FICO Survey: 3 in 5 Malaysian Consumers Will Abandon Long Online Banking Account Applications

The pandemic is driving a digital-first mindset around financial services

KUALA LUMPUR,Malaysia,Aug. 30,2021 --

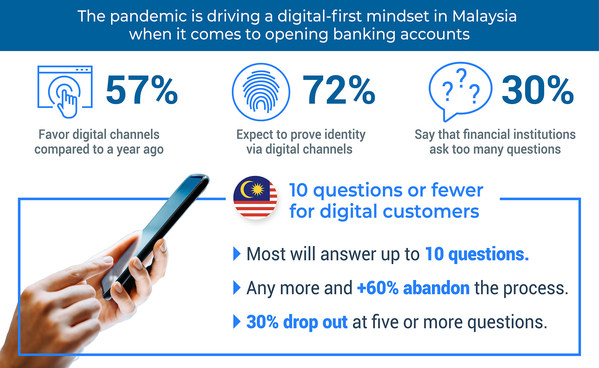

The pandemic is driving a digital-first mindset in Malaysia when it comes to opening banking accounts.

Highlights

3 in 5 Malaysians expect to answer 10 questions or less or they will abandon an application

57 percent of consumers more likely to open an account digitally than a year ago

30 percent of Malaysians say financial institutions ask too many questions

FICO's 2021 digital banking survey shows that people in the Malaysia expect a seamless banking experience when it comes to opening an account via a mobile app or website,with three in five expecting to answer 10 questions or less or they will abandon the process. Three in 10 Malaysians will drop out if asked more than five questions.

"The pandemic is driving a digital-first mindset in the Malaysia with 57 percent of consumers more likely to open an account digitally than a year ago," said Aashish Sharma,senior director of decision management solutions for FICO in Asia Pacific. "The number of consumers who prefer to open bank accounts digitally has grown to 42 percent and continues to rise,which is significant in a country with a strong branch culture."

More information: https://www.fico.com/en/solutions/account-opening

Turning friction into momentum

The survey revealed that consumer patience with account applications varied according to product. Malaysians had the highest expectations for completing applications in 10 questions or less,for Buy Now Pay Later products (67 percent),savings accounts (67 percent) and transaction accounts (62 percent).

Interestingly this expectation was significantly higher than other countries in the survey. For instance,just 41 percent of UK consumers and 51 percent of Australian consumers expected to answer 10 questions or less when opening a transaction account.

Overall Malaysian consumers want digital experiences that reduce friction and inconvenience. They expect their main bank to know them,72 percent want to prove their identity online and 30 percent of Malaysians say that financial institutions ask too many questions.

"Where there is friction there is opportunity,as the quote goes," said Sharma. "Either you solve it for your customers today,or a competitor will do it tomorrow. Consumers want banks to find answers to application questions through technology approaches such as improved identity checks,transaction history analysis,open banking and government databases."

Mortgages deserve more scrutiny

The survey showed that increased friction and security is deemed appropriate by consumers when it comes to applying and onboarding for specific high-value financial products.

Despite relatively high levels of ease and confidence in applying for day-to-day online financial products such as current accounts,savings,loans and credit cards,more than half (61 percent) of customers polled expect greater rigor when it comes to mortgage applications.

Research showed that just 25 percent of Malaysians would apply for a mortgage digitally,compared to the survey average of around one in three (34 percent). In all countries bar the USA and UK,in-branch openings are preferred to online methods. South Africa was a modest outlier with 43 percent of customers favoring online mortgage applications.

Nearly two in five Malaysians polled said they were willing to answer 11 to 20 or more questions when it came to applying online for a mortgage.

Don't change the channel

Malaysians who open an account digitally prefer to carry out the process entirely in their chosen channel,whether it be smartphone or website. If customers are asked to move out of channel to prove their identities,many of them will abandon the application,either giving up on opening an account completely or by going to a competitor. Of those who don't immediately abandon,up to an additional 25 percent will delay the process.

The survey found that any disruption matters. Asking people to scan and email documents or use a separate identity portal causes almost as much application abandonment as asking them to visit branches or mail in documents.

This survey was conducted in January 2021 by an independent research company adhering to research industry standards. 1,000 Malay adults were surveyed,along with 13,000 consumers in the USA,UK,Canada,South Africa,Australia,New Zealand,Indonesia,The Philippines,Thailand,Vietnam,Brazil,Colombia and Mexico.

FICO is a registered trademark of Fair Isaac Corporation in the US and other countries.

Photo - http://cusmail.com/res/2023/07-23/23/7b3bc814f0fbdda408d5a84b702790b6.jpg

Logo - http://cusmail.com/res/2023/07-23/23/3cfb910b67bdc90e100431d76c69bbf7.jpg