Manulife Hong Kong reports record results for the third quarter of 2019

HONG KONG,Nov. 7,2019 -- The Manulife group of companies operating in Hong Kong ("Manulife Hong Kong") today reported strong results for the third quarter and first nine months of 2019.

Results overview:

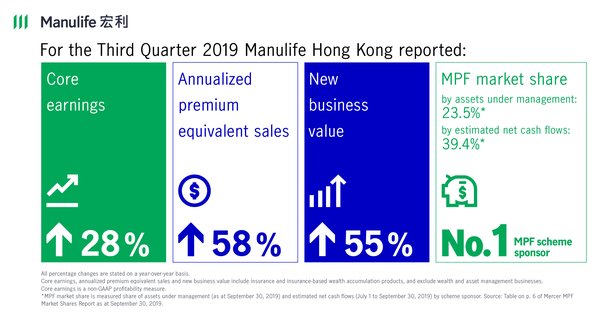

Core earnings

- Record-high quarterly core earnings of HK$1.5 billion,up 28% from the same quarter of 2018

- Year-to-date core earnings of HK$4.2 billion,up 24% fromthe same period of2018

Annualized premium equivalent (APE) sales

- Record-high quarterly APE sales of HK$2.1 billion,up 58% from the same quarter of 2018

- Year-to-date APE sales of HK$4.9 billion,up 37% from the same period of 2018

New business value (NBV)

- Record-high quarterly NBV of HK$1.3 billion,up 55% from the same quarter of 2018

- Year-to-date NBV of HK$3.0 billion,up 32% fromthe same period of2018

Wealth and asset management (WAM) gross flows

- Record-high quarterly WAM gross flows of HK$10.7 billion,up 26% from the same quarter of 2018

- Year-to-date WAM gross flows of HK$26.8 billion,up 8% from the same period of 2018

Mandatory Provident Funds (MPF) market share:Manulife remained the largest MPF scheme sponsor with a record-high market share of 23.5% based on assets under management as at September 30,2019,and the highest share of estimated net cash flows at 39.4% for the period from July 1 to September 30,2019

Agency force:up 20% over the previous year to 9,508 agents

Manulife HK 2019Q3 Highlights

"We had another outstanding quarter with record-high financial results," said Guy Mills,Chief Executive Officer of Manulife Hong Kong. "Tax-deductible solutions,with their protection and tax benefits,continued to fuel new growth across all distribution channels. Once again,it shows that our unique position as a one-stop,go-to expert for all tax-deductible offerings makes us a top choice for many. Our agency force is scaling up fast,enabling more customers to benefit from our professional advice and personalized health and retirement solutions."

As a result of new business and in-force growth,third quarter core earnings reachedHK$1.5 billion,up 28% from HK$1.1 billion in the same quarter of 2018. Year-to-date core earnings increased 24% to HK$4.2 billion from HK$3.3 billion inthe same period of2018.

APE sales increased 58% to HK$2.1 billion from HK$1.3 billion in the same quarter last year. The strong growth in APE sales was driven by the success of Manulife's recently-launched Voluntary Health Insurance Scheme (VHIS) and Qualifying Deferred Annuity Policy (QDAP) products,as well as participating products launched at the beginning of this year. Year-to-date APE sales were HK$4.9 billion,up 37% from HK$3.6 billion in the same period of 2018.

NBV grew 55% to HK$1.3 billion from HK$0.9 billion in the same quarterlast year. Year-to-date NBV reached HK$3.0 billion,up 32% from HK$2.3 billion inthe same period of2018. New business volume increased on the back of strong channel expansion,and the success of the QDAP and VHIS products.

Quarterly WAM gross flows increased 26% to HK$10.7 billion from HK$8.5 billion in the same quarter of 2018,as mutual fund sales quadrupled and pension fund gross flows remained steady. Year-to-date WAM gross flows rose to HK$26.8 billion,up 8% from HK$24.8 billion in the same period of 2018.

Manulife is one of a few insurers to offer its customers a full suite of tax-deductible solutions. These solutions include the Manulife Shelter VHIS Standard Plan and the Manulife First VHIS Flexi Plan,the MPF Tax Deductible Voluntary Contributions (TVC) account,and QDAP product.

Manulife's VHIS offerings stand out with a fully digital purchasing and claims experience. Customers can choose to buy the Manulife Shelter VHIS Standard Plan directly from BuySimple.hk,Manulife's online sales platform. Medical claims can be submitted in less than one minute using the fast eClaims solution,ClaimSimple.hk.

To meet growing demand for retirement solutions,Manulife in October launched a new QDAP product,ManuLeisure Deferred Annuity. This tax-deductible annuity enables those as young as 18 years of age to start investing towards their future with flexible plan options,and it incorporates unique features that include premium holiday and critical illness benefits.

Manulife was recently honoured in four categories at the Hong Kong Insurance Awards 2019,including top award for "Outstanding MPF/Employees' Benefit Product/Service" and "Outstanding Equal Opportunity Employers". Organized by the Hong Kong Federation of Insurers,this award programme is one of the most prestigious annual recognitions in Hong Kong's insurance industry.

During the reporting quarter,Manulife also won a number of top prizes from the Headline No.1 Awards 2019 and Next Magazine Top Service Awards,with its QDAP,VHIS,MPF products and services,critical illness cover and savings plans. These accolades reaffirm the company's reputation as a leading insurance and pension provider in Hong Kong.

About Manulife Hong Kong

Manulife Hong Kong,through Manulife International Holdings Limited,owns Manulife (International) Limited,Manulife Investment Management (Hong Kong) Limited and Manulife Provident Funds Trust Company Limited. As a member of the Manulife group of companies,Manulife Hong Kong offers a diverse range of protection and wealth products and services to individual and corporate customers in Hong Kong and Macau.

About Manulife

Manulife Financial Corporation is a leading international financial services group that helps people make their decisions easier and lives better. With our global headquarters in Toronto,we operate as Manulife across our offices in Canada,Asia,and Europe,and primarily as John Hancock in the United States. We provide financial advice,insurance,as well as wealth and asset management solutions for individuals,groups and institutions. At the end of 2018,we had more than 34,000 employees,over 82,000 agents,and thousands of distribution partners,serving almost 28 million customers. As of September 30,we had over C$1.2 trillion (HK$6.9 trillion) in assets under management and administration,and in the previous 12 months we made C$29.8 billion in payments to our customers. Our principal operations in Asia,Canada and the United States are where we have served customers for more than 100 years. We trade as 'MFC' on the Toronto,New York,and the Philippine stock exchanges and under '945' in Hong Kong.

Notes:i. Manulife Hong Kong includes all our Hong Kong businesses including insurance,insurance-based wealth accumulation products,and our wealth and asset management businesses.

ii. All percentage changes are stated on a year-over-year basis,except for MPF market share.

iii. Core earnings for Manulife Hong Kong include insurance and insurance-based wealth accumulation products,and exclude our wealth and asset management businesses. Core earnings is a non-GAAP profitability measure. For full definition of core earnings,see "Performance and non-GAAP measures" in Manulife Financial Corporation's Third Quarter 2019 Management's Discussion and Analysis.

iv. Annualized premium equivalent ("APE") sales are presented to provide consistency of scope for NBV disclosures and industry practice. APE sales consist of insurance and insurance-based wealth accumulation products,and exclude our wealth and asset management businesses. They comprise 100% of regular premiums/deposits sales and 10% of single premiums/deposits sales.

v. New business value ("NBV") is the change in embedded value as a result of sales in the reporting period. NBV is calculated as the present value of shareholders' interests in expected future distributable earnings,after the cost of capital,on actual new business sold in the period using assumptions that are consistent with the assumptions used in the calculation of embedded value. NBV excludes businesses with immaterial insurance risks,such as Hong Kong's wealth and asset management businesses. NBV is a useful metric to evaluate the value created by Manulife Hong Kong's new business franchise.

vi. Wealth and asset management ("WAM") gross flows is a new business measure comprised of all deposits into mutual funds and pension products. Gross flows is a common industry metric for WAM businesses as it provides a measure of how successful the businesses are at attracting assets.

vii. MPF market share is measured share of assets under management and estimated net cash flows by scheme sponsor. Source: Table on p. 6 of Mercer MPF Market Shares Report as at September 30,2019.Manulife (International) Limited

Incorporated in Bermuda with limited liability

22/F.,Tower A,Manulife Financial Centre,223 – 231 Wai Yip Street,Kwun Tong,Kowloon,Hong Kong

Tel: (852) 2510 5600

manulife.com.hkPhoto - https://photos.prnasia.com/prnh/20191107/2635525-1-a?lang=0