Qudian Inc. Reports Fourth Quarter and Full Year 2020 Unaudited Financial Results

XIAMEN,China,March 29,2021 -- Qudian Inc. ("Qudian" or "the Company" or "We") (NYSE: QD),a leading technology platform empowering the enhancement of online consumer finance experience in China,today announced its unaudited financial results for the quarter and full year ended December 31,2020.

Fourth Quarter 2020 Operational Highlights:

Number of outstanding borrowers[1] from loan book business and transaction services business as of December 31,2020 decreased by 14.7% to 3.5million from 4.1million as of September 30,2020 as a result of the conservative and prudent strategy which the Company has deployed

Total outstanding loan balance from loan book business[2] decreased by24.8% toRMB4.8billion as of December 31,2020,compared to the outstanding balance as of September 30,2020; Total outstanding loan balance from transactions serviced on open platform decreased by 25.7% to RMB5.1billion as of December 31,2020

Amount of transactions from loan book businessfor this quarter decreased by 2.3% to RMB4.8 billion from the third quarter of 2020; Amount of transactions serviced on open platform for this quarter decreased by 50.2% to RMB248.0 million from the third quarter of 2020

Weighted average loan tenure for our loan book business was 4.5 months for this quarter,compared with 4.6 months for the third quarter of 2020; Weighted average loan tenure for transactions serviced on open platform was 6.4 months for this quarter,compared with 6.8 months for the third quarter of 2020

[1]Outstanding borrowers are borrowers who have outstanding loans as of a particular date,including outstanding borrowers from both loan book business and transaction services business. Transaction services business,relates to various services,including credit assessment,referral and post-origination services,provided through our open platform,which was launched in the second half of 2018.

[2]Includes (i) off and on balance sheet loans directly or indirectly funded by our institutional funding partners or our own capital,net of cumulative write-offs and (ii) does not include auto loans from Dabai Auto business.

Fourth Quarter 2020 Financial Highlights:

Total revenues were RMB713.6 million (US$109.4 million),representing a decrease of 63.1% from the same period of last year

Net income increased by 427.0% year-on-year to RMB673.9 million (US$103.3 million),or RMB2.54 (US$0.39) per diluted ADS

Non-GAAP net income[3] increased by 335.6% year-on-year to RMB683.5 million (US$104.8 million),or RMB2.57 (US$0.39) per diluted ADS

Full Year2020 Financial Highlights:

Total revenues were RMB3,688.0 million (US$565.2 million) in 2020,representing a decrease of 58.3% from 2019,primarily due to the decrease in the amount of transactions

- Loan facilitation income and other related income decreased by 58.3%year-on-yearto RMB957.8 million (US$146.8 million) from RMB2,297.4 million for 2019

- Transaction services fee and other related income which relate to transaction services and traffic referral services provided by the Company's open platform,was a loss of RMB136.5 million (US$20.9 million)

- Financing income decreased by 40.1% to RMB2,102.7 million (US$322.2 million) from RMB3,510.1 million in 2019as a result of the decrease in the average on-balance sheet loan balance

Net income decreased by 70.6% year-on-year to RMB958.8 million (US$146.9 million),or RMB3.59 (US$0.55) per diluted ADS

Non-GAAP net income[3] decreased by 88.6% year-on-year to RMB382.3 million (US$58.6 million),or RMB1.49 (US$0.23) per diluted ADS

[3]For more information on this Non-GAAP financial measure,please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

"Despite pandemic-driven uncertainty and challenging market conditions as well as a continuously shifting regulatory environment,we were able to conclude 2020 with further improvements in our asset quality as we remained vigilant in our cash credit business operation," said Mr. Min Luo,Founder,Chairman and Chief Executive Officer of Qudian. "During the fourth quarter of 2020,we maintained strict credit approval standards as we focused on borrowers with strong credit profiles. By the end of the fourth quarter,our overall D1 delinquency rate[4]fell to approximately 11%,from around 17% at the end of the third quarter,reflecting the effectiveness of our strategy. As 2021 unfolds,we will continue to prudently operate our cash loan business while simultaneously exploring new areas for growth."

"Given that 2020 saw the impact from a weakened global economy and intricate online lending market dynamics,we upheld stringent credit risk assessments for new loans originated on our platform. At the same time,we remain dedicated to pursuing new investment opportunities. Supported by ample cash reserves and a healthy financial position,our core strengths and solid fundamentals can bolster the long-term sustainability of our overall business," said Ms. Sissi Zhu,Vice President of Investor Relations of Qudian.

[4]"D1 delinquency rate" is defined as (i)the total amount of principal and financing service fees that became overdue as of a specified date,divided by (ii)the total amount of principal and financing services fees that was due for repayment as of such date,in each case with respect to our loan book business and transaction services business.

FourthQuarter Financial Results

Total revenueswere RMB713.6 million (US$109.4 million),representing a decrease of 63.1% from RMB1,931.6 million for the fourth quarter of 2019.

Financing incometotaled RMB411.8 million (US$63.1 million),representing a decrease of42.6% from RMB717.0 million for the fourthquarter of 2019,as a result of the decrease in the average on-balance sheet loan balance.

Loan facilitation income and other related income decreased by 77.6% to RMB103.2 million (US$15.8 million) from RMB460.0 million for the fourth quarter of 2019,as a result of the reduction in transaction volume of off-balance sheet loans during this quarter.

Transaction services fee and other related income decreased to RMB3.1 million (US$0.5 million) from RMB649.4 million for thefourthquarter of 2019,mainly as a result of the substantial decrease in the transaction amounts of open platform.

Sales income increased to RMB161.5 million (US$24.7 million) from RMB35.9 million for the fourthquarter of 2019,mainly due to sales related to the Wanlimu e-commerce platform,partially offset by winding down the Dabai Auto business.

Sales commission fee decreasedby 73.3% to RMB14.8 million (US$2.3 million) from RMB55.5 million for the fourthquarter of 2019,due to the decrease in the amount of merchandise credit transactions.

Total operating costs and expenses decreased by 99.0% to RMB16.7 million (US$2.6 million) from RMB1,754.3 million for the fourthquarter of 2019.

Cost of revenuesincreased by 35.4% to RMB201.6 million (US$30.9 million) from RMB148.8 million for the fourth quarter of 2019,primarily due to the increase in cost of goods sold related to the Wanlimu e-commerce platform,partially offset by the decrease in funding costs associated with the on-balance sheet loan book business and the decrease in costs of the Dabai Auto business.

Sales and marketing expensesdecreased by 77.6% to RMB12.9 million (US$2.0 million) from RMB57.5 million for the fourthquarter of 2019,primarily due to the decrease in third-party service fees.

General and administrative expensesincreased by 7.0% to RMB75.7 million(US$11.6 million) fromRMB70.8 millionfor the fourth quarter of 2019.

Research and development expensesdecreased by 74.9% to RMB8.6 million(US$1.3 million) from RMB34.3 millionfor the fourth quarter of 2019,as a result of the decrease in staff salaries.

Provision for receivables and other assetsreversed to RMB-75.6 million(US$-11.6 million),compared to RMB707.2 millionfor the fourth quarter of 2019,mainly due to the decrease in past-due on-balance sheet outstanding principal receivables compared to the fourth quarter of 2019.

As ofDecember 31,the total balance of outstanding principal and financing service fee receivables for on-balance sheet transactions for which any installment payment was more than 30 calendar days past due wasRMB358.2 million(US$54.9 million),and the balance of allowance for principal and financing service fee receivables at the end of the period wasRMB849.2million(US$130.2 million),indicating M1+ Delinquency Coverage Ratio of 2.4x.

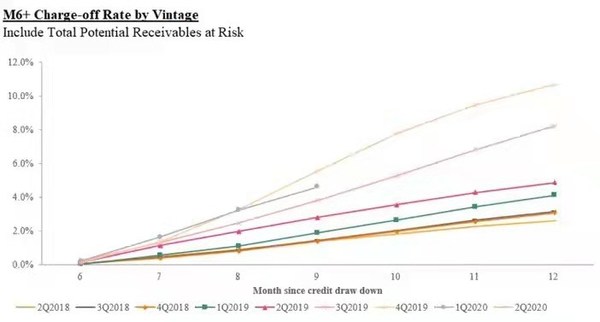

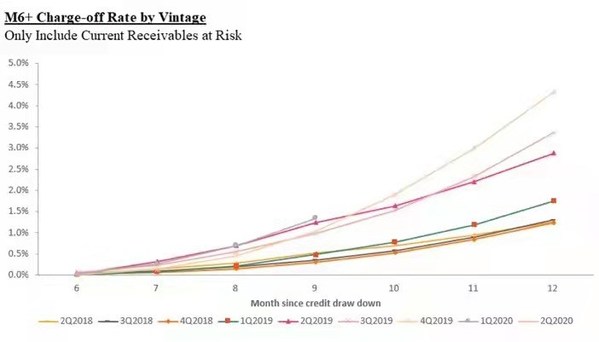

The following charts display the "vintage charge-off rate." Total potential receivables at risk vintage charge-off rate refers to,with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period,the total potential outstanding principal balance of the transactions that are delinquent for more than 180 days up to twelve months after origination,divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Current receivables at risk vintage charge-off rate refers to,the actual outstanding principal balance of the transactions that are delinquent for more than 180 days up to twelve months after origination,divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

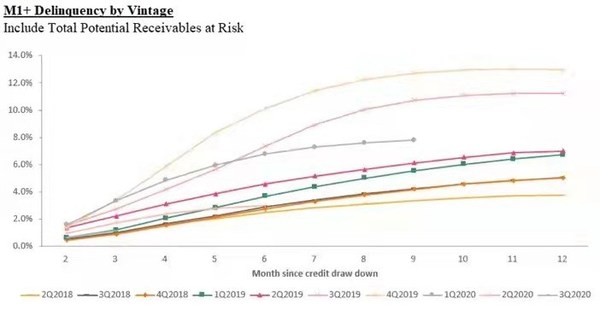

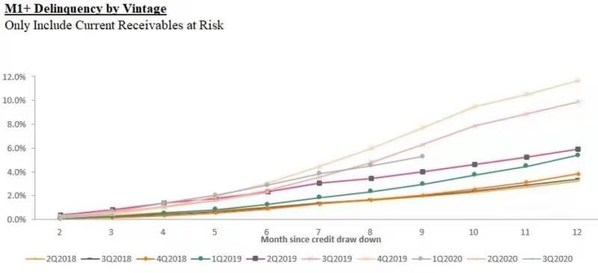

Total potential receivables at risk M1+ delinquency rate by vintage refers to,the total potential outstanding principal balance of the transactions that are delinquent for more than 30 days up to twelve months after origination,divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Current receivables at risk M1+ delinquency rate by vintage refers to,the actual outstanding principal balance of the transactions that are delinquent for more than 30 days up to twelve months after origination,divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Income from operationsincreased to RMB746.6 million(US$114.4 million) from RMB226.8 million for the fourth quarter of 2019.

Net income attributable to Qudian's shareholderswasRMB673.9 million(US$103.3 million),or RMB2.54 (US$0.39) per diluted ADS.

Non-GAAP net income attributable to Qudian's shareholderswasRMB683.5 million(US$104.8 million),or RMB2.57 (US$0.39) per diluted ADS.

Full Year 2020 Financial Results

Total revenueswere RMB3,688.0 million (US$565.2 million),a decrease of 58.3% from RMB8,840.0 million for 2019.

Financing incometotaled RMB2,102.7 million (US$322.2 million),a decrease of 40.1% from RMB3,510.1 million for 2019.

Loan facilitation income and otherrelated income decreased by 58.3% to RMB 957.8 million (US$146.8 million) from RMB2,297.4 million for 2019,as a result of the decrease in the amount of off-balance sheet transactions.

Transaction services fee and other related income was a loss of RMB136.5 million (US$20.9 million),primarily due to a revaluation loss for contract assets incurred for the transactions facilitated in the past year.

Sales income substantially increased to RMB610.8 million (US$93.6 million) from RMB431.9 million for 2019,mainly due to the launch of the Wanlimu e-commerce platform,partially offset by winding down the Dabai Auto business.

Sales commission fee decreasedby 77.3% to RMB81.0 million (US$12.4 million) from RMB356.8 million for 2019,due to the decrease in the amount of merchandise credit transactions.

Total operating costs and expenses decreased by 37.9% to RMB3,165.7 million (US$485.2 million) from RMB5,099.8 million for 2019.

Cost of revenuesdecreased by 4.4% to RMB862.4 million (US$132.2 million) from RMB901.8 million for 2019,primarily due to the decrease in funding costs associated with the on-balance sheet loan book business and the decrease in costs of Dabai Auto business,partially offset by the increase in cost of goods sold related to the Wanlimu e-commerce platform.

Sales and marketing expensesincreased by 4.5% to RMB293.3 million (US$44.9 million) from RMB280.6 million for 2019. The increase was primarily due to marketing expenses incurred by the Wanlimu e-commerce platform.

General and administrative expensesdecreased by 0.1% to RMB285.9 million(US$43.8 million) fromRMB286.1 millionfor 2019.

Research and development expensesdecreased by 16.6% to RMB170.7 million(US$26.2 million) from RMB204.8 millionfor 2019. The decrease was primarily due to the decrease in staff salaries.

Provision for receivables and other assetsdecreased by 28.1% toRMB1,641.4 million(US$251.6 million) fromRMB2,283.1 millionfor 2019.The decrease was primarily due to the decrease in past-due on-balance sheet outstanding principal receivables compared to 2019.

Income from operationsdecreased by 77.5% to RMB865.6 million(US$132.7 million) from RMB3,848.8 million for 2019.

Net income attributable to Qudian's shareholdersdecreased by 70.6%toRMB958.8 million(US$146.9 million),or RMB3.59 (US$0.55) per diluted ADS.

Non-GAAP net income attributable to Qudian's shareholdersdecreased by 88.6%toRMB382.3 million(US$58.6 million),or RMB1.49 (US$0.23) per diluted ADS.

Cash Flow

As of December 31,the Company had cash and cash equivalents ofRMB1,537.6 million(US$235.6 million) and restricted cash ofRMB135.4million(US$20.8million). Restricted cash mainly represents (i) cash held by the consolidated trusts through segregated bank accounts; and (ii) security deposits held in designated bank accounts for the guarantee of off-balance sheet transactions. Such restricted cash is not available to fund the general liquidity needs of the Company.

For the fourthquarter of 2020,net cash provided by operating activities wasRMB437.5 million(US$67.1 million),mainly attributable to net income of RMB673.9 million (US$103.3 million) and partially offset by the change in other current and non-current liabilities of RMB377.9 million (US$57.9 million). Net cash used in investing activitieswas RMB355.0 million(US$54.4 million),mainly due to investments in short-term wealth management products and partially offset by net proceeds from collection of loan principal. Net cash used in financing activities was RMB50.2 million(US$7.7 million),mainly due to repurchases of convertible senior notes.

For the full year of 2020,net cash provided by operating activities wasRMB2,471.7 million(US$378.8 million),mainly attributable to net income of RMB958.8 million (US$146.9 million) and the adjustment of provision for receivables and other assets of RMB1,641.4 million (US$251.6 million). Net cash used in investing activities was RMB3,269.9 million(US$501.1 million),mainly due to investments in short-term wealth management products of RMB16,802.9 million (US$2,575.2 million),partially offset by proceeds from redemption of short-term investments of RMB 11,815.2 million (US$1,810.8 million). Net cash used in financing activities was RMB1,591.3 million(US$243.9 million),mainly due to repayments of borrowings of RMB1,038.7 million (US$159.2 million) and repurchases of convertible senior notes of RMB859.2 million (US$131.7 million).

Update on Share Repurchase and Convertible Bond Repurchase

As of the date of this release,the Company has repurchased total principal amount of convertible senior notes of US$217.0 million. The Company has cumulatively completed total share repurchases of approximately US$574.0million.

Conference Call

The Company's management will host an earnings conference call on March 29,2021 at 7:00 AM U.S. Eastern Time (7:00 PM Beijing/Hong Kong Time).Details for the conference call are as follows:

Title of Event:

Qudian Inc. Fourth Quarter and Full Year 2020 Earnings Conference Call

Conference ID:

4155829

Registration link:

http://apac.directeventreg.com/registration/event/4155829

For participants who wish to join the call,please complete the online registration at least 15 minutes prior to the scheduled call start time. Upon registration,participants will receive the conference call access information,including participant dial-in numbers,a Direct Event Passcode,a unique Registrant ID,and an e-mail with detailed instructions to join the conference call.

Additionally,a live and archived webcast of the conference call will be available on the Company's investor relations website at http://ir.qudian.com.

A replay of the conference call will be accessible approximately two hours after the conclusion of the live call until April 5,2021,by dialing the following telephone numbers:

U.S.:

+1-855-452-5696 (toll-free) / +1-646-254-3697

International:

+61-2-8199-0299

Hong Kong,China:

800-963-117 (toll-free) / +852-3051-2780

Mainland China:

400-632-2162 / 800-870-0205 (toll-free)

Passcode:

4155829

About Qudian Inc.

Qudian Inc. ("Qudian") is a leading technology platform empowering the enhancement of online consumer finance experience in China. The Company's mission is to use technology to make personalized credit accessible to hundreds of millions of young,mobile-active consumers in China who need access to small credit for their discretionary spending but are underserved by traditional financial institutions due to lack of traditional credit data or high cost of servicing. Qudian's credit solutions enable licensed,regulated financial institutions and ecosystem partners to offer affordable and customized loans to this young generation of consumers.

For more information,please visithttp://ir.qudian.com.

Use of Non-GAAP Financial Measures

We use adjusted net income/loss,a Non-GAAP financial measure,in evaluating our operating results and for financial and operational decision-making purposes. We believe that adjusted net income/loss helps identify underlying trends in our business by excluding the impact of share-based compensation expenses,which are non-cash charges,and convertible bonds buyback income. We believe that adjusted net income/loss provides useful information about our operating results,enhances the overall understanding of our past performance and future prospects and allows for greater visibility with respect to key metrics used by our management in its financial and operational decision-making.

Adjusted net income/loss is not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. This Non-GAAP financial measure has limitations as analytical tools,and when assessing our operating performance,cash flows or our liquidity,investors should not consider them in isolation,or as a substitute for net loss / income,cash flows provided by operating activities or other consolidated statements of operation and cash flow data prepared in accordance with U.S. GAAP.

We mitigate these limitations by reconciling the Non-GAAP financial measure to the most comparable U.S. GAAP performance measure,all of which should be considered when evaluating our performance.

For more information on this Non-GAAP financial measure,please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars ("US$") at specified rates solely for the convenience of the reader. Unless otherwise stated,all translations from RMB to US$ were made at the rate ofRMB6.5250 toUS$1.00,the noon buying rate in effect on December 31,2020in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB,as the case may be,at any particular rate or at all.

Statement Regarding Preliminary Unaudited Financial Information

The unaudited financial information set out in this earnings release is preliminary and subject to potential adjustments. Adjustments to the consolidated financial statements may be identified when audit work has been performed for the Company's year-end audit,which could result in significant differences from this preliminary unaudited financial information.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among other things,the expectation of its collection efficiency and delinquency,contain forward-looking statements. Qudian may also make written or oral forward-looking statements in its periodic reports to the SEC,in its annual report to shareholders,in press releases and other written materials and in oral statements made by its officers,directors or employees to third parties. Statements that are not historical facts,including statements about Qudian's beliefs and expectations,are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement,including but not limited to the following: Qudian's goal and strategies; Qudian's expansion plans; Qudian's future business development,financial condition and results of operations; Qudian's expectations regarding demand for,and market acceptance of,its credit products; Qudian's expectations regarding keeping and strengthening its relationships with borrowers,institutional funding partners,merchandise suppliers and other parties it collaborate with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Qudian's filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release,and Qudian does not undertake any obligation to update any forward-looking statement,except as required under applicable law.

For investor and media inquiries,please contact:

Qudian Inc.

Tel: +86-592-591-1711

E-mail:ir@qudian.com

The Piacente Group,Inc.

Jenny Cai

Tel: +86 (10) 6508-0677

E-mail: qudian@tpg-ir.com

The Piacente Group,Inc.

Brandi Piacente

Tel: +1-212-481-2050

E-mail: qudian@tpg-ir.com

QUDIAN INC.

Unaudited Condensed Consolidated Statements of Operations

Three months ended December 31,

(In thousands except for number

2019

2020

of shares and per-share data)

(Unaudited)

(Unaudited)

(Unaudited)

RMB

RMB

US$

Revenues:

Financing income

716,972

411,797

63,110

Sales commission fee

55,481

14,802

2,269

Sales income

35,906

161,474

24,747

Penalty fee

13,827

19,261

2,952

Loan facilitation income and other related income

460,011

103,163

15,810

Transaction services fee and other relatedincome

649,373

3,147

482

Total revenues

1,931,570

713,644

109,370

Operating cost and expenses:

Cost of revenues

(148,831)

(201,570)

(30,892)

Sales and marketing

(57,489)

(12,880)

(1,974)

General and administrative

(70,768)

(75,714)

(11,604)

Research and development

(34,288)

(8,601)

(1,318)

Changes in guarantee liabilities and riskassurance

liabilities(1)

(735,688)

206,469

31,643

Provision for receivables and other assets

(707,201)

75,570

11,582

Total operating cost and expenses

(1,754,265)

(16,726)

(2,563)

Other operating income

49,519

49,680

7,614

Income from operations

226,824

746,598

114,421

Interest and investment income,net

(3,095)

6,714

1,029

Foreign exchange gain,net

602

2,164

332

Other income

958

369

57

Other expenses

(6,661)

(5,519)

(846)

Net income before income taxes

218,628

750,326

114,993

Income tax expenses

(90,755)

(76,451)

(11,717)

Net income

127,873

673,875

103,276

Net income attributable to Qudian Inc.'s

shareholders

127,276

Earnings per share for Class A and Class B

ordinary shares:

Basic

0.50

2.66

0.41

Diluted

0.49

2.54

0.39

Earnings per ADS (1 Class A ordinary

share equals 1 ADSs):

Basic

0.50

2.66

0.41

Diluted

0.49

2.54

0.39

Weighted average number of Class A and

Class B ordinary shares outstanding:

Basic

254,466,950

253,663,338

253,338

Diluted

293,747,979

267,392,578

267,578

Other comprehensive (loss)/income:

Foreign currency translation adjustment

38,464

(12,921)

(1,980)

Total comprehensive income

166,337

660,954

101,296

Total comprehensive income

attributable to Qudian Inc.'s s

hareholders

166,296

Note:

(1) The amount includes the change in fair value of the guarantee liabilities accounted in accordance with ASC

815,"Derivative",and the change in risk assurance liabilities accounted in accordance with ASC 450,

"Contingencies" and ASC 460,"Guarantees".

QUDIAN INC.

Unaudited Condensed Consolidated Statements of Operations

Year ended December 31,

(In thousands except for number

2019

2020

of shares and per-share data)

(Audited)

(Unaudited)

(Unaudited)

RMB

RMB

US$

Revenues:

Financing income

3,510,055

2,102,665

322,248

Sales commission fee

356,812

80,992

12,413

Sales income

431,946

610,793

93,608

Penalty fee

44,354

72,235

11,070

Loan facilitation income and other related income

2,297,413

957,831

146,794

Transaction services fee and other related income

2,199,464

(136,542)

(20,926)

Total revenues

8,840,044

3,687,974

565,207

Operating cost and expenses:

Cost of revenues

(901,787)

(862,354)

(132,162)

Sales and marketing

(280,616)

(293,282)

(44,947)

General and administrative

(286,059)

(285,905)

(43,817)

Research and development

(204,781)

(170,691)

(26,160)

Changes in guarantee liabilities and risk assurance

liabilities(1)

(1,143,428)

87,894

13,470

Provision for receivables and other assets

(2,283,126)

(1,641,362)

(251,550)

Total operating cost and expenses

(5,099,797)

(3,165,700)

(485,166)

Other operating income

108,508

343,324

52,617

Income from operations

3,848,755

865,598

132,658

Interest and investment income,net

20,872

338,212

51,833

Foreign exchange (loss)/gain,net

6,636

(107)

(16)

Other income

24,583

26,358

4,040

Other expenses

(10,324)

(9,263)

(1,420)

Net income before income taxes

3,890,522

1,220,798

187,095

Income tax expenses

(626,234)

(261,979)

(40,150)

Net income

3,264,288

958,819

146,945

Net income attributable to Qudian Inc.'s

shareholders

3,945

Earnings per share for Class A and Class B

ordinary shares:

Basic

11.72

3.78

0.58

Diluted

10.94

3.59

0.55

Earnings per ADS (1 Class A ordinary s

hare equals 1 ADSs):

Basic

11.72

3.78

0.58

Diluted

10.94

3.59

0.55

Weighted average number of Class A and

Class B ordinary shares outstanding:

Basic

278,531,382

253,658,448

253,448

Diluted

300,457,711

274,333,161

274,161

Other comprehensive (loss)/income:

Foreign currency translation adjustment

31,893

(38,455)

(5,893)

Total comprehensive income

3,296,181

920,364

141,052

Total comprehensive income

attributable to Qudian Inc.'s

shareholders

3,052

Note:

(1) The amount includes the change in fair value of the guarantee liabilities accounted in accordance with ASC

815,"Guarantees".

QUDIAN INC.

Unaudited Condensed Consolidated Balance Sheets

As of December 31,

As of December 31,

(In thousands except for number

2019

2020

of shares and per-share data)

(Audited)

(Unaudited)

(Unaudited)

RMB

RMB

US$

ASSETS:

Current assets:

Cash and cash equivalents

2,860,938

1,537,558

235,641

Restricted cash

1,257,649

135,404

20,752

Time deposits

231,132

-

-

Short-term investments

-

5,042,314

772,768

Short-term loan principal and financing service fee

receivables

7,894,697

3,940,461

603,902

Short-term finance lease receivables

398,256

179,613

27,527

Short-term contract assets

2,741,914

92,813

14,224

Other current assets

1,638,905

762,313

116,830

Total current assets

17,023,491

11,690,476

1,791,644

Non-current assets:

Long-term loan principal and financing service fee

receivables

424

-

-

Long-term finance lease receivables

239,697

28,771

4,409

Operating lease right-of-use assets

148,851

210,898

32,322

Investment in equity method investee

44,779

349,276

53,529

Long-term investments

223,158

209,868

32,164

Property and equipment,net

92,821

302,969

46,432

Intangible assets

6,803

8,478

1,299

Long-term contract assets

273,597

23,094

3,539

Deferred tax assets,net

290,285

154,960

23,749

Other non-current assets

17,698

419,242

64,252

Total non-current assets

1,338,113

1,707,556

261,695

TOTAL ASSETS

18,361,604

13,398,032

2,053,339

QUDIAN INC.

Unaudited Condensed Consolidated Balance Sheets

As of December 31,

(In thousands except for number

2019

2020

of shares and per-share data)

(Audited)

(Unaudited)

(Unaudited)

RMB

RMB

US$

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Short-term borrowings and interest payables

1,049,570

-

-

Short-term lease liabilities

21,919

23,763

3,642

Accrued expenses and other current liabilities

718,266

336,790

51,615

Guarantee liabilities and risk assurance liabilities(2)

1,517,827

31,400

4,812

Income tax payable

589,739

80,656

12,361

Total current liabilities

3,897,321

472,609

72,430

Non-current liabilities:

Deferred tax liabilities,net

178,985

10,923

1,674

Convertible senior notes

2,339,552

822,005

125,978

Long-term lease liabilities

21,694

80,236

12,297

Long-term borrowings and interest payables

-

102,415

15,696

Total non-current liabilities

2,540,231

1,015,579

155,645

Total liabilities

6,437,552

1,488,188

228,075

Shareholders' equity:

Class A Ordinary shares

131

132

20

Class B Ordinary shares

44

44

7

Treasury shares

(362,130)

(371,551)

(56,943)

Additional paid-in capital

3,967,733

4,007,260

614,139

Accumulated other comprehensive loss

(12,965)

(51,420)

(7,880)

Non-controlling interests

-

10,000

1,533

Retained earnings

8,331,239

8,315,379

1,274,388

Total shareholders' equity

11,924,052

11,909,844

1,825,264

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY

18,339

Note:

(2) The amount includes the balance of the guarantee liabilities accounted in accordance with ASC 815,and the balance of risk

assurance liabilities accounted in accordance with ASC 450,"Contingencies" and ASC 460,"Guarantees".

QUDIAN INC.

Unaudited Reconciliation of GAAP And Non-GAAP Results

Three months ended December 31,

2019

2020

(In thousands except for number

(Unaudited)

(Unaudited)

(Unaudited)

of shares and per-share data)

RMB

RMB

US$

Total net income attributable to Qudian Inc.'s shareholders

127,875

103,276

Add: Share-based compensation expenses

29,042

5,050

774

Less: Convertible bonds buyback (loss)/income

-

(4,586)

(703)

Non-GAAP net income attributable to Qudian Inc.'s shareholders

156,915

683,511

104,753

Non-GAAP net income per share—basic

0.62

2.69

0.41

Non-GAAP net income per share—diluted

0.59

2.57

0.39

Weighted average shares outstanding—basic

254,388

253,388

Weighted average shares outstanding—diluted

293,578

267,578

QUDIAN INC.

Unaudited Reconciliation of GAAP And Non-GAAP Results

Year ended December 31,

2019

2020

(In thousands except for number

(Audited)

(Unaudited)

(Unaudited)

of shares and per-share data)

RMB

RMB

US$

Total net income attributable to Qudian Inc.'s shareholders

3,819

146,945

Add: Share-based compensation expenses

87,299

45,634

6,994

Less: Convertible bonds buyback income

-

622,109

95,342

Non-GAAP net income attributable to Qudian Inc.'s shareholders

3,351,587

382,344

58,597

Non-GAAP net income per share—basic

12.03

1.51

0.23

Non-GAAP net income per share—diluted

11.23

1.49

0.23

Weighted average shares outstanding—basic

278,448

253,448

Weighted average shares outstanding—diluted

300,161

274,161

![]()

View original content to download multimedia:/news-releases/qudian-inc-reports-fourth-quarter-and-full-year-2020-unaudited-financial-results-301257371.html

Tags: Banking/Financial Service Computer/Electronics Financial Technology

Previous:Asiaray Announces 2020 Annual Results

Next:Molecular Data Inc. Gears up its Data Services with IPFS

Leave a comment

Follow Us

Newsletter

Join us to get the latest news.