Qudian Inc. Reports Second Quarter 2022 Unaudited Financial Results

XIAMEN,China,Sept. 6,2022 -- Qudian Inc. ("Qudian" or "the Company" or "We") (NYSE: QD),a consumer-oriented technology company in China,today announced its unaudited financial results for the quarter ended June 30,2022.

Second Quarter 2022 Operational Highlights:

Number of outstanding borrowers[1] from loan book business as of June 30,2022 decreased by 6.7% to 2.4 million from 2.6 million as of March 31,2022,as a result of the Company's deployment of a conservative and prudent strategy

Total outstanding loan balance from loan book business[2] decreased by 54.4% toRMB0.7 billion as of June 30,2022 from RMB1.5 billion as of March 31,2022

Amount of transactions from loan book business for this quarter decreased by 31.0% to RMB1.5 billion from the first quarter of 2022

Weighted average loan tenure for our loan book business was 2.0 months for this quarter,compared to 2.3 months for the first quarter of 2022

[1]Outstanding borrowers are borrowers who have outstanding loans from the Company's loan book business as of a particular date.

[2]Includes (i) off and on balance sheet loans directly or indirectly funded by our institutional funding partners or our own capital,net of cumulative write-offs and (ii) does not include auto loans from Dabai Auto business.

Second Quarter 2022 Financial Highlights:

Total revenues were RMB105.4 million (US$15.7 million),compared to RMB412.1 million for the same period of last year

Net loss attributable to Qudian's shareholders was RMB61.3 million (US$9.2 million),compared to an income of RMB269.9 million for the same period of last year,or net loss of RMB0.25 (US$0.04) per diluted ADS

Non-GAAP net lossattributable to Qudian's shareholders[3] was RMB52.8 million (US$7.9 million),compared to non-GAAP net income attributable to Qudian's shareholders of RMB282.5 million for the same period of last year,or Non-GAAP net loss of RMB0.21 (US$0.03) per diluted ADS

[3]For more information on this Non-GAAP financial measure,please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

Recent Developments

Loan Book Business

After careful evaluation,the Company has decided to cease new credit offerings as of September 6,2022. As of August 31,the Company's total outstanding loan balance from the loan book business was below RMB500 million,with an average loan tenure of approximately three months. The existing outstanding loans continue to generate revenue and will be collected in an orderly manner. As a result of this business adjustment,the Company expects its revenues to significantly decline in the coming quarters compared with the previous quarters.

QD Food Business

After assessing current market conditions,the Company has decided to streamline its QD Food business. With the streamlining in QD Food operations,the Company expects to incur employee severance costs,termination fees for business partners and inventory write offs,which may adversely affect its financial condition and results of operations.

The Company will continue to explore new business opportunities and protect long term value for its shareholders.

Second Quarter Financial Results

Total revenues were RMB105.4 million (US$15.7 million),representing a decrease of 74.4% from RMB412.1 million for the second quarter of 2021.

Financing income totaled RMB66.2 million (US$9.9 million),representing a decrease of 78.8% from RMB311.8 million for the second quarter of 2021,as a result of the decrease in the average on-balance sheet loan balance.

Loan facilitation income and other related income decreased by 47.6% to RMB6.6 million (US$1.0 million) from RMB12.6 million for the second quarter of 2021,as a result of the reduction in transaction volume of off-balance sheet loans during this quarter.

Transaction services fee and other related income decreased to RMB6.5 million (US$1.0 million) from RMB38.5 million for the second quarter of 2021,mainly as a result of the winding down of the transaction service business.

Sales income and others decreased to RMB8.8 million (US$1.3 million),which was mainly attributable to sales income generated by QD Food,from RMB23.7 million for the second quarter of 2021,which was mainly attributable to sales generated by the Wanlimu e-commerce platform. We have wound down the Wanlimu e-commerce platform.

Total operating costs and expenses increased to RMB135.9 million (US$20.3 million) from RMB89.3 million for the second quarter of 2021.

Cost of revenues decreased by 36.7% to RMB41.1 million (US$6.1 million) from RMB64.9 million for the second quarter of 2022,primarily due to the decrease in cost of goods sold as a result of the wind-down of the Wanlimu e-commerce platform,partially offset by the cost of goods sold relating to QD Food.

Sales and marketing expenses increased by 82.6% to RMB53.2 million (US$7.9 million) from RMB29.1 million for the second quarter of 2021,primarily due to the increase in marketing expenses related to QD Food.

General and administrative expensesdecreased by 68.1% to RMB34.8 million(US$5.2 million) fromRMB109.1 millionfor the second quarter of 2021,primarily due to the downsizing of the WLM Kids business.

Research and development expensesdecreased by 52.1% to RMB18.8 million(US$2.8 million) from RMB39.2 million for the second quarter of 2021,as a result of the decrease in staff head count,which led to a corresponding decrease in staff salaries.

Provision for receivables and other assets was a reversal of RMB28.7 million(US$4.3 million) for the second quarter of 2022,mainly due to the decrease in past-due on-balance sheet outstanding principal receivables compared to the second quarter of 2021

Impairment loss from long-lived assets was RMB45.5 million(US$6.8 million) for this quarter,as a result of the downsizing of the WLM Kids business.

As ofJune 30,the total balance of outstanding principal and financing service fee receivables for on-balance sheet transactions for which any installment payment was more than 30 calendar days past due wasRMB124.0 million(US$18.5 million),and the balance of allowance for principal and financing service fee receivables at the end of the period wasRMB147.2 million(US$22.0 million),indicating M1+ Delinquency Coverage Ratio of 1.2x.

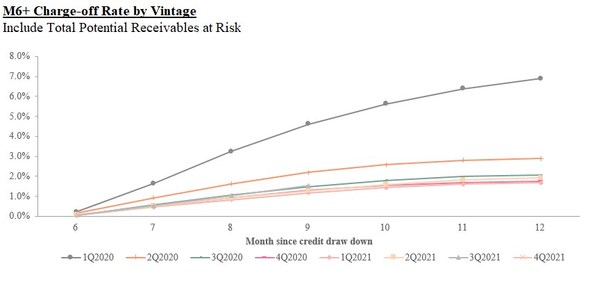

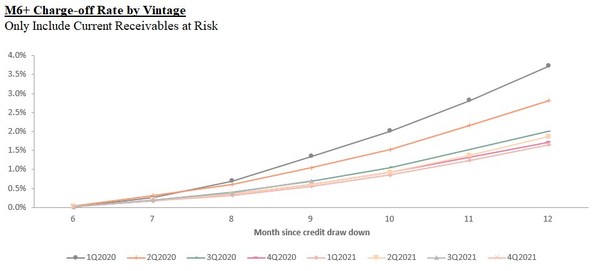

The following charts display the "vintage charge-off rate." Total potential receivables at risk vintage charge-off rate refers to,with respect to on- and off-balance sheet transactions facilitated under the loan book business during a specified time period,the total potential outstanding principal balance of the transactions that are delinquent for more than 180 days up to twelve months after origination,divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Current receivables at risk vintage charge-off rate refers to,the actual outstanding principal balance of the transactions that are delinquent for more than 180 days up to twelve months after origination,divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

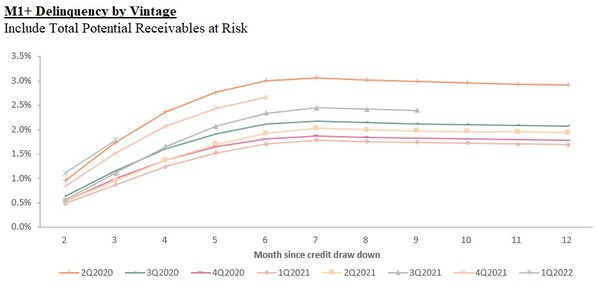

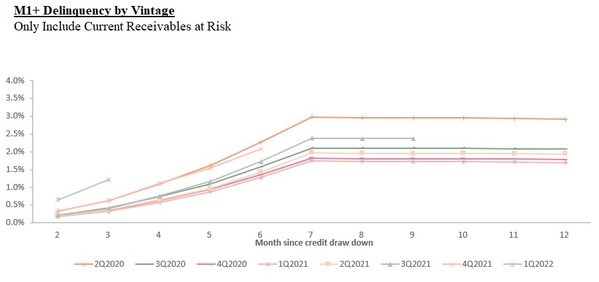

Total potential receivables at risk M1+ delinquency rate by vintage refers to,the total potential outstanding principal balance of the transactions that are delinquent for more than 30 days up to twelve months after origination,divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Current receivables at risk M1+ delinquency rate by vintage refers to,the actual outstanding principal balance of the transactions that are delinquent for more than 30 days up to twelve months after origination,divided by the total initial principal of the transactions facilitated in such vintage. Delinquencies may increase or decrease after such 12-month period.

Loss from operations was RMB29.4 million(US$4.4 million),compared to income from operations of RMB327.2 million for the second quarter of 2021.

Net loss attributable to Qudian's shareholderswas RMB61.3 million (US$9.2 million),or net loss of RMB0.25 (US$0.04) per diluted ADS.

Non-GAAP net loss attributable to Qudian's shareholderswas RMB52.8 million (US$7.9 million),or Non-GAAP net loss of RMB0.21 (US$0.03) per diluted ADS.

Cash Flow

As of June 30,the Company had cash and cash equivalents ofRMB3,099.0 million(US$462.7 million) and restricted cash ofRMB257.8 million(US$38.5 million). Restricted cash mainly represents security deposits held in designated bank accounts for the guarantee of on-and-off balance sheet transactions. Such restricted cash is not available to fund the general liquidity needs of the Company.

For the second quarter of 2022,net cash used in operating activities wasRMB365.7 million(US$54.6 million),mainly due to the decrease in other current and non-current assets. Net cash provided by investing activities was RMB1,454.7 million(US$217.8 million),mainly due to the net proceeds from the redemption of short-term investments. Net cash used in financing activities was RMB227.3 million(US$33.9 million),mainly due to the repurchase of ordinary shares and convertible senior notes.

Update on Share Repurchase and Convertible Bond Repurchase

As of the date of this release,the Company has repurchased all of the convertible senior notes of US$345 million. The Company has cumulatively completed total share repurchases of approximately US$584.8 million.

About Qudian Inc.

Qudian Inc.("Qudian") is a consumer-oriented technology company inChina. The Company historically focused on providing credit solutions to consumers. Qudian is exploring innovative consumer products and services to satisfy Chinese consumers' fundamental and daily needs by leveraging its technology capabilities. InMarch 2022,it launched a ready-to-cook meal business catering to working-class consumers inChina.

For more information,please visithttp://ir.qudian.com.

Use of Non-GAAP Financial Measures

We use adjusted net income/loss,a Non-GAAP financial measure,in evaluating our operating results and for financial and operational decision-making purposes. We believe that adjusted net income/loss helps identify underlying trends in our business by excluding the impact of share-based compensation expenses,which are non-cash charges,and convertible bonds buyback income,which isnon-cashandnon-recurring. We believe that adjusted net income/loss provides useful information about our operating results,enhances the overall understanding of our past performance and future prospects and allows for greater visibility with respect to key metrics used by our management in its financial and operational decision-making.

Adjusted net income/loss is not defined under U.S. GAAP and is not presented in accordance with U.S. GAAP. This Non-GAAP financial measure has limitations as analytical tools,and when assessing our operating performance,cash flows or our liquidity,investors should not consider them in isolation,or as a substitute for net loss /income,cash flows provided by operating activities or other consolidated statements of operation and cash flow data prepared in accordance with U.S. GAAP.

We mitigate these limitations by reconciling the Non-GAAP financial measure to the most comparable U.S. GAAP performance measure,all of which should be considered when evaluating our performance.

For more information on this Non-GAAP financial measure,please see the table captioned "Unaudited Reconciliation of GAAP and Non-GAAP Results" set forth at the end of this press release.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars ("US$") at specified rates solely for the convenience of the reader. Unless otherwise stated,all translations from RMB to US$ were made at the rate ofRMB6.6981 toUS$1.00,the noon buying rate in effect on June 30,2022in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or US$ amounts referred could be converted into US$ or RMB,as the case may be,at any particular rate or at all.

Statement Regarding Preliminary Unaudited Financial Information

The unaudited financial information set out in this earnings release is preliminary and subject to potential adjustments. Adjustments to the consolidated financial statements may be identified when audit work has been performed for the Company's year-end audit,which could result in significant differences from this preliminary unaudited financial information.

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as "will," "expects," "anticipates," "future," "intends," "plans," "believes," "estimates" and similar statements. Among other things,the expectation of its collection efficiency and delinquency,contain forward-looking statements. Qudian may also make written or oral forward-looking statements in its periodic reports to the SEC,in its annual report to shareholders,in press releases and other written materials and in oral statements made by its officers,directors or employees to third parties. Statements that are not historical facts,including statements about Qudian's beliefs and expectations,are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement,including but not limited to the following: Qudian's goal and strategies; Qudian's expansion plans; Qudian's future business development,financial condition and results of operations; Qudian's expectations regarding demand for,and market acceptance of,its products; Qudian's expectations regarding keeping and strengthening its relationships with customers,business partners and other parties it collaborates with; general economic and business conditions; and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in Qudian's filings with the SEC. All information provided in this press release and in the attachments is as of the date of this press release,and Qudian does not undertake any obligation to update any forward-looking statement,except as required under applicable law.

For investor and media inquiries,please contact:

In China:

Qudian Inc.

Tel: +86-592-596-8208

E-mail:ir@qudian.com

The Piacente Group,Inc.

Jenny Cai

Tel: +86 (10) 6508-0677

E-mail: qudian@tpg-ir.com

In the United States:

The Piacente Group,Inc.

Brandi Piacente

Tel: +1-212-481-2050

E-mail: qudian@tpg-ir.com

QUDIAN INC.

Unaudited Condensed Consolidated Statements of Operations

Three months ended June 30,

(In thousands except for number

2021

2022

of shares and per-share data)

(Unaudited)

(Unaudited)

(Unaudited)

RMB

RMB

US$

Revenues:

Financing income

311,755

66,231

9,888

Sales commission fee

9,081

95

14

Sales income and others

23,655

8,753

1,307

Penalty fee

16,569

17,297

2,582

Loan facilitation income and other related income

12,565

6,589

984

Transaction services fee and other related income

38,462

6,481

968

Total revenues

412,087

105,446

15,743

Operating cost and expenses:

Cost of revenues

(64,890)

(41,083)

(6,134)

Sales and marketing

(29,140)

(53,211)

(7,944)

General and administrative

(109,112)

(34,828)

(5,200)

Research and development

(39,204)

(18,774)

(2,803)

Changes in guarantee liabilities and risk assurance liabilities(1)

55,624

28,839

4,306

Provision for receivables and other assets

97,385

28,657

4,278

Impairment loss from long-lived assets

-

(45,536)

(6,798)

Total operating cost and expenses

(89,337)

(135,936)

(20,295)

Other operating income

4,482

1,129

169

(Loss)/Income from operations

327,232

(29,361)

(4,383)

Interest and investment income,net

17,713

4,646

694

Loss from equity method investments

-

(241)

(36)

Loss on derivative instruments

-

(34,671)

(5,176)

Foreign exchange gain,net

319

798

119

Other income

85

9,569

1,428

Other expenses

(750)

(4,974)

(743)

Net (loss)/income before income taxes

344,599

(54,234)

(8,097)

Income tax expenses

(75,457)

(7,081)

(1,057)

Net (loss)/income

269,142

(61,315)

(9,154)

Net (loss)/profit attributable to non-

controlling interest shareholders

(805)

-

-

Net (loss)/income attributable to Qudian

Inc.'s shareholders

269,947

(61,154)

(Loss)/Earnings per share for Class A and

Class B ordinary shares:

Basic

1.07

(0.25)

(0.04)

Diluted

1.03

(0.25)

(0.04)

(Loss)/Earnings per ADS (1 Class A

ordinary share equals 1 ADSs):

Basic

1.07

(0.25)

(0.04)

Diluted

1.03

(0.25)

(0.04)

Weighted average number of Class A

and Class B ordinary shares outstanding:

Basic

253,370,503

248,458,980

248,980

Diluted

266,973,780

253,530,688

253,688

Other comprehensive (loss)/gain:

Foreign currency translation adjustment

(7,087)

6,489

969

Total comprehensive (loss)/income

262,055

(54,826)

(8,185)

Less: total comprehensive loss attributable

to non-controlling interest shareholders

(805)

-

-

Total comprehensive (loss)/income

attributable to Qudian Inc.'s

shareholders

262,860

(54,185)

Note:

(1):The amount includes the change in fair value of the guarantee liabilities accounted in accordance with ASC 815,"Derivative",

and the change in risk assurance liabilities accounted in accordance with ASC 450,"Contingencies" and ASC 460,"Guarantees".

QUDIAN INC.

Unaudited Condensed Consolidated Balance Sheets

As of March 31,

As of June 30,

(In thousands except for number

2022

2022

of shares and per-share data)

(Unaudited)

(Unaudited)

(Unaudited)

RMB

RMB

US$

ASSETS:

Current assets:

Cash and cash equivalents

2,245,403

3,098,964

462,663

Restricted cash

229,130

257,792

38,487

Derivative instruments-assets

11,289

8,665

1,294

Short-term investments

6,036,136

5,070,080

756,943

Short-term loan principal and financing service fee

receivables

1,319,751

556,095

83,023

Short-term finance lease receivables

11,875

5,602

836

Short-term contract assets

19,001

13,680

2,042

Other current assets

1,941,411

2,654,670

396,332

Total current assets

11,813,996

11,665,548

1,741,620

Non-current assets:

Long-term finance lease receivables

15

-

-

Operating lease right-of-use assets

271,545

553,161

82,585

Investment in equity method investee

119,038

119,777

17,882

Long-term investments

268,921

249,257

37,213

Property and equipment,net

643,734

696,128

103,929

Intangible assets

11,070

11,232

1,677

Long-term contract assets

1

-

-

Deferred tax assets,net

51,706

35,831

5,349

Other non-current assets

430,551

426,713

63,707

Total non-current assets

1,796,581

2,092,099

312,342

TOTAL ASSETS

13,610,577

13,757,647

2,053,962

QUDIAN INC.

Unaudited Condensed Consolidated Balance Sheets

As of March 31,

(In thousands except for number

2022

2022

of shares and per-share data)

(Unaudited)

(Unaudited)

(Unaudited)

RMB

RMB

US$

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Short-term borrowings and interest payables

-

120,000

17,916

Short-term lease liabilities

38,640

65,686

9,807

Convertible senior notes-short term

-

133,962

20,000

Derivative instruments-liability

-

77,377

11,552

Accrued expenses and other current liabilities

387,372

527,450

78,746

Guarantee liabilities and risk assurance liabilities(2)

658

275

42

Income tax payable

115,016

47,396

7,076

Total current liabilities

541,686

972,146

145,139

Non-current liabilities:

Deferred tax liabilities,net

85,495

90,795

13,555

Convertible senior notes

300,312

-

-

Long-term lease liabilities

160,679

388,474

57,998

Long-term borrowings and interest payables

145,312

25,312

3,779

Other non-current liabilities

629

-

-

Total non-current liabilities

692,427

504,581

75,332

Total liabilities

1,234,113

1,476,727

220,471

Shareholders' equity:

Class A Ordinary shares

132

132

20

Class B Ordinary shares

44

44

7

Treasury shares

(351,436)

(390,271)

(58,266)

Additional paid-in capital

4,019,352

4,027,471

601,286

Accumulated other comprehensive loss

(60,047)

(53,559)

(7,996)

Non-controlling interests

6,765

-

-

Retained earnings

8,761,654

8,697,103

1,298,440

Total shareholders' equity

12,376,464

12,280,920

1,833,491

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY

13,962

Note:

(2) The amount includes the balance of the guarantee liabilities accounted in accordance with ASC 815,and the balance of risk

assurance liabilities accounted in accordance with ASC 450,"Guarantees".

QUDIAN INC.

Unaudited Reconciliation of GAAP And Non-GAAP Results

Three months ended June 30,

2021

2022

(In thousands except for number

(Unaudited)

(Unaudited)

(Unaudited)

of shares and per-share data)

RMB

RMB

US$

Total net (loss)/income attributable to Qudian Inc.'s shareholders

269,154)

Add: Share-based compensation expenses

12,505

8,672

1,295

Less: Convertible bonds buyback income

-

196

29

Non-GAAP net (loss)/income attributable to Qudian Inc.'s shareholders

282,452

(52,839)

(7,888)

Non-GAAP net (loss)/income per share—basic

1.11

(0.21)

(0.03)

Non-GAAP net (loss)/income per share—diluted

1.07

(0.21)

(0.03)

Weighted average shares outstanding—basic

253,980

Weighted average shares outstanding—diluted

266,688

View original content to download multimedia:https://www.prnewswire.com/news-releases/qudian-inc-reports-second-quarter-2022-unaudited-financial-results-301618064.html