UOB and SP Group partner to offset 100% or more of household electricity carbon emissions for UOB EVOL cardholders

Cardholders can now achieve their sustainability goals seamlessly and conveniently when they charge their utilities bills to their card

SINGAPORE,Nov. 23,2022 -- UOB EVOL cardholders will now be able to offset 100 per cent or more of their household electricity carbon footprint for free when they charge SP Group's (SP) utilities bills to their credit card,via a new exclusive feature jointly launched by UOB and SP this month.

With this new feature,when customers charge SP utilities bills to their UOB EVOL card,UOB will fund and contribute 2 per cent of the billed amount to purchase My Green Credits on the SP app on behalf of the customer. My Green Credits is an affordable and convenient way for customers to get on the sustainability movement by greening their energy consumption through the purchase the amount of "green credits" in the form of Renewable Energy Certificates (RECs)[1].

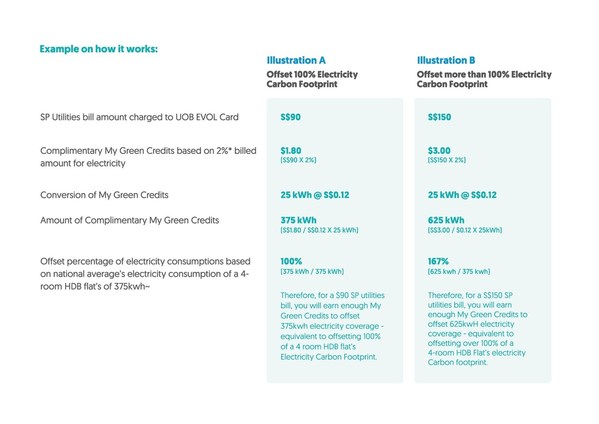

For example,when customers charge a $90 utilities bill to their UOB EVOL card,they will receive $1.80 worth of complimentary My Green Credits from UOB,equivalent to 2% of the billed amount. My Green Credits is purchased at a cost of S$0.12 per 25 kWh,which will translate to offsetting 375 kWh (kilowatt hour) or equivalent to an average national 4-room HDB flat's electricity usage. This is equivalent to offsetting 100 per cent of the home's electricity carbon footprint (see Annex for illustration).

New UOB EVOL cardmembers paying their SP bills via the SP app will automatically enjoy the complimentary My Green Credits,while existing cardholders who are using the SP app to pay their bills before 10 November 2022 will simply need to do a one-time re-add of their EVOL card as a payment method to be eligible. My Green Credits will be automatically reflected within the customer's SP app,with no additional effort required from them when bill payments are made. This benefit is available for both one-time and recurring SP bills payments.

UOB EVOL card is the first in the market to partner with SP Group,Singapore's national grid operator and leading sustainable energy solutions provider in the region,to offer customers complimentary My Green Credits when they use their EVOL Card to make utilities payment. This feature is applicable to all existing and new EVOL cardholders. The My Green Credits purchased will go towards supporting sustainable energy project developments in the region for the generation of green energy. Customers can log on to the SP app to view and select their preferred projects to support with the complimentary My Green Credits.

[1]Renewable Energy Certificates (RECs) are tradable green energy attributes that represent units of electricity generated from renewable energy generation facilities. These facilities comply with and are registered under internationally recognised standards,such as the I-REC standard,and are eligible to be issued RECs for every unit of electricity generated.

A credit card that supports the green initiative

UOB EVOL card is designed to appeal and serve the needs of younger customers,particularly their increasing focus on sustainability.

The UOB EVOL Card is Southeast Asia's first credit card to use bio-sourced materials to minimise ecological footprint. The EVOL Card is made of 84 percent polylactic acid (PLA) and created from renewable sources which are safe for incineration process. An EVOL Card that has expired and discarded is biodegradable in an industrial facility. Each EVOL card cuts down the use of plastic by 84 per cent and reduces carbon footprint by 10 grams per card.

EVOL card also has a strong partnership with over 30 green partners to increase customers' awareness of sustainability in their daily spending. This new card feature is another innovative initiative to further help them contribute to sustainable efforts seamlessly and conveniently.

Ms Jacquelyn Tan,Head of Group Personal Financial Services,UOB,said "We understand that every customer has unique needs,preferences and goals,and this drives us to do right by them,to serve them in a way that meets their needs. Our wide suite of credit cards provides a comprehensive range of benefits and rewards to cater to different groups of customers on their differing needs. Through our partnership with SP,we are happy to further support the younger generation's sustainability goals with our UOB EVOL card. This also shows UOB's commitment towards sustainability,as we empower customers to work with us to tackle climate change and to forge a more sustainable future together."

Mr Luke Tang,Head of Strategy and Sustainability,SP Group,said "We are pleased to partner UOB to catalyse behaviour that promotes sustainability and the use of renewable energy certificates on the SP App to green household electricity consumption. As younger customers chart their sustainability journeys,we look forward to empowering them with green platforms and resources and collectively accelerate Singapore's progress towards net zero."

The SP app was launched by SP as the first sustainability lifestyle app in Singapore. It aims to incorporate green solutions and initiatives to provide users with insights and solutions to manage their utilities and to reduce their carbon footprint. In addition to My Green Credits,users can also use the app to manage their utilities,reduce electricity consumption and contribute to Singapore's sustainability targets to achieve a low-carbon future.

On another sustainable front,as part of the UOB EVOL Card My Green Credits launch,SP supported National Parks Board's (NParks) OneMillionTrees movement to plant a million more trees across Singapore by 2030 through NParks' registered charity and IPC,Garden City Fund's Plant-A-Tree programme. UOB and SP will plant 50 trees in April 2023,bringing us closer to realising our vision of becoming a City in Nature,a key pillar of the Singapore Green Plan 2030.

Strategic partnership to create better solutions for customers

This year marks the fourth year of partnership between UOB and SP,with joint efforts to empower customers on their green goals. Previous collaborations include the purchase of RECs through SP as part of a National Day promotion in 2021 for the EVOL card. UOB has also launched an API with SP in 2020,to allow UOB customers to instantly use their UNI$ to off-set their utility bills.

Moving forward,UOB will work with SP to launch another new feature in the first quarter of 2023 that allows UOB cardholders to use their UNI$ to redeem for My Green Creditsvia the SP mobile app. They can choose which local or international renewable energy projects that they would like to support with the My Green Creditsredeemed. Under the My Green Credits initiative,SP is supporting various green projects ranging from a solar farm in Vietnam,to a wind farm in Thailand,to a solar rooftop system in Singapore,to help reduce emissions and impact on the environment.

In line with Singapore's strong push to electrify its vehicle population,ecosystem,UOB and SP also have plans to provide promotional offers to customers who use their UOB cards to pay for electric vehicles (EV) charging at SP EV charging points.

Over the past 2 years,UOB has been building up a suite of sustainable future solutions to make it simpler for customers to create impact with their everyday choices. The Bank has an established sustainable investing approach which set standards for its Singapore and regional footprint by curating a suite of sustainable investments across funds,bonds and structured products. This includes its first UOB Personal Financial Services (PFS) secured loans green product framework,serving as the foundation of its Go Green home and car loans. The framework leverages insight from Morningstar Sustainalytics,a leading global provider of ESG research,ratings,and data. In November 2022,UOB also will be availing a digital doorway to sustainable banking on the UOB TMRW app,allowing customers to easily access green deals,investments and banking products on mobile. Through the app,customers will also receive eco-friendly tips for the holiday festivities,and personalised insights to bank and live more sustainably in 2023.

About UOB

UOB is a leading bank in Asia with a global network of around 500 offices in 19 countries and territories in Asia Pacific,Europe and North America. Since its incorporation in 1935,UOB has grown organically and through a series of strategic acquisitions. UOB is rated among the world's top banks: Aa1 by Moody's Investors Service and AA- by both S&P Global Ratings and Fitch Ratings. In Asia,UOB operates through its head office in Singapore and banking subsidiaries in China,Indonesia,Malaysia,Thailand and Vietnam,as well as branches and representative offices across the region.

For more than eight decades,generations of UOB employees have carried through the entrepreneurial spirit,the focus on long-term value creation and an unwavering commitment to do what is right for our customers and our colleagues.

We believe in being a responsible financial services provider and we are committed to making a difference in the lives of our stakeholders and in the communities in which we operate. Just as we are dedicated to helping our customers manage their finances wisely and to grow their businesses,UOB is steadfast in our support of the social development of art,children and education,doing right by our communities.

About SP Group

SP Group is a leading utilities group in the Asia Pacific,empowering the future of energy with low-carbon,smart energy solutions for its customers. It owns and operates electricity and gas transmission and distribution businesses in Singapore and Australia,and sustainable energy solutions in Singapore,China,Vietnam and Thailand.

As Singapore's national grid operator,about 1.6 million industrial,commercial and residential customers benefit from its world-class transmission,distribution and market support services. These networks are amongst the most reliable and cost-effective world-wide.

Beyond traditional utilities services,SP Group provides a suite of sustainable and renewable energy solutions such as microgrids,cooling and heating systems for business districts and residential townships,solar energy solutions,electric vehicle fast charging and digital energy solutions for customers in Singapore and the region.

For more information,please visit spgroup.com.sg or for follow us on Facebook at fb.com/SPGroupSG and LinkedIn at spgrp.sg/linkedin.

ANNEX: Illustration of offsetting customers' carbon footprint with UOB EVOL Card

Illustration of how customers can offset 100% of more of their household electricity carbon footprint when they charge SP bills to their UOB EVOL Card