SIHL Achieves Outstanding Performance in 1H2018 Operating Results

- Robust Growth in Infrastructure Facilities

- Stable Development in Real Estate and Consumer Products

SHANGHAI,Aug. 30,2018 -- Shanghai Industrial Holdings Limited ("SIHL",SEHK Stock Code: 0363) announced its unaudited interim results for the period ended 30 June 2018. Revenue amounted to HK$15.339 billion,with an increase of 26.3% year-on-year; net profit was HK$1.982 billion,increased by 22.6% year-on-year. The board of directors has proposed an interim dividend of HK48 cents per share.

The board of directors has proposed an interim dividend of HK48 cents per share.

2018 Interim Results Highlights:

Unaudited

For the six months ended 30 June

2018

2017

(restated)

Change

Revenue (HK$ million)

15,339

12,141

26.3%

Profit attributable to shareholders

(HK$ million)

1,982

1,616

22.6%

Earnings per share (HK$)

1.823

1.487

22.6%

Dividend per share–interim (HK cents)

48

46

As at

30 June 2018

As at

31 December 2017

(restated)

Change

Total assets (HK$ million)

171,205

174,382

-1.8%

Equity attributable to the owners of

the Company (HK$ million)

42,282

41,743

1.3%

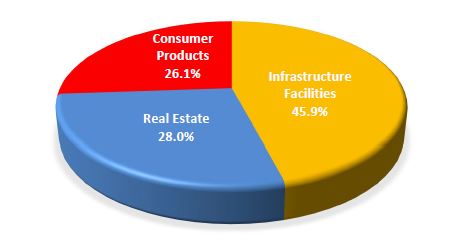

Profit Contributions by Business

Profit Contributions by Business

Business Highlights:

Infrastructure Facilities

Robust segment performance with profit contribution surged 18.4% year-on-year to HK$963 million.

Rapid business growth in water service business. Revenue from SIIC Environment rose 42.9% year-on-year to RMB2.851 billion,mainly attributable to the contribution from increased construction projects and newly acquired projects. After deducting listing expenses,net profit increased by 6.5% year-on-year to RMB256 million. SIIC Environment completed its dual primary listing on HKEX on 23 March 2018. General Water of China's revenue and net profit increased by 22.5% and 41.5% respectively.

Satisfactory performance in both toll revenue and attributable net profit of toll roads and Hangzhou Bay Bridge,grew 14.4% and 11.9% respectively.

In new business arena,total electricity generated from photovoltaic power generation projects increased by 19.6% to 422 million kWh,reaching new heights. Set up a joint venture company with Shanghai Galaxy and Shanghai Shangtou and acquired 30% equity interests of Shanghai Green Energy,in order to invest in new energy technology; SIHL and Shanghai Pharmaceutical (a subsidiary of SIIC) subscribed CIRC H-share for HK$257 million and HK$173 million respectively,as cornerstone investors to explore investments in radiopharmaceuticals industry.

Real Estate

Encouraging performance in real estate business. Profit contribution surged 64.3% year-on-year to HK$587 million,mainly attributable to the direct holdings of 49% equity interests in the "Shanghai Bay" project held by SI Development and its sales booked during the period,leading to a significant increase in profit sharing from the project.

Total contracted GFA and contracted sales of SI Development and SI Urban Development,two property arms of the Company,amounted to 300,000 sqm and approximately HK$5.8 billion respectively. Total rental income generated from the two property companies was HK$570 million in 1H2018.

Consumer Products

Consumer products successfully transformed and upgraded. Profit contribution was HK$547 million,a year-on year increase of 0.4%.

Nanyang Tobacco's revenue increased by 3.7% year-on-year; profit after tax remained flat. The company accelerated brand upgrading and new products launch,and actively promoted the construction of the flexible production line.

Wing Fat Printing's revenue increased by 34.0% year-on-year; net profit remained flat. Revenue of printing and packaging for electronic products achieved double-digit growth.

Mr. Shen Xiao Chu,Chairman of SIHL,stated,"The global economy was complex and volatile in the first half of 2018. Under the leadership of the board and our management team,SIHL actively enhanced its operating efficiency,revitalized assets and seized market opportunities. The Company achieved an outstanding performance in the first half of 2018 and realized the strategic objectives,laying a solid foundation for its development in the second half of the year. Looking ahead,SIHL will continue to promote high-quality business development,adhere to transformation and innovation and further optimize its asset portfolio. In addition,SIHL will continue to improve its corporate governance efficiency and strengthen its risk management,aiming to to create better value for shareholders."

About SIHL

Shanghai Industrial Holdings Limited ("SIHL",SEHK Stock Code: 0363) is the largest overseas conglomerate under Shanghai Industrial Investments (Holdings) Co.,Ltd ("SIIC"). As the flagship of the SIIC group of companies,SIHL has been successful in leveraging its Shanghai advantage since listing,in terms of securing the best investment opportunities in mainland China with full support from the parent company.

Over the past 20 years,SIHL has secured a unique position as a leading red chip company in Hong Kong with three core businesses: infrastructure facilities,real estate and consumer products. SIHL will continue to raise its governance standard in order to create favourable returns and value for shareholders.

For more information about SIHL,please visit the company website at www.sihl.com.hk.

Photo - https://photos.prnasia.com/prnh/20180830/2223935-1-a