Big Gaps Found in Climate Risk Disclosures in China

HONG KONG and SHANGHAI,Sept. 24,2020 -- Ping An Insurance (Group) Company of China,Ltd. (hereafter "Ping An" or the "Group",HKEX: 02318; SSE: 601318) announced today that the Ping An Digital Economic Research Center and OneConnect in collaboration with Imperial College London released a new report that used natural language processing (NLP) techniques to assess the current state of climate risk disclosures among the largest companies in China and the United States. The report found that Chinese companies in the CSI 300 lag significantly behind their global peers in the S&P 500 in climate risk disclosures and need to work towards wider adoption to catch up.

The report,"Where we stand on climate disclosures and why we need them",applied NLP techniques to analyze 277 documents for climate risk disclosures from 182 companies between July 2019 and July 2020. The tool could enable investors to gauge the quality of companies' climate disclosures in a scalable fashion.

The report calls for tighter links between climate risk exposures and financial performance and adoption of more forward-looking information in truthful,transparent,and communicable disclosures,with the help of scalable technology tools to automatically assess disclosure quality.

Overview

Despite companies increasing adoption of climate disclosure frameworks such as the international Task Force on Climate-related Financial Disclosures (TCFD),there is wide variation in the adoption of specific recommendations. The report found:

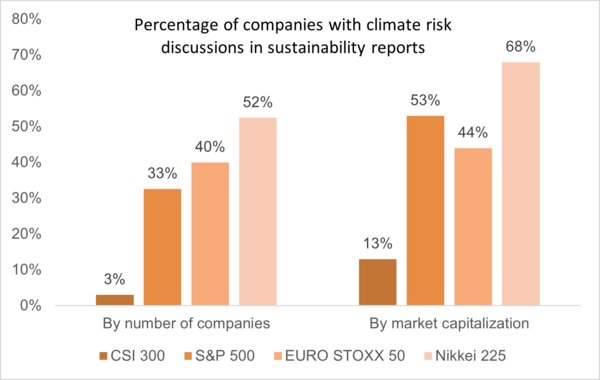

1. Japanese companies have the highest incidence of discussions of climate risks in their sustainability reports,followed closely by European and US companies. Chinese companies lag significantly behind their global peers.

Among the four major equity indices examined,including the CSI 300,S&P 500,EURO STOXX 50,and Nikkei 225,Japanese companies lead in terms of incidence of climate risk discussions. Fifty-two percent of companies in the Nikkei 225,which represents 68% of market capitalization,discuss climate risks in their company reports. Forty percent of EURO STOXX 50 companies,representing 44% of market capitalization,and 33% of S&P 500 companies,representing 53% of market capitalization,do so.

Chinese companies in the CSI 300 index significantly lag behind. Only 3% of companies,representing 13%of market capitalization,currently discuss climate risks in their sustainability reports.

Percentage of companies with climate risk discussions in sustainability reports

Source: Analysis of Bloomberg data

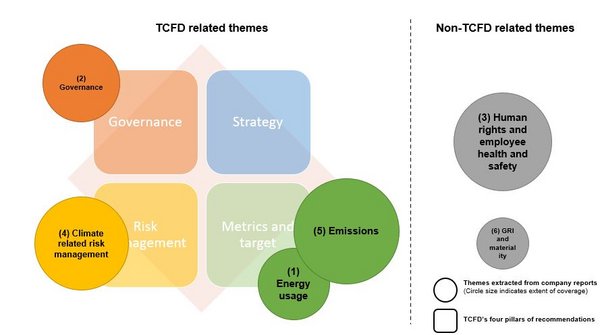

2. Among US and Chinese companies that disclose climate risks,the report identified six distinct themes: "Energy usage","Governance","Human rights and employee health and safety","Climate-related risk management","Emissions",and "Global Reporting Initiative (GRI) reporting and materiality".

The textual analysis focused on a S&P 500 and CSI 300 companies because they are the most representative indices of the US and China,the world's two largest economies,which constitute 52 percent of the global equity market.

"Emissions" is the best covered theme (21.4%),while "GRI reporting and materiality" received the least coverage (10.1%).

A mapping of the six themes across TCFD's four recommendations pillars,"Strategy","Risk management",and "Metrics and targets",found that none of the six themes identified fits exactly into the "Strategy" pillar. This suggests that companies under-disclose on "Strategy" related to climate change. "Metrics and targets" is the best covered pillar.

TCFD Chart

3. Despite international frameworks such as the TCFD,which recommends linking climate risk exposures and financial performance,financial impact metrics are not well disclosed by companies. Purely climate-related metrics have higher disclosure rates.

Among companies that provide climate disclosures,more than 90% report on metrics related to carbon emissions and energy usage. The rates are similar across most sectors: within every sector,more than 90 percent disclose carbon emission and energy use. Transportation is an exception.

Disclosure of water usage is less common,with an average rate of 58% of companies in each sector including coverage.

Land useis considerably underreported,with only 6% of companies disclosing it,possibly because it is only relevant for certain sectors.

Financial impact metrics are not well disclosed by companies. This is especially true for impact on capital and financing,with disclosure from only 16% of companies.

An analysis by sector found that insurance companies are more articulate in quantitative disclosures on "asset & liabilities" impacts,together with the Infrastructure and Transportation sectors. The latter are also better than other sectors in covering the "revenue and expenditures" dimension.

4. The report calls for Chinese companies to catch up with their global peers by taking the step to disclose in the first place. For all companies,there is still gap between current state of disclosures and requirements from guidelines such as the TCFD.

Companies should establish tighter links between climate risk disclosures and financial performance. Companies can conduct analyses on key forthcoming policies related to the transition to a low-carbon economy,for example carbon pricing and changes in energy mix,to project costs and opportunities in terms of cost of capital,valuations,and market share. Ping An is working on asset-repricing models for portfolios that price in climate risks,based on portfolio companies' specific revenue streams and the potential impact of physical and transition policy risks.

Companies should move from backward-looking to forward-looking information when disclosing climate risks. Backward-looking data,such as carbon footprints,have limited relevance for company valuations,as the latter are based on future financial prospects. In addition to current emission data,companies should use forward-looking projections,such as future production curves,and disclose investments and/or strategies that companies are currently adopting to address climate risks going forward. The emergence of climate-related tail risk metrics,such as climate Value-at-Risk,which gauges the potential for asset-price corrections due to climate change,is promising and supports market participants' efforts to screen for resilience in the face of downside risks brought about by climate change.

Business needs to move to truthful,and communicable disclosures with scalable tools for automatic detection of disclosure quality. The lack of unified standards,clear definitions,well-accepted methodologies,and stricter enforcement on disclosures may have made it easy for companies to misrepresent their environmental sustainability. Regulators and professional standards bodies must lead companies to move to more trustworthy and transparent disclosures. Analytics tools showcased in this report can be used to assess the comprehensiveness of companies' climate disclosures and detect potential "greenwashing" or misrepresentation. Application of these tools across particular sectors could inform the creation of standardized indicators of climate risk disclosure that would enable ranking of climate risk disclosure performance in a scalable fashion.

The report is part of a broader joint project on "Climate Risk and Financial Innovation" between Ping An Digital Economic Research Center and Imperial College London. The collaboration aims to leverage cutting-edge academic research and industry expertise to develop robust methodologies for assessing the impact of climate risks on investment assets. These methodologies will be deployed to inform the development of innovative financial products such as disclosure transparency index,new insurance contracts and financial instruments related to climate risk valuation,and the provision of advisory services to the industry.

About Ping An Group

Ping An Insurance (Group) Company of China,Ltd. ("Ping An") is a world-leading technology-powered retail financial services group. With over 210 million retail customers and 560 million Internet users,Ping An is one of the largest financial services companies in the world.

Ping An has two over-arching strategies,"pan financial assets" and "pan health care",which focus on the provision of financial and health care services through our integrated financial services platform and our five ecosystems of financial services,health care,auto services,real estate services and smart city services. Our "finance + technology" and "finance + ecosystem" strategies aim to provide customers and internet users with innovative and simple products and services using technology. As China's first joint stock insurance company,Ping An is committed to upholding the highest standards of corporate reporting and corporate governance. The Group is listed on the stock exchanges in Hong Kong and Shanghai.

In 2020,Ping An ranked 7th in the Forbes Global 2000 list and ranked 21st in the Fortune Global 500 list. Ping An also ranked 38th in the 2020 WPP Kantar Millward Brown BrandZTM Top 100 Most Valuable Global Brands list. For more information,please visit www.pingan.cn.

About Ping An Digital Economic Research Center

Ping An Digital Economic Research Center utilizes more than 50 TB high frequency data points,more than 30 years of historical data and more than 1.5 billion data points to drive research on the "AI + Macro Forecast" and provide insights and methods towards precise macroeconomic trends.

About OneConnect

OneConnect is a leading technology-as-a-service platform for financial institutions in China. The Company's platform provides cloud-native technology solutions that integrate extensive financial services industry expertise with market-leading technology. The Company's solutions provide technology applications and technology-enabled business services to financial institutions. Together they enable the Company's customers' digital transformations,which help them increase revenue,manage risks,improve efficiency,enhance service quality and reduce costs.

Our technology-as-a-service platform strategically covers multiple verticals in the financial services industry,including banking,insurance and asset management,across the full scope of their businesses – from sales and marketing and risk management to customer services,as well as technology infrastructure such as data management,program development,and cloud services.

Photo - https://photos.prnasia.com/prnh/20200924/2927727-1-a?lang=0

Photo - https://photos.prnasia.com/prnh/20200924/2927727-1-b?lang=0