Galaxy Entertainment Group Announces Q4 & Annual Results 2018

Full Year Adjusted EBITDA of $16.9 Billion,Up 19% YoY

Q4 Adjusted EBITDA of $4.3 Billion,Up 4% YoY & Up 12% QoQ

Announced Another Special Dividend of $0.45 Per Share

HONG KONG,Feb. 28,2019 -- Galaxy Entertainment Group ("GEG","Company"or the "Group") (HKEx stock code: 27) today reported results for the three months and twelve months periodsended 31 December 2018. (All amounts are expressed in HKD unless otherwise stated)

Q4 & FULL YEAR 2018 RESULTS HIGHLIGHTS

GEG : Delivered Solid Performance,Proceeding On A $1.5 Billion Property Enhancement Program For Galaxy Macau™ And StarWorld Macau

Full Year Group Net Revenue* of $55.2 billion,up 14% year-on-year

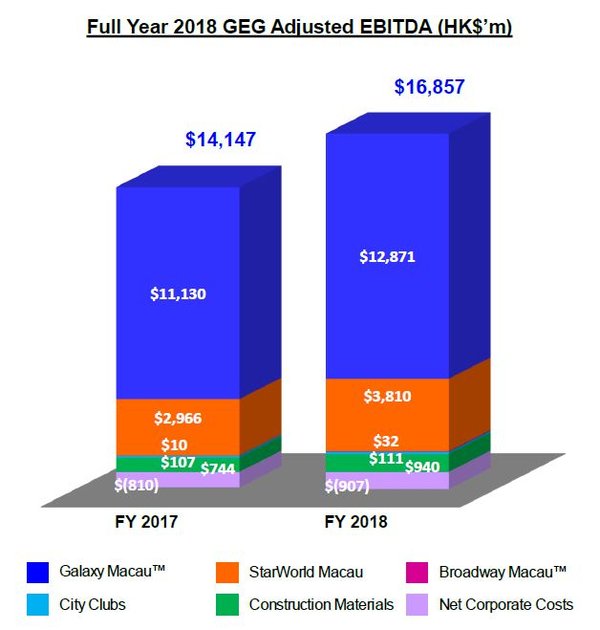

Full Year Group Adjusted EBITDA of $16.9 billion,up 19% year-on-year

Full Year net profit attributable to shareholders ("NPAS") of $13.5 billion,an increase of 29% year-on-year including $0.6 billion of non-recurring charges

Full year Adjusted NPAS of $14.1 billion,up 28% year-on-year after adjusting for non-recurring charges

Q4 Group Net Revenue* of $14.2 billion,up 2% year-on-year and up 9% quarter-on-quarter

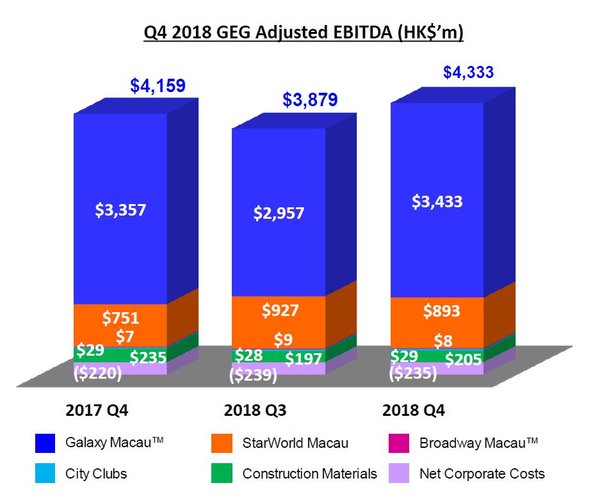

Q4 Group Adjusted EBITDA of $4.3 billion,up 4% year-on-year,up 12% quarter-on-quarter

Played lucky in Q4 which increased Adjusted EBITDA by approximately $77 million,normalized Q4 Adjusted EBITDA of $4.3 billion,up 4% year-on-year and up 1% quarter-on-quarter

Galaxy Macau™: Continued Solid Performance Driven By Mass And Non-gaming

Full Year Net Revenue* of $39.5 billion,up 14% year-on-year

Full Year Adjusted EBITDA of $12.9 billion,up 16% year-on-year

Q4 Net Revenue* of $10.4 billion,up 2% year-on-year and up 11% quarter-on-quarter

Q4 Adjusted EBITDA of $3.4 billion,up 2% year-on-year and up 16% quarter-on-quarter

Played lucky in Q4 which increased Adjusted EBITDA by approximately $191 million,normalized Q4 Adjusted EBITDA of $3.2 billion,up 1% year-on-year and down 1% quarter-on-quarter

Hotel occupancy for Q4 across the five hotels was virtually 100%

StarWorld Macau: Continued Solid Performance Driven By Mass

Full Year Net Revenue* of $12.2 billion,up 18% year-on-year

Full Year Adjusted EBITDA of $3.8 billion,up 28% year-on-year

Q4 Net Revenue* of $3.0 billion,up 12% year-on-year and up 2% quarter-on-quarter

Q4 Adjusted EBITDA of $893 million,up 19% year-on-year and down 4% quarter-on-quarter

Played unlucky in Q4 which decreased Adjusted EBITDA by approximately $115 million,normalized Q4 Adjusted EBITDA of $1.0 billion,up 18% year-on-year and up 8% quarter-on-quarter

Hotel occupancy for Q4 was virtually 100%

Broadway Macau™: A Unique Family Friendly Resort,Strongly Supported By Macau SMEs

Full Year Net Revenue* of $562 million,up 9% year-on-year

Full Year Adjusted EBITDA of $32 million versus $10 million in FY 2017

Q4 Net Revenue* of $144 million,down 1% year-on-year and down 1% quarter-on-quarter

Q4 Adjusted EBITDA of $8 million versus $7 million in Q4 2017 and $9 million in Q3 2018

Played lucky in Q4 which increased Adjusted EBITDA by approximately $1 million,normalized Q4 Adjusted EBITDA of $7 million versus $3 million in Q4 2017 and $13 million in Q3 2018

Hotel occupancy for Q4 was 98%

Balance Sheet: Healthy Balance Sheet

Cash and liquid investments was $45.8 billion and net cash was $37.0 billion as at 31 Dec 2018

Debt of $8.8 billion as of 31 Dec 2018 primary reflects ongoing yield management initiative

Paid two special dividends: $0.41 per share on 27 April 2018 and $0.50 per share on 26 October 2018

Announced another special dividend of $0.45 per share payable on or about 26 April 2019

Development Update: Continuing to Pursue Development Opportunities

Cotai Phases 3 & 4 -- Continue to move forward with Phases 3 & 4,with a strong focus on non-gaming,primarily targeting MICE,entertainment,family facilities and also including gaming

Hengqin-- Plans moving forward to develop a low-density integrated resort to complement our high-energy entertainment resorts in Macau

International -- Continuously exploring opportunities in overseas markets,including Japan

*Net Revenue is calculated in accordance with the new accounting standard and the Net Revenue in Q4 and full year 2017 is restated forcomparison.

Dr. Lui Che Woo,Chairman of GEG said:

"I am pleased to provide an updated on our financial results for Q4 and full year 2018. At GEG,we continue to drive every segment of the business with a particular focus on the mass business and continue to allocate resources to their most efficient use. Our efforts are reflected in full year Adjusted EBITDA of $16.9 billion. This was despite continuing competitive openings in both Macau and regionally and a number of geo-political and economic issues that impacted consumer sentiments. Our cash and liquid investments were $45.8 billion and net cash was $37.0 billion.

During the year,we purchased a minority equity stake of approximately 4.9% of Wynn Resorts.

We are pleased to announce another special dividend of $0.45 per share to be paid on or about 26 April 2019. Additionally,the Group paid two special dividends of $0.41 and $0.50 per share in 2018. The Group will continue to focus on both our Macau development plans and international expansion ambitions.

During 2018,Macau experienced another strong typhoon in September which resulted for the first time in the closure of casinos for a modest period of time. Due to the careful planning by the Macau government,damage to Macau and properties was minimal and there were only minor personal injuries but more importantly there were no fatalities.

Finally,I would like to extend my sincere appreciation to all of our committed team members whom without their commitment we would not have been able to achieve these solid financial results. Our team members continue to deliver exceptional customer experiences and 'World Class,Asian Heart' service each and every day."

Macau Market Overview

Investor sentiment throughout 2018 experienced periods of volatility. This was a result of a number of geo-political and economic issues such as global trade tensions,the slowing Chinese economy,rising interest rates,currency fluctuations and also the introduction of smoking restrictions,to name a few. Despite the above,GGR for full year 2018 was $294.0 billion,up 14% year-on-year. Quarterly GGR in Q4 2018 was $76.5 billion,up 9% year-on-year and up 7% quarter-on-quarter.

In 2018,visitor arrivals to Macau were 35.8 million,up 10% year-on-year,in which visitors from Mainland China grew at a faster rate of 14% year-on-year. Overnight visitors accounted for 52% of total visitation. The average length of stay for overnight visitors increased 0.1day year-on-year to 2.2days. The visitation growth in 2018 was also assisted by the improvements in infrastructure,including the opening of the Hong Kong-Shenzhen-Guangzhou high speed train,the Hong Kong-Zhuhai-Macau Bridge and further relaxation of visas for Mainland Chinese to enter Macau.

Summary of Accounting Changes During 2018

In accordance with the Hong Kong Institute of Certified Public Accountants (HKICPA),GEG adopted a new accounting standard in reporting revenue from gaming operation beginning from 1 January 2018. GEG's first mandatory full year reporting period is the twelve months period ended 31 December 2018. The main changes due to this reporting standard are that commission and incentives are to be deducted from the net wins from gaming operation to arrive at the net gaming revenue. In addition,GEG now also reports all complimentary provided to gaming customers at market rate.The comparative figures of revenue in 2017 have been restated to conform with the current period's presentation.

In summary the impact of these accounting changes will be lower reported gaming revenue,an increased Adjusted EBITDA margin,and an increase in non-gaming revenue such as hotels and F&B.There will be no change in the Adjusted EBITDA or NPAS.

Group Financial Results

Full Year 2018

The Group posted net revenue of $55.2 billion,up 14% year-on-year,and generating Adjusted EBITDA of $16.9 billion,up 19% year-on-year in 2018. Net profit attributable to shareholders was $13.5 billion,up 29% year-on-year. Galaxy Macau™'s Adjusted EBITDA was $12.9 billion,up 16% year-on-year. StarWorld Macau's Adjusted EBITDA was $3.8 billion,up 28% year-on-year. Broadway Macau™'s Adjusted EBITDA was $32 million versus $10 million in 2017.

GEG experienced bad luck in its gaming operation during 2018,which decreased its Adjusted EBITDA by approximately $484 million. Normalized 2018 Adjusted EBITDA grew 22% year-on-year to $17.3 billion.

Full Year 2018 GEG Adjusted EBITDA (HK$’m)

The Group's total GGR on a management basis[1] in 2018was $67.2billion,up 16% year-on-year. Total mass table GGR was $27.5billion,up 14% year-on-year. Total VIP GGR was $37.3 billion,up 18% year-on-year. Total electronic GGR was $2.5billion,up 15% year-on-year.

Group Key Financial Data

FY2017 (Restated)

FY2018

Revenues: (HK$'m)

Net Gaming

40,624

47,025

Non-gaming

4,949

5,298

Construction Materials

3,067

2,888

Total Net Revenue[2]

48,640

55,211

Adjusted EBITDA

14,147

16,857

Gaming Statistics[3](HK$'m)

FY2017

FY2018

Rolling Chip Volume

912,147

1,103,107

Win Rate %

3.5%

3.4%

Win

31,600

37,250

Mass Table Drop[4]

100,252

119,657

Win Rate %

24.1%

23.0%

Win

24,208

27,487

Electronic Gaming Volume

61,847

72,461

Win Rate %

3.5%

3.4%

Win

2,161

2,476

Total GGR Win[5]

57,969

67,213

Balance Sheet and Special Dividends

As of 31 December 2018,cash and liquid investments were $45.8billion and net cash was $37.0 billion. Total debt was $8.8 billion as at 31 December 2018,this was due solely to an ongoing treasury management exercise where interest income on cash holdings exceeds corresponding borrowing costs.Our balance sheet combined with cash flow from operations allows us to return capital to shareholders via dividends and to fund both our Macau development pipeline and international expansion ambitions.

In 2018,GEG returned capital to shareholders by paying two special dividends of $0.41 per share and $0.50 per share on 27April 2018and 26October 2018,respectively. The Group announced another special dividend of $0.45per share to be paid on or about 26 April 2019.

Q4 2018

During Q4 2018,the Group's net revenue increased 2% year-on-yearand increased 9% quarter-on-quarter to $14.2billion. Adjusted EBITDA increased 4% year-on-yearand increased 12% quarter-on-quarter to $4.3 billion. Galaxy Macau™'s Adjusted EBITDA increased 2% year-on-year and increased 16% quarter-on-quarter to $3.4billion. StarWorld Macau's Adjusted EBITDA increased 19% year-on-year and decreased 4% quarter-on-quarter to $893 million. Broadway Macau™'s Adjusted EBITDA was $8 million versus $9 million inQ3 2018 and $7 million in Q42017.

During Q4 2018,GEG played lucky in its gaming operations which increased Adjusted EBITDA by approximately $77 million. Normalized Q4 2018 Adjusted EBITDA grew 4% year-on-year and increased 1% quarter-on-quarter to $4.3 billion.

Q4 2018 GEG Adjusted EBITDA (HK$’m)

The Group's total GGR on a management basis[6] in Q4 2018was $17.0billion,up 2% year-on-year and up 8% quarter-on-quarter. Total mass table GGR was $7.3 billion,up 10% year-on-year and up 11% quarter-on-quarter. Total VIP GGR was $9.0 billion,down 5% year-on-year and up 5% quarter-on-quarter. Total electronic GGR was $681 million,up 24% year-on-year and up 10% quarter-on-quarter.

Group Key Financial Data

(HK$'m)

Q4 2017

(Restated)

Q3 2018

Q4 2018

FY2017

(Restated)

FY2018

Revenues:

Net Gaming

11,630

11,068

12,138

40,025

Non-gaming

1,319

1,358

1,369

4,298

Construction Materials

921

569

651

3,888

Total Net Revenue[7]

13,870

12,995

14,158

48,211

Adjusted EBITDA

4,159

3,879

4,333

14,857

Gaming Statistics[8]

(HK$'m)

Q4 2017

Q3 2018

Q4 2018

FY2017

FY2018

Rolling Chip Volume

280,698

264,491

260,505

912,107

Win Rate %

3.4%

3.3%

3.5%

3.5%

3.4%

Win

9,481

8,604

9,034

31,250

Mass Table Drop[9]

27,375

29,923

31,571

100,657

Win Rate %

24.3%

22.1%

23.2%

24.1%

23.0%

Win

6,655

6,609

7,328

24,487

Electronic Gaming Volume

15,936

18,202

18,191

61,461

Win Rate %

3.5%

3.4%

3.7%

3.5%

3.4%

Win

551

621

681

2,476

Total GGR Win

16,687

15,834

17,043

57,213

Galaxy Macau™

Galaxy Macau™ is the primary contributor to Group revenue and earnings. Net revenue in the year was up 14% year-on-year to $39.5 billion. Adjusted EBITDA was up 16% year-on-year to $12.9 billion. Adjusted EBITDA margin under HKFRS was 33% (2017: 32%).

Galaxy Macau™ experienced bad luck in its gaming operations which decreased its Adjusted EBITDA by approximately $434 million in 2018. Normalized 2018 Adjusted EBITDA grew 19% year-on-year to $13.3 billion.

In Q4 2018,Galaxy Macau™'s net revenue was $10.4 billion,up 2% year-on-year and up 11% quarter-on-quarter. Adjusted EBITDA was $3.4 billion,up 2% year-on-year and up 16% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 33% (Q4 2017: 33%).

Galaxy Macau™ played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $191 million in Q4 2018. Normalized Q4 Adjusted EBITDA was $3.2 billion,up 1% year-on-year and down 1% quarter-on-quarter.

The combined five hotels registered strong occupancy was virtually 100% for both the full year and Q4.

Galaxy Macau™ Key Financial Data

(HK$'m)

Q4 2017

(Restated)

Q3 2018

Q4 2018

FY2017

(Restated)

FY2018

Revenues:

Net Gaming

9,001

8,181

9,201

30,500

34,983

Hotel / F&B / Others

864

888

858

3,279

3,385

Mall

250

268

302

906

1,123

Total Net Revenue[10]

10,115

9,337

10,361

34,685

39,491

Adjusted EBITDA

3,357

2,957

3,433

11,130

12,871

Adjusted EBITDA Margin %

33%

32%

33%

32%

33%

Gaming Statistics[11]

(HK$'m)

Q4 2017

Q3 2018

Q4 2018

FY2017

FY2018

Rolling Chip Volume

191,995

189,607

172,378

621,525

775,429

Win Rate %

3.8%

3.4%

3.8%

3.7%

3.5%

Win

7,263

6,354

6,612

23,060

27,423

Mass Table Drop[12]

16,135

17,650

18,593

59,041

70,286

Win Rate %

29.0%

25.1%

27.8%

28.2%

26.7%

Win

4,682

4,434

5,178

16,664

18,746

Electronic Gaming Volume

11,782

13,026

12,851

46,062

52,778

Win Rate %

4.0%

4.0%

4.5%

4.0%

3.9%

Win

467

527

573

1,842

2,082

Total GGR Win

12,412

11,315

12,363

41,566

48,251

StarWorld Macau

StarWorld Macau's net revenue in the year was up 18% year-on-year to $12.2 billion. Adjusted EBITDA was up 28% year-on-year to $3.8 billion. Adjusted EBITDA margin under HKFRS increased to 31% (2017: 29%).

StarWorld Macau experienced bad luck in its gaming operations which decreased its Adjusted EBITDA by approximately $48 million in 2018. Normalized 2018 Adjusted EBITDA grew 30% year-on-year to $3.9 billion.

In Q4 2018,StarWorld Macau's net revenue was $3.0 billion,up 12% year-on-year and up 2% quarter-on-quarter. Adjusted EBITDA was $893 million,up 19% year-on-year and down 4% quarter-on-quarter. Adjusted EBITDA margin under HKFRS increased to 30% (Q4 2017: 28%).

StarWorld Macau played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $115 million in Q4 2018. Normalized Q4 Adjusted EBITDA was $1.0 billion,up 18% year-on-year and up 8% quarter-on-quarter.

Hotel occupancy was virtually 100% for both the full year and Q4.

StarWorld Macau Key Financial Data

(HK$'m)

Q4 2017

(Restated)

Q3 2018

Q4 2018

FY2017

(Restated)

FY2018

Revenues:

Net Gaming

2,524

2,794

2,839

9,758

11,659

Hotel / F&B / Others

122

110

121

461

449

Mall

13

12

13

48

51

Total Net Revenue[13]

2,659

2,916

2,973

10,267

12,159

Adjusted EBITDA

751

927

893

2,966

3,810

Adjusted EBITDA Margin %

28%

32%

30%

29%

31%

Gaming Statistics[14]

(HK$'m)

Q4 2017

Q3 2018

Q4 2018

FY2017

FY2018

Rolling Chip Volume

85,920

73,750

87,317

278,575

323,063

Win Rate %

2.5%

3.0%

2.7%

2.9%

3.0%

Win

2,116

2,191

2,386

8,213

9,654

Mass Table Drop[15]

8,201

9,062

9,620

29,509

36,375

Win Rate %

17.9%

18.5%

16.9%

19.0%

18.5%

Win

1,467

1,680

1,630

5,609

6,723

Electronic Gaming Volume

1,640

1,945

2,010

6,472

7,585

Win Rate %

2.1%

2.1%

2.1%

2.3%

2.3%

Win

35

41

42

146

172

Total GGR Win

3,618

3,912

4,058

13,968

16,549

Broadway Macau™

Broadway Macau™ is a unique family friendly,street entertainment and food resort supported by Macau SMEs,it does not have a VIP gaming component. The property's net revenue in 2018 was up 9% year-on-year to $562 million. Adjusted EBITDA was $32 million for 2018 versus $10 million in 2017. Adjusted EBITDA margin for 2018 calculated under HKFRS was 6% (2017: 2%).

Broadway Macau™ experienced bad luck in its gaming operations which decreased its Adjusted EBITDA by approximately $2 million in 2018. Normalized 2018 Adjusted EBITDA was $34 million versus $12 million in 2017.

In Q4 2018,Broadway Macau™'s net revenue was $144 million,down 1% year-on-year and down 1% quarter-on-quarter. Adjusted EBITDA was $8 million,versus $7 million in prior year and $9 million in Q3 2018. Adjusted EBITDA margin under HKFRS increased to 6% (Q4 2017: 5%).

Broadway Macau™ played lucky in its gaming operations which increased its Adjusted EBITDA by approximately $1 million in Q4 2018. Normalized Q4 Adjusted EBITDA was $7 million,versus $3 million in prior year and $13 million in Q3 2018. Hotel occupancy was 97% for the full year and 98% in Q4.

Broadway Macau™ Key Financial Data

(HK$'m)

Q4 2017

(Restated)

Q3 2018

Q4 2018

FY2017

(Restated)

FY2018

Revenues:

Net Gaming

75

65

69

258

272

Hotel / F&B / Others

60

69

63

216

246

Mall

11

11

12

40

44

Total Net Revenue[16]

146

145

144

514

562

Adjusted EBITDA

7

9

8

10

32

Adjusted EBITDA Margin %

5%

6%

6%

2%

6%

Gaming Statistics[17]

(HK$'m)

Q4 2017

Q3 2018

Q4 2018

FY2017

FY2018

Mass Table Drop[18]

377

368

346

1,456

1,404

Win Rate %

19.7%

16.9%

18.9%

18.0%

18.4%

Win

75

62

65

262

259

Electronic Gaming Volume

327

509

574

1,019

2,008

Win Rate %

2.7%

2.1%

2.3%

3.0%

2.3%

Win

9

11

13

31

46

Total GGR Win

84

73

78

293

305

City Clubs

City Clubs contributed $111million of Adjusted EBITDA to the Group's earnings for 2018 versus $107 million in 2017. Q4 2018 Adjusted EBITDA was $29 million,flatyear-on-year,up 4%quarter-on-quarter.

City Clubs Key Financial Data

(HK$'m)

Q4 2017

Q3 2018

Q4 2018

FY2017

FY2018

Adjusted EBITDA

29

28

29

107

111

Gaming Statistics[19]

(HK$'m)

Q4 2017

Q3 2018

Q4 2018

FY2017

FY2018

Rolling Chip Volume

2,783

1,134

810

12,047

4,615

Win Rate %

3.7%

5.2%

4.4%

2.7%

3.7%

Win

102

59

36

327

173

Mass Table Drop[20]

2,662

2,843

3,012

10,246

11,592

Win Rate %

16.2%

15.2%

15.1%

16.3%

15.2%

Win

431

432

455

1,673

1,759

Electronic Gaming Volume

2,178

2,722

2,756

8,294

10,090

Win Rate %

1.8%

1.6%

1.9%

1.7%

1.7%

Win

40

42

53

142

176

Total GGR Win

573

533

544

2,142

2,108

Construction Materials Division

The Construction Materials Division contributed Adjusted EBITDA of $940 million in 2018,up 26% year-on-year. Q4 2018 Adjusted EBITDA was $205 million,down 13% year-on-year and up 4% quarter-on-quarter.

Development Update

Galaxy Macau™ and StarWorld Macau

To maintain our attractiveness,we are proceeding on a $1.5 billion property enhancement program for Galaxy Macau™ and StarWorld Macau. This program not only enhances our attractiveness,but also includes preparation work for the effective future integration and connectivity of Phases 3 & 4.

Cotai-- The Next Chapter

GEG is uniquely positioned for long term growth. We continue to move forward with Phases 3 & 4,which will include approximately 4,500 hotel rooms,including family and premium high end rooms,400,000 square feet of MICE space,a 500,000 square feet 16,000-seat multi-purpose arena,F&B,retail and casinos,among others.We look forward to formally announcing our development plans in the future.

Hengqin

We continue to make progress with our concept plan for our Hengqin project. Hengqin will allow GEG to develop a low density leisure destination resort that will complement our high energy resorts in Macau.

International

On 20 July 2018 the Japanese Diet passed the Integrated Resort ("IR") Bill. We are very pleased with the recent passing of the IR Bill in Japan. We view Japan as a great long term growth opportunity that will complement our Macau operations and our other international expansion ambitions. GEG,together withMonte-Carlo SBM from the Principality of Monaco and our Japanese partners,look forward to bringing our brand of World Class IRs to Japan.

Selected Major Awards in 2018

Award

Presenter

GEG

Asiamoney Asia's Outstanding Companies Poll – Most Outstanding

Company in Hong Kong – Consumer Discretionary Sector

Asiamoney

Most Honored Company

Best Investor Relations Program (Overall)-- First Place

Best Corporate Governance (Overall)-- First Place

Best ESG SRI Metrics (Overall)-- First Place

Best Analyst Day (Overall)-- First Place

Institutional Investor Magazine-- 2018 All

Asia Executive Team Survey

Sina 2018 Golden Lion Awards-- Best Listed Companies

Sina

Best IR Company (Large Cap)

Hong Kong Investor Relations Association

Top 100 Hong Kong Listed Companies Award-- Comprehensive

Strength

QQ.com x Finet

Outstanding Corporate Social Responsibility Award

Mirror Post

Galaxy MacauTM

Integrated Resort of the Year

11th International Gaming Awards

World's Leading Casino Resort 2018

Asia's Leading Casino Resort 2018

The 25th World Travel Awards

Best Hospitality & Gaming Company 2018

APAC Hong Kong Business Awards 2018

Best Integrated Resort Award

Best Gaming Floor Award

G2E Asia Awards

StarWorld Macau

The Supreme Award of Asia's Best F&B Service Hotel

The 18th Golden Horse Awards of China

Hotel

Top Ten Charm City Hotels

The 13th International Hotel Platinum Award

Broadway MacauTM

Business Awards of Macau 2018 -Excellence Award for Environmental

Performance

Macau Business Magazine

Construction Materials Division

Caring Company Scheme-- 15 Years Plus Caring Company Logo

The Hong Kong Council of Social Service

Grand Award-Excellence in Environmental Disclosure

Hong Kong ESG Reporting Awards

Hong Kong Green Organization Certification-- Wastewi$e Certificate--

Excellence Level

Environmental Campaign Committee

17th Hong Kong OSH Award

--Safety Performance Award - Other Industries

--Safety Management System Award - Other Industries

Occupational Safety and Health Council

Sustainable Consumption Award Scheme-- Certificate of Excellence --

Sustainable Consumption Enterprise Award

Business Environment Council

Green Office Award Labeling Scheme-- Certificate of Recognition

Green Office and Eco-- Healthy Workplace Awards Labeling Scheme -

Green Office and Eco-- Healthy Workplace

World Green Organization

Social Capital Builder Logo Award

Labour and Welfare Bureau-- Community

Investment & Inclusion Fund

Outlook

In 2019,we will continue to focus on driving every segment of our business with a particular focus on the mass segment and we will continue to allocate resources to their highest and best use.

Our healthy balance sheet combined with our strong cash flow allows us to return capital to shareholders through special dividends and fund both our Macau development pipeline and international expansion opportunities.These include Cotai Phases 3 & 4,Hengqin and Japan.

Mainland China has significant demand for leisure,tourism and travel. GEG is uniquely positioned to capitalize on future growth potential having the largest development pipeline in Macau with Phases 3 & 4.

In addition,we believe the Greater Bay Area integration plan will further facilitate the flow of people,logistics and capital within Macau,Hong Kong and the nine cities of southern Guangdong. GEG will continue to support and leverage on the plan by enhancing the competitiveness of our resort portfolio,including our development plans on Hengqin.

We also look forward to the continued improvements in infrastructure. The opening of the Hong Kong-Shenzhen-Guangzhou high speed train and the Hong Kong-Zhuhai-Macau Bridge in 2018 will further enhance the appeal and accessibility to Macau for both Chinese and international visitors. In addition,the expected opening of the Light Rail Transport (LRT) in Taipa in the second half of 2019 will also help to enhance the ease of travel within Macau.

The recent developments in the United States and China trade discussions are certainly cause for optimism,having said that we expect to continue to experience geo-political and economic challenges that may have an impact on consumer confidencein 2019.

We remain confident in the longer term outlook for Macau in general,and GEG specifically. We look forward to celebrating the 20th anniversary of Macau's handover to China and continue to support the Central Government's Greater Bay Area Initiative. GEG is committed to invest in Macau's economic diversification and support the Macau Government's vision of becoming a World Centre of Tourism and Leisure.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group ("GEG" or the "Group") is one of the world's leading resorts,hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort,retail,dining,hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative,spectacular and award-winning properties,products and services,underpinned by a "World Class,Asian Heart" service philosophy,that has enabled it to consistently outperform and lead the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai,Galaxy Macau™,one of the world's largest integrated destination resorts,and the adjoining Broadway Macau™,a unique landmark entertainment and food street destination; and on the Peninsula,StarWorld Macau,an award winning premium property.

The Group has the largest undeveloped landbank of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed,GEG's resorts footprint on Cotai will double to more than 2 million square meters,making the resorts,entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG is also planning to develop a world class leisure and recreation destination resort on a 2.7 square kilometer land parcel on Hengqin adjacent to Macau. This resort will complement GEG's offerings in Macau,and at the same time differentiate it from its peers while supporting Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015,GEG made a strategic investment in Société Anonyme des Bains de Mer et du Cercle des Etrangers à Monaco ("Monte-Carlo SBM"),a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM including Japan.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group,please visit www.galaxyentertainment.com

[1]The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the group level the gaming statistics include Company owned resorts plus City Clubs.

[2]Total net revenue is reported under the new accounting standard and the corresponding figures for past periods are restated.

[3]Gaming statistics are presented before deducting commission and incentives.

[4]Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

[5] Total GGR win includes gaming win from City Clubs.

[6]The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the group level the gaming statistics include Company owned resorts plus City Clubs.

[7]Total net revenue is reported under the new accounting standard and the corresponding figures for past periods are restated.

[8]Gaming statistics are presented before deducting commission and incentives.

[9]Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

[10]Total net revenue is reported under the new accounting standard and the corresponding figures for past periods are restated.

[11]Gaming statistics are presented before deducting commission and incentives.

[12]Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

[13]Total net revenue is reported under the new accounting standard and the corresponding figures for past periods are restated.

[14]Gaming statistics are presented before deducting commission and incentives.

[15]Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

[16]Total net revenue is reported under the new accounting standard and the corresponding figures for past periods are restated.

[17]Gaming statistics are presented before deducting commission and incentives.

[18]Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

[19]Gaming statistics are presented before deducting commission and incentives.

[20]Mass table drop includes the amount of table drop plus cash chips purchased at the cage.

Photo - https://photos.prnasia.com/prnh/20190228/2389078-1-a

Photo - https://photos.prnasia.com/prnh/20190228/2389078-1-b

Tags: Banking/Financial Service Entertainment Travel

Previous:Tuniu to Report Fourth Quarter and Fiscal Year 2018 Financial Results on Februar...

Next:Tuniu Announces Unaudited Fourth Quarter and Fiscal Year 2018 Financial Results

Leave a comment

Follow Us

Newsletter

Join us to get the latest news.