Qudian Inc. Reports Third Quarter 2019 Unaudited Financial Results

XIAMEN,China,Nov 18,2019 -- Qudian Inc. ("Qudian" or the "Company") (NYSE: QD),a leading technology platform empowering the enhancement of online consumer finance experience in China,today announced its unaudited financial results for the quarter ended Sep 30,2019.

Third Quarter 2019 Operational Highlights:

Total number of registered users as ofSep 30,2019 reached 78.3 million,representing an increase of 11.8% from Sep 30,2018

Number of outstanding borrowers[1] from loan book business and transaction services business as of Sep 30,2019 increased by 3.4% to 6.3 million from 6.1 million as of June 30,2019

Cumulative number of borrowers[2] from loan book business and transaction services business as of Sep 30,2019 increased by 3.6% to 19.0 million from June 30,2019

New active borrowers[3] from loan book business and transaction services business for this quarter increased by 15.2% to 669,111 from 580,727 for the third quarter of 2018 as a result of incremental user growth driven by transaction services business

Total outstanding loan balance including transaction services business[4] as of Sep 30,2019 increased by 151.2% toRMB38.4 billion from Sep 30,2018

Weighted average loan tenure for our loan book business was 10.4 months for this quarter,compared with 8.4 months for the second quarter of 2019; Weighted average loan tenure for transactions serviced on open-platform was 13.0 months for this quarter,compared with 14.1 months for the second quarter of 2019

Cumulative number of users for transactions serviced on open-platform as of Sep 30,2019 increased by 153.3% to 1,057,497 from June 30,2019 Cumulative amount of transactions serviced on open-platform in 2019 was RMB15.7 billion as of Sep 30,2019

[1]Outstanding borrowers are borrowers who have outstanding loans as of a particular date,including outstanding borrowers from both loan book business and transaction services business. Transaction services business,relates to various services,including credit assessment,referral and post-origination services,provided through our open-platform,which was launched in the second half of 2018.

[2] Cumulative number of borrowers are borrowers who have drawn down credit on or prior to a particular date,on a cumulative basis,including outstanding borrowers from both loan book business and transaction services business.

[3] Active borrowers are borrowers who have drawn down credit in the specified period from both loan book business and transaction services business. New active borrowers are active borrowers who had never drawn down credit on our platform prior to the specified period.

[4]Includes off and on balance sheet loans directly or indirectly funded by our institutional funding partners or our own capital,net of cumulative write-offs. Includes loan balance facilitated through our open platform to funding partners which Qudian does not undertake credit risks and does not include auto loans from Dabai Auto business.

Third Quarter 2019 Financial Highlights:

Total revenues were RMB2,590.9 million (US$362.5 million),increased by 34.3% from same period last year,primarily due to the ramp up of the open-platform initiative

Loan facilitation income and other related income increased by 72.6% year-on-year to RMB583.3 million (US$81.6 million) from RMB337.9 million for the same period last year

Transaction services fee and other related income which relate to transaction services and traffic referral services provided by our open-platform,substantially increased to RMB993.3 million (US$139.0 million) from nil for the same period last year

Financing income decreased by 16.9% to RMB797.9 million (US$111.6 million) from RMB960.2 million for the same period last year as a result of a decrease in average on-balance sheet loan balance

Net income increased by 52.6% year-on-year to RMB1,043.4 million (US$146.0 million),or RMB3.29 (US$0.46) per diluted ADS

Non-GAAP net income[5] increased by 52.9% year-on-year to RMB1,061.8million (US$148.6 million),or RMB3.34 (US$0.47) per diluted ADS

[5]For more information on this Non-GAAP financial measure,please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

"The third quarter marks our successful evolution to a balance sheet independent,technology services fee driven business. Our transaction services fee overtook as the largest in revenue scale and delivered staggering 150% growth from the previous quarter," said Mr. Min Luo,Founder,Chairman and Chief Executive Officer of Qudian.

"In the face of a complex and evolving regulatory framework over the past several years we have proven our ability to lead and innovate,creating China's leading regulatory compliant fintech company. Our past efforts in full compliance with Circular 141,restrained use of micro lending license,complete avoidance of P2P business model,100% institutional funding base,disciplined approach to collection and respect of our customers' data privacy have all cumulated to our open platform solution. Our open platform where the licensed and regulated financial institutions lend and assume borrowers risk while QD provides a full suite of transaction services using cutting edge technologies to enhance analytics,user experience,reduce customer acquisition and engagement cost,is likely to be the ultimate form of regulatory compliant fintech in China."

"Our open platform technology enables high speed precision processing of micro loans while simultaneously syndicating each individual user to multiple lenders. This allows all our lender partners to lower risk while providing enhancement in credit size,allowing open platform to focus on the higher quality borrowers. As of the end of third quarter,our open-platform has bridged over 1,020,940 outstanding borrowers and 11 licensed and,regulated financial institutions,both more than doubling from last quarter. Notably,the repeat borrowing ratio was more than 70% for the quarter,demonstrating strong sustainability and user stickiness trends."

"As a whole,our registered user base grew to 78.3 million and total outstanding borrowers reached 6.3million,both the highest in our company's history,illustrating the sustained demand for our services. With the right high-scale,risk-free and regulatory compliant approach to China's exciting consumer credit opportunity,we believe Qudian remains best positioned to deliver exceptional financial results and returns to our shareholders for the long term."

"We delivered another quarter of solid Non-GAAP net income of RMB1,061.8 million,a 52.9% year-over-year increase despite the overall industry credit deterioration driven by the macro economic environment and reduced liquidity as non-complaint player exit the credit market," said Mr. Carl Yeung,Chief Financial Officer of Qudian. "Continuing last quarter's momentum,our open-platform initiative has become the main growth and profit driver,generating RMB993.3 million revenue for the third quarter,which represents over 90% of our net profit,further boosting our bottom line,as it carries little marginal operational cost and zero credit risk."

"Attracted by our affordable and seamless product offering,more than 669,000 new borrowers joined the platform with minimal acquisition costs. Our total loan balance including the risk-free open platform business has grown further to RMB38.4 billion,solidifying our strong execution capabilities to drive business development and focus on the higher quality borrowers. Building on the innovation in our open-platform,we will continue to pursue our tech-driven growth strategy to connect China's over 300 million creditworthy but underserved consumers to more than 5,000 licensed domestic financial institutions."

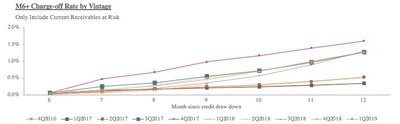

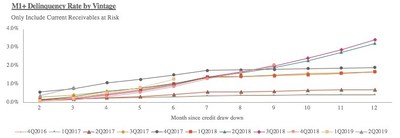

"In our risk undertaking business,we implemented a conservative strategy of reducing credit volumes and paused our credit trial program. Our proactive and prompt management of macro driven risk was effective in stabilizing the delinquency rates. To enhance comparability to peers and transparency in our disclosures,our M6+ vintage charge-off rates measured by current receivables at risk stayed below 1.6%. Although risk remains well managed,we believe the recent exit of many smaller players may create further credit liquidity pressure for the Chinese consumption credit sector. As such,we expect to continue a conservative approach on our risk-taking book into the final quarter of 2019 and thus revise our full year guidance accordingly."

"Given a large disconnect between the strong momentum in our open-platform and risk-free fee based business model and the market value of our company which is near net assets,we have announced another US$195 million of shares under our forward stock repurchase program,bringing our total buyback amount to US$572 million since we became a public company. This reflects our confidence in Qudian's growth prospects and upholds our commitment to creating shareholder value."

Third Quarter Financial Results

Total revenues were RMB2,increased by 34.3% from RMB1,928.9 million for the third quarter of 2018.

Financing income totaled RMB797.9 million (US$111.6 million),a decrease of 16.9% from RMB960.2 million for the third quarter of 2018,as a result of a decrease in average on-balance sheet loan balance.

Loan facilitation income and other related income increased by 72.6% to RMB583.3 million (US$81.6 million) from RMB337.9 million for the third quarter of 2018,as a result of an increase in the amount of off-balance sheet transactions.

Transaction services fee and other related income substantially increased to RMB993.3 million (US$139.0 million) from nil in the third quarter of 2018,as a result of the ramp-up of the open-platform initiative.

Sales income substantially decreased to RMB135.5 million (US$19.0 million) from RMB586.1 million for the third quarter of 2018,due to the scaling down of the Dabai Auto business.

Sales commission fee increasedby 96.0% to RMB69.9 million (US$9.8 million) from RMB35.7 million for the third quarter of 2018,due to an increase in the margins for merchandise credit products.

Total operating costs and expenses increased by 14.0% to RMB1,400.8 million (US$196.0 million) from RMB1,229.0 million for the third quarter of 2018.

Cost of revenues decreased by 70.5% to RMB206.3 million (US$28.9 million) from RMB698.5 million for the third quarter of 2018,primarily due to a decrease in costs incurred by the Dabai Auto business and a decrease in funding costs associated with the on-balance sheet portion of our loan book business.

Sales and marketing expenses decreased by 45.4% to RMB65.5 million (US$9.2 million) from RMB120.1 million for the third quarter of 2018. The decrease was primarily due to the scaling down of the Dabai Auto business.

General and administrative expensesincreased by 34.9% to RMB65.1 million(US$9.1 million) fromRMB48.2 millionfor the third quarter of 2018. The increase was primarily due to an increase in service fees.

Research and development expensesincreased by 7.0% to RMB44.1 million(US$6.2 million) from RMB41.2 million for the third quarter of 2018.

Provision for receivables increased by 136.4% toRMB691.1 million(US$96.7 million) fromRMB292.4 millionfor the third quarter of 2018.The increase was primarily due to an increase in past-due on-balance sheet outstanding principal receivables compared to the third quarter of 2018 and a write-down relating to the Dabai Auto business of RMB42.7 million (US$6.0 million).

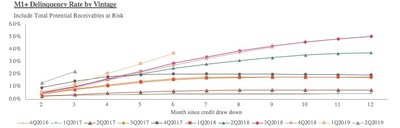

As ofSep 30,2019,the total balance of outstanding principal and financing service fee receivables for on-balance sheet transactions for which any installment payment was more than 30 calendar days past due wasRMB970.6 million(US$135.8 million),and the balance of allowance for principal and financing service fee receivables at the end of the period wasRMB1,184.5 million(US$165.7 million),indicating M1+ Delinquency Coverage Ratio of 1.2x.

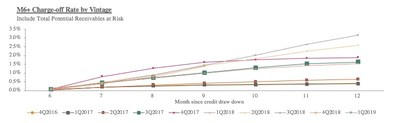

The following charts display "vintage charge-off rate." Total potential receivables at risk vintage charge-off rate refers to,with respect to on- and off-balance sheet transactions facilitated during a specified time period,the total potential outstanding principal balance of the transactions that are delinquent for more than 180 days during such period,divided by the total initial principal of the transactions facilitated in such vintage.

M6+ Charge-off Rate by Vintage: Include Total Potential Receivables at Risk

Current receivables at risk vintage charge-off rate refers to,actual outstanding principal balance of the transactions that are delinquent for more than 180 days during such period,divided by the total initial principal of the transactions facilitated in such vintage.

M6+ Charge-off Rate by Vintage: Only include Current Receivables at Risk

Total potential receivables at risk M1+ delinquency rate by vintage refers to,the total potential outstanding principal balance of the transactions that are delinquent for more than 30 days during such period,divided by the total initial principal of the transactions facilitated in such vintage.

M1+ Delinquency Rate by Vintage: Include Total Potential Receivables at Risk

Current receivables at risk M1+ delinquency rate by vintage refers to,the actual outstanding principal balance of the transactions that are delinquent for more than 30 days during such period,divided by the total initial principal of the transactions facilitated in such vintage.

M1+ Delinquency Rate by Vintage: Only include Current Receivables at Risk

Income from operations increased by 73.5% to RMB1,219.6 million(US$170.6 million) from RMB702.8 million for the third quarter of 2018.

Net income attributable to Qudian's shareholdersincreased by 52.6%toRMB1,043.4 million(US$146.0 million),or RMB3.29 (US$0.46) per diluted ADS.

Non-GAAP net income attributable to Qudian's shareholdersincreased by 52.9%toRMB1,061.8 million(US$148.6 million),or RMB3.34 (US$0.47) per diluted ADS.

Cash Flow

As of Sep 30,the Company had cash and cash equivalents ofRMB2,656.1 million(US$371.6 million) and restricted cash ofRMB981.6 million(US$137.3 million). Restricted cash mainly represents (i) cash held by the consolidated trusts through segregated bank accounts; (ii) time deposits that are pledged for short-term bank loans; and (iii) security deposits held in designated bank accounts for guarantee of off-balance sheet transactions. Such restricted cash is not available to fund the general liquidity needs of the Company.

For the quarter ended Sep 30,net cash provided by operating activities wasRMB1,670.9 million(US$233.8 million),mainly attributable to net income of RMB1,adjustment of provision for receivables of RMB691.1 million (US$96.7 million). Net cash provided by investing activities was RMB438.6 million(US$61.4 million),mainly due to proceeds from collection of loan principal of RMB5,779.4 million (US$808.6 million),partially offset by payments to originate loan principal of RMB5,279.4 million (US$738.6 million). Net cash used in financing activities was RMB1,919.4 million(US$268.5 million),mainly due to repayments of borrowings of RMB2,752.5 million (US$385.1 million) and prepayment of forward purchasesof RMB1,383.1 million (US$193.5 million),partially offset by net proceeds from convertible senior notes of RMB2,389.0 million (US$334.2 million).

Board Member Changes

We also announced today the replacementof Mr. Lianzhu Lv from Qudian's Board of Directors by Mr. Long Xu,Qudian's Senior Vice President.

With extensive experience managing startups,Mr. Xu joined Qudian,Inc. in 2016 and has focused on key operations including products,human resources and customer engagement. Mr. Lv will remain as key management of the company focusing on administration.

Outlook

Due to recent strategy for the company to reduce risk-taking loan balance and focus on higher quality borrowers via open-platform,the Company has adjusted its expected total Non-GAAP net income for the full year of 2019 to RMB4.0 billion,which will represent an approximately 57% increase from RMB2.55 billion for 2018.

The above outlook is based on current market conditions and reflects the Company's preliminary expectations as to market conditions,its regulatory and operating environment,as well as customer demand,all of which are subject to change.

Qudian to Hold Annual General Meeting on December 30,2019

Qudianannounced that it will hold its annual general meeting of shareholders (the "AGM") at Level 39,Tower A,AVIC Zijin Plaza,Siming District,Xiamen,Fujian Province,onDecember 30,2019at11:00AM(Beijing/ Hong Kong Time). No proposal will be submitted to shareholders for approval at the AGM. Instead,the AGM will serve as an open forum for shareholders and holders of the Company's ADSs to discuss the Company's affairs with management. The chairman of the AGM will conduct and lead the AGM and may accept questions from shareholders at his sole and absolute discretion.

The board of directors of the Company has fixed the close of business onDecember 6,2019 (Eastern Standard Time) as the record date (the "Record Date") for determining the shareholders entitled to receive notice of and attend the AGM or any adjournment or postponement thereof.

Holders of record of the ordinary shares,par valueUS$0.0001per share,of the Company (the "Ordinary Shares"),at the close of business on the Record Date are entitled to attend the AGM and any adjournment or postponement thereof in person.

The notice of the annual general meeting is available on the Company's website athttp://ir.qudian.com. The Company filed its annual report on Form 20-F for the fiscal year endedDecember 31,2018with theU.S. Securities and Exchange Commission(the "SEC") onApril 15,2019. Holders of the Ordinary Shares and the Company's American depositary shares may obtain a copy of the Company's annual report on Form 20-F,free of charge,from the Company's website athttp://ir.qudian.com,or from the website of theU.S. Securities and Exchange Commissionathttp://www.sec.gov,or by contactingQudianat Level 39,attention: Mr. Ben Zhao,email:ir@qudian.com.

Conference Call

The Company's management will host an earnings conference call on November 18,2019 at 7:00 AM U.S. Eastern Time,(8:00 PM Beijing/Hong Kong Time).

Dial-in details for the earnings conference call are as follows:

U.S.: +1-866-519-4004 (toll-free) / +1-845-675-0437

International: +65-6713-5090

Hong Kong: 800-906-601 (toll-free) / +852-3018-6771

Mainland China: 400-620-8038 / 800-819-0121

Please dial in 15 minutes before the call is scheduled to begin and provide the passcode to join the call. The passcode is "Qudian Conference Call". Additionally,a live and archived webcast of the conference call will be available on the Company's investor relations website athttp://ir.qudian.com.

A replay of the conference call will be accessible approximately one hour after the conclusion of the live call until November 26,by dialing the following telephone numbers:

U.S.: +1-855-452-5696 (toll-free) / +1-646-254-3697

International: +61-2-8199-0299

Hong Kong: 800-963-117 (toll-free) / +852-3051-2780

Mainland China: 400-632-2162 (toll-free) / 800-870-0205 (toll-free)

Passcode: 6738659

About Qudian Inc.

Qudian Inc. ("Qudian") is a leading technology platform empowering the enhancement of online consumer finance experience in China. The Company's mission is to use technology to make personalized credit accessible to hundreds of millions of young,mobile-active consumers in China who need access to small credit for their discretionary spending but are underserved by traditional financial institutions due to lack of traditional credit data or high cost of servicing. Qudian's credit solutions enable licensed,regulated financial institutions and ecosystem partners to offer affordable and customized loans to this young generation of consumers.

For more information,please visithttp://ir.qudian.com.

Use of Non-GAAP Financial Measures

We use adjusted net income,a Non-GAAP financial measure,in evaluating our operating results and for financial and operational decision-making purposes. We believe that adjusted net income helps identify underlying trends in our business by excluding the impact of share-based compensation expenses,which are non-cash charges. We believe that adjusted net income provides useful information about our operating results,enhances the overall understanding of our past performance and future prospects and allows for greater visibility with respect to key metrics used by our management in its financial and operational decision-making.

Adjusted net income is not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. This Non-GAAP financial measure has limitations as analytical tools,and when assessing our operating performance,cash flows or our liquidity,investors should not consider them in isolation,or as a substitute for net loss / income,cash flows provided by operating activities or other consolidated statements of operation and cash flow data prepared in accordance with U.S. GAAP.

We mitigate these limitations by reconciling the Non-GAAP financial measure to the most comparable U.S. GAAP performance measure,all of which should be considered when evaluating our performance.

For more information on this Non-GAAP financial measure,please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars ("US$") at specified rates solely for the convenience of the reader. Unless otherwise stated,all translations from RMB to US$ were made at the rate ofRMB7.1477 toUS$1.00,the noon buying rate in effect on September 30,2019in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB,as the case may be,at any particular rate or at all.

Statement Regarding Preliminary Unaudited Financial Information

The unaudited financial information set out in this earnings release is preliminary and subject to potential adjustments. Adjustments to the consolidated financial statements may be identified when audit work has been performed for the Company's year-end audit,which could result in significant differences from this preliminary unaudited financial information.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among other things,the expectation of its collection efficiency and delinquency,contain forward-looking statements. Qudian may also make written or oral forward-looking statements in its periodic reports to the SEC,in its annual report to shareholders,in press releases and other written materials and in oral statements made by its officers,directors or employees to third parties. Statements that are not historical facts,including statements about Qudian's beliefs and expectations,are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement,including but not limited to the following: Qudian's goal and strategies; Qudian's expansion plans; Qudian's future business development,financial condition and results of operations; Qudian's expectations regarding demand for,and market acceptance of,its credit products; Qudian's expectations regarding keeping and strengthening its relationships with borrowers,institutional funding partners,merchandise suppliers and other parties it collaborate with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Qudian's filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release,and Qudian does not undertake any obligation to update any forward-looking statement,except as required under applicable law.

For investor and media inquiries,please contact:

Qudian Inc.

Ben Zhao

Tel: +86-592-591-1580

E-mail:ir@qudian.com

The Foote Group

Philip Lisio

Tel: +86-135-0116-6560

E-mail: qudian@thefootegroup.com

QUDIAN INC.

Unaudited Condensed Consolidated Statements of Operations

Three months ended September 30,

(In thousands except for number

2018

2019

of shares and per-share data)

(Unaudited)

(Unaudited)

(Unaudited)

RMB

RMB

US$

Revenues:

Financing income

960,207

797,879

111,627

Sales commission fee

35,650

69,873

9,776

Sales income

586,057

135,533

18,962

Penalty fee

9,047

10,993

1,538

Loan facilitation income and other related income

337,950

583,340

81,612

Transaction services fee and other related income

-

993,299

138,968

Total revenues

1,928,911

2,590,917

362,483

Operating cost and expenses:

Cost of revenues

(698,519)

(206,336)

(28,867)

Sales and marketing

(120,071)

(65,538)

(9,169)

General and administrative

(48,233)

(65,069)

(9,104)

Research and development

(41,237)

(44,103)

(6,170)

Changes in guarantee liabilities and risk

assurance liabilities[1]

(28,578)

(328,631)

(45,977)

Provision for receivables and other assets

(292,350)

(691,080)

(96,686)

Total operating cost and expenses

(1,228,988)

(1,400,757)

(195,973)

Other operating income

2,886

29,425

4,116

Income from operations

702,809

1,219,585

170,626

Interest and investment income,net

23,487

10,511

1,471

Foreign exchange gain/(loss),net

(52,799)

(814)

(114)

Other income

2,445

483

68

Other expenses

(56)

(1,764)

(247)

Net income before income taxes

675,886

1,001

171,804

Income tax expenses

7,897

(184,614)

(25,829)

Net income

683,783

1,043,387

145,975

Net income attributable to Qudian Inc.'s

shareholders

683,975

Earnings per share for Class A and Class B

ordinary shares:

Basic

2.15

3.74

0.52

Diluted

2.13

3.29

0.46

Earnings per ADS (1 Class A ordinary share

equals 1 ADS):

Basic

2.15

3.74

0.52

Diluted

2.13

3.29

0.46

Weighted average number of Class A and

Class B ordinaryshares outstanding:

Basic

318,484,524

279,325,050

279,050

Diluted

320,441,092

320,089,013

320,013

Other comprehensive income:

Foreign currency translation adjustment

60,586

2,483

348

Total comprehensive income

744,369

1,045,870

146,323

Total comprehensive income attributable

to Qudian Inc.'sshareholders

744,323

Note:

[1] The amount includes the change in fair value of the guarantee liabilities accounted in accordance with

ASC 815,"Derivative",and the change in risk assurance liabilities accounted in accordance with ASC 450,

"Contingencies" and ASC 460,"Guarantees".

QUDIAN INC.

Unaudited Condensed Consolidated Balance Sheets

As of June 30,

As of September 30,

(In thousands except for number

2019

2019

of shares and per-share data)

(Unaudited)

(Unaudited)

(Unaudited)

RMB

RMB

US$

ASSETS:

Current assets:

Cash and cash equivalents

2,586,949

2,656,105

371,603

Restricted cash

858,648

981,618

137,333

Short-term investments

30,000

30,000

4,197

Short-term loan principal and financing service

fee receivables

8,743,378

8,023,224

1,122,490

Short-term finance lease receivables

448,494

426,495

59,669

Short-term amounts due from related parties

45

228

32

Short-term contract assets

1,809,313

2,908,284

406,884

Other current assets

1,967,223

1,791,529

250,644

Total current assets

16,444,050

16,817,483

2,352,852

Non-current assets:

Long-term loan principal and financing service

fee receivables

251,921

37,652

5,268

Long-term finance lease receivables

484,989

331,927

46,438

Operating lease right-of-use assets

137,668

145,605

20,371

Investment in equity method investees

49,651

47,464

6,641

Long-term investments

180,000

224,180

31,364

Property and equipment,net

63,920

79,461

11,117

Intangible assets

6,111

6,050

846

Long-term contract assets

575,066

272,222

38,085

Deferred tax assets

450,116

713,160

99,775

Other non-current assets

20,266

19,770

2,766

Total non-current assets

2,708

1,877,491

262,671

TOTAL ASSETS

18,663,758

18,694,974

2,615,523

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Short-term borrowings and interest payables

3,241,491

777,726

108,808

Short-term lease liabilities

11,957

18,373

2,570

Accrued expenses and other current liabilities

657,416

828,466

115,907

Guarantee liabilities

409,160

422,022

59,043

Risk assurance liabilities

760,313

1,083,721

151,618

Income tax payable

339,715

626,189

87,607

Total current liabilities

5,420,052

3,756,497

525,553

Non-current liabilities:

Deferred tax liabilities

376,321

508,249

71,107

Convertible senior notes

-

2,391,584

334,595

Long-term lease liabilities

18,996

21,344

2,986

Long-term borrowings and interest payables

597,500

278,000

38,894

Total non-current liabilities

992,817

3,199,177

447,582

Total liabilities

6,412,869

6,955,674

973,135

Shareholders' equity:

Class A Ordinary shares

150

150

21

Class B Ordinary shares

44

44

6

Treasury shares

(362,130)

(362,130)

(50,664)

Additional paid-in capital

5,506,759

3,949,300

552,527

Accumulated other comprehensive loss

(53,912)

(51,429)

(7,195)

Retained earnings

7,159,978

8,203,365

1,147,693

Total shareholders' equity

12,250,889

11,739,300

1,642,388

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY

18,523

QUDIAN INC.

Unaudited Reconciliation of GAAP And Non-GAAP Results

Three months ended September 30,

2018

2019

(In thousands except for number

(Unaudited)

(Unaudited)

(Unaudited)

of shares and per-share data)

RMB

RMB

US$

Total net income attributable to

Qudian Inc.'s shareholders

683,387

145,975

Add: Share-based compensation expenses

10,529

18,439

2,580

Non-GAAP net income attributable to

Qudian Inc.'s shareholders

694,312

1,061,826

148,555

Non-GAAP net income per share - basic

2.18

3.80

0.53

Non-GAAP net income per share - diluted

2.17

3.34

0.47

Weighted average shares outstanding - basic

318,050

279,050

Weighted average shares outstanding - diluted

320,013

320,013

![]()

View original content to download multimedia:/news-releases/qudian-inc-reports-third-quarter-2019-unaudited-financial-results-300959827.html

Tags: Banking/Financial Service Computer/Electronics Financial Technology

Previous:ChipMOS to Present at MasterLink Securities' 2019 November Corporate Day Fo...

Next:Absen LED Enhances Visitor Experience at Russian Oil Exposition

Leave a comment

Follow Us

Newsletter

Join us to get the latest news.