Survey reveals majority of Singaporeans invest in money market funds to hedge against rising inflation

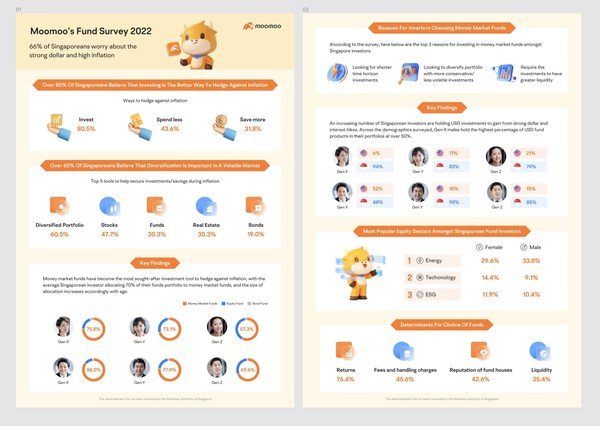

SINGAPORE,Aug. 15,2022 -- Digital brokerage - Moomoo Financial Singapore Pte. Ltd. and moomoo wealth management platform ("moomooSG"),a subsidiary of Futu Holdings Limited (Nasdaq: FUTU; "Futu"),recently concluded a survey on how Singaporeans are tiding against inflation and the behaviors of different demographics when allocating their money to fund portfolios. Primarily,the data shows that 66% of respondents are worried about the strong US dollar and high inflation,with 80.5% believing that investing is essential to hedge against inflation.

Staying agile through portfolio diversification

The survey distilled investment tools used by Singaporean investors to diversify their portfolios and revealed that money-market funds remain the most sought-after tools,with the average Singaporean investor allocating 70% of their fund portfolios to them. The data showed a different appetite for funds across different age groups and genders. Females allocated a lesser portion of their fund portfolios towards money-market funds compared to their male counterparts,while Gen X males and females had the highest allocations based on gender data at 86.2% and 75.8% respectively.

The data gleaned from the survey can be attributed to any one of three factors including a rise in the number of local investors looking for short-term investment horizon,a shift of appetite towards safer investments and the desire for higher liquidity. Accordingly,key factors for choosing funds are investment returns (76.4%),fees and handling charges (45.6%),reputation of the fund houses (42.6%) and liquidity (35.4%). Results also showed that energy,technology and ESG remained the most popular equity sectors amongst Singaporean funds investors.

Commenting on the investing landscape,Mr. Gavin Chia,Managing Director of moomoo Singapore,said "At moomooSGwe understand that Singaporeans are increasingly prioritising how to preserve wealth and retain their purchasing power. The unmet needs of the general public aspired us to launch moomoo Cash plus,powered by diverse money market funds,to provide liquidity and competitive returns compared to demand deposits. As a leading tech-driven super-app,we consistently equip Singaporeans with necessary tools and accessibility that will empower them to flourish at every step of their financial journey."

Have a cup of kopi on moomoo

MoomooSGremains committed to staying agile to support more Singaporeans in kickstarting their financial planning. Introducing moomoo Cash Plus that creates flexibility for investors to choose between SGD and USD money-market funds which can be withdrawn,deposited,or redirected without margin interests at any time. It aims to preserve one's principal investment while maintaining a higherdegree of liquidity with returns. No transaction fees or interest will be charged.

In celebration of Singapore's birthday month,users who invest SGD 100 into moomoo Cash Plus can "have a kopi on moo daily"and receive S$2*in cashback daily,capped at S$60 for 30 days. To amplify support for retail investors,moomoo SG will be present in the heartlands – at Waterway Point,Century Square and Serangoon Nex – from 15 August to 23 August,to learn more about coping with investment challenges faced by Singaporeans over a free cup of coffee. There will also be a teaching corner where children can learn about patience and delayed gratification,to focus on long-term benefits over short-term gains.

* Refers to S$2 Cash Coupon on moomoo.

About Moomoo Financial Singapore Pte. Ltd.

Moomoo Financial Singapore Pte. Ltd. (Moomoo SG) is a wholly owned subsidiary of Futu Holdings Limited (NASDAQ: FUTU),which is an advanced financial technology company transforming the investing experience by offering a digitised brokerage and wealth management platform- moomoo. Moomoo enhances the user experience with market data,news,and powerful analytical tools. Moomoo also embeds social media tools to provide connectivity to all users,investors,companies,analysts,media and key opinion leaders.

In Singapore,Moomoo Financial Singapore Pte. Ltd. (www.moomoo.com/sg) offers investment products for trading via the moomoo platform,and it is a capital markets services licence holder regulated by the Monetary Authority of Singapore (Licence No. CMS101000). In June 2022,Moomoo SG became the first digital brokerage in receiving full memberships from the SGX Group.

*This article has not been reviewed by the Monetary Authority of Singapore.