEMI Reports

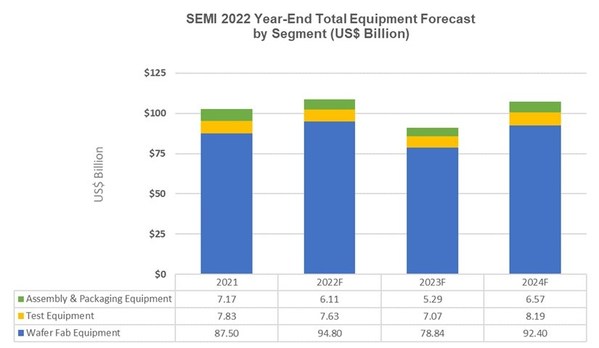

TOKYO,Dec. 13,2022 -- Global sales of total semiconductor manufacturing equipment by original equipment manufacturers are forecast to reach a new high of $108.5 billion in 2022,rising 5.9% from the previous industry record of $102.5 billion in 2021,SEMI announced today in its Year-End Total Semiconductor Equipment Forecast – OEM Perspective at SEMICON Japan 2022. The record high caps three consecutive years of record revenue. The global total semiconductor manufacturing equipment market is expected to contract to $91.2 billion next year before rebounding in 2024 driven by both the front-end and back-end segments.

Segment

Application

"Record fab constructions have driven total semiconductor manufacturing equipment sales to cross the $100 billion mark for a second straight year," said Ajit Manocha,SEMI president and CEO. "Emerging applications in multiple markets have set expectations for significant semiconductor industry growth this decade,which will necessitate further investments to expand production capacity."

Semiconductor Equipment Sales by Segment

The wafer fab equipment segment,which includes wafer processing,fab facilities,and mask/reticle equipment,is projected to expand 8.3% to a new industry record of $94.8 billion in 2022,followed by a 16.8% contraction to $78.8 in 2023 billion before rebounding 17.2% to $92.4 billion in 2024.

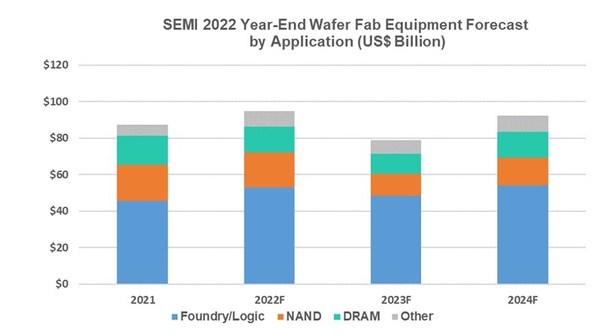

Equipment sales in the foundry and logic segment,accounting for more than half of total wafer fab equipment receipts,are expected to rise 16% year-over-year to $53.0 billion in 2022 as demand for both leading-edge and mature nodes remains strong. Foundry and logic investments are projected to decrease in 2023,leading to an expected 9% drop in sales across the segment.

As enterprise and consumer demand for memory and storage weakens,DRAM equipment sales are expected to fall 10% to $14.3 billion in 2022 and 25% to $10.8 billion in 2023,while NAND equipment sales are projected to drop 4% to $19.0 billion in 2022 and 36% to $12.2 billion in 2023.

Challenging macroeconomic and semiconductor industry conditions are expected to spark a decline in back-end equipment segment sales. After registering robust 30% growth in 2021,semiconductor test equipment market sales are forecast to slip 2.6% to $7.6 billion in 2022 and 7.3% to $7.1 billion in 2023. Following an 87% surge in 2021,assembly and packaging equipment sales are projected to drop by 14.9% to $6.1 billion in 2022 and 13.3% to $5.3 billion in 2023. Back-end equipment expenditures are expected to improve in 2024 with growth of 15.8% and 24.1%,respectively,in the test equipment and assembly and packaging equipment segments.

Semiconductor Equipment Sales by Region

Mainland China,Taiwan and Korea are projected to remain the top three destinations for equipment spending in 2022. Mainland China is projected to maintain the top position next year after claiming it for the first time in 2020,while Taiwan is expected to regain the lead in 2024. Equipment spending for all regions tracked,except Korea,are expected to grow in 2022,though most will see a decrease in 2023 before returning to growth in 2024.

* Total equipment includes new wafer fab,test,and assembly and packaging. Total equipment excludes wafer manufacturing equipment. Totals may not add due to rounding.

The SEMI forecast is based on collective input from top equipment suppliers,the SEMI Worldwide Semiconductor Equipment Market Statistics (WWSEMS) data collection program and the industry-recognized SEMI World Fab Forecast database.

The Equipment Market Data Subscription (EMDS) from SEMI provides comprehensive market data for the global semiconductor equipment market. A subscription includes three reports:

Monthly SEMI North American Billings Report,an early perspective of equipment market trends

Monthly Worldwide Semiconductor Equipment Market Statistics (WWSEMS),a detailed report of semiconductor equipment billings for seven regions and more than 22 market segments

Bi-annual Total Semiconductor Equipment Forecast – OEM Perspective,an outlook for the semiconductor equipment market

For more information online,please visit SEMI Market Data.

About SEMI

SEMI® connects more than 2,500 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials,design,equipment,software,devices,and services that enable smarter,faster,more powerful,and more affordable electronic products. Electronic System Design Alliance (ESD Alliance),FlexTech,the Fab Owners Alliance (FOA),the MEMS & Sensors Industry Group (MSIG) and SOI Consortium are SEMI Strategic Technology Communities. Visit www.semi.org,contact one of our worldwide offices,and connect with SEMI onLinkedInandTwitter to learn more.

Association Contact

Michael Hall/SEMI

Phone:1.408.943.7988

Email:mhall@semi.org