Sihuan Pharmaceutical (0460.HK): Under innovation transformation, an internationalized new pattern in construction

HONG KONG,Sept. 15,2020 -- Recently,share price of Sihuan Pharmaceutical (0460.HK) continued to rise,hitting HK$1.09 per share,up 53.52% from its low on May 25. Judging from the stock price trend,the stock price of Sihuan Pharmaceutical seems to have entered the stage of rebounding. After a small correction in recent days,the company's PB was 0.88 (still below 1) as of the market close on September 10,2020.

Founded in 2001,Sihuan Pharmaceutical,together with its subsidiaries,is a pharmaceutical group with integrated R&D,production and marketing and sales capabilities. It is one of China's largest suppliers of cardio-cerebral vascular ("CCV") prescription drugs. Sihuan Pharmaceutical has an excellent and professional marketing model,a nationwide distribution network,and a diversified product portfolio with great market potential,as well as strong R&D capability.

I. Innovative R&D: core growth driver

Tremendous policy change (including centralized procurement and NRDL negotiation) and competitive landscape have reshaped China's healthcare industry. The policy change is more inclined to encourage innovative R&D,and the profits of generic drugs are being squeezed,and innovation-driven is the theme of the future of this industry. The Group has built a number of high-quality product R&D platforms after many years of precipitation and they startedto reap fruit.

1. 80 projects in current R&D pipeline,covering a number of major therapeutic areas.

The company currently has a total of 80 products in its pipelines,which includes 14 small molecule target innovative drugs,13 biological drugs with great market potential,as well as 53 generic drugs with high-tech barriers.

R&D pipeline covers major therapeutic areas,which includes oncology,metabolic disease,chronic disease,neuropsychiatric disease,digestive disease,anti-infection and cardio-cerebrovascular disease,more than 10 of them have commenced the phase 3 clinical trials or have acquired production approval.

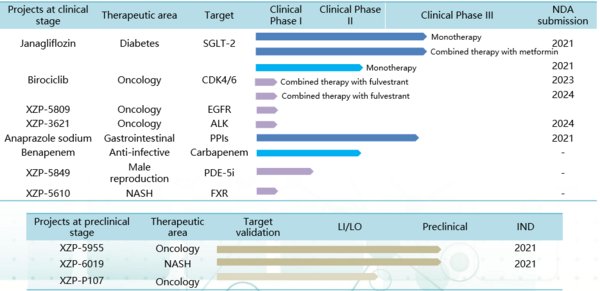

Chart 1:Company Product Pipelines -- Innovative R&D Pipeline

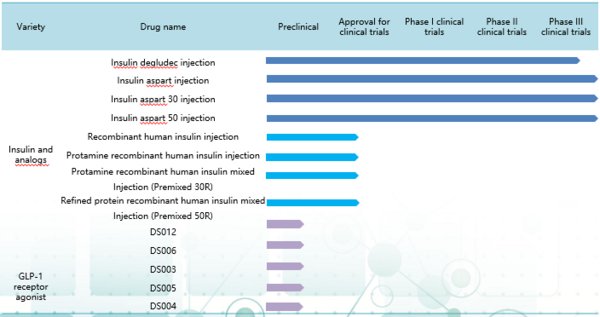

Chart 1:Company Product Pipelines -- Biosimilar R&D Pipeline

2. Innovative R&D platform: layout strengthened with the investment of CMG-SDIC,a number of core products commenced phase 3 clinical trials.

Xuanzhu has been set up as the core of the innovative drug R&D platform,supporting the group's innovative drug pipeline. Recently,cash investment of RMB800 million from CMG-SDIC has been introduced,strengthening the layout of innovation R&D.

Blockbuster product Janagliflozin,is an SGLT-2 inhibitor for diabetes treatment,it also has heart and kidney protection function. It's currently in its phase 3 clinical trial and the data has been locked for analysis.

The independently developed patented drug Anaprazole Sodium for digestive systems has entered Phase 3 clinical trials,and Birociclib,as a CDK4/6 inhibitor for advanced breast cancer,has successfully conducted several clinical trials.

At present,the company has a high-quality pre-clinical R&D team with nearly 200 people,including a number of senior scientists from overseas,they have worked in the international well-known pharmaceutical companies for more than 20 years. There are also 200 clinical development teams,including more than 70 people with Ph.D.s,master's degrees or with overseas experience.

The future direction of the company's R&D is clearer,and will focus on oncology,metabolic diseases,non-alcoholic hepatitis and other therapeutic areas of with significant clinical needs.

3. Bioimilar: Layout in diabetes therapeutic area,Insulin Aspart expected for NDA submission in 2021

The company is actively planning out in the biological drugs field,in treatment areas mainly in diabetes and its complications,there are currently 13 products in development,covering insulin and its biosimilars,GLP-1 biosimilars,as well as oral solids and other products,a number of products have entered the clinical late stage,commercialization is expected in the near future.

Phase 3 clinical trials of Insulin Aspart,Insulin Aspart 30 and Insulin Aspart 50 have completed patient recruitment,and are expected to for data lockup by the end of 2020,NDA submission expected in 2021.

Insulin Degludec has commenced its phase 3 clinical trial and started to recruit patient in large scale. It is expected to complete patient recruitment in the middle of 2021. In addition,Insulin Glargine is in IND stage and GLP-1 biosimilars is in pre-clinical stage.

The company is also creating a comprehensive product platform for diabetes treatment,including metformin,DPP-4 inhibitors,GLP-1 analogue,etc.

4. Aesthetic business: forward-looking layout,blockbuster product expected to launch in the near future.

According to Frost & Sullivan forecast,China will become the world's largest aesthetic market in 2021,the market size is expected to exceed RMB900 billion,the market potential huge. Sihuan Pharmaceutical started to plan in the field of aesthetic business as early as 2014,the blockbuster product botulinum toxin is expected to be approved and launched in the near future.

Product wise,currently there are Sihuan Aesthetic hit-product - Princess series facial filling products,and other medical skin care products,including: hyalurino acid sodium repair skin original liquid,hyalurino acid sodium repair rehydration serum,hyalurino acid sodium disposable original liquid,hyalurino acid supplement crystal mask,hyalurogenic sodium repair nourishing mask and so on.

The company is working with Hugel to develop botulinum toxin and hyaluronic acid products,which are expected to contribute new business growth driver to the company's aesthetic development. Hugel is a leading producer of botulinum toxins in South Korea,which ranks the first in South Korea sales market for the fourth year in a row

Sihuan Aesthetic is the exclusive agent of botulinum toxin products,and the product is expected to be approved by the end of this year,becoming the first and only Korean botulinum toxin products to obtain the relevant approval of the same type of products in China.

II. Strong sales team: support in the process of products commercialization

Currently,the professional marketing team of Sihuan has more than 1,000 people,and work with more than 20,000 sales managers from over 3,000 distributors,of which nearly 40% only distribute Sihuan products. The number of hospitals covered is 14,460,of which 2,000 are tertiary hospitals,covering 100% of the provinces. Sihuan's sales staff are very professional,most of the relevant practitioners have master's degree and above in the medical related majors. A strong sales system will be beneficial to the company's future expansion of new products and the realization of internationalization.

1. New areas in the future: a number of promising products are launching to the market

In addition to the company's existing mature products on the market and the recently launched new products,the company also has active layout and promotion for the development of late-stage products that will be commercialized.

In the field of vascular dementia treatment,the company has obtained production approval for rivastigmine hydrogen tartrate capsule,for the treatment of mild to moderate Alzheimer's dementia. As the number of patients with such kind of dementia is increasing with an aging society and there is a lack of effective medicines,there will be a market with huge potential.

In respect of products for treatment of epilepsy,oxcarbazepine tablet,which has been launched,levetiracetam tablet which has been granted production approval and will be launched soon,as well as midazolam oromucosal granted registration approval,and eslicarbazepine submitted for review,are expected to create synergy and provide epilepsy patients with more better treatment options. Midazolam oromucosal solution is also effective for febrile seizures. Compared with other formulations,it is convenient for administer and has a fast onset of effect and can also be used for out-of-hospital and home emergency first-aid treatment. It is expected to greatly fill the existing market gaps after launch and will provide a safe and effective new treatment option for infants,children and adolescents at home.

In the field of anti-infection,Sihuan is active in joint R&D,acquisition and joint ventures and other forms to enrich the anti-infection field product line. At present,the associate company Beijing Ruiye Pharmaceutical Co.,Ltd. developed the "non-PVC solid-liquid double chamber infusion" products (including cefuroxime,ceftazidime,cefodizime),and has obtained approvals for a number of varieties and specifications,the company is also the first and only enterprise in China to obtain this type of infusion product registration. According to China's current use status quo,non-PVC soft bag infusion products only accounted for 20% of the market,Beijing Ruiye has a great policy advantage,and the predictable policy advantages will be stable for a long time in the future if the use of non-PVC products is promoted and volume procurement is initiated from the environmental protection aspects or from the perspective of drug stability.

Under the COVID-19,the company has also increased its layout in the field of anti-infection. Recently,the company introduced investment from two investors (Guangdong Guanrun and Nanjing Huiji) with a total of RMB200 million. One can tell that the double-chamber bag infusion business has drawn the industry's high attention and recognition. In addition,the company has reached a framework agreement with Hetero,India involving the anti-viral drug manufacturing field.

2 . Non-CCV field: Many new products in growth-stage,academic promotions help to rapidly expand the volume.

In the non-CCV fields,the company relies on the growth of academic promotion ability to drive the rapid expansion of a number of new products. In the first half of 2020,the company's total revenue in the non-CCV sectors increased by 114.6% to RMB445 million,among which the revenue of four products increased by more than 100% year-on-year.

Existing products include Huineng (YOY: + 137.3%),Jie'ao (YOY: + 11.3%),Shucheng (YOY:+116.2%),Diprophylline for injection (YOY:+162.6%),Oxcarbazepine (YOY:104.5%),azithromycin capsule and Xinnuoao,etc.

Among them,Huineng is a recently listed new products,and was included in the 2019 National Reimbursement Drug List,and the sales is growing rapidly. Regarding the digestive system drug Jie'ao,there are currently preclinical and clinical studies conducted with leading hospitals and research institutes in China to clarify the pharmacology,mechanism of action and clinical effectiveness and safety of the product.

3. CCV field: Rejuvenate the product vitality by academic promotion

CCV field is the company's traditional business,and the company has accumulated a strong product base in this field,with a number of mature products. In recent years,the company is expected to reshape its leading position in this field by reorganizing its products and supplement with a lot of academic promotion work.

Kelinao is the blockbuster product in the treatment of stroke in Chinese market,it used to make to the top on the ranking of terminal sales for single product. Recently,an important paper has been published on international SCI journal,and the research results have confirmed the effectiveness of Kelinao,which will be conducive to the re-entering of Kelinao in NRDL in the future,and the sales volume is expected to recover.

Sales of Mainuokang has presented strong growth in the first half of 2020. It has been included in 10 PRDL,and is expected to seek new opportunities in the new round of national insurance adjustment.

Nicotinamide injection is also one of the products with great potential,maintained its rapid growth in in the first half 2020,up 187.2% year-on-year. At present,the company increases the promotion of this product,so as to accelerate hospital coverage and further increase market share is expected.

Moreover,the company will also take advantage its sales platform,launching new varieties to supplement the current lack of drug varieties in CCV treatment area.

III. Manufacturing facilities: high-efficiency,low-cost and high cost performance

Under the GPO policy,companies are required to have the ability to increase productivity while reducing production costs. For Sihuan Pharmaceutical,the company not only has enough production capacity,but also has sufficient production capacity to do additional CMO/CDMO business.

In the production of APIs and intermediates,the company not only has APIs (API) up to GMP standard,advanced intermediates (ASM) up to GMP standard,also has key starting materials (KSM) up to GMP standard,starting materials (SM) up to ISO standard for sale. By means of branch management,the management costs are greatly reduced,so it is very cost-effective.

Sihuan Pharmaceutical also completed an equity investment in Zhongrui Pharmaceutical,which increased the Group's API production capacity. The Company also made an equity investment in Guanhua Biologicals to strengthen the Group's R&D capabilities in the enzymatic process and continuous flow process of APIs.

In the production of TCM,the company has set up a production base for TCM and for oral solution in Jilin Aokang,and has now obtained the qualification of the only high content CBD research and cultivation of industrial hemp in Jilin Province,and jointly established the "Northern Industrial Hemp Research Center" with the Institute of Hemp of the Chinese Academy of Agricultural Sciences to build the largest industrial hemp CBD drug R&D and production base and fiber product R&D and production base in China.

IV. Abundant cash to support the transformation to an international enterprise.

Let's take another look at the company's financials.

1. Abundant cash,undervalued valuation

As of June 30,2020,the Company's cash and cash equivalents were approximately RMB4.95 billion. At the same time,the Company's bank borrowings were approximately RMB610 million. As a result,the Company's net cash holdings exceeded RMB4.34 billion.

The total market capitalization of Sihuan Pharmaceutical is about HKD8.3 billion (equivalent to RMB7.3 billion),and if the cash held by the company is excluded,the net market capitalization of the company is RMB3 billion.

However,with a post-investment valuation of RMB4.3 billion for Xuanzhu Biopharmaceutical alone,and a valuation of RMB3.26 billion for the portion of Xuanzhu Biopharmaceutical held by Sihuan Pharmaceutical,plus the company's net cash holdings of RMB4.34 billion,the company's market capitalization of $7.6 billion has exceeded the current overall market capitalization of the company ($7.3 billion),not including the company's other business segments. In other words,the company's overall valuation,is being undervalued.

Along with more and more of the company's products in research getting approved,plus the newly approved products listed on the market to bring new growth,the company's performance is likely to achieve greater growth,and a return to reasonable valuation can be expected.

2. Transformation to international enterprise,and paint out a new landscape

Mergers and acquisitions will also be an important part of Sihuan Group's international transformation,the introduction of high-quality products,not only complement the company's product portfolio,is also an important way to drive the growth of the company's revenue.

Currently,Sihuan Pharmaceutical has established a Global Business Development Center in the U.S. with a focus on oncology,diabetes and other therapeutic areas with large clinical needs. The company has also hired a number of international experts to develop and manage its business projects at home and abroad. These international experts have been instrumental in accelerating the introduction and layout of Sihuan's global business.

Chief Business Development Officer Leslie Boyd,Ph.D.,is responsible for the company's product operations rights acquisition and M&A strategy. With nearly to 20 years of experience in drug discovery and business development,he was previously Vice President of Global Business Development at GSK and Vice President of Research and Evaluation and Head of Special Projects Due Diligence at Teva.

Joyce Pei,Head of Global Oncology Business Development,has more than 35 years of experience with leading multinational pharmaceutical companies and more than 20 years of experience in oncology/immunology,business development and product licensing,including as Senior Director of Global Strategic Alliances in Oncology at Boehringer Ingelheim and International Business Development Investment at Simcere Pharmaceuticals. Vice President.

V. Summary

The company has set a clear five-year strategic development goal,i.e. an innovation-led,international pharmaceutical technology enterprise focusing on cerebrovascular,oncology,diabetes,medical and aesthetic fields,with independent and leading independent research and development technology platform,a rich global product pipeline and a mature and excellent sales system. As Dr. Che Feng Sheng,Chairman and Executive Director of Sihuan Pharmaceutical Holdings Group,said,"Sihuan Pharmaceutical adheres to the core value of independent innovation and research and development and cultivation of quality manufacturing enterprises,supplemented by investment,mergers,incubation,holding and spin-offs,to generate a number of independently operated subsidiaries and help them land in the capital market as soon as possible to add value to the parent company." Guided by the management's precise strategy of "innovation-driven,with both imitation and creation",Sihuan Pharmaceutical's subsidiaries have been working together at all levels to promote the transformation of Sihuan Pharmaceutical from a traditional pharmaceutical company into a comprehensive pharmaceutical group,creating the new pattern of internationalization,and will strongly contribute to the steady rise in Sihuan Pharmaceutical's enterprise value and stock price.

About Sihuan Pharmaceutical Holdings Group Ltd.

Founded in 2001,Sihuan Pharmaceutical Holdings Group Ltd. ("Sihuan Pharmaceutical" or the "Company"),together with its subsidiaries (the "Group") is a pharmaceutical group with integrated research and development ("R&D"),production and marketing and sales capabilities. It is one of the largest suppliers of cardio-cerebral vascular ("CCV") prescription drugs in China. Sihuan Pharmaceutical has an excellent and professional marketing model,a diversified product portfolio with great market potential,as well as strong R&D capability. The Group continues to increase investment in R&D every year. Because of the continuing efforts over the past decade,Sihuan Pharmaceutical has a R&D platform with over 1,000 researchers conducting more than 110 pharmaceutical research projects. More than 300 patents on innovative drugs have been granted and over 80 of them are overseas patent. The Group's current pipeline projects cover key therapeutic areas including diabetes,anti-infectives and non-alcoholic steatohepatitis,etc.

For more information about Sihuan Pharmaceutical,please visit the company website https://www.sihuanpharm.com/.

Photo - https://photos.prnasia.com/prnh/20200915/2917268-1-c?lang=0

Photo - https://photos.prnasia.com/prnh/20200915/2917268-1-d?lang=0