Cobalt 27 Files NI 43-101 Technical Report on the Producing Ramu Nickel-Cobalt Project

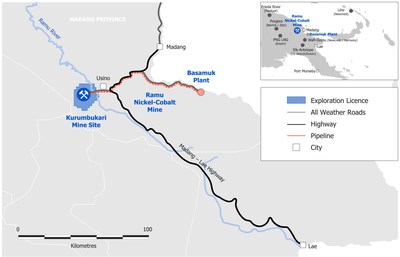

TORONTO,July 25,2019 -- Cobalt 27 Capital Corp. (TSXV: KBLT) (OTCQX: CBLLF) (FRA: 270) ("Cobalt 27" or the "Company") is pleased to report it has filed a technical report for its recently acquired interest in the low-cost,long-life,Ramu nickel-cobalt operation ("Ramu"),prepared in accordance with National Instrument 43-101 - Standards for Disclosure for Mineral Projects ("NI 43-101"). The Ramu Technical Report is in support of the Company's May 17,2019 news release announcing the acquisition of Highlands Pacific Limited,whereby Cobalt 27 acquired an 8.56% joint venture interest in Ramu,an integrated producing nickel-cobalt operation,located in Madang Province,Papua New Guinea ("PNG") (see Figure 1).

Anthony Milewski,Chairman and CEO of Cobalt 27,commented,"We are excited to be releasing additional information on the Ramu asset so that investors can better understand the world-class nature of this operation and the nickel and cobalt exposure it provides to investors. Ramu is a first-quartile project on the global nickel cost-curve,has an extensive mine life,with potential to deliver 30+ years,and compelling exploration upside. The hydroxide product produced at Ramu is optimal for electric vehicles and battery storage markets,in fact already being sold to battery makers,enhancing shareholders' nickel exposure at a time when global inventory levels are approaching levels not seen since the end of 2012,when nickel was trading at approximately US$8 per pound,on average."

The technical report was independently prepared by Behre Dolbear Australia Pty Ltd. ("BDA") after several months of working with majority owner and operator,Metallurgical Corporation of China Limited ("MCC") to conduct required due diligence and site visits. MCC is a major Chinese State-owned construction and operating company ranked in the Fortune Global 500. Ramu is comprised of the Kurumbukari mine,which utilizes conventional open-pit mining methods and beneficiation plant designed to treat around 4.6 million tonnes of ore per annum,located in the foothills of the Bismarck Ranges; and the Basamuk processing plant ("Basamuk Plant") located on the East coast of Papua New Guinea,approximately 55km southeast of Madang. Beneficiated ore is transported from the mine via a 135 km slurry pipeline to the Basamuk Plant which is designed to produce a mixed nickel-cobalt hydroxide product ("MHP") containing around 32,600 tonnes nickel and 3,300 tonnes cobalt on an annual basis. MHP production for 2017 and 2018 has exceeded design capacity (106% and 108% respectively). BDA considers that commissioning and ramp-up was completed in 2015,and that the plant is capable of operating at design capacity going forward.

Economic Analysis

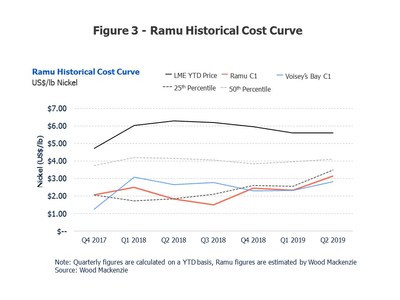

BDA has developed a life of mine ("LOM") cash flow forecast model for Ramu using Proven and Probable Mineral Reserves based on the macroeconomic assumptions set out in detail in the technical report. Over the current LOM of 14 years from 2019,Ramu projects that 52.3Mt of ore will be processed to produce 428,000 tonnes of nickel and 47,000 tonnes of cobalt in MHP. The LOM capital costs are projected to total US$247 million,for sustaining capital. Projected operating costs over the LOM are expected to remain consistent with actual operating costs experienced to date. Based on Wood Mackenzie's independent analysis of global primary nickel producers,Ramu has positioned itself at or near the bottom quartile of global production based on a C1 cash cost basis since late 2017. This supports that Ramu has been profitable on a C1 basis at all points of the nickel commodity cycle over the last few years. Projections for revenue are based on the Mineral Resource and Reserve estimates and continuation of current production levels.

Ramu Location and Surrounding Infrastructure

Established Operating History

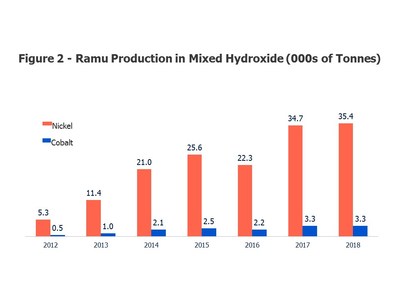

Ramu has an established history of operations since being commissioned in 2012. In the last two years,the refinery has exceeded design capacity,producing an average of approximately 90,000 tonnes per annum of MHP containing 35,000 tonnes of nickel and 3,300 tonnes of cobalt. Current guidance for 2019 indicates that similar production levels will once again be attained. A summary of Ramu's historical ore and MHP production is shown in Table 1 and Figure 2.

Over the course of 2017,2018 and H1 2019 Ramu has consistently ranked at or near the bottom quartile of C1 cash costs as reported by Wood Mackenzie. Since Q4 2017 Wood Mackenzie has reported that Ramu has averaged a C1 cash cost of US$ 2.27/lb of nickel which is below the same period average for the bottom quartile of US$2.34/lb (see Figure 3).

Table 1: Ramu Nickel and Cobalt Production History

Item

Units

2012

2013

2014

2015

2016

2017

2018

Ore Mined

Mt (wet)

1.547

3.482

5.949

6.105

3.876

5.523

6.350

Ore Processed

Mt (dry)

0.816

1.253

2.273

2.784

2.270

3.601

3.719

Ore Grade

Ni (%)

0.98

1.00

1.06

1.12

1.13

1.09

1.10

Ore Grade

Co (%)

0.09

0.09

0.10

0.11

0.11

0.11

0.10

MHP Produced

t (dry)

13,777

29,736

57,360

65,286

57,824

89,947

92,258

Contained Ni

t

5,283

11,369

20,987

25,581

22,269

34,666

35,355

Contained Co

t

469

1,013

2,134

2,505

2,191

3,308

3,275

Ramu Production in Mixed Hydroxide (000s of Tonnes)

Ramu Historical Cost Curve

Mineral Resources and Mineral Reserves

The Mineral Resource and Reserve estimates for the Ramu nickel and cobalt deposit have been carried out under the guidelines of the Australasian JORC Code by Competent Persons as defined by those guidelines. The JORC Code guidelines are compatible with the requirements of NI 43-101 in this regard. Summary Mineral Resources Reserves extracted from the report are summarized in Tables 2 and 3,respectively.

Table 2: Ramu Mineral Resources – December 31,2017[1,2]

Category

Tonnage (Mt)

Nickel Grade (%)

Cobalt Grade (%)

Measured

34

0.9

0.1

Indicated

42

0.9

0.1

Measured & Indicated

76

0.9

0.1

Inferred

60

1.0

0.1

Table 3: Ramu Mineral Reserves – December 31,20172

Category

Tonnage (Mt)

Nickel Grade (%)

Cobalt Grade (%)

Proven

24

0.9

0.1

Probable

33

0.9

0.1

Total Reserves

56

0.9

0.1

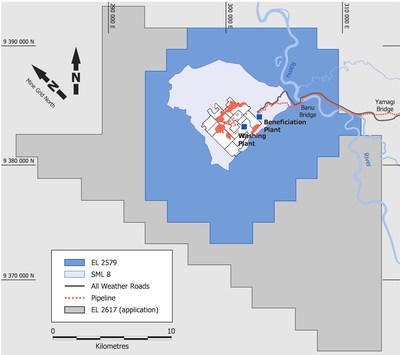

Significant Exploration Potential

The technical report highlights significant exploration potential within and outside of the current exploration license area,and it is anticipated that the total Mineral Resource will increase significantly when additional drilling is conducted. The following Mineral Resource potential at Ramu is highlighted by the technical report:

The currently drilled area for defining Mineral Resources is about 25km2,which represents a portion of the total Mining License (SML 8) area of 54.4km2 and less than 13% of the surrounding Exploration License (EL 2579) with an area of 194.95km2 (Figure 4). Additional drilling outside the currently drilled area is expected to increase the Mineral Resources,and potentially add to the Mineral Reserves.

In addition to the Measured and Indicated Resources,there are significant Inferred Resources in the current Ramu resource estimate. Additional infill drilling could upgrade at least a portion of the Inferred Resource to Measured and Indicated status,which could potentially be included in future reserves with further mine planning.

The Ramu technical report is available on SEDAR at www.sedar.com and on the Company's website www.cobalt27.com

Ramu License Area and Surrounding Infrastructure

Ownership Summary

Ramu is a joint venture between MCC Ramu,which has 85% ownership and is the operator of the project,and Ramu Nickel Limited,a wholly owned subsidiary of Cobalt 27 with an 8.56% interest,and Mineral Resources Madang Limited (landowner entity) and Mineral Resources Ramu Limited (government entity) which hold 2.5% and 3.94% interest respectively,and which are both managed by Mineral Resource Development Corporation ("MRDC"). MRDC is a PNG Government entity which holds the government interest of 3.94% and manages the landowners' interest of 2.5% in trust for the landowners. MCC Ramu is wholly owned by MCC-JJJ Mining whose shareholders are MCC with 67.02%,Jilin Jien Nickel Industry Limited (13%),Jiuquan Iron and Steel (Group) Limited (13%) and Jinchuan Group Limited (6.98%).

As disclosed in the Company's press release dated June 18,2019,Cobalt 27 and Pala Investments Limited ("Pala") have entered into an agreement pursuant to which Pala will acquire 100% of Cobalt 27's issued and outstanding common shares (other than the approximately 19% that Pala already owns),for C$5.75 per common share,comprised of C$3.57 in cash plus C$2.18 in shares of a newly listed company to be named Nickel 28 Capital Corp. ("Nickel 28"). Nickel 28 will hold the joint venture interest in Ramu,among other assets including a royalty portfolio on future projects,certain equity positions,and US$5 million in cash with no corporate debt.

Footnotes

Resources at a cut off of 0.5% Ni; resources are inclusive of reserves; the figures may not add exactly due to rounding; resources do not include the +2mm rock fragments in the rocky saprolite layers; Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability; the Mineral Resources are classified according to the 2014 CIM Definition Standards.

Mineral Reserves at a cut-off grade of 0.5% Ni,which is not materially different from the 0.58% nickel equivalent cut-off grade used in the previous year; reserves are included in resources; the figures may not add exactly due to rounding; reserves do not include the +2mm rock fragments in the rocky saprolite layers; the Mineral Reserves are classified according to the 2014 CIM Definition Standards.

NI 43-101 Matters

The scientific and technical information in this news release has been prepared,reviewed and approved in accordance with Canadian regulatory requirements by,or under the supervision of Dr. Qingping Deng,Peter D. Ingham,Roland Nice,and Adrian Brett,of BDA,all of whom are independent Qualified Persons as set out in NI 43-101.

The Mineral Resource estimate set out in this news release was classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves (November 2010) by Dr Qingping Deng,of BDA.

The Mineral Reserve estimate set out in this news release was classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves (November 2010) by Peter D. Ingham,of BDA.

Readers are advised that Mineral Resources not included in Mineral Reserves do not demonstrate economic viability. Mineral Resource estimates do not account for mineability,selectivity,mining loss and dilution. These Mineral Resource estimates include Inferred Mineral Resources that are normally considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that Inferred Mineral Resources will be converted to Measured and Indicated categories through further drilling,or into Mineral Reserves,once economic considerations are applied.

About Cobalt 27

Cobalt 27 Capital Corp. is a leading battery metals streaming company offering exposure to metals integral to key technologies of the electric vehicle and energy storage markets. Cobalt 27 holds an 8.56% joint venture interest in the long-life,world-class Ramu mine which currently delivers near-term attributable nickel and cobalt production. Cobalt 27 also manages a portfolio of 11 royalties. Cobalt 27 also owns physical cobalt and a cobalt stream on the Voisey's Bay mine.

For Further Information Please Contact:

Justin Cochrane

President & COO

info@cobalt27.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain information which constitutes 'forward-looking statements' and 'forward-looking information' within the meaning of applicable Canadian securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward looking statements are often identified by terms such as "may","should","anticipate","expect","potential","believe","intend" or the negative of these terms and similar expressions. Forward-looking statements in this news release include,but are not limited to statements with respect to: production and operations at Ramu; the LOM cash flow,capital expenditure and operating expenditure forecasts for Ramu; cash costs at Ramu; and Ramu's Mineral Reserves and Mineral Resources (and the potential to increase such Mineral Resources). This news release also contains references to estimates of Mineral Reserves and Mineral Resources. The estimation of Mineral Reserves and Mineral Resources is inherently uncertain and involves subjective judgments about many relevant factors. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The accuracy of any such estimates is a function of the quantity and quality of available data,and of the assumptions made and judgments used in engineering and geological interpretation,which may prove to be unreliable and depend,to a certain extent,upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource estimates may have to be re-estimated based on,among other things: (i) fluctuations in nickel and cobalt prices or other mineral prices; (ii) results of drilling; (iii) results of metallurgical testing and other studies; (iv) changes to proposed mining operations,including dilution; (v) the evaluation of mine plans subsequent to the date of any estimates; (vi) the possible failure to receive required permits,approvals and licences,or changes to any such permits,approvals or licences; and (v) changes in laws,rules or regulations,including changes to tax and royalty rates whether to be applied prospectively or retroactively. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties,most of which are beyond the Company's control. For more details on these and other risk factors see the Company's most recent Annual Information Form on file with Canadian securities regulatory authorities on SEDAR at www.sedar.com under the heading "Risk Factors". Should one or more of the risks or uncertainties underlying these forward-looking statements materialize,or should assumptions underlying the forward-looking statements prove incorrect,actual results,performance or achievements could vary materially from those expressed or implied by the forward-looking statements.

The forward-looking statements contained herein are made as of the date of this release and,other than as required by applicable securities laws,the Company does not assume any obligation to update or revise them to reflect new events or circumstances. The forward-looking statements contained in this release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No securities regulatory authority has either approved or disapproved of the contents of this news release.

Cobalt 27

Photo - http://cusmail.com/res/2023/07-23/21/397cd11da35f521d3f695b188a79745d.jpg

Photo - http://cusmail.com/res/2023/07-23/21/4bd6c7aceedba4a8a88f880e62e05a0f.jpg

Photo - http://cusmail.com/res/2023/07-23/21/a05c908b1cffd68eb8874009fe618aba.jpg

Photo - http://cusmail.com/res/2023/07-23/21/0930209be7df40925c3f6bc0edafa021.jpg

Photo - http://cusmail.com/res/2023/07-23/21/583a8188d5a8cb92af33e63010fb1d2d.jpg