Release of Market Confidence Survey Results of Colliers in 2022

SHANGHAI,May 9,2022 -- With the COVID-19 outbreak in 2022 gradually reaching a breaking point,the epidemic prevention and control measures have entered a rather challenging final phase. Once the current epidemic wave is over,a vast majority of enterprises will begin to resume production,with employees gradually returning to their posts as well. How will the current outbreak influence and challenge business development,investment decisions and future expectations for all sorts of companies?

Recently,Colliers (NASDAQ Stock Exchange Transaction Code: CIGI; TSX Stock Exchange Transaction Code: CIGI),the world's leading diversified professional services and investment management company,released the results of its 2022 Market Confidence Survey. Colliers tracks market dynamics and development trends in real time,consistently embracing the future with forward-looking strategies. Over the course of a brief two days,from April 19th to 20th,Colliersfocused on the most pressing concerns for the real estate field and invited enterprises from various industries to participate in a series of surveys via questionnaires. A total of 2,318 surveys were collected in Shanghai and other Chinese cities nationwide.

By analysing the respondents' feedback and specialized assessment on the epidemic's impact in different fields and industries,this series of surveys aims to present the latest market response in the fastest and most intuitive way. We dedicate our professional strength to the exploration of the strategic opportunities and outlook of the real estate market,stepping up to the challenges and key measures for the recovery and sustainable development of the market in a post-epidemic scenario,as well as accomplishing innovative transformations of business models.

Report download link

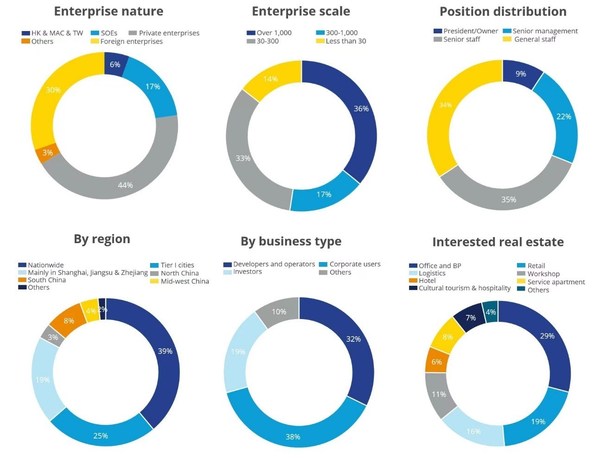

1. Respondents' Profiles

For this survey,the respondents' profiles consist primarily of 44% private enterprises,30% foreign capital and 17% state owned enterprises (SOE).

In terms of scale,enterprises with more than 1,000 employees account for 36%,and enterprises with 301,000 employees account for 50%.

Regarding job titles,35% are senior staff,34% are general staff and 22% hold senior management positions.

58% of respondents have a national business footprint or have business mainly in Jiangsu,Zhejiang and Shanghai.

38% of the respondents are corporate users,followed by developers and operators at 32% and 19% are investors.

Among the interviewed companies,the top three concerned real estates are office and business parks,commercial real estate and logistics warehouse.

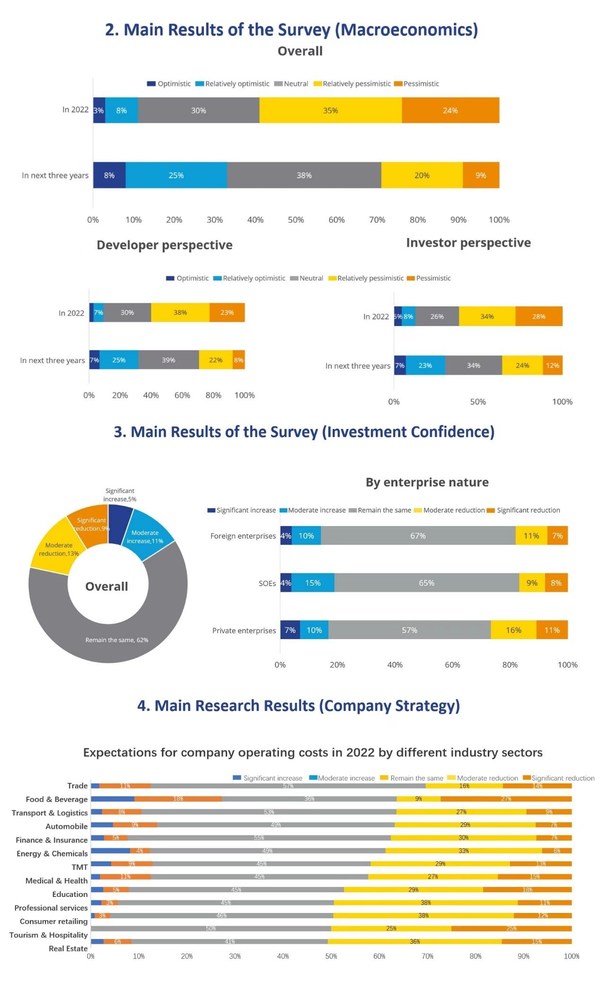

2. Main Results of the Survey (Macroeconomics)

As a whole,respondents are more optimistic about China's overall economic and market trends for the next three years.71% of the respondents reported that their confidence in the macro-market has not been negatively affected,with over 30% of developers and investors remaining optimistic about the market trendsfor the next three years. When it comes to the confidence of the respondents on the market,it is therefore apparent that the current outbreak only exerts a short-term andphased impact on their assessment.

3. Main Results of the Survey (Investment Confidence)

Overall nearly 80% of the respondents believe that the outbreak will not affect their investments in China. 16% of respondents in this group are considering increasing their investment after the outbreak,a figure that has doubled from the 8% recorded by Colliers in our 2020 survey under the similar epidemic circumstance. It can be seen that the market is confident in China's epidemic prevention measures and holds positive expectations forthe resumption of work and production.

4. Main Research Results (Company Strategy)

More than 50% of respondents believe that their companies are unlikely to reduce investment in operating costs,a figure that stands valid for virtually all industries mentioned in this survey. Those industries that are currently less affected by the epidemic include trade,logistics and transportation,as well as finances and insurance. Furthermore,it is worth noting here that over 12% of respondents in the automotive,energy and chemical industries,along with TMT and medical and health industries, have considered increasing their operational investment after the outbreak in order to boost the positive signals to shore upthe market.

Under the guidance of dynamic clearing policy and with the support from governments at all levels,the interviewed enterprises expressed confidence that they will be able to tide over the challenges together. The negative impact caused by COVID tends to be short-term. We're still positive about the medium and long term investment in China and Shanghai. We believe that more financial credits and other strategic support in all aspects will be given,and element security and labor needs will be guaranteed in order to enable resuming production,allowing enterprises to recover to normal business practices, and achieving development goals.

It is expected that some time is needed to completely recover from the existing situation. However,we believe that the dawn of success is just ahead,and we are not afraid of any challenges. We just need to continue to work closely with our clients and business partners to accelerate success,as well as work together to make plans served for the development of our industry.