Cobalt 27 Files Management Information Circular Seeking Approval for Proposed Acquisition by Pala Investments for C$5.75 per Cobalt 27 Share and Creation of Nickel 28

TORONTO,Aug. 14,2019 --Cobalt 27 Capital Corp. (TSXV: KBLT) (OTCQX: CBLLF) (FRA: 270) ("Cobalt 27" or the "Company") today announces it has filed a management information circular (the "Circular") for the annual general and special meeting of shareholders of the Company to be held in connection with the proposed acquisition of Cobalt 27 by Pala Investments Limited ("Pala") by way of a plan of arrangement (the "Arrangement"). Under the Arrangement,Pala would indirectly acquire 100% of Cobalt 27's issued and outstanding common shares (other than the approximately 19% that Pala already owns) for C$5.75 per common share (the "Consideration"),comprised of C$3.57 in cash plus one share of a newly listed company,Nickel 28 Capital Corp. ("Nickel 28"),valued at C$2.18. Upon successful closing of the transaction,Nickel 28 is expected to be listed on the TSX Venture Exchange ("TSXV") under the symbol 'NKL'.

The mailing procedures for the Circular and related materials has commenced and shareholders of Cobalt 27 should receive them shortly. An electronic copy of the Circular is available on the Company's website at https://www.cobalt27.com/investors/financials/ and on SEDAR under Cobalt 27's profile at www.sedar.com. Cobalt 27 encourages shareholders to read the Circular in detail.

The Cobalt 27 Special Committee and Board of Directors UNANIMOUSLY recommend that you vote FOR the Arrangement. Your vote is IMPORTANT to the success of this transaction.

Reasons for and Benefits of the Arrangement

Significant Premium to Cobalt 27 Shareholders: The Consideration represents a significant premium of 66% to the Cobalt 27 share price,based on the closing price on the TSXV of the Cobalt 27 shares on June 17,2019,the last trading day prior to the announcement of the Arrangement. The Consideration also represents a substantial premium of 46% to the volume weighted average price of the Cobalt 27 shares on the TSXV for the 20-day period ending on June 17,2019. Additionally,the Consideration represents a premium of41%to the volume weighted average price of the Cobalt 27 shares on the TSXV between January 2,2019 and June 17,2019.

Significant Cash Component Delivers Immediate Liquidity and Value Certainty in a Volatile Cobalt Market: The Consideration is made up of a significant cash component which delivers immediate liquidity and value certainty to Cobalt 27 shareholders at a time of significant market volatility and amidst an uncertain outlook for cobalt prices and the global economy,and at an implied cobalt price well in excess of the spot average price of US$12.53 per lb as of July 31,2019.

During 2016 through until the first half of 2018,cobalt prices experienced a significant run-up. In the latter half of 2018,cobalt prices began to decline significantly,and by June 2019,prices had fallen 66% from their April 2018 peak of US$44.10 per lb to US$15.12 per lb. As of July 31,spot average cobalt prices have fallen further to US$12.53 per lb as reported by Fastmarkets. The Board and Special Committee's knowledge of cobalt supply-demand dynamics informed their view that a sustained rebound in cobalt prices in the short to medium term is unlikely.

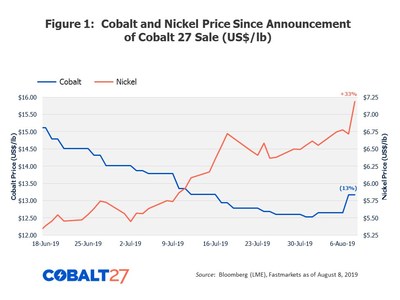

Nickel 28 to Provide Continued Exposure to Battery Metal Upside and the Electric Vehicle Revolution: Cobalt 27 shareholders,through their ownership of shares of Nickel 28,will continue to be exposed to the electric vehicle revolution. In connection with the transaction,Cobalt 27 will contribute its 8.56% joint venture interest in the producing,long-life,low-cost Ramu nickel-cobalt integrated mine and plant,certain royalty interests,and shares of Giga Metals Corporation to Nickel 28. Nickel 28 will be well funded with US$5 million in cash at inception with no corporate debt. Since the announcement of the Arrangement,as of August 8,nickel prices have increased by approximately 33%,while cobalt prices have decreased by approximately 13%.

Figure 1: Cobalt and Nickel Price Since Announcement of Cobalt 27 Sale (US$/lb)

Nickel 28 is valued at C$2.18 per share which is comprised of the purchase price that Cobalt 27 paid for each of the assets being transferred to Nickel 28 plus an enhanced value for the Dumont royalty which recently released an updated feasibility study. These assets are primarily leveraged to the price of nickel and all of these assets were purchased in a substantially lower nickel price environment.

Repayment of Debt:Cobalt 27 is expected to have up to US$48.5 million of net corporate debt on closing of the Arrangement (consisting of current drawings under its credit facilities and transaction expenses),which debt will be repaid by Pala. Absent the transaction,Cobalt 27 would need to service and repay the majority of the aforementioned debt using its own resources.

Comprehensive Review of Strategic Alternatives and Independent Oversight:The Cobalt 27 Board of Directors established a Special Committee comprised entirely of independent directors to review and oversee the consideration of strategic alternatives,the negotiation of the transaction with Pala and to make recommendations to the Board. Several months prior to entering into the transaction,the Company retained Scotia Capital to conduct a process to evaluate business and strategic opportunities with the objective of maximizing shareholder value,which included the possibility of a potential strategic transaction with other prospective acquirors (including royalty/streaming companies,industrial companies,commodities traders and private equity sponsors). Twelve (12) other prospective acquirors were contacted in addition to Pala,eleven (11) of whom were contacted by Scotia Capital,which led to three (3) additional non-binding indicative proposals for alternative transactions. However,none of the proposals were for an acquisition of Cobalt 27 as a whole,and each proposal was for total cash consideration less than the cash component per share of Pala's offer.

Ultimately,the Special Committee,having supervised the process that led up to and the negotiation of the Arrangement and taken into account such matters as it considered relevant and after receiving independent legal and financial advice,unanimously determined that the Arrangement is in the best interests of the Company and unanimously recommended that the Board approve the Arrangement and recommend that the Cobalt 27 shareholders vote FOR the Arrangement. After careful consideration and taking into account,among other things,the recommendation of the Special Committee,the Board,after receiving legal and financial advice,unanimously determined that the Arrangement is in the best interests of the Company and approved the Company's entry into the arrangement agreement. Accordingly,the Board unanimously recommends that Cobalt 27 shareholders vote FOR the Arrangement.

Meeting Details and Record Date

The annual general and special meeting of shareholders of Cobalt 27 is scheduled for 10:00 a.m. (Toronto time) on September 12,2019 at the offices of Stikeman Elliott LLP,5300 Commerce Court West,199 Bay Street,Toronto,Ontario,to consider a special resolution to approve the Arrangement.

Only Cobalt 27 shareholders of record at the close of business on August 12,2019 will be entitled to receive notice of and vote at the meeting,or any adjournment or postponement thereof.

Shareholder Information and Questions

Cobalt 27 shareholders who have questions about the Circular,or need assistance with voting their shares,can contact our proxy solicitation agent,Kingsdale Advisors:

Kingsdale Advisors

North American Toll-Free Number: +1.888.518.6554

Outside North America,Banks,Brokers and Collect Calls: +1.416.867.2272

Email: contactus@kingsdaleadvisors.com

North American Toll-Free Facsimile: +1.888.683.6007

Facsimile: +1.416.867.2271

Shareholders are encouraged to vote today using the internet,telephone or facsimile. Your vote is important regardless of the number of Cobalt 27 shares you own.

About Cobalt 27

Cobalt 27 Capital Corp. is a leading battery metals streaming company offering exposure to metals integral to key technologies of the electric vehicle and energy storage markets. Cobalt 27 holds an 8.56% joint venture interest in the long-life,world-class Ramu operation which currently delivers near-term attributable nickel and cobalt production. Cobalt 27 also manages a portfolio of 11 royalties. Cobalt 27 also owns physical cobalt and a cobalt stream on the Voisey's Bay mine.

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain information which constitutes 'forward-looking statements' and 'forward-looking information' within the meaning of applicable Canadian securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward looking statements are often identified by terms such as "may","should","anticipate","expect","potential","believe","intend" or the negative of these terms and similar expressions. Forward-looking statements in this news release include,but are not limited to statements with respect to: the anticipated benefits associated with the Arrangement; the business and assets (including their implied value) of Nickel 28 and its strategy going forward; future prices of cobalt,nickel and other commodities; statements pertaining to the adoption of electric vehicles and battery storage globally; the Consideration to be received by shareholders of Cobalt 27,which may fluctuate in value due to Nickel 28 common shares forming part of the Consideration; and the satisfaction of closing conditions including,without limitation (i) required Cobalt 27 shareholder approvals; (ii) necessary court approval in connection with the plan of arrangement; (iii) no exercise of the termination rights available to the parties under the Arrangement Agreement; (iv) Cobalt 27 obtaining the necessary approvals from the TSXV for the listing of the common shares of Nickel 28 in connection with the Arrangement; and (v) other closing conditions,including,without limitation,other regulatory approvals and compliance by Cobalt 27 and Pala with various covenants and representations contained in the Arrangement Agreement. In particular,there can be no assurance that the Arrangement will be completed. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties,most of which are beyond the Company's control. For more details on these and other risk factors see the Circular on file with Canadian securities regulatory authorities on SEDAR at www.sedar.com under the heading "Risk Factors". Should one or more of the risks or uncertainties underlying these forward-looking statements materialize,or should assumptions underlying the forward-looking statements prove incorrect,actual results,performance or achievements could vary materially from those expressed or implied by the forward-looking statements.

The forward-looking statements contained herein are made as of the date of this release and,other than as required by applicable securities laws,the Company does not assume any obligation to update or revise them to reflect new events or circumstances. The forward-looking statements contained in this release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No securities regulatory authority has either approved or disapproved of the contents of this news release.

Photo - http://cusmail.com/res/2023/07-23/21/f9526766b270c75cca9d3f85b4530b93.jpg