I-Mab Provides Business and Corporate Updates and Reports Financial Results for the Six Months Ended June 30, 2022

Seven key clinical milestones achieved year-to-date,including positive data readouts for lemzoparlimab,uliledlimab,and TJ-CD4B

Lemzoparlimab is on track for Phase 3 study for 1L MDS

Amendment to the global partnership with AbbVie for certain new CD47 antibodies currently in development with up to US$1.295 billion in milestone payments

Significant progress made on the expanded uliledlimab phase 2 NSCLC clinical trial with more complete dataset to be expected

Continued focus on key value drivers of five clinical-stage assets with three potential BLAs within the next three years

Repositioned commercialization strategy for felzartamab and eftansomatropin alfa

Total cash position of US$586 million (RMB3.9 billion),sufficient to fund key business operations for more than three years

I-Mab will host conference calls and webcasts on August 30,2022. A Mandarin session will be held at 7:00 a.m. ET and an English session will be held at 8:15 a.m. ET.

GAITHERSBURG,Md. and SHANGHAI,Aug. 30,2022 -- I-Mab (the "Company") (Nasdaq: IMAB),a clinical-stage biopharmaceutical company committed to the discovery,development,and commercialization of novel biologics,today announced financial results for the six months ended June 30,2022,and provided key business updates.

During this reporting period,the Company has implemented a series of strategic initiatives that aim to re-position its overall business priorities to focus on key value drivers while preserving a strong cash position estimated to be sufficient to support its key business operations for more than three years.

Specifically,the Company will continue to drive value by leveraging its global R&D competitive advantages in immuno-oncology,which has been demonstrated in the Company's short history with such examples as lemzoparlimab,uliledlimab and TJ-CD4B. Today,our pipeline is not only innovative but also advanced as certain key assets move towards BLA and near-term commercialization,including felzartamab and eftansomatropin alfa. The Company's current business model relies on a two-pillarapproach to realize the value of innovation. The first pillar is to partner out the global rights of its innovative assets after global phase 1 or phase 2 clinical validation while retaining the rights for clinical development,manufacturing,and commercialization in China.This is exemplified by the global partnership with AbbVie for lemzoparlimab. The Company will continue to pursue more partnership opportunities for other global assets in its pipeline. The second pillar is to rapidly develop the assets towards BLA and commercialization in China and then partner with large pharmaceutical companies which have well-established sales forces and proven commercialization capabilities to marketthe products in China. This approachis exemplified by the commercial partnership with Jumpcan for eftansomatropin alfa. The Company is seeking similar commercial partnerships for other late-stage assets,including felzartamab. In addition to the broad strategic approach outlined above,the Company is committed to the following:

Firstly,following a systematic review of its pipeline development and overall business,the Company has prioritized its resources to focus on five key clinical stage assets with 10 ongoing and planned clinical trials. These prioritized programs represent the Company's key value drivers as significant progress in these prioritized programs will not only accelerate the clinical development towards pivotal or registrational studies (such as lemzoparlimab and uliledlimab) but also facilitate global business development deals. The Company is currently pursuing potential global partnership deals for uliledlimab and TJ-CD4B.

Secondly,theCompany's current commercialization strategy aims to maximize the commercial value of its pre-BLA products through commercial partnerships typically structured with upfront,regulatory,and sales milestone payments along with significant sales royalties. A commercial partnership for eftansomatropin alfa was established with Jumpcanin 2021 and is progressing as planned. By doing so,the Company is able to avoid investing significant resources to build its sales forces and instead allocate the resources to deliver the value-driver milestones or catalysts. The Company is currently pursuing a similar commercial partnership for felzartamab.

Thirdly,the Company will continue to invest in the discovery and development of its next-generation pipeline assets. I-Mab's next-generation innovative pipeline is strategically designed and driven by cutting-edge science and technology,with a focus on first-in-class and best-in-class potential. Multiple novel assets focusing on innovative bi-specific antibodies and cytokine-based immune adjuvants are on track to advance towards an IND enabling stage with a goal to achieve four to five INDs or Phase 1 study initiations around 2025.

Fourthly,through a strategy of re-positioning the pipeline to prioritize key assets with high probability of commercial success,the Company has been making significant efforts to preserve its strong cash position. As of June 30,the Company had a total cash position,consisting of cash,cash equivalents,and short-term investments,of US$586 million (RMB3.9 billion),which the Company estimates to besufficient to fund its key business operations for over three years.

"As we weather turbulent market conditions worldwide,we must prioritize our resources to focus on value-driving assets while continuing to deliver on key milestonesand strengtheningthe Company's fundamentals," said Dr. Jingwu Zang,Founder,Chairman,and Acting CEO."We haveachieved seven critical clinical milestones year-to-date,uliledlimab and TJ-CD4B. In our pipeline development,we have also made significant progress onlemzoparlimab. Phase 2 data will be presented in a proffered presentation at the upcoming European Society for Medical Oncology (ESMO) Congress in September,and we are on track to initiate a registrational trial in China by the end of 2022. We expect to see additional data from the expanded phase 2 study of uliledlimab in the fourth quarter of 2022."

Dr. Zang added,"Another key focus is the current registrational studies towards anticipated BLAs between now and 2024 and subsequent commercialization for felzartamab and eftansomatropin alfa. We have a clear strategy to focus on creating value for our shareholders while preserving a strong cash position to support our key business operations for over three years."

"On the corporate development front,business development remains a key strategic priority for the Company,and we continue to pursue potential partnership opportunities. Looking ahead,we remain confident inachievingcritical clinical and corporate milestones by year-end to continue to createvalue for our stakeholders." Dr. Zang concluded.

Updated Pipeline Development Highlights and Upcoming Milestones

The Company's drug pipeline has a number of critical features: (1) The pipeline is innovative and globally competitive,comprised of three generations of products with first-in-class and best-in-class potential. This is exemplified by the first generation of differentiated drug assets,such as felzartamab and eftansomatropin alfa,which are in registrational trial or at a pre-BLA stage,as well as novel monoclonal antibodies such as lemzoparlimab and uliledlimab,which are in phase 2 clinical trials or preparation for phase 3. The second generation of even more innovative bi-specific antibody assets,including TJ-CD4B and TJ-L14B,are in phase 1 clinical trials,followed by additional bi-specific antibody assets progressing towards an IND enabling stage. The new discovery initiatives for the third-generation innovation are on the way for high-risk and high-value drug candidates enabled by transformative technologies. (2) The pipeline is focused on immuno-oncology and biologics,leveraging its unique R&D and CMC strengths. (3) The pipeline is advanced with three assets are either in phase 3 or registrational studies or planned for phase 3. The Company expects to achieve three potential BLA submissions or market launches between 2023 and 2025.

The chart below summarizes the development status of the Company's clinical stage pipeline (pre-clinical programs are not shown).

(1) Five prioritized clinical assets:

Lemzoparlimab (Phase 3 planned): The current focus is on the combination therapy of lemzoparlimab with azacytidine (AZA) for the treatment of newly diagnosed myelodysplastic syndromes (MDS) with the goal of being first-to-market in China. The probability of success is supported by collective safety data based on nearly 200 patients from multiple clinical trials and the positive efficacy data,especially from the phase 2 study in patients with MDS. Active communications are ongoing with the China CDE and NMPA for the initiation of a registrational trial by the end of 2022,depending upon the regulatory process and the preparation of the clinical sites around the country. In parallel,two other studies,including solid tumor indications are ongoing.

Clinical development progress and update on global strategic partnership with AbbVie. Lemzoparlimab,a novel CD47 antibody developed by the Company,is being investigated through a comprehensive clinical development plan for hematologic malignancies and solid tumors. The Company's near-term priority is to initiate a phase 3 registrational trial in newly diagnosed higher-risk MDS patients by Q4 2022,potentially making lemzoparlimab the first CD47 product in China. I-Mab is currently leading three clinical studies of lemzoparlimab,with about 200 patients treated across different indications. Safety Data. Overall,the safety data from multiple clinical trials in the U.S. and China involving nearly 200 cancer patients have demonstrated a good safety profile of lemzoparlimab without the need for a priming dose regimen. Efficacy Data. Lemzoparlimab has shown encouraging efficacy signals in different tumor indications from multiple clinical trials. In particular,recent phase 2 data from lemzoparlimab combination therapy with AZA indicated that lemzoparlimab exerted a comparable level of clinical efficacy with magrolimab in a similar therapeutic setting as described below.

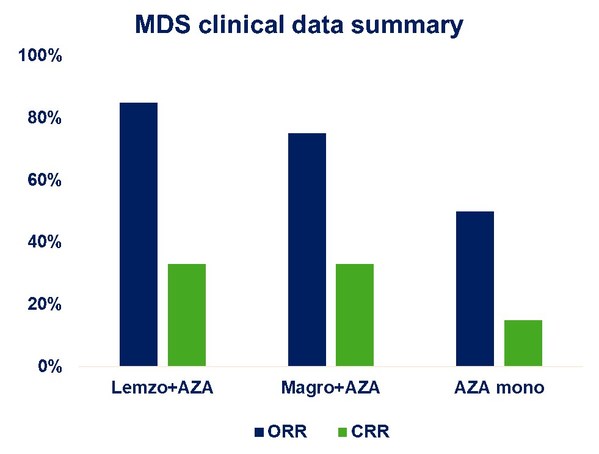

Lemzoparlimab in combination with AZA for AML and MDS: Over 90 patients with newly diagnosed MDS or acute myeloid leukemia (AML) have been dosed with lemzoparlimab at 30 mg/kg in combination with AZA in China. This patient cohort had a more severe disease at baseline due to disease conditions and clinical practice patterns in China. I-Mab's recent data analysis of the MDS cohort,including over 50 patients who received the combination treatment,showed that without a priming dose,lemzoparlimab was well tolerated. The Company observed significant clinical responses as defined by the overall response and complete response rates,which improved over time (Figure 1). Detailed safety and efficacy data,along with gene mutation analysis,will be presented in a proffered paper at the European Society for Medical Oncology (ESMO) Congress 2022.

Phase 3 clinical trial of lemzoparlimab in combination with AZA as a 1L treatment for MDS. An end-of-phase 2 (EOP2) meeting request was submitted to China CDE and NMPA and discussion is ongoing with CDE to initiate a phase 3 clinical trial in patients with MDS by the end of 2022.

Figure 1. Clinical efficacy of lemzoparlimab and AZA combination in MDS patients who received initial dose over six months

Lemzoparlimab in combination with rituximab for non-Hodgkin's lymphoma (NHL): The dose expansion trial is ongoing to enroll more patients. The preliminary data were reported at ASH 2021.

Lemzoparlimab in combination with PD-1 therapy for solid tumors:Phase 2 clinical trial in combination with a PD-1 antibody (pembrolizumab or toripalimab) are ongoing in patients with selected advanced solid tumors.

Update on AbbVie partnership: On August 15,the Company and AbbVie entered into an amendment to the original license and collaboration agreement dated September 3,2020 between the parties on CD47 antibody therapies (as amended,the "Agreement"). Both parties will continue to collaborate on the global development of anti-CD47 antibody therapy under the Agreement. The Company will be eligible to receive,and AbbVie will pay,up to US$1.295 billion in the development,regulatory and sales milestone payments,and the tiered royalties at rates from mid-to-high single digit percentages on global net sales outside of Greater China for certain new anti-CD47 antibodies currently in development,or the original milestone payments and tiered royalties previously disclosed in the Company's Form 20-F for the fiscal year 2021 for other licensed products. The Company has the exclusive right to develop and commercialize all licensed products under the Agreement in Greater China.

The Company continues its commitment to lemzoparlimab development based on the accumulative safety data,without the need for a priming dosing regimen,from nearly 200 cancer patients as well as the efficacy data,especially from a Phase 2 study of combination therapy of lemzoparlimab and AZA in patients with higher risk MDS. The detailed data will be presented in a proffered paper at the European Society for Medical Oncology (ESMO) Congress in September 2022. The Company is on track to initiate a Phase 3 clinical trial in patients with MDS in China as planned.

AbbVie has discontinued the global Phase 1b study of lemzoparlimab combination therapy with AZA and venetoclax,in patients with MDS and AML. This decision was not based on any specific or unexpected safety concerns.

Uliledlimab (End of Phase 2,Pivotal Study Planned in 2023):A highly differentiated CD73 antibody being developed for solid tumor indications. The Company is currently advancing uliledlimab in two phase 2 clinical trials in the U.S. and China in selected tumor types for clinical proof-of-concept. The current development focus is on non-small cell lung cancer (NSCLC) as a combination therapy with a PD-1 antibody to aim for the potential initiation of a pivotal clinical study in 2023.

Phase 2 clinical study of uliledlimabin combination with PD-1 antibody (toripalimab) in advanced NSCLC:The Company presented the preliminary clinical results of an ongoing phase 2 clinical study of uliledlimab in combination with toripalimab (TUOYI®) in patients with NSCLC at the 2022 American Society of Clinical Oncology (ASCO) Annual Meeting.The results are largely consistent with those observed in phase 1 clinical trial in relation to favorable safety,pharmacokinetics (PK),and pharmacodynamic (PD) profile of uliledlimab. Uliledlimab appears safe and well-tolerated up to the highest doses tested at 30 mg/kg Q3W,as a monotherapy and as a combination therapy with toripalimab with no dose limiting toxicity (DLT). Uliledlimab exhibited a linear PK profile at doses ≥5mg/kg and a dose-dependent receptor occupancy with no "hook effect" where the antibody loses its effectiveness at high concentrations.

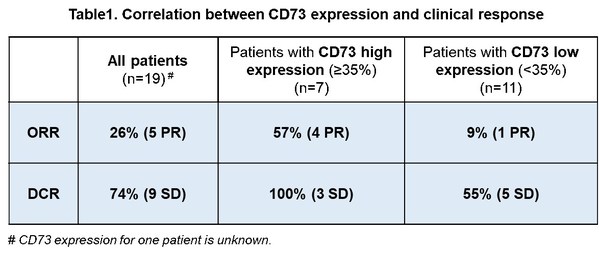

The phase 2 preliminary efficacy data as of March 29,are summarized as follows. Among the three NSCLC patient cohorts who were under different treatment settings,clinical responses varied. The highest clinical response rate was observed in the patient cohort with advanced NSCLC (mostly stage 4 disease) who were previously ineligible for standard of care treatment. Among 19 efficacy evaluable patients from this cohort,5 partial responses (5 PR,overall response rate [ORR]=26%) and 9 stable disease (9 SD,disease control rate [DCR] =74%) were observed. Approximately 80% of patients in this cohort showed low PD-L1 expression in baseline tumor samples (tumor proportion score [TPS] 1-49% or TPS<1%) who were considered less responsive to a checkpoint inhibitor therapy as demonstrated in KEYNOTE-042 (ORR=16.9% for patients with PD-L1 TPS 1-49%). Notably,the clinical response observed in this patient cohort correlated with tumor CD73 expression. In a subgroup of 7 patients with high CD73 expression (≥35% expression level in tumor cells or immune cells),ORR (4 PR) was 57% with 100% DCR (3 SD) (Table 1). While the other two heavily treated NSCLC cohorts showed a lower clinical response.

Based on the preliminary data mentioned above,the phase 2 clinical trial was expanded to focus on enrolling the selected patient cohort with advanced NSCLC who were previously ineligible for standard of care treatment for further evaluation of treatment efficacy as well as the role of CD73 as a potential predictive biomarker.

The current status of the expanded phase 2 clinical trial in patients with NSCLC: As of August 2022,47 patients have been enrolled in this expanded cohort,and more data are being collected. At a high level,the new data have further confirmed the compelling safety and encouraging efficacy signals as well as the correlation between high tumor expression of CD73 and clinical response in patients with NSCLC. The Company's goal is to speed up the expanded phase 2 study and complete the target enrollment of 60 patients within the next two months. A more complete dataset is expected by Q4 2022. The Company is seeking a suitable opportunity to present the new dataset either by the end of 2022 or early 2023. In parallel,the company is in the process of exploring a potential global partnership deal.

Development of companion diagnostic (CDx) kit of CD73:Based on the correlation data between clinical response and tumor CD73 expression,I-Mab is collaborating with WuXi Diagnostics to develop a standardized companion diagnostic kit of CD73 to be employed in the planned pivotal clinical trial in 2023.

Felzartamab (BLA ready for 3L MM,Phase 3 for 2L MM):A differentiated CD38 antibody for the treatment of relapsing and refractory multiple myeloma (MM) and potentially autoantibody-mediated autoimmune diseases such as membranous nephropathy. A new combination therapy with lemzoparlimab for high-risk MM is being investigated pre-clinically. The Company owns the rights for the development,and commercialization of felzartamab in Greater China from MorphoSys.

Felzartamab is positioned as the first and only locally manufactured CD38 antibody to be commercially more competitive in China. Although the current BLA plan is based on an imported drug license application,the Company has a manufacturing plan by leveraging the manufacturing facilityheld by I-Mab Biopharma (Hangzhou) Limited("I-Mab Hangzhou"),an unconsolidated investee of the Company,for future commercial production with potentially lowcost of goods.

China BLA ready for third-line MM:The registrational trial has been completed,and the topline data have met the preset primary and secondary endpoints. More importantly,the clinical data have confirmed the clinical advantages of felzartamab in terms of lower infusion-related reaction rate and shorter infusion time,which has made it possible for its use in an outpatient clinic setting. In January 2022,the Company signed a partnership agreement with the Hangzhou Qiantang Government in China to manufacture felzartamab locally to accelerate its commercialization. The local manufacturing plan is expected to significantly reduce the cost of goods and render felzartamab commercially more competitive. The Company is exploring potential commercial partnership for felzartamab in China,which,if successful,will enable the Company to maximize the value of felzartamab while avoiding investing significant resources in building up commercialization capability at this time.

China phase 3 trial as a second-line treatment for MM:Patient enrollment for a randomized,open-label,parallel-controlled phase 3 registrational trial of felzartamab in combination with lenalidomide as a second-line treatment for MM was completed in September 2021. The topline data package,if fully matured in 2023,is expected to support a potential BLA submission.

New potential combination therapy with lemzoparlimab: CD47 is consistently and highly expressed on MM tumor cells expressing various levels of CD38; the Company investigated the possibility of combining felzartamab with lemzoparlimab for a more effective treatment for MM in a pre-clinical setting. The results supported that the combination therapy has a synergistic effect on MM. The data have been submitted to ASH 2022 for presentation.

Eftansomatropin alfa (Phase 3,BLA ready in 2023):A differentiated long-acting growth hormone for pediatric growth hormone deficiency (PGHD). Eftansomatropin alfa is the only rhGH in its proprietary fusion protein format (pure protein-based molecule) without chemically linking with PEG or other moieties. Its safety,tolerability,and efficacy have been well demonstrated in a phase 2 clinical trial in the EU. The Company has the rights for the development,and commercialization of eftansomatropin alfa in China from Genexine.

Phase 3 clinical trial for PGHD: This phase 3 registrational trial (TALLER) of eftansomatropin alfa as a weekly treatment for PGHD patients is ongoing in China. On May 31,the Company announced the completion of patient enrollment in the TALLER study for treatment of PGHD. TALLER is a multi-center,randomized,active-controlled phase 3 clinical study (NCT04633057) that has enrolled 168 patients in China. The study aims to evaluate the efficacy,safety,and pharmacokinetics (PK) of eftansomatropin alfa in PGHD,as compared to Norditropin®,a daily rhGH marketed in China. Following the completion of the enrollment in May 2022,the final dataset from the TALLER study is anticipated in Q3 2023,which is expected to be followed by a BLA submission in Q4 2023 or Q1 2024.

Strategic commercial partnership with Jumpcan: In November 2021,the Company announced a strategic commercial partnership with Jumpcan,a leading domestic pharmaceutical company specializing in and committed to pediatric medicines,to accelerate the commercialization of eftansomatropin alfa. I-Mab will be the marketing authorization holder (MAH) of the product and supply the product at an agreed cost rate to Jumpcan. Jumpcan will be responsible for commercializing the product and developing new indications in collaboration with I-Mab in mainland China. Jumpcan has made an upfront payment of RMB224 million to I-Mab. Further,upon achievement of development,registration and sales milestones,I-Mab will be eligible to receive milestone payments in aggregate of up to RMB1.792 billion andtotal non-royalty payments up to RMB2.016 billion. In addition,I-Mab and Jumpcan will share profits generated from the commercialization of the product in mainland China on a 50/50 basis,pursuant to which I-Mab will be entitled to receive tiered low double-digit royalties on net sales. This partnership deal represents one of the largest in China's biopharma market.

TJ-CD4B/ABL111 (Phase 1): A novel Claudin 18.2 and 4-1BB bi-specific antibody is composed of a highly potent Claudin18.2 IgG with high binding affinity even in Claudin18.2 low-expressing tumors and a unique 4-1BB scFv which could stimulate T cells only upon tumor cell engagement to avoid systemic and liver toxicity. TJ-CD4B is designed to treat patients with Claudin18.2 positive gastric and pancreatic cancer. In March 2022,the Company received FDA Orphan Drug Designation for TJ-CD4B for the treatment of gastric cancer,including cancer of the gastroesophageal junction.

Phase 1 clinical trial of TJ-CD4B in patients with advanced or metastatic solid tumors: The dose escalation part of the study reached 8 mg/kg without encountering dose limiting toxicity. More data are being generated as the trial progresses. As of Q2 2022,5 dose cohorts had been completed,with 16 subjects dosed. Regarding safety,no grade 2 TRAEs or DLTs were reported. There is a dose-dependent increase of drug exposure and soluble 4-1BB in serum,suggestive of a favorable PK/PD profile and potentially a longer dosing interval with durable T cell activation. Preliminary clinical activity was also observed,with one confirmed PR of a metastatic esophageal adenocarcinoma patient who failed three lines of prior therapies,including PD-1 therapy,and three cases of stable disease (SD). The study is currently at 8 mg/kg without significant toxicities. Additional clinical sites in China joined this phase 1 international multi-center clinical trial,with the first patient dosed at 5 mg/kg in July 2022.

(2) Other clinical assets

Efineptakin alfa (Phase 2):The world's first and only long-acting recombinant human interleukin-7 ("rhIL-7") and is designed as a monotherapy for the treatment of cancer patients with lymphopenia because of its unique properties of increasing tumor-attacking T cells and as a combination with a PD-1 or PD-L1 antibody because of its potential synergism with PD-1/PD-L1 therapy. The Company has the rights for the development,and commercialization of efineptakin alfa in Greater China from Genexine.

Phase 2 Clinical Trial: the first patient was dosed in a phase 2 study of efineptakin alfa (also known as TJ107) in combination with pembrolizumab (Keytruda®) in patients with advanced solid tumors in January 2022. The study follows a "basket" trial design to include selected tumor types,including triple-negative breast cancer (TNBC) and squamous cell cancer of the head and neck (SCCHN).

Clinical data published by Genexine/NeoImmuneTech: (1) According to the data from the NIT-110 dose-escalation trial presented at ASCO 2021,the combination of efineptakin alfa and pembrolizumab is safe and well-tolerated in patients with advanced solid tumors. It significantly increased T cell numbers in both tumor specimens and the peripheral blood in patients treated with efineptakin alfa. (2) Data from phase 1b/2Keynote-899study,presented at ASCO 2022,showed that combination treatment of efineptakin alfa with pembrolizumab (Keytruda®) induced ORR of 15.7% (8/51) for phase 1b and 21.2% (7/33) for phase 2 study in patients with metastatic TNBC. Notably,the ORR in patients with PD-L1 CPS ≥ 10 was 60% (6/10) compared to 0% (0/15) in patients with PD-L1 CPS < 10,which warrants a further study of a combination regimen for patients with PD-L1 CPS ≥ 10.

Plonmarlimab (TJM2):a monoclonal antibody targeting human granulocyte-macrophage colony-stimulating factor (GM-CSF),a cytokine that plays a critical role in acute and chronic inflammation and cytokine release syndrome (CRS) associated with CAR-T and severe COVID-19.

CRS associated with severe COVID-19: In August 2021,the Company reported positive interim analysis from the phase 2/3 trial of plonmarlimab to treat patients with severe COVID-19. Plonmarlimab treatment resulted in a higher mechanical ventilation free (MVF) rate (83.6% vs. 76.7%),a lower mortality rate (4.9% vs. 13.3%) by day 30,higher recovery rates (68.9% vs. 56.7% at day 14 and 80.3% vs. 70.0% at day 30),as well as reduced time to recovery and hospitalization duration,as compared to placebo. Biomarker results were consistent with the observed clinical outcome and indicated patients treated with plonmarlimab had a reduction in plasma levels of pro-inflammatory cytokines and chemokines critically involved in CRS,including TARC,IP10,GCSF,IL10,IL6,MCP1,IL1RA,TNF-alpha but not interferon-gamma. A transient increase in Neutrophil to Lymphocyte Ratio (NLR) that is commonly associated with disease exacerbation was only observed in placebo. Plonmarlimab was well tolerated in all patients with no significant safety concerns. The clinical data obtained so far have validated the effect of plonmarlimab on CRS,paving the way to continue exploring the therapeutic indications where CRS is a critical element of the diseases. Additional clinical data are being analyzed to determine the next step development plan. The last patient out was in February 2022,and the final clinical study report is expected in the second half of 2022. Currently,no active clinical study is ongoing.

Enoblituzumab (TJ271): A humanized B7-H3 antibody as an immuno-oncology treatment agent. Enoblituzumab works through a dual mechanism to attack tumor cells,i.e.,ADCC and immune activation. The Company licensed the rights for the development and commercialization of enoblituzumab in Greater China from MacroGenics,Inc. ("MacroGenics") under a collaboration agreement (as amended from time to time,the "MacroGenics Agreement"). The Company originally planned a phase 2 clinical trial of enoblituzumab in combination with pembrolizumab (Keytruda®) in patients with selected solid tumors,including NSCLC,bladder cancer and melanoma,in China,but has not enrolled any patient in the trial. In July 2022,due to an unexpected high incidence of fatal bleeding,MacroGenics terminated a phase 2 study of enoblituzumab as a combination therapy with PD-1 antibody or PD-1/LAG3 bispecific antibody in patients with head and neck cancers. The Company exercised its right to terminate the MacroGenics Agreement by serving a termination notice on August 29,which termination will take effect in 180 days after the date of the notice.

TJ210/MOR210:A novel monoclonal antibody targeting C5aR1 to treat solid tumors through the suppression of myeloid-derived suppressor cells and modulation of tumor microenvironment in favor of enhanced anti-tumor immune response as a novel mechanism of action. The in vitro and in vivo pre-clinical studies are ongoing to explore and validate the most effective combination partner(s) of TJ210 in addition to the PD-(L)1 antibody. I-Mab has the rights for the development,manufacturing and commercialization of TJ210 from MorphoSys in Greater China and South Korea,and co-develops the asset globally with MorphoSys. Phase 1 clinical trial in patients with advanced solid tumors: The phase 1 study is ongoing in the U.S.,and patient recruitment for dose escalation will be completed in Q3 2022. In addition,the clinical study report of this phase 1 study is expected in Q4 2022. The phase 1 clinical trial in Chinese patients has been approved by China NMPA. Currently,no active clinical study is ongoing.

TJ-L14B/ABL503:A novel PD-L1-based bispecific antibody with the PD-L1 arm to target PD-L1+ tumor cells and block PD-L1/PD-1 interaction and the 4-1BB arm to conditionally activate T cells upon local tumor engagement. Phase 1 clinical trial in patients with advanced solid tumors: Dose escalation of TJ-L14B monotherapy is ongoing in the U.S. in patients with advanced or metastatic solid tumors. More data are being generated as the trial progresses.

(3) Preclinical assets and programs

The Company's R&D strategy to sustain and enrich the growing innovative immuno-oncology pipeline is to generate the next generation of innovative assets enabled by cutting-edge science and technology. The goal is to achieve four to five INDs or phase 1 clinical trials within the next three years by focusing on bi-specific antibodies and so-called "super antibodies" that are enabled by new technologies,such as mRNA technology,orformatted with novel modalities such as the masking technology. Innovative immune adjuvants to activate both innate and adaptive anti-tumor immunity are also being developed. The Company has made steady progress in advancing the development of these preclinical assets culminating in successful candidate selection of two bispecific molecules early this year and another 4 molecules expected to achieve candidate selection in the near future. Two leading molecules are described below.

TJ-L1IFis a novel PD-L1/IFN-α antibody-cytokine fusion protein,which is specifically designed for the treatment of PD-1/PD-L1 resistant tumors through the addition of a strong immune adjuvant (interferon-alpha,IFN-α) to potentially convert "cold" tumor to "hot" tumor on top of a PD-L1 antibody to achieve superior anti-tumor activity than PD-(L)1 antibody monotherapy. Novel drug molecules with such design is badly needed to address the current clinical challenges where a majority of cancer patients do not or poorly respond to PD-1/PDL-1 therapies.

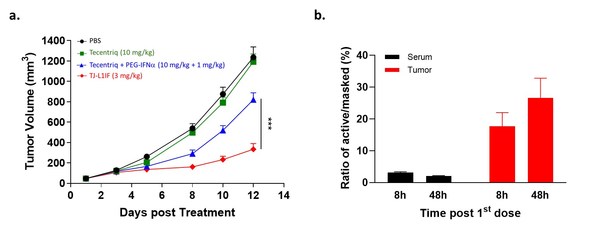

IFN-α was the first cytokine approved for cancer treatment,but its clinical use is highly limited due to considerable systemic toxicity. TJ-L1IF is composed of a PD-L1 VHH nanobody linked with the Fc of human IgG with an engineered IFN-α2b fused at the C-terminus. It is a prodrug in that the IFN-α2b moiety is masked by a PEG group through a protease-cleavable linker rendering the drug inactive in the systemic circulation,thus strongly reducing systemic toxicity. Once the drug accumulates at the tumor site by PD-L1 antibody targeting,the linker is cleaved by proteases that are highly expressed in the tumor environment to achieve specific activation only at the tumor site. This unique property of TJ-L1IF has been confirmed in a series of in vitro and in vivo studies,in which TJ-L1IF demonstrated plasma stability,good safety in cynomolgus monkeys,and superior anti-tumor activity in the PD-1/PD-L1 resistant tumor models,than that achieved by PD-L1 antibody or IFN-α used either alone or in combination. After the first dose of treatment,the active format of the drug was quickly detected and accumulated in the tumor but not in the periphery,confirming the local delivery and conversion to an active form of IFN-α at the tumor site (Figure 2). TJ-L1IF was developed using Affinity's TMEA technology and is now under pre-clinical development.

Figure 2. In vivo anti-tumor activity of TJ-L1IF in PD-L1 resistant tumor model. (a) NSG mice transplanted subcutaneously with colon cancer cell line were treated with Tecentriq (10 mg/kg) alone,Tecentriq (10 mg/kg) and PEG-IFNa (1 mg/kg) combination and TJ-L1IF (3 mg/kg) twice a week. (b) The concentration of PEG cleaved active and PEG masked L1IF was measured in tumor and serum,respectively at 8h and 48h post the first dosing. The ratio of the level of active to that of masked L1IF was calculated.

TJ-C64Bis the Company's third bispecific molecule being developed by leveraging a conditional 4-1BB platform which has the advantage of minimizing liver toxicity with an increased therapeutic window. It is specifically designed to simultaneously target Claudin 6 (CLDN6),uniquely expressed in specific cancer types,including ovarian cancer cells,and 4-1BB expressed by T cells to mediate the T cell killing of CLDN6+ tumor cells. CLDN6 is hardly detectable in normal adult tissues to ensure treatment specificity for ovarian cancers. The Company has achieved candidate selection and is actively progressing the pre-clinical development of the candidate molecule.

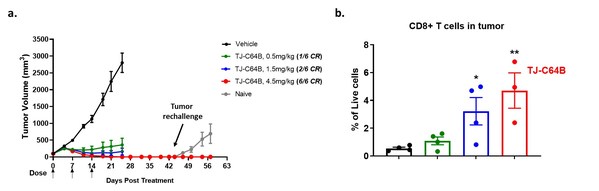

TJ-C64B activates T cells through 4-1BB stimulation only upon CLDN6 engagement,providing a localized immune activation in tumors with expected efficacy and reduced systemic toxicity. Owing to a competent Fc,TJ-C64B has an added advantage of specifically depleting CLDN6-expressing tumor cells and intra-tumor regulatory T cells highly expressing 4-1BB,which differentiates it from other 4-1BB bispecific antibodies under clinical development. As published in AACR 2022,pre-clinical data showed that TJ-C64B enhances CLDN6-dependent T cell activation upon the engagement of cancer cell lines with different CLDN6 expression levels. In a syngeneic mouse model,TJ-C64B treatment induces strong anti-tumor activity with complete tumor regression in all tested mice at the dose of 4.5 mg/kg and long-term protection from tumor re-challenge through the immunological memory response. Further,ex vivo analysis confirms localized immune activation by TJ-C64B as evident by the increased CD8+ T cells,specifically those residing in tumors (Figure 3). TJ-C64B is now under pre-clinical development and the Company plans to submit an IND in the U.S. around mid-2023.

Figure 3. In vivo anti-tumor activity of different doses of TJ-C64B treatment. (a) Humanized 4-1BB mice transplanted MC38 tumor cells were treated with different doses of TJ-C64B once a week. After the stop of the treatment,the mice with complete tumor regression were injected with new tumor cells for tumor re-challenge. (b) The percentage of CD8+ T cells in tumor-infiltrating lymphocytes from different treatment groups was analyzed by flow cytometry.

Furthermore,the third wave of innovation initiatives launched in 2021 is making good progress,with multiple innovative molecules now in candidate selection and pre-clinical stage. Among these programs,immune adjuvants are an area of focus designed to prime and amplify both innate and adaptive immune responses. The immune adjuvant portfolio is comprised of cytokine fusions and immuno-cytokines. The cytokine fusions are engineered to extend half-life with Fc fusion and detune the binding affinity and potency of natural cytokine for better safety and efficacy with site-specific mutation. The immuno-cytokines are designed to conjugate engineered cytokines e.g. by masking technology to the tumor or immune cell targeting antibody to achieve pro-longed half-life,minimal systemic toxicity,and enhanced activity by selective tumor targeting.

This growing new portfolio of novel drug candidates represents the Company's strong commitment to sustaining the global competitiveness of its pipeline through continued innovation.

Business Development and Partnership Deals

(1)Research partnershipsat I-Mab are aimed at buildingup the next wave of innovative assets that are enabled by cutting-edge scientific research and new transformative technologies. Firstly,I-Mab collaborated with selected academic groups to investigate the new regulatory pathways involved in the activation and suppression of multiple immune cells (e.g. myeloid cells) in the tumor microenvironment,leading to the identification of new targets that can complement PD-1/PD-L1 antibody or overcome the resistant mechanism of immune checkpoint inhibitor treatment. Secondly,the Company continuesto actively seek out opportunitiesto partner with other biotech companies which are specialized in the development of unique technology platforms in the field of protein design,engineering,and delivery. In the first half of 2022,the Company achieved three early-stage collaborations to co-develop novel antibody products in new modalities by leveraging the proprietary technologies of each partner. Moreover,in terms of the collaboration of translational research,the Company reached an agreement with WuXi Diagnostics to develop a standardized CD73 in vitro diagnostic (IVD) kit to accompany the ongoing phase 2 and planned phase 3 clinical studies with uliledlimab.

(2)Commercial partnershipsare designed as the key model for near-term commercialization of upcoming products,including felzartamab and eftansomatropin alfa. For eftansomatropin alfa,the Company has been working closely with its commercial partner,Jumpcan,to prepare for the product launch and the subsequent local manufacturing plan. The Company is working towards a similar commercial partnership for felzartamab with an aim to maximize the value of felzartamab without investing heavily to build up its own sales capability.

(3)Out-licensing dealscontinue to remain one of the Company's corporate priorities. The Company is currently pursuing potential global partnership deals of uliledlimab and TJ-CD4B.

Near-Term Product Commercialization

With the rapid progress in clinical development,the Company's most advanced assets,i.e. felzartamab,eftansomatropin alfa,and followed by lemzoparlimab,are expected to potentially achieve BLA in China in the next two to three years.

For felzartamab,there are about 20,000 newly diagnosed MM patients in China every year,and patients with refractory or relapsed MM who are eligible for 2L and 3L treatment are about 100,000[1]. Product advantages of felzartamab in lower injection reaction rate and shorter infusion time for out-patient use,together with its advantage as potentially the first locally manufactured CD38 antibody product,put it in a competitive position in China. The Company plans to partner with a leading domestic pharmaceutical company with a well-established sales force and proven commercialization capabilities to market felzartamab in China.

For eftansomatropin alfa,approximately 3.4 million children suffer from growth hormone deficiency (PGHD) in China[2]. Eftansomatropin alfa is the only pure protein-based long-acting GH with no pegylation or chemical linkers,which potentially offers a favorable safety profile. With its unique product advantages,among the few long-acting growth hormone players,and Jumpcan's commercial leadership in pediatric therapeutic area in China,eftansomatropin alfa has the potential to become a major player in China growth hormone market.

[1] Frost & Sullivan,Globocan

[2]Frost & Sullivan

Updates Regarding Holding Foreign Companies Accountable Act (HFCAA)

During the last six months,the Company has completed the process of evaluating and selecting a U.S. based public accounting firm that is subject to inspection by the Public Company Accounting Oversight Board (the "PCAOB") for the preparation of its audit reports commencing from the fiscal year of 2022. On August 26,the PCAOB signed a Statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the People's Republic of China relating to inspections and investigations by the PCAOB of audit firms based in mainland China and Hong Kong. I-Mab has noted this positive progress and will closely follow the development under the Statement of Protocol,which is expected to be executed in steps and may ultimately mitigate delisting risks under the HFCAA. In parallel,the Company will continue working on and is prepared to effect,as a contingency plan,the change of its auditor to the foregoing US based public accounting firm in the event that the progress of Statement of Protocol does not meet the deadline for the Company to mitigate the delisting risk in the 2022 financial report.

Environmental,Social and Governance (ESG) Update

In May 2022,the Company published its 2021 ESG report to summarize highlights and progress of its recent ESG practices.

Currently,femalesaccount for two-thirds of the Company's total workforce,and more than 30% of the Company's Board of Directors. The Company has previously established the Women's Leadership Council in 2020,a global programto promote gender equality,and nurture women employees through their personal and career growth. I-Mab fully understands the power of collective action by both women and men,and is dedicated to creating a diversified,equitable and inclusive workplace for all employees.

In response to urgent situations caused by Covid-19 in 2022,I-Mab immediately set up an emergency task force to deliver food supplies to employees in areas experiencing prolonged home quarantine,including daily necessities and anti-pandemic gift packs to support employees and their families affected by the pandemic in Shanghai.

In the future,the Company intends to continue to strengthen its efforts toward sustainable development and continue to strive to make consequential contributions to society.

Corporate Development

The Company further strengthened its corporate governance and senior management team:

I-Mab appointed Mr. Richard Yeh as Chief Operating Officer and Dr. John Hayslip as Chief Medical Officer on April 28,2022. Mr. Yeh is based in Shanghai,China. He was also appointed to join I-Mab's Board. Mr. Yeh leads I-Mab's investor relations,global alliance management,and major facilities across the world. Dr. Hayslip is based in the United States. As I-Mab's Chief Medical Officer,Dr. Hayslip leads the Company's pipeline development,addressing the key challenges in clinical sciences to increase the probability of success and the speed of clinical development for I-Mab's innovative assets.

Appointment of Dr. Lin Li,Ph.D. nominated by Hony Capital,as a member of the Company's board of directors and a member of the Audit Committee,will become effective on August 31,replacing Ms. Xi Liu of Hony Capital,who resigned on the same day. Dr. Li served as the Company's director from July 2018 to April 2020. Dr. Li has served as a partner since March 2021 and an investment director from December 2016 to March 2021 at Hony Capital. Dr. Li worked as an associate at Snow Lake Capital (HK) Limited from November 2014 to November 2016. Dr. Li served as a senior investment manager in the cross-border investment group at Hony Capital from April 2012 to October 2014. Prior to that,he worked as an associate in the corporate finance department of Goldman Sachs Gao Hua Securities Company Limited in Beijing from July 2010 to April 2012. Dr. Li received his bachelor's degree in biology from Peking University in July 2000,Ph.D. in biology from Boston University in 2006,and a Master's degree in business administration from Harvard Business School in 2010.

Dr. Zheru Zhang resigned from his position as the President of the Company and a director of the board effective from August 31,2022 and was appointed as the President for I-Mab Hangzhou,an investee of the Company with a comprehensive biologics manufacturing facility in Hangzhou,China. Mr. Jielun Zhu resigned from his position as the Chief Strategy Officer of the Company on July 31,2022 to pursue other interests.

The Company and its senior management demonstrated full confidence in the Company's fundamentals by implementing share purchase plans:

The Company announced on August 23,that it plans to implement share repurchases pursuant to the share repurchase program previously authorized by its board of directors. On the same day,the Company was informed by Dr. Jingwu Zang,Chairman and Acting Chief Executive Officer of the Company,and other members of senior management of their intention to use personal funds to purchase the Company's American Depositary Shares (the "ADSs") on the open market. Under the share purchase plans,the Company and the senior management may purchase up to US$40 million of ADSs in aggregate. The timing and dollar amount of share repurchase and share purchase transactions will be subject to the applicable U.S. Securities and Exchange Commission rule requirements. The Company's board of directors will review the implementation of share repurchases periodically and may authorize adjustment of its terms and size.

In January 2022,the Company's senior management executed a share purchase plan and purchased over 78,000 ADSs in aggregate on the open market.

The Company invested in I-Mab Hangzhou in 2020 as a part of the Company's overall strategic plan. On July 16,I-Mab Hangzhou entered into a definitive financing agreement with a group of domestic investors in China to raise approximately US$46 million in RMB equivalent. To date,the closing of the financing is in progress. Upon closing,the Company,through its wholly-owned subsidiary,remains the largest shareholder. Upon the occurrence of certain triggering events as specified in the shareholders agreement among I-Mab Hangzhou,I-Mab (through its wholly-owned subsidiary) and other domestic investors,including but not limited to I-Mab Hangzhou's failure to accomplish certain public offering condition,I-Mab may be obligated to repurchase the equity held by other domestic investors in cash or in I-Mab's stocks within certain time period.

The Company was ranked among the top companies in six different categories by the leading global financial publicationInstitutional Investor,based on its 2022 All-Asia Executive Team survey. The awards recognize I-Mab's continued strong leadership,corporate governance,ESG strategy,and investor relations capabilities. I-Mab was recognized in the "Honored Companies," "Best CEO," "Best CFO," "Best IR Professional," "Best IR Program," and "Best ESG" categories.

The Company recently hosted an R&D Day,providing a comprehensive update on its business strategy,clinical development of its key innovative assets as well as its next-generation preclinical programs,and the Company shared key repositioning strategies.

First-Half 2022 Financial Results

Cash Position

As of June 30,the Company had cash,and short-term investments of RMB3.9 billion (US$586 million),compared with RMB4.3 billion as of December 31,2021. I-Mab's strong cash balance is estimated to provide the Company with adequate funding to support its key business operations for over three years.

Net Revenues

Total net revenues for the six months ended June 30,were RMB51.9 million (US$7.7 million),compared with RMB17.8 million for the comparable period in 2021. Revenues generated for the six months ended June 30,consisted of revenues recognized in connection with the strategic collaboration with AbbVie and revenues generated from the supply of investigational products under the strategic collaboration agreement; whereby the revenues generated for the comparable period of 2021 solely consisted of the revenues recognized in connection with the strategic collaboration with AbbVie.

Research & Development Expenses

Research and development expenses for the six months ended June 30,were RMB452.6 million (US$67.6 million),compared with RMB593.0 million for the comparable period in 2021. The decrease was primarily due to the reduced demand for investigational products as the Company procured sufficient stock in 2021 and lower share-based compensation expenses. Share-based compensation expense was RMB77.6 million (US$11.6 million) for the six months ended June 30,compared with RMB112.7 million for the comparable period in 2021.

Administrative Expenses

Administrative expenses for the six months ended June 30,were RMB392.5 million (US$58.6 million),compared with RMB451.5 million for the comparable period in 2021. The decrease was primarily due to lower share-based compensation expenses in relation to management,partially offset by higher expenses for professional services. Share-based compensation expense was RMB119.3 million (US$17.8 million) for the six months ended June 30,compared with RMB222.0 million for the comparable period in 2021.

Other Income (Expenses),net

Net other expenses for the six months ended June 30,was RMB51.9 million (US$7.8 million),compared with net other income of RMB51.9 million for the comparable period in 2021. The change was primarily caused by unrealized exchange losses due to the significant fluctuation in the exchange rate of RMB against the USD in 2022.

Equity in loss of affiliates

Equity in loss of affiliates for the six months ended June 30,was RMB181.0 million (US$27.0 million),compared with RMB114.2 million for the comparable period in 2021. The change was primarily due to the increased expenditure of the Company's affiliate,I-Mab Hangzhou.

Net Loss

Net loss for the six months ended June 30,was RMB1,046.9 million (US$156.3 million),compared with RMB1,076.5 million for the comparable period in 2021. Net loss per share attributable to ordinary shareholders as of June 30,was RMB5.54 (US$0.83),compared with RMB6.38 for the comparable period in 2021. Net loss per ADS attributable to ordinary shareholders as of June 30,was RMB12.74 (US$1.90),compared with RMB14.67 for the comparable period in 2021.

Non-GAAP Net Loss

Non-GAAP adjusted net loss,which excludes share-based compensation expenses,for the six months ended June 30,was RMB848.0 million (US$126.6 million),compared with RMB729.4 million for the comparable period in 2021. Non-GAAP adjusted net loss per share attributable to ordinary shareholders for the six months ended June 30,was RMB4.49 (US$0.67),compared with RMB4.32 for the comparable period in 2021. Non-GAAP adjusted net loss per ADS attributable to ordinary shareholders for the six months ended June 30,was RMB10.33 (US$1.54),compared with RMB9.94 for the comparable period in 2021.

Subsequent Event

As a subsequent event,on August 15,the Company and AbbVie entered into an amendment to the original licensing and collaboration agreement. As a part of the amendment,AbbVie has discontinued the global Phase 1b study of lemzoparlimab combination therapy with AZA and venetoclax,in patients with MDS and AML,which in turn would lead to the noncompletion of a key milestone in the original licensing and collaboration agreement. As a result,this event is expected to result in a loss of no more than US$50.0 million for the Company in the second half of 2022.

Conference Call and Webcast Information

The Company's management will host conference calls to discuss the results and updates,and a Mandarin session conference call will be held at 7:00 a.m. ET,and an English session conference call will be held at 8:15 a.m. ET. The conference calls can be accessed by the following Zoom links:

Mandarin Session

Meeting URL:

https://i-mabbiopharma.zoom.us/j/81457574870?pwd=ZTJ0SVIzMWpJS2Q0WlJiTGROL1Bndz09

Meeting ID:

814 5757 4870

Password:

593909

English Session

Meeting URL:

https://i-mabbiopharma.zoom.us/j/84196628861?pwd=K3hpeEpMUUdXUGFlWmU4dlF3UWtnZz09

Meeting ID:

841 9662 8861

Password:

934660

About I-Mab

I-Mab (Nasdaq: IMAB) is a dynamic,global biotech company exclusively focused on discovery,development and soon,commercialization of novel or highly differentiated biologics in the therapeutic areas of immuno-oncology and autoimmune diseases. The Company's mission is to bring transformational medicines to patients around the world through innovation. I-Mab's innovative pipeline of more than 10 clinical and pre-clinical stage drug candidates is driven by the Company's Fast-to-Proof-of-Concept and Fast-to-Market development strategies through internal R&D and global partnerships and commercial partnerships. I-Mab has established its global footprint in Shanghai,Beijing,Hangzhou,Guangzhou,Lishui and Hong Kong in China,and Maryland and San Diego in the United States. For more information,please visit https://www.i-mabbiopharma.com and follow I-Mab on LinkedIn,Twitter and WeChat.

I-Mab Forward Looking Statements

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates," "confident" and similar statements. I-Mab may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the "SEC"),in its annual report to shareholders,in press releases and other written materials and in oral statements made by its officers,directors or employees to third parties. Statements that are not historical facts,including statements about I-Mab's beliefs and expectations,are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement,including but not limited to the following: I-Mab's ability to demonstrate the safety and efficacy of its drug candidates; the clinical results for its drug candidates,which may not support further development or NDA/BLA approval; the content and timing of decisions made by the relevant regulatory authorities regarding regulatory approval of I-Mab's drug candidates; I-Mab's ability to achieve commercial success for its drug candidates,if approved; I-Mab's ability to obtain and maintain protection of intellectual property for its technology and drugs; I-Mab's reliance on third parties to conduct drug development,manufacturing and other services; I-Mab's limited operating history and I-Mab's ability to obtain additional funding for operations and to complete the development and commercialization of its drug candidates; and the impact of the COVID-19 pandemic on the Company's clinical developments,commercial and other operations,as well as those risks more fully discussed in the "Risk Factors" section in I-Mab's most recent annual report on Form 20-F,as well as discussions of potential risks,uncertainties,and other important factors in I-Mab's subsequent filings with the SEC. All forward-looking statements are based on information currently available to I-Mab,and I-Mab undertakes no obligation to publicly update or revise any forward-looking statements,whether as a result of new information,future events or otherwise,except as may be required by law.

Use of Non-GAAP Financial Measures

To supplement its consolidated financial statements which are presented in accordance with U.S. GAAP,the Company uses adjusted net income (loss) as a non-GAAP financial measure. Adjusted net income (loss) represents net income (loss) excluding share-based compensation expenses. The Company's management believes that adjusted net income (loss) facilitates better understanding of operating results and provide management with a better capability to plan and forecast future periods. For more information on the non-GAAP financial measures,please see the table captioned "Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

Non-GAAP information is not prepared in accordance with GAAP and may be different from non-GAAP methods of accounting and reporting used by other companies. The presentation of this additional information should not be considered a substitute for GAAP results. A limitation of using adjusted net income (loss) is that adjusted net income (loss) excludes share-based compensation expense that has been and may continue to be incurred in the future.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader.Unless otherwise noted,all translations from Renminbi to U.S. dollars are made at a rate of RMB6.6981 to US$1.00,the rate in effect as of June 30,published by the Federal Reserve Board.

I-MAB

Consolidated Balance Sheets

(All amounts in thousands,except for share and per share data,unless otherwise noted)

As of December 31,

As of June 30,

2021

2022

RMB

RMB

US$

Assets

Current assets

Cash and cash equivalents

3,523,632

3,710,901

554,023

Accounts receivable

33,081

510

76

Contract assets

253,780

291,079

43,457

Short-term investments

753,164

211,184

31,529

Inventories

27,237

-

-

Prepayments and other receivables

190,824

101,004

15,080

Total current assets

4,781,718

4,314,678

644,165

Property,equipment and software

45,716

61,141

9,128

Operating lease right-of-use assets

112,781

100,860

15,058

Intangible assets

119,666

119,277

17,808

Goodwill

162,574

162,574

24,272

Investments accounted for using the equity method

352,106

217,662

32,496

Other non-current assets

26,634

15,380

2,296

Total assets

5,601,195

4,991,572

745,223

Liabilities and shareholders' equity

Current liabilities

Accruals and other payables

593,335

547,472

81,736

Operating lease liabilities,current

30,669

42,527

6,349

Total current liabilities

624,004

589,999

88,085

Put right liabilities

96,911

70,242

10,487

Contract liabilities

224,000

240,006

35,832

Operating lease liabilities,non-current

81,786

61,302

9,152

Other non-current liabilities

14,934

13,948

2,082

Total liabilities

1,041,635

975,497

145,638

Shareholders' equity

Ordinary shares (US$0.0001 par value,800,000,000 shares

authorized as of December 31,2021 and June 30,2022;

183,826,753 and 191,127,336 shares issued and

outstanding as of December 31,

respectively)

126

131

20

Additional paid-in capital

9,100,777

9,370,583

1,398,991

Accumulated other comprehensive income (loss)

(186,510)

47,051

7,025

Accumulated deficit

(4,354,833)

(5,401,690)

(806,451)

Total shareholders' equity

4,559,560

4,016,075

599,585

Total liabilities and shareholders' equity

5,223

I-MAB

Consolidated Statements of Comprehensive Loss

(All amounts in thousands,unless otherwise noted)

For the six months ended June 30,

2021

2022

RMB

RMB

US$

Revenues

Licensing and collaboration revenue

17,775

23,756

3,547

Supply of investigational products

-

28,102

4,195

Total revenues

17,775

51,858

7,742

Cost of revenues

-

(27,237)

(4,066)

Expenses

Research and development expenses (Note 1)

(592,993)

(452,618)

(67,574)

Administrative expenses (Note 2)

(451,500)

(392,460)

(58,593)

Loss from operations

(1,026,718)

(820,457)

(122,491)

Interest income

9,409

6,566

980

Other income (expenses),net

51,904

(51,944)

(7,755)

Equity in loss of affiliates (Note 3)

(114,200)

(181,022)

(27,026)

Loss before income tax expense

(1,079,605)

(1,046,857)

(156,292)

Income tax benefit

3,124

-

-

Net loss attributable to I-MAB

(1,076,481)

(1,292)

Net loss attributable to ordinary shareholders

(1,292)

Net loss attributable to I-MAB

(1,292)

Foreign currency translation adjustments,net of nil tax

(73,577)

233,561

34,870

Total comprehensive loss attributable to I-MAB

(1,150,058)

(813,296)

(121,422)

Net loss attributable to ordinary shareholders

(1,292)

Weighted-average number of ordinary shares used in calculating net loss per

share - basic

168,827,190

188,857,353

188,353

Weighted-average number of ordinary shares used in calculating net loss per

share - diluted

168,353

Net loss per share attributable to ordinary shareholders

—Basic

(6.38)

(5.54)

(0.83)

—Diluted

(6.38)

(5.54)

(0.83)

Net loss per ADS attributable to ordinary shareholders (Note 4)

—Basic

(14.67)

(12.74)

(1.90)

—Diluted

(14.67)

(12.74)

(1.90)

Note:

(1) Includes share-based compensation expense of RMB112,696 thousand and RMB77,628 thousand (US$11,590 thousand) for the six months

ended June 30,2021 and 2022,respectively.

(2) Includes share-based compensation expense of RMB222,027 thousand and RMB119,314 thousand (US$17,813 thousand) for the six months

ended June 30,respectively.

(3) Includes share-based compensation expense of RMB12,338 and RMB1,925 thousand (US$287 thousand) for the six months ended June 30,

2021 and 2022,respectively.

(4) Each tenADSsrepresents twenty-three ordinary shares.

I-MAB

Reconciliation of GAAP and Non-GAAP Results

For the six months ended June 30,

2021

2022

RMB

RMB

US$

GAAP net loss attributable to I-MAB

(1,292)

Add back:

Share-based compensation expense

347,061

198,867

29,690

Non-GAAP adjusted net loss attributable to I-MAB

(729,420)

(847,990)

(126,602)

Non-GAAP adjusted loss attributable to ordinary

shareholders

(729,602)

Weighted-average number of ordinary shares used in

calculating net loss per share - basic

168,353

Weighted-average number of ordinary shares used in

calculating net loss per share - diluted

168,353

Non-GAAP adjusted loss per share attributable to

ordinary shareholders

—Basic

(4.32)

(4.49)

(0.67)

—Diluted

(4.32)

(4.49)

(0.67)

Non-GAAP adjusted loss per ADS attributable to ordinary

shareholders

—Basic

(9.94)

(10.33)

(1.54)

—Diluted

(9.94)

(10.33)

(1.54)

![]()

View original content to download multimedia:https://www.prnewswire.com/news-releases/i-mab-provides-business-and-corporate-updates-and-reports-financial-results-for-the-six-months-ended-june-30-2022-301614531.html

Tags: Health Care/Hospital Medical/Pharmaceuticals Pharmaceuticals

Previous:Fosun Pharma Announces 2022 Interim Results

Next:Kintor Announces 2022 Interim Results and Recent Business Update

Leave a comment

Follow Us

Newsletter

Join us to get the latest news.