Japan-Insights from RENOSY Research: People became cautious about investment due to the pandemic with real estate receiving the most attention from investors

TOKYO,Jan. 12,2022 -- According to recent research released by "RENOSY",a one-stop comprehensive real estate service platform operated by GA technologies Co.,Ltd (Headquarters: Minato-Ku,Tokyo; CEO: Ryo Higuchi / Securities Code: 3491) found more than 50% of the RENOSY users researched have changed their views on investment due to the pandemic,and more than 80% of the users (current investors) have made an adjustment to increase the items for investment. The item that catches the attention and receives the most popularity from most investors is "real estate". The service tops the pre-owned compact condominiums sales sector in the market of Japan for 2 years in a row *1. The research this time was carried out among users with an annual income that is above 6,000,000 JPY. (approx. 52454 USD)

Key Highlights

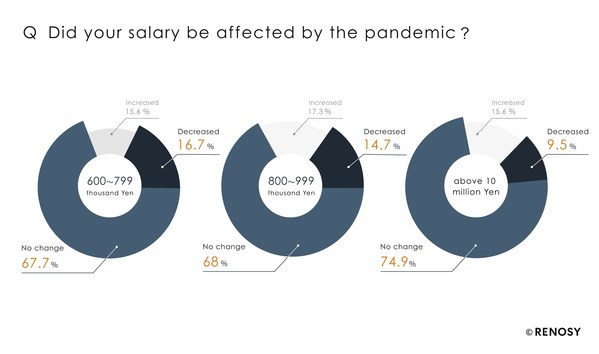

Less than 20% of the investors being researched answered that their annual incomes have increased due to the pandemic

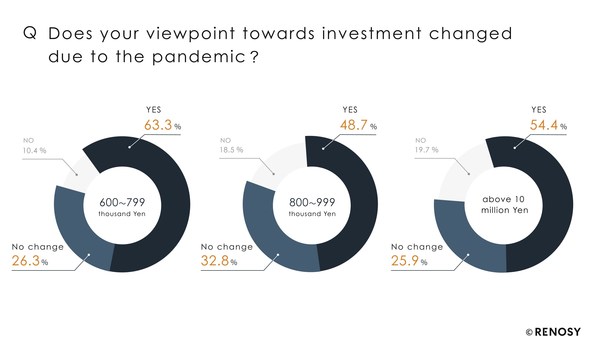

More than 50% of the RENOSY users researched answered that they have changed their views about investment because of the pandemic

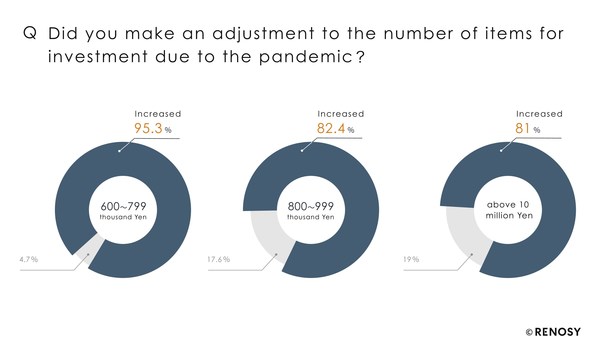

Along with the change of viewpoint,more than 80% of the current investors answered that they decided to increase the items for investments because of the pandemic

The item for investment that receives the most attention is "real estate"

Result Summary

Research time period: October 22,2021 ~ November 9,2021

Research method: Online research

Practical answered received: 764 (Users with an annual income above 6million JPY)

Data for further reference: https://www.renosy.com/magazine/entries/5002

(RENOSY Magazine)

Details of the Research

(1) Changes of income due to the pandemic

When being asked about "whether your income has been affected by the pandemic?" Only 13.6% gave a positive answer (increase of the income); this is less than 20% of all the users interviewed this time. On the other hand,people with annual income falls in the range of "6,000JPY~ 7,990,000JPY" showed the most drastic decrease in their incomes with 16.7% of them answered with "a decrease of the income".

Japan-Insights: People became cautious about investment due to the pandemic with real estate receiving the most attention from investors

(2) The change of viewpoint towards future investment due to the pandemic

55.4% of the people we have researched answered that they have made some adjustments towards future investment because of the outbreak of the pandemic. From the statistics we could see that people from the lowest income group (annual income falls between 6,000 JPY~7,000 JPY) suffered the most from the pandemic with their incomes decreasing the most drastically. People from this group also have the most significant change of viewpoint towards investments (63.3%).

(3) Adjustments about number of items for future investment due to the pandemic

When asking the investors whether they have made some adjustments about the number of items for investment. More than 80% of them across all income groups answered that they have added more items for investment on their lists. People with an annual income range between6,000 JPY have the most significant increase which is 95.3%. From this result we could see that regardless of the effect on an individual's annual income because of the pandemic,people with an annual income above 6,000 JPY have experienced some kind of changes in their viewpoints towards investment,and for those of whom are currently investing tend to add new items for investment on their lists.

(4) Real estate receives the most attention and becomes the most popular item for investment

Real estate investment tops the list across investors among all income groups. Especially investors with an annual income falling between 8,000 JPY~9,000 JPY have shown a significant 57.3% increase of putting money into the real estate industry. According to the JRPPI report (*2) released by Ministry of Land,Infrastructure,Transport & Tourism of Japan,the index point of residential real estates was 113.4pt in Dec.,2019 and has risen to 122.4pt in July 2021. Not to mention,the index point has risen from 149.3pt in December 2019 to 167.7pt in July 2021 for residential apartments. In fact,the number of properties sold annually by RENOSY has risen over the years. There was 1.4 times (2,723 listings) increase in 2020 compared to 2019,and a 1.2 times increase (3,460 listings) in 2021 compared to the previous year. We can tell the real estate market is quite vibrant with a continuous increase of the number of deals made starting from 2019 to 2021 despite the hit of the pandemic. Other than these numbers,we have heard many of our customers pointing out that the purpose for investing in real estate is as a preparation for retirement in which it accounts for 68.6% of the customers being researched.

About RENOSY: the comprehensive one-stop real estate transaction supporting platform

RENOSY is a comprehensive one-stop real estate platform provided by GA technologies under the concept of "making house hunting and assets management easier." With the business vision of "inspiring the world with the power of technology and innovation". The purpose of RENOSY is to make everything about real estate easier for our customers,whether you want to "rent","buy","sell","lease","renovate" or "invest" on a property,you can get what you want and need all in one place. Currently,we have about 24,0000 registered members,and more than 15,0000 existing properties in the center of Tokyo available on our website. GA technologies is working on helping to accelerate the digital transformation process of the industry,and to provide a better customer experience both online and offline.

*Data of the number of RENOSY members: by October 2021 / Data of the number of properties available on the website: by October 2020

About GA technologies

Company: GA technologies Co.,Ltd.

Representative: Ryo Higuchi

URL:https://www.ga-tech.co.jp/en/

Head office: 40F of Sumitomo Fudosan Roppongi Grand Tower,Roppongi 3-2-1,Minato District,Tokyo

Year of founding: March 2013

Capital fund: 7,219,146,516JPY (by October 2021)

What we do:

Running the RENOSY service,an online,one-stop real estate service platform

Running the ITANDI BB service,a cloud service targets at real estate management companies

Sub companies: ITANDI Co.,Ltd,Modern Standard Co.,Shenjumiausuan Co.,Ltd and 8 other companies

Reference:

(*1) Tokyo Shoko Research : Report of pre-owned apartments for investment: February 2021( Reference:https://www.ga-tech.co.jp/news/8531/)

(*2) The JRPPI report released by Ministry of Land,Transport & Tourism (July,2021,second quarter of 2022) (Related release: https://www.mlit.go.jp/common/001429360.pdf)

(*3) RENOSY customers voice: https://www.renosy.com/asset/reviews

For this release,please contact below:

Nami (+81-90-1503-9158),Judy,GA technologies Co.,Ltd. MAIL: pr@ga-tech.co.jp

View original content to download multimedia:https://www.prnewswire.com/news-releases/japan-insights-from-renosy-research-people-became-cautious-about-investment-due-to-the-pandemic-with-real-estate-receiving-the-most-attention-from-investors-301455099.html