China's Corporates Need Technology and Regulatory Support to Catch Up to Global Peers on ESG Disclosure

HONG KONG and SHANGHAI,June 15,2020 -- Ping An Insurance (Group) Company of China,Ltd. (hereafter "Ping An" or the "Group",HKEX: 02318; SSE: 601318) announced today that the Ping An Digital Economic Research Center released a new report on Environmental,Social and Governance (ESG) disclosure in China. With Chinese regulators expected to detail mandatory disclosure requirements by the end of this year,Mainland companies need support to provide with valuable ESG data and insights on par with their global peers. Investors are demanding more information on the impact companies have on the environment,society and their own risk management in order to make better informed decisions about where to invest and where they can use their influence to improve companies' sustainable management practices.

The report calls the use of technology for automated continuous monitoring of ESG indicators and insightful data analysis – making ESG disclosure not only efficient,but actionable,and for unified guidelines from China regulators.

Overview

Chinese corporates face significant challenges to meet stricter regulations and investor demands for high quality ESG disclosure:

1. Major Chinese companies lag behind companies from developed markets,although ESG disclosure rates have been improving.

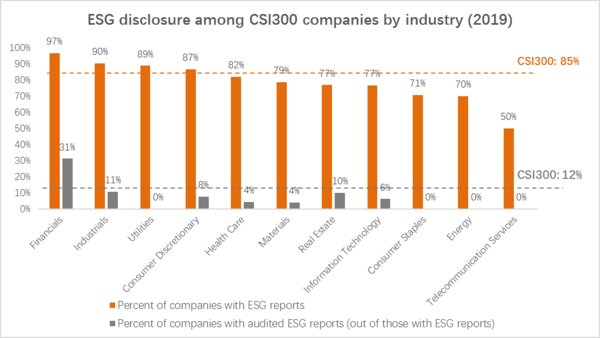

In 2019,85% of Chinese Securities Index (CSI) 300 companies released annual ESG reports,up from 54% in 2013. However,among those companies that disclose ESG reports,only 12% have audited reports.

On average,the scope and quality of ESG disclosures among CSI300 companies in Mainland China rank the lowest among companies that are part of major stock market indices,according to an analysis of the average Bloomberg ESG disclosure scores for major stock market indices,including the CSI 300,the ASX 200 (Australia),Hang Seng (Hong Kong),Nikkei 225 (Japan),S&P 500 (US),FTSE 100 (UK),and KOSPI 200 (Korea) from 2013 to 2018.

Note: Industry classification is based on Wind’s level 1 industry classification Source: Analysis of Wind data

2. Most companies have no processes for collecting high quality ESG data. Many companies have not set up streamlined internal data collection procedures to collect detailed ESG data. Manual collection across departments lead to low data quality and time-consuming processes. This is especially challenging in large companies with complex revenue streams and sub-divisions. In addition,companies report on ESG once a year and mainly to meet regulatory requirements. There is little monitoring and benchmarking with their industry peers. Often,they lack actionable insights on how to improve their performance.

The report recommends that companies leverage technological solutions to collect,monitor,and learn from its ESG data. Instead of a manual process,it should be automated across departments. Instead of an annual one-off exercise,it should be continuously monitored. Instead of confusion around what indicators to disclose,it should be a customized list based on the relevant guidelines,reducing the resources required to respond to different requirements. Ping An has leveraged its technological prowess to streamline and simplify its own ESG reporting process across more than 40 subsidiaries. It's artificial intelligence (AI)-ESG platform mapped more than 500 indicators from different regulatory agencies and has helped Ping An to automate data collection,monitor changes,and generate actionable insights through industry peer comparison. As a result,Ping An's own annual ESG reporting process has been shortened by 22 days,making it one of the first financial services companies globally to release its annual sustainability report this year.

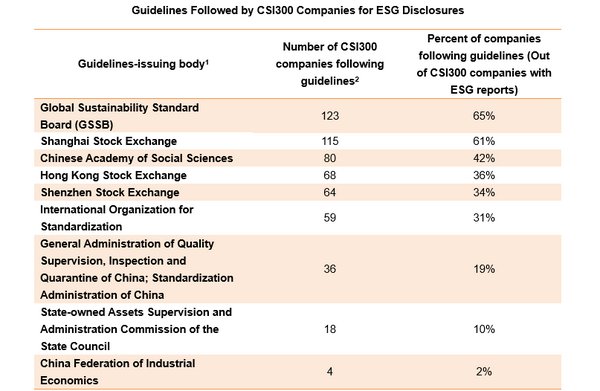

3. The multitude of guidelines lead to companies' confusion about what ESG information they need to disclose. Just among companies in the CSI300 index,there are a total of nine different sets of guidelines they follow,from a mix of financial regulators,non-financial regulators and stock exchanges with different aims. In addition,companies have to respond to requirements from ESG rating providers. Different rating providers have different frameworks and assessment processes for companies' ESG performance. As a result,there is dramatic divergence in their assessment of companies' performance,giving companies mixed signals. In an analysis of four ESG rating providers,including China Alliance of Social Value Investment (CASVI),SynTao Green Finance,Sino-Securities Index,and FTSE Russell,the average pair-wise correlation is only 0.33. This suggests different ESG rating providers are inconsistent in their evaluation of companies' ESG performance.

Note: 1 Guidelines issued may not be solely about ESG,but may include recommendations on ESG-related issues. 2 Companies can follow multiple guidelines. Source: Analysis of Wind data

Without a unified set of guidelines,companies lack clarity on what information is most material to their shareholders and their external ratings.As a result,companies tend to report on indicators that are the easiest to disclose rather than the most important.For example,companies have higher disclosure rates for qualitative indicators and those that are already typically part of earnings reports.

The report recommends that Mainland China regulators develop unified guidelines and converge on a set of the most material indicators that companies must disclose.While different issuing bodies differ in their objectives and scope,there should be a subset of specific and material indicators that are mandatory. Chinese regulators and stock exchanges should build on guidelines and recommendations from international organizations such as the Global Reporting Initiative (GRI) and the UN-supported Principles for Responsible Investment (PRI),and integrate local market considerations specific to Chinese companies. Regulators should also encourage companies to audit their ESG disclosures. ESG is an important complement to the governance of Chinese companies. Better ESG disclosures and performance can help improve the credibility and value of Chinese companies for global investors.

4. The report also calls on investors to incorporate ESG information into their investment decisions,develop ESG investment tools,exert shareholder influence and encourage better ESG disclosures from Chinese companies. It suggests that investors implement ESG investing in three stages: First,investment managers can start from simpler processes,such as negative and positive screening,by leveraging several mainstream ESG rating providers in the market. Second,deepen analysis and application of ESG indicators and the ratings framework,analyze the impact of ESG indicators on investment decisions,and establish customized evaluation frameworks consistent with the investors' own investment styles. Third,fully integrate ESG factors into their own valuation models and develop targeted research on important ESG topics,such as climate change and demographic trends. Asset owners can also include external managers' ESG practices as part of their manager selection criteria. During company engagement,investors should encourage more specific and longer-timeline ESG data from companies. Only with clear expectations from both investors and regulators will companies be more motivated to improve their disclosures.

Download the full report: ESG in China - Current State and Challenges in Disclosures and Integration

- End -

About Ping An Group

Ping An Insurance (Group) Company of China,Ltd. ("Ping An") is a world-leading technology-powered retail financial services group. With over 204 million retail customers and 534 million Internet users,Ping An is one of the largest financial services companies in the world.

Ping An has two over-arching strategies,"pan financial assets" and "pan health care",which focus on the provision of financial and healthcare services through our integrated financial services platform and our five ecosystems of financial services,health care,auto services,real estate services and smart city services. Our "finance + technology" and "finance + ecosystem" strategies aim to provide customers and internet users with innovative and simple products and services using technology. As China's first joint stock insurance company,Ping An Group is committed to upholding the highest standards of corporate reporting and corporate governance. The Company is listed on the stock exchanges in Hong Kong and Shanghai.

In 2020,Ping An ranked 7th in the Forbes Global 2000 list. In 2019,Ping An ranked 29th on the Fortune Global 500 list. Ping An also ranked 40th in the 2019 WPP Millward Brown BrandZ[TM] Top 100 Most Valuable Global Brands list. For more information,please visit www.pingan.cn.

About Ping An Digital Economic Research Center

Ping An Digital Economic Research Center utilizes more than 50 TB high frequency data points,more than 30 years of historical data and more than 1.5 billion data points to drive research on the "AI + Macro Forecast" and provide insights and methods towards precise macroeconomic trends.

Photo - https://photos.prnasia.com/prnh/20200615/2830847-1-a?lang=0

Photo - https://photos.prnasia.com/prnh/20200615/2830847-1-b?lang=0