Qudian Inc. Reports Fourth Quarter and Full Year 2019 Unaudited Financial Results

XIAMEN,China,March 18,2020 -- Qudian Inc. ("Qudian" or the "Company") (NYSE: QD),a leading technology platform empowering the enhancement of online consumer finance experience in China,today announced its unaudited financial results for the fourth quarter and full year ended December 31,2019.

Fourth Quarter 2019 Operational Highlights:

Number of outstanding borrowers[1] from loan book business and transaction services business as of December 31,2019 decreased by 2.4% to 6.1 million from 6.3million as of September 30,2019

Total outstanding loan balance from loan book business as of December 31,2019 decreased by13.4% toRMB22.6 billion from September 30,2019 as a result of conservative and prudent strategy the Company deployed

Weighted average loan tenure for our loan book business was 10.9 months for this quarter,compared with 10.4 months for the third quarter of 2019; Weighted average loan tenure for transactions serviced on open platform was 13.8 months for this quarter,compared with 13.0 months for the third quarter of 2019

Amount of transactions serviced on open platform in the fourth quarter of 2019 decreased by 19.7% to RMB8.0 billion from RMB10.0 billion for the third quarter of 2019,as a result of funding partners taking a more conservative stance on credit risk

[1]Outstanding borrowers are borrowers who have outstanding loans as of a particular date,including outstanding borrowers from both loan book business and transaction services business. Transaction services business,relates to various services,including credit assessment,referral and post-origination services,provided through our open platform,which was launched in the second half of 2018.

Fourth Quarter 2019 Financial Highlights:

Total revenues were RMB1,931.6 million (US$277.5 million),representing a decrease of 25.4% from the third quarter of 2019 and an increase of 7.1% from the same period of last year.

- Loan facilitation income and other related income decreased by 21.1% quarter-on-quarter and decreased by 20.6% year-on-year to RMB460.0 million (US$66.1 million) as a result of a decrease in the amount of off-balance sheet transactions[2]

- Transaction services fee and other related income which relate to transaction services and traffic referral services provided by the Company's open platform,decreased by 34.6% quarter-on-quarter,as a result of funding partners taking a more conservative stance on credit risk,and increased substantiallyyear-on-year to RMB649.4 million (US$93.3 million) as a result of the ramp-up of the open platform initiative

- Financing income decreased by 10.1% quarter-on-quarter anddecreased by 20.6%year-on-year to RMB717.0 million (US$103.0 million) as a result of a decrease in average on-balance sheet loan balance

Net income decreased by 87.7% quarter-on-quarter anddecreased by 83.3% year-on-year to RMB127.9 million (US$18.4 million),or RMB0.49 (US$0.07) per diluted American depositary share ("ADS")

Non-GAAP net income[3] decreased by 85.2% quarter-on-quarter anddecreased by 79.9% year-on-year to RMB156.9million (US$22.5 million),or RMB0.59 (US$0.08) per diluted ADS

Full Year2019 Financial Highlights:

Total revenues were RMB8,840.0 million (US$1,269.8 million) in 2019,representing an increase of 14.9% from 2018,primarily due to the establishment of the open platform initiative

- Loan facilitation income and other related income increased by 39.5% year-on-year to RMB2,297.4million (US$330.0 million) from RMB1,646.8 million for 2018

- Transaction services fee and other related income which relate to transaction services and traffic referral services provided by the Company's open platform,substantially increased to RMB2,199.5 million (US$315.9 million)

- Financing income decreased by 0.7%to RMB3,510.1 million (US$504.2 million) from RMB3,535.3 million in 2018 as a result of a decrease in the average on-balance sheet loan balance

Net income increased by 31.0% year-on-year to RMB3,264.3 million (US$468.9 million),or RMB10.94 (US$1.57) per diluted ADS

Non-GAAP net income[3] increased by 31.5% year-on-year to RMB3,351.6million (US$481.4 million),or RMB11.23 (US$1.61) per diluted ADS

[2] "Off-balance sheet transactions" are defined as transactions that are not recorded on the Company's balance sheet and are guaranteed by the Company.

[3]For more information on this Non-GAAP financial measure,please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

"We concluded 2019 with a strategic focus on reducing risks and protecting net assets,in response to the challenging market conditions and further evolving regulatory parameters," said Mr. Min Luo,Founder,Chairman and Chief Executive Officer of Qudian. "In the second half of 2019,the regulatory environment became increasingly stringent with the introduction of further restrictions on loan collection practices,data collection and usage,and marketing campaigns of fintech platforms,as well as the regulatory requirements for P2P lending platforms to orderly exit their P2P businesses. As such,the overall availability of funding sources for consumer credit has shrunk,and delinquency rates across the industry have surged. Our D1 delinquency rate[4],a more real-time representation of our portfolio asset quality,has risen to around 13% as of the end of the fourth quarter of 2019,from around 10% as of the end of the previous quarter."

"In light of these market dynamics,we adopted more precautionary measures to protect our net asset value with a long-term perspective in mind. For our risk undertaking business,we implemented stricter loan approval standards,limiting our loan approval rate to low single-digit in the fourth quarter. As a result,we substantially reduced our risk-undertaking outstanding loan balance by RMB3.5 billion within one single quarter. Meanwhile,our open platform institutional funding partners have also adopted more stringent credit evaluation criteria,which subsequently decreased the credit volume on our open platform by 19.7% in the fourth quarter of 2019,compared to the preceding quarter."

"Looking at the near term,although the impact of the COVID-19 outbreak on the economy is still unclear,we expect the epidemic to exacerbate the already existing challenges in the consumer credit sector. Therefore,we plan to continue mitigating our risk exposure to the consumer credit market by reducing loan book aggressively in the first half of 2020. Until the credit cycle terminates the current downtrend,we intend to maintain a leverage ratio[5]of lower than 1.9x and remain committed to protecting our net assets. With this prudent operating strategy,we will utilize the increased liquidity of our capital for our share repurchase program as well as strategic investments for new areas of growth," Mr. Luo concluded.

"The combined impact from the macroeconomic slowdown,regulatory developments,and difficult operating environment presented us with a challenging start of 2020," said Ms. Sissi Zhu,Vice President,Investor Relations of Qudian.

"In light of the COVID-19 outbreak and its ensuing adverse influence on the macroeconomy,we worked closely with our partners to mitigate the epidemic's negative impact on the consumer credit industry. Together with our partners,we further accelerated the deleveraging process by implementing more rigorous credit approval standards,which allowed us to reduce our overall transaction volume. During the first two months of 2020,our average monthly transaction volume in our loan book and open platform further decreased by approximately 50% and 61%,respectively,compared to the average monthly transaction volume in the fourth quarter of 2019. In addition,we also recorded higher provisions for our receivables and losses on guarantee and risk assurance liabilities. This reflects near-term asset quality challenges ever since our vintage M1+ delinquency rate reached 5.6% in December 2019 and D1 delinquency rate doubled to 20% in February 2020 from approximately 10% for the third quarter of 2019. Consequently,we expect the reduced origination volume combined with higher provisions for receivables and losses on guarantee and risk assurance liabilities to generate a material loss in the first quarter of 2020."

"Given the fast moving dynamics of the industry,uncertainties and macro challenges,we believe our practice of not providing guidance is appropriate,as it gives the management flexibility in taking quick and decisive actions to protect net assets on behalf of our stakeholders. The quick reduction in loan book in the last quarter of 2019 and thus far in the first quarter of 2020 will have a near term impact on our quarterly results,but we also believe it is the right course of action to ensure the longer term viability of the business. We will keep monitoring the market development and stay agile in our strategic adjustments," Ms. Zhu concluded.

[4] "D1 delinquency rate" is defined as (i) the total amount of principal and financing service fees that became overdue as a specified date,divided by (ii) the total amount of principal and financing services fees that was due for repayment as of such date,in each case with respect to our loan book business and transaction services business.

[5]"Leverage ratio" is defined as the ratio between (i) outstanding balance of our loan book business and (ii) total net assets.

FourthQuarter Financial Results

Total revenueswere RMB1,an increase of 7.1% from RMB1,803.2 million for the fourth quarter of 2018.

Financing incometotaled RMB717.0 million (US$103.0 million),a decrease of 20.6% from RMB903.2 million for the fourthquarter of 2018,as a result of a decrease in average on-balance sheet loan balance.

Loan facilitation income and otherrelated income decreased by 20.6% to RMB460.0 million (US$66.1 million) from RMB579.1 million for the fourthquarter of 2018,as a result of a decrease in the amount of off-balance sheet transactions.

Transaction services fee and other related income substantially increased to RMB649.4 million (US$93.3 million),as a result of the ramp-up of the open platform initiative.

Sales income substantially decreased to RMB35.9 million (US$5.2 million) from RMB257.9 million for the fourthquarter of 2018,due to the winding down of the Dabai Auto business.

Sales commission fee increasedby 1.7% to RMB55.5 million (US$8.0 million) from RMB54.6 million for the fourthquarter of 2018,due to an increase in the margins for merchandise credit products.

Total operating costs and expenses increased by 88.8% to RMB1,754.3 million (US$252.0 million) from RMB929.0 million for the fourthquarter of 2018.

Cost of revenuesdecreased by 63.0% to RMB148.8 million (US$21.4 million) from RMB402.7 million for the fourthquarter of 2018,primarily due to a decrease in costs incurred by the Dabai Auto business and a decrease in funding costs associated with the on-balance sheet portion of the Company's loan book business as a result of a decrease in on-balance sheet transactions.

Sales and marketing expensesdecreased by 58.0% to RMB57.5 million (US$8.3 million) from RMB136.9 million for the fourthquarter of 2018. The decrease was primarily due to the winding down of the Dabai Auto business.

General and administrative expensesdecreased by 14.3% to RMB70.8 million(US$10.2 million) fromRMB82.5 millionfor the fourth quarter of 2018. The decrease was primarily due to a decrease in staff salary.

Research and development expensesdecreased by 56.0% to RMB34.3 million(US$4.9 million) from RMB77.9 millionfor the fourth quarter of 2018. The decrease was primarily due to a decrease in staff salary.

Provision for receivables and other assetsincreased by 220.3% toRMB707.2 million(US$101.6 million) fromRMB220.8 millionfor the fourth quarter of 2018.The increase was primarily due to an increase in past-due on-balance sheet outstanding principal receivables compared to the fourth quarter of 2018.

As ofDecember 31,2019,the total balance of outstanding principal and financing service fee receivables for on-balance sheet transactions for which any installment payment was more than 30 calendar days past due wasRMB1,047.4 million(US$150.4 million),and the balance of allowance for principal and financing service fee receivables at the end of the period wasRMB1,623.9 million(US$233.3 million),indicating M1+ Delinquency Coverage Ratio of 1.6x.

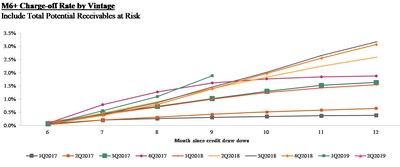

The following charts display the "vintage charge-off rate." Total potential receivables at risk vintage charge-off (with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period),refers to the total outstanding principal balance of the transactions for which any repayment is over due for more than 180 days during such period,divided by the total initial principal of the transactions facilitated in such vintage.

M6+ Charge-off Rate by Vintage: Include Total Potential Receivables at Risk

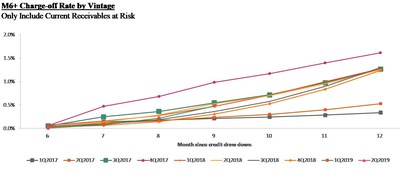

Current receivables at risk vintage charge-off rate (with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period),refers to the principal amount of repayments that are overdue for more than 180 days during such period,divided by the total initial principal of the transactions facilitated in such vintage.

M6+ Charge-off Rate by Vintage: Only Include Current Receivables at Risk

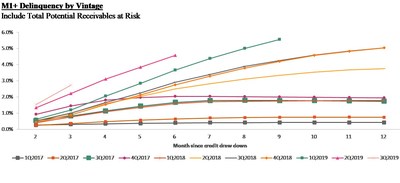

Total potential receivables at risk M1+ delinquency rate by vintage (with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period),refers to the total outstanding principal balance of the transactions for which any repayment is overdue for more than 30 days during such period,divided by the total initial principal of the transactions facilitated in such vintage.

M1+ Delinquency by Vintage: Include Total Potential Receivables at Risk

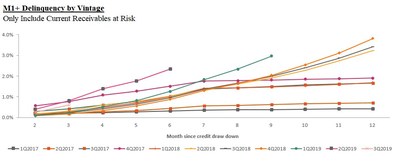

Current receivables at risk M1+ delinquency rate by vintage (with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period),refers to the principal amount of repayments that are overdue for more than 30 days during such period,divided by the total initial principal of the transactions facilitated in such vintage.

M1+ Delinquency by Vintage: Only Include Current Receivables at Risk

Income from operationsdecreased by 74.4% to RMB226.8 million(US$32.6 million) from RMB886.4 million for the fourth quarter of 2018.

Net income attributable to Qudian's shareholdersdecreased by 83.3%toRMB127.9 million(US$18.4 million),or RMB0.49 (US$0.07) per diluted ADS.

Non-GAAP net income attributable to Qudian's shareholdersdecreased by 79.9%toRMB156.9 million(US$22.5 million),or RMB0.59 (US$0.08) per diluted ADS.

Full Year 2019 Financial Results

Total revenueswere RMB8,269.8 million),an increase of 14.9% from RMB7,692.3 million for 2018.

Financing incometotaled RMB3,510.1 million (US$504.2 million),a decrease of 0.7% from RMB3,535.3 million for 2018.

Loan facilitation income and otherrelated income increased by 39.5% to RMB2,297.4 million (US$330.0 million) from RMB1,646.8 million for 2018,as a result of an increase in the amount of off-balance sheet transactions.

Transaction services fee and other related income substantially increased to RMB2,199.5 million (US$315.9 million),as a result of the ramp-up of the open platform initiative.

Sales income substantially decreased to RMB431.9 million (US$62.0 million) from RMB2,174.8 million for 2018,due to the winding down of the Dabai Auto business.

Sales commission fee increasedby 16.0% to RMB356.8 million (US$51.3 million) from RMB307.5 million for 2018,due to an increase in the margins for merchandise credit products.

Total operating costs and expenses increased by 1.5% to RMB5,099.8 million (US$732.5 million) from RMB5,026.7 million for 2018.

Cost of revenuesdecreased by 67.0% to RMB901.8 million (US$129.5 million) from RMB2,735.4 million for 2018,primarily due to a decrease in costs incurred by the Dabai Auto business and a decrease in funding costs associated with the on-balance sheet portion of our loan book business as a result of a decrease in on-balance sheet transactions.

Sales and marketing expensesdecreased by 48.1% to RMB280.6 million (US$40.3 million) from RMB540.6 million for 2018. The decrease was primarily due to the winding down of the Dabai Auto business.

General and administrative expensesincreased by 11.8% to RMB286.1 million(US$41.1 million) fromRMB255.9 millionfor 2018. The increase was primarily due to an increase in third-party service fees.

Research and development expensesincreased by 2.6% to RMB204.8 million(US$29.4 million) from RMB199.6 millionfor 2018.

Provision for receivables and other assetsincreased by 93.7% toRMB2,283.1 million(US$328.0 million) fromRMB1,178.7 millionfor 2018.The increase was primarily due to an increase in past-due on-balance sheet outstanding principal receivables compared to 2018.

Income from operationsincreased by 43.1% to RMB3,848.8 million(US$552.8 million) from RMB2,689.4 million for 2018.

Net income attributable to Qudian's shareholdersincreased by 31.0%toRMB3,264.3 million(US$468.9 million),or RMB10.94 (US$1.57) per diluted ADS.

Non-GAAP net income attributable to Qudian's shareholdersincreased by 31.5%toRMB3,351.6 million(US$481.4 million),or RMB11.23 (US$1.61) per diluted ADS.

Cash Flow

As of December 31,the Company had cash and cash equivalents ofRMB2,860.9 million(US$410.9 million) and restricted cash ofRMB1,257.6 million(US$180.6 million). Restricted cash mainly represents (i) cash held by the consolidated trusts through segregated bank accounts; (ii) security deposits held in designated bank accounts for guarantee of off-balance sheet transactions. Such restricted cash is not available to fund the general liquidity needs of the Company.

For the full year of 2019,net cash provided by operating activities wasRMB5,503.4 million(US$790.5 million),mainly attributable to net income of RMB3,adjustment of provision for receivables and other assets of RMB2,283.1 million (US$328.0 million). Net cash used in investing activities was RMB929.6 million(US$133.5 million),mainly due to payments to originate loan principal of RMB22,760.4 million (US$3,269.3 million),partially offset by proceeds from collection of loan principal of RMB22,140.9 million (US$3,180.3 million). Net cash used in financing activities was RMB3,372.3 million(US$484.4 million),mainly due to repayments of borrowings of RMB5,402.4 million (US$776.0 million) and repurchase of ordinary shares of RMB2,087.2 million (US$299.8 million),partially offset by net proceeds from convertible senior notes of RMB2,289.6 million (US$328.9 million) and proceeds from borrowings of RMB2,251.6 million (US$323.4 million).

Conference Call

The Company's management will host an earnings conference call on March 18,2020 at 7:00 AM U.S. Eastern Time,(7:00 PM Beijing/Hong Kong Time).

Dial-in details for the earnings conference call are as follows:

U.S.:

+1-866-519-4004 (toll-free) / +1-845-675-0437

International:

+65-6713-5090

Hong Kong:

800-906-601 (toll-free) / +852-3018-6771

Mainland China:

400-620-8038 / 800-819-0121

Please dial in 15 minutes before the call is scheduled to begin and provide the passcode to join the call. The passcode is "Qudian Conference Call". Additionally,a live and archived webcast of the conference call will be available on the Company's investor relations website athttp://ir.qudian.com.

A replay of the conference call will be accessible approximately one hour after the conclusion of the live call until March 25,2020,by dialing the following telephone numbers:

U.S.:

+1-855-452-5696 (toll-free) / +1-646-254-3697

International:

+61-2-8199-0299

Hong Kong:

800-963-117 (toll-free) / +852-3051-2780

Mainland China:

400-632-2162 (toll-free) / 800-870-0205 (toll-free)

Passcode:

9763736

About Qudian Inc.

Qudian Inc. ("Qudian") is a leading technology platform empowering the enhancement of online consumer finance experience in China. The Company's mission is to use technology to make personalized credit accessible to hundreds of millions of young,mobile-active consumers in China who need access to small credit for their discretionary spending but are underserved by traditional financial institutions due to lack of traditional credit data or high cost of servicing. Qudian's credit solutions enable licensed,regulated financial institutions and ecosystem partners to offer affordable and customized loans to this young generation of consumers.

For more information,please visithttp://ir.qudian.com.

Use of Non-GAAP Financial Measures

We use adjusted net income,a Non-GAAP financial measure,in evaluating our operating results and for financial and operational decision-making purposes. We believe that adjusted net income helps identify underlying trends in our business by excluding the impact of share-based compensation expenses,which are non-cash charges. We believe that adjusted net income provides useful information about our operating results,enhances the overall understanding of our past performance and future prospects and allows for greater visibility with respect to key metrics used by our management in its financial and operational decision-making.

Adjusted net income is not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. This Non-GAAP financial measure has limitations as analytical tools,and when assessing our operating performance,cash flows or our liquidity,investors should not consider them in isolation,or as a substitute for net loss / income,cash flows provided by operating activities or other consolidated statements of operation and cash flow data prepared in accordance with U.S. GAAP.

We mitigate these limitations by reconciling the Non-GAAP financial measure to the most comparable U.S. GAAP performance measure,all of which should be considered when evaluating our performance.

For more information on this Non-GAAP financial measure,please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars ("US$") at specified rates solely for the convenience of the reader. Unless otherwise stated,all translations from RMB to US$ were made at the rate ofRMB6.9618 toUS$1.00,the noon buying rate in effect on December 31,2019in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB,as the case may be,at any particular rate or at all.

Statement Regarding Preliminary Unaudited Financial Information

The unaudited financial information set out in this earnings release is preliminary and subject to potential adjustments. Adjustments to the consolidated financial statements may be identified when audit work has been performed for the Company's year-end audit,which could result in significant differences from this preliminary unaudited financial information.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among other things,the expectation of its collection efficiency and delinquency,contain forward-looking statements. Qudian may also make written or oral forward-looking statements in its periodic reports to the SEC,in its annual report to shareholders,in press releases and other written materials and in oral statements made by its officers,directors or employees to third parties. Statements that are not historical facts,including statements about Qudian's beliefs and expectations,are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement,including but not limited to the following: Qudian's goal and strategies; Qudian's expansion plans; Qudian's future business development,financial condition and results of operations; Qudian's expectations regarding demand for,and market acceptance of,its credit products; Qudian's expectations regarding keeping and strengthening its relationships with borrowers,institutional funding partners,merchandise suppliers and other parties it collaborate with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Qudian's filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release,and Qudian does not undertake any obligation to update any forward-looking statement,except as required under applicable law.

For investor and media inquiries,please contact:

Qudian Inc.

Tel: +86-592-591-1711

E-mail:ir@qudian.com

The Piacente Group,Inc.

Xi Zhang

Tel: +86 (10) 6508-0677

E-mail: qudian@tpg-ir.com

The Piacente Group,Inc.

Brandi Piacente

Tel: +1-212-481-2050

E-mail: qudian@tpg-ir.com

QUDIAN INC.

Unaudited Condensed Consolidated Statements of Operations

Three months ended December 31,

(In thousands except for number

2018

2019

of shares and per-share data)

(Unaudited)

(Unaudited)

(Unaudited)

RMB

RMB

US$

Revenues:

Financing income

903,191

716,972

102,987

Sales commission fee

54,565

55,481

7,969

Sales income

257,945

35,906

5,158

Penalty fee

8,314

13,827

1,986

Loan facilitation income and other related income

579,142

460,011

66,076

Transaction services fee and other related income

-

649,373

93,277

Total revenues

1,803,157

1,931,570

277,453

Operating cost and expenses:

Cost of revenues

(402,688)

(148,831)

(21,378)

Sales and marketing

(136,949)

(57,489)

(8,258)

General and administrative

(82,535)

(70,768)

(10,165)

Research and development

(77,939)

(34,288)

(4,925)

Changes in guarantee liabilities and risk assurance liabilities(1)

(8,080)

(735,688)

(105,675)

Provision for receivables and other assets

(220,807)

(707,201)

(101,583)

Total operating cost and expenses

(928,998)

(1,754,265)

(251,984)

Other operating income

12,202

49,519

7,113

Income from operations

886,361

226,824

32,582

Interest and investment income,net

(11,867)

(3,095)

(445)

Foreign exchange gain/(loss),net

(34,442)

602

86

Other income

4,286

958

138

Other expenses

(297)

(6,661)

(957)

Net income before income taxes

844,041

218,628

31,404

Income tax expenses

(76,516)

(90,755)

(13,036)

Net income

767,525

127,873

18,368

Net income attributable to Qudian

Inc.'sshareholders

767,368

Earnings per share for Class A and Class B

ordinary shares:

Basic

2.54

0.50

0.07

Diluted

2.52

0.49

0.07

Earnings per ADS (1 Class A ordinary share

equals 1 ADSs):

Basic

2.54

0.50

0.07

Diluted

2.52

0.49

0.07

Weighted average number of Class A and

Class B ordinary shares outstanding:

Basic

302,326,683

254,466,950

254,950

Diluted

304,640,119

293,747,979

293,979

Other comprehensive gain:

Foreign currency translation adjustment

1,812

38,464

5,525

Total comprehensive income

769,337

166,337

23,893

Total comprehensive income attributable to Qudian Inc.'s

shareholders

769,893

Note:

(1):The amount includes the change in fair value of the guarantee liabilities accounted in accordance with ASC

815,"Derivative",and the change in risk assurance liabilities accounted in accordance with ASC 450,"Contingencies"

and ASC 460,"Guarantees".

QUDIAN INC.

Unaudited Condensed Consolidated Statements of Operations

Year ended December 31,

(In thousands except for number

2018

2019

of shares and per-share data)

(Unaudited)

(Unaudited)

RMB

RMB

US$

Revenues:

Financing income

3,535,276

3,510,055

504,188

Sales commission fee

307,492

356,812

51,253

Sales income

2,174,789

431,946

62,045

Penalty fee

28,013

44,354

6,371

Loan facilitation income and other related income

1,646,773

2,297,413

330,003

Transaction services fee and other related income

-

2,199,464

315,933

Total revenues

7,692,343

8,840,044

1,269,793

Operating cost and expenses:

Cost of revenues

(2,735,428)

(901,787)

(129,534)

Sales and marketing

(540,550)

(280,616)

(40,308)

General and administrative

(255,867)

(286,059)

(41,090)

Research and development

(199,560)

(204,781)

(29,415)

Changes in guarantee liabilities and risk assurance liabilities(1)

(116,593)

(1,143,428)

(164,243)

Provision for receivables and other assets

(1,178,723)

(2,283,126)

(327,951)

Total operating cost and expenses

(5,026,721)

(5,099,797)

(732,540)

Other operating income

23,748

108,508

15,586

Income from operations

2,689,370

3,848,755

552,839

Interest and investment income,net

35,740

20,872

2,998

Foreign exchange gain/(loss),net

(90,771)

6,636

953

Other income

15,231

24,583

3,531

Other expenses

(522)

(10,324)

(1,483)

Net income before income taxes

2,649,048

3,890,522

558,839

Income tax expenses

(157,731)

(626,234)

(89,953)

Net income

2,491,317

3,264,288

468,886

Net income attributable to Qudian

Inc.'sshareholders

2,886

Earnings per share for Class A and Class B

ordinary shares:

Basic

7.82

11.72

1.68

Diluted

7.74

10.94

1.57

Earnings per ADS (1 Class A ordinary share

equals 1 ADSs):

Basic

7.82

11.72

1.68

Diluted

7.74

10.94

1.57

Weighted average number of Class A and

Class B ordinary shares outstanding:

Basic

318,685,836

278,531,382

278,382

Diluted

321,955,142

300,457,711

300,711

Other comprehensive gain:

Foreign currency translation adjustment

33,089

31,893

4,581

Total comprehensive income

2,524,406

3,296,181

473,467

Total comprehensive income attributable to Qudian Inc.'s

shareholders

2,467

Note:

(1):The amount includes the change in fair value of the guarantee liabilities accounted in accordance with ASC

815,"Guarantees".

QUDIAN INC.

Unaudited Condensed Consolidated Balance Sheets

As of December 31,

As of December 31,

(In thousands except for number

2018

2019

of shares and per-share data)

(Unaudited)

(Unaudited)

RMB

RMB

US$

ASSETS:

Current assets:

Cash and cash equivalents

2,501,188

2,860,938

410,948

Restricted cash

339,827

1,257,649

180,650

Time deposits

-

231,132

33,200

Short-term loan principal and financing service fee receivables

8,417,821

7,894,697

1,134,002

Short-term finance lease receivables

508,647

398,256

57,206

Short-term amounts due from related parties

2

-

-

Short-term contract assets

903,436

2,741,914

393,851

Other current assets

1,818,222

1,638,905

235,414

Total current assets

14,489,143

17,023,491

2,445,271

Non-current assets:

Long-term loan principal and financing service fee receivables

665,653

424

61

Long-term finance lease receivables

649,243

239,697

34,430

Land use right

106,545

-

-

Operating lease right-of-use assets

-

148,851

21,381

Investment in equity method investee

33,199

44,779

6,432

Long-term investments

-

223,158

32,055

Property and equipment,net

26,224

92,821

13,333

Intangible assets

7,264

6,803

977

Long-term contract assets

15,597

273,597

39,300

Deferred tax assets

243,413

595,895

85,595

Other non-current assets

17,093

17,698

2,542

Total non-current assets

1,764,231

1,643,723

236,106

TOTAL ASSETS

16,253,374

18,667,214

2,681,378

QUDIAN INC.

Unaudited Condensed Consolidated Balance Sheets

As of December 31,

(In thousands except for number

2018

2019

of shares and per-share data)

(Unaudited)

(Unaudited)

RMB

RMB

US$

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Short-term borrowings and interest payables

3,441

1,049,570

150,761

Short-term lease liabilities

-

21,919

3,148

Accrued expenses and other current liabilities

507,486

718,266

103,172

Guarantee liabilities and risk assurance liabilities(2)

302,605

1,517,827

218,022

Income tax payable

348,830

589,739

84,711

Total current liabilities

5,019,362

3,897,321

559,815

Non-current liabilities:

Deferred tax liabilities

-

484,595

69,608

Convertible senior notes

-

2,339,552

336,056

Long-term lease liabilities

-

21,694

3,116

Long-term borrowings and interest payables

413,400

-

-

Total non-current liabilities

413,400

2,845,841

408,779

Total liabilities

5,432,762

6,743,162

968,595

Shareholders' equity:

Class A Ordinary shares

161

131

19

Class B Ordinary shares

44

44

6

Treasury shares

(362,130)

(362,130)

(52,017)

Additional paid-in capital

6,160,446

3,967,733

569,929

Accumulated other comprehensive loss

(44,858)

(12,965)

(1,862)

Retained earnings

5,066,951

8,331,239

1,196,708

Total shareholders' equity

10,820,614

11,924,052

1,712,783

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

16,376

18,378

Note:

(2):The amount includes the balance of the guarantee liabilities accounted in accordance with ASC 815,and the balance of risk assurance

liabilities accounted in accordance with ASC 450,"Contingencies" and ASC 460,"Guarantees".

QUDIAN INC.

Unaudited Reconciliation of GAAP And Non-GAAP Results

Three months ended December 31,

2018

2019

(In thousands except for number

(Unaudited)

(Unaudited)

(Unaudited)

of shares and per-share data)

RMB

RMB

US$

Total net income attributable to Qudian Inc.'s shareholders

767,873

18,368

Add: Share-based compensation expenses

11,249

29,042

4,172

Non-GAAP net income attributable to Qudian Inc.'s shareholders

778,774

156,915

22,540

Non-GAAP net income per share—basic

2.58

0.62

0.09

Non-GAAP net income per share—diluted

2.56

0.59

0.08

Weighted average shares outstanding—basic

302,950

254,950

Weighted average shares outstanding—diluted

304,979

293,979

QUDIAN INC.

Unaudited Reconciliation of GAAP And Non-GAAP Results

Year ended December 31,

2018

2019

(In thousands except for number

(Unaudited)

(Unaudited)

of shares and per-share data)

RMB

RMB

US$

Total net income attributable to Qudian Inc.'s shareholders

2,316

3,288

468,886

Add: Share-based compensation expenses

57,981

87,299

12,540

Non-GAAP net income attributable to Qudian Inc.'s shareholders

2,549,297

3,351,587

481,426

Non-GAAP net income per share—basic

8.00

12.03

1.73

Non-GAAP net income per share—diluted

7.92

11.23

1.61

Weighted average shares outstanding—basic

318,382

278,382

Weighted average shares outstanding—diluted

321,711

300,711

![]()

View original content to download multimedia:/news-releases/qudian-inc-reports-fourth-quarter-and-full-year-2019-unaudited-financial-results-301025994.html

Tags: Banking/Financial Service

Previous:EESTech, Inc. Announces Heads of Agreement with Ramboll

Leave a comment

Follow Us

Newsletter

Join us to get the latest news.