LexinFintech: Consumer Finance to Further Benefit from Regulatory Support

GUANGZHOU,China,Nov.29,2018 -- China's consumer finance industry will experience accelerating growth in the coming years,as the industry stands to benefit from regulatory support to drive domestic consumption,said CEO of LexinFintech Holdings Ltd. ("Lexin" or the "Company") (Nasdaq:LX),a leading online consumer finance platform for educated young adults inChina.

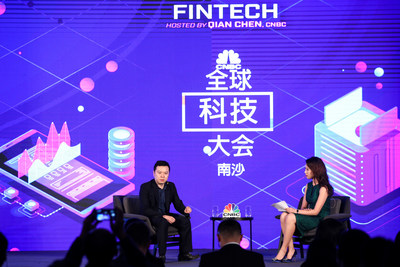

Jay Wenjie Xiao,CEO of LexinFintech,speaks at CNBC's East Tech West conference in Guangzhou,on November 28.

"The industry has experienced enormous growth in the past few years and we expect this trend to continue," said Mr. Jay Wenjie Xiao,Lexin's CEO,at CNBC's East Tech West conference inGuangzhou,China.

The Chinese government said in September that it will encourage innovation in consumer finance and broaden the development of consumer loans,as the government increasingly looks to make consumption the driving force of economic growth.

China'sconsumer finance market is projected to grow toUS$1.6 trillionby the end of 2020,which is equivalent to the GDP ofMexico,representing a compound annual growth rate (CAGR) of 18%,according to market research company Oliver Wyman. The niche sector of online consumer finance is estimated to grow even faster,reaching US$417 billion by the same period,with a CAGR of 62%.

"It is not only smartphones,but also smaller ticket items like a T-shirt or even a pair of shoes,that people have started to pay with an installment payment service," said Mr. Xiao.

The concept of installment payment is increasingly seen not only as a way to satisfy an urgent need,but also as a normal method of shopping,according to a January report published by Lexin,with support from its e-commerce partners including Apple,Dell,L'Oreal,and P&G.

In the third quarter of 2018,Lexin saw the gross merchandise volume of its e-commerce platform Fenqile increase by 33.8% year-on-year,while China's retail consumer sales grew at only 9.3% year-on-year in the first nine months of 2018,according to official data.

Mr. Xiao attributed the growth of consumer financial services in China to a large untapped market and advanced technologies that enable fintech players to meet burgeoning demand,with risk management and a streamlined loan application process as the keys to success.

In risk management,Lexin has adopted a forward-looking approach by using a combination of big data and artificial intelligence (AI) to assess a customer's credit worthiness,which allows the Company to perform a more comprehensive credit analysis of its customers than traditional financial institutions.

Lexin's proprietary risk management engine,"Hawkeye," processes more than 1,000 decision rules and over 7,500 data variables to generate an assessment within seconds,and automatically manages 98% of all loan applications. It can create in real-time a customer's latest credit profile and engage in predictive analytics to understand how this profile may change in the future.

Through the strong use of AI and big data,Lexin is also able to streamline the traditional process of loan applications,making it possible for its customers to complete a credit application within just a few minutes without having to submit excessive paperwork or become mired in red tape.

About LexinFintech Holdings Ltd.

LexinFintech Holdings Ltd.is a leading online consumer finance platform for educated young adults in China. As one of China's leading financial technology companies,Lexin integrates its e-commerce-driven installment finance platform,Fenqile,with advanced risk management technologies,the Company's Dingsheng asset distribution technology platform,and the Company's Juzi Licai online investment platform for individual investors,to create a comprehensive consumer finance ecosystem. The Company utilizes technologies including big data,cloud computing and artificial intelligence to enable the near-instantaneous matching of user funding requests with offers from the Company's more than 30 funding partners,which include commercial banks,consumer finance companies,and other licensed financial institutions.

For more information,please visit http://ir.lexinfintech.com.

To follow us on Twitter,please go to: https://twitter.com/LexinFintech.

View original content to download multimedia:/news-releases/lexinfintech-consumer-finance-to-further-benefit-from-regulatory-support-300757533.html