Global 300mm Fab Equipment Spending Forecast to Reach Record $119 Billion in 2026, SEMI Reports

MILPITAS,Calif.,June 13,2023 -- Global 300mm fab equipment spending for front-end facilities next year is expected to begin a growth streak to a US$119 billion record high in 2026 following a decline in 2023,SEMI highlighted today in its quarterly 300mm Fab Outlook Report to 2026. Strong demand for high-performance computing,automotive applications and improved demand for memory will fuel double-digit spending in equipment investments over the three-year period.

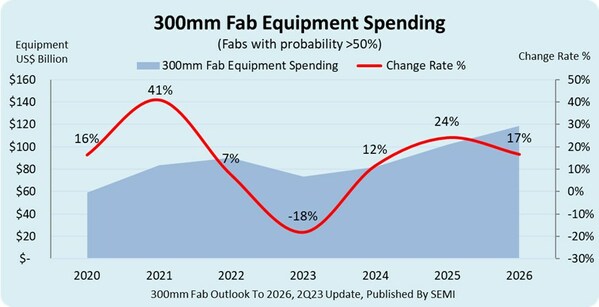

After the projected 18% drop to US$74 billion this year,global 300mm fab equipment spending is forecast to rise 12% to $US82 billion in 2024,24% to US$101.9 billion in 2025 and 17% to US$118.8 billion in 2026.

"The projected equipment spending growth wave underscores the strong secular demand for semiconductors," said Ajit Manocha,SEMI President and CEO. "The foundry and memory sectors will figure prominently in this expansion,pointing to demand for chips across a wide breadth of end markets and applications."

300mm Fab Equipment Spending

Regional Growth

Korea is expected to lead global 300mm fab equipment spending in 2026 with US$30.2 billion in investments,nearly doubling from US$15.7 billion in 2023. Taiwan is forecast to invest US$23.8 billion in 2026,up from US$22.4 billion this year,and Mainland China is projected to log US$16.1 billion in spending in 2026,an increase from US$14.9 billion in 2023. Americas equipment spending is expected to nearly double from US$9.6 billion this year to US$18.8 billion in 2026.

Segment Growth

Foundry is projected to lead other segments in equipment spending at US$62.1 billion in 2026,an increase from US$44.6 billion in 2023,followed by memory at US$42.9 billion,a 170% increase from 2023. Analog spending is forecast to increase from US$5 billion this year to US$6.2 billion in 2026. The microprocessor/microcontroller,discrete (mainly power devices),and optoelectronics segments are expected to see spending declines in 2026,while investments in logic is forecast to rise.

The SEMI 300mm Fab Outlook Report To 2026 report lists 369 facilities and lines globally,including 53 high-probability facilities expected to start operation during the four years starting in 2023.

About SEMI

SEMI® connects more than 2,500 member companies and 1.3 million professionals worldwide to advance the technology and business of electronics design and manufacturing. SEMI members are responsible for the innovations in materials,design,equipment,software,devices,and services that enable smarter,faster,more powerful,and more affordable electronic products. Electronic System Design Alliance (ESD Alliance),FlexTech,the Fab Owners Alliance (FOA),the MEMS & Sensors Industry Group (MSIG),Nano-Bio Materials Consortium (NBMC),and SOI Consortium are SEMI Strategic Technology Communities. Visit www.semi.org,contact one of our worldwide offices,and connect with SEMI onLinkedInandTwitter to learn more.

Association Contacts

Michael Hall/SEMI

Phone:1.408.943.7988

Email:mhall@semi.org

Christian G. Dieseldorff/SEMI US

Phone: 1.408.943.7940

Email:cdieseldorff@semi.org

Chih-Wen Liu/SEMI Taiwan

Phone: 886.3.560.1777

Email: cwliu@semi.org