Galaxy Entertainment Group Announces Selected Unaudited Q3 2018 Financial Data

- Q3 Group Adjusted EBITDA of $3.9 Billion,Up 10% YoY

- 11thConsecutive Quarter of YoY EBITDA Growth

- Paying Previously Announced Special Dividend of $0.50 Per Share on 26 October 2018

HONG KONG,Oct. 25,2018 -- Galaxy Entertainment Group ("GEG","Company" or the "Group") (HKEx stock code: 27) today reported selected unaudited financial data for the three months period ended 30 September 2018. (All amounts are expressed in HKD unless otherwise stated)

Q3 2018 RESULTS HIGHLIGHTS

GEG: Delivered Solid Performance,Driven by Mass,VIP & Operational Execution,Despite Playing Unlucky

Q3 Group Net Revenue* of $13.0 billion,up 6% year-on-year and down 7% quarter-on-quarter

Q3 Group Adjusted EBITDA of $3.9 billion,up 10% year-on-year and down 10% quarter-on-quarter

Played unlucky in Q3 which decreased Adjusted EBITDA by approximately $332 million,Normalized Q3 Adjusted EBITDA of $4.2 billion,up 16% year-on-year and down 6% quarter-on-quarter

LTM Adjusted EBITDA of $16.7 billion,up 29% year-on-year and up 2% quarter-on-quarter

Galaxy Macau™: Continued Solid Performance,Despite Playing Unlucky

Q3 Net Revenue* of $9.3 billion,up 7% year-on-year and down 6% quarter-on-quarter

Q3 Adjusted EBITDA of $3.0 billion,up 9% year-on-year and down 8% quarter-on-quarter

Played unlucky in Q3 which decreased Adjusted EBITDA by approximately $323 million,Normalized Q3 Adjusted EBITDA of $3.3 billion,up 14% year-on-year and down 2% quarter-on-quarter

Hotel occupancy for Q3 across the five hotels was virtually 100%

StarWorld Macau: Continued Solid Performance Driven by Mass

Q3 Net Revenue* of $2.9 billion,up 7% year-on-year and down 5% quarter-on-quarter

Q3 Adjusted EBITDA of $927 million,up 16% year-on-year and down 6% quarter-on-quarter

Played unlucky in Q3 which decreased Adjusted EBITDA by approximately $5 million,Normalized Q3 Adjusted EBITDA of $932 million,up 24% year-on-year and down 6% quarter-on-quarter

Hotel occupancy for Q3 was virtually 100%

Broadway Macau™:A Unique Family Friendly Resort,Strongly Supported By Macau SMEs

Q3 Net Revenue* of $145 million,up 38% year-on-year and up 11% quarter-on-quarter

Q3 Adjusted EBITDA of $9 million,versus $(4) million in prior year and $2 million in Q2 2018

Played unlucky in Q3 which decreased Adjusted EBITDA by approximately $4 million,Normalized Q3 Adjusted EBITDA of $13 million,versus $(4) million in prior year and $4 million in Q2 2018

Hotel occupancy for Q3 was 96%

Balance Sheet: Healthy Balance Sheet

Cash and liquid investments were $43.3 billion and net cash of $34.7 billion as at 30 September 2018

Debt of $8.6 billion as at 30 September 2018,primarily reflects ongoing treasury yield management initiative

Paying the previously announced special dividend of $0.50 per share on 26 October 2018

Development Update: Continuing to Pursue Development Opportunities

Cotai Phases 3 & 4 -- Continue to move forward with Phases 3 & 4,with a strong focus on non-gaming,primarily targeting MICE,entertainment,family facilities and also including gaming

Hengqin -- Plans moving forward to develop a low-density integrated resort to complement our high-energy entertainment resorts in Macau

International -- Continuously exploring opportunities in overseas markets,including Japan

*Net Revenue is calculated in accordance with the new accounting standard and the comparison percentage is over the restated Net Revenue in Q3 2017 and Q2 2018.

Dr. Lui Che Woo,Chairman of GEG said:

"I am pleased to report that GEG delivered solid results for the three months period ended 30 September 2018.Before going into details of our results I would like to make a few comments concerning super typhoon Mangkhut which impacted Macau last month.

On 16 September 2018 Macau experienced super typhoon Mangkhut which was reportedly as strong as Hato in August last year. Macau saw significantly less damages and injuries during this No. 10 typhoon Mangkhut,thanks to the precautionary measures taken by the Macau SAR Government and the community,including team members of GEG.

Firstly I would like to thank the Macau SAR Government for their leadership during this challenging event.I would also acknowledge the significant efforts of the civil protection teams,the broader community,our staff and fellow Concessionaires.Significant advanced warning was given which allowed for timely preparation.The Concessionaires,including GEG,worked closely with the Government both pre and post typhoon and helped the community recover from the event.In all,with strong leadership,active community involvement and careful preparation,Macau was substantially less impacted by typhoon Mangkhut when compared to previous typhoons.

Despite increased competition,with new property openings both in Macau and regionally,GEG delivered solid results with Q3 Adjusted EBITDA growing 10% year-on-year to $3.9 billion. It should be noted that during the quarter gaming operations played unlucky which reduced EBITDA by approximately $0.3 billion. Additionally Macau experienced adverse impacts from both the World Cup in July and typhoon Mangkhut in September. We continue to drive every segment of our business with a particular focus on yielding our resorts. GEG's renowned 'World Class,Asian Heart' service combined with our differentiated resorts offerings have resulted in our portfolio of hotels reporting virtually full occupancy.

GEG remains financially healthy with a solid balance sheet. Our balance sheet combined with substantial cash flow from operations allows us to return capital to shareholders through special dividends and to fund our development pipeline and international expansion plans. These include Cotai Phases 3 & 4,Hengqin and Japan. On 26 October 2018 we will pay the previously announced special dividend of $0.50 per share.

The continued growth in the rapidly emerging and underpenetrated middle-class in Mainland China and their demand for leisure and travel gives us confidence in the longer term outlook for Macau. However,I do acknowledge that the current international trade tensions,rising interest rates and a slowing economy may impact consumer sentiment in the short term. We are committed to support the Macau SAR Government's vision to develop Macau into a World Centre of Tourism and Leisure.

I am very proud of our team members and I would like to take this opportunity to express my sincere gratitude to our executive team and all team members for their commitment and efforts in delivering these results,especially during typhoon Mangkhut."

Macau Market Overview

Macau's Gross Gaming Revenue ("GGR") for Q3 2018 was $71.7 billion,up 10% year-on-year and flat quarter-on-quarter. This is the 9th reported consecutive quarter of YoY growth. These results were achieved despite the negative impact of super typhoon Mangkhut.

During the period,visitor arrivals to Macau were 9.0 million,up 9% year-on-year,in which visitors from Mainland China grew at a faster rate of 13%. Overnight visitors grew 7% year-on-year,with the average length of stay rising by 0.1 day year-on-year to 2.27 days.

Group Financial Results

Q3 2018

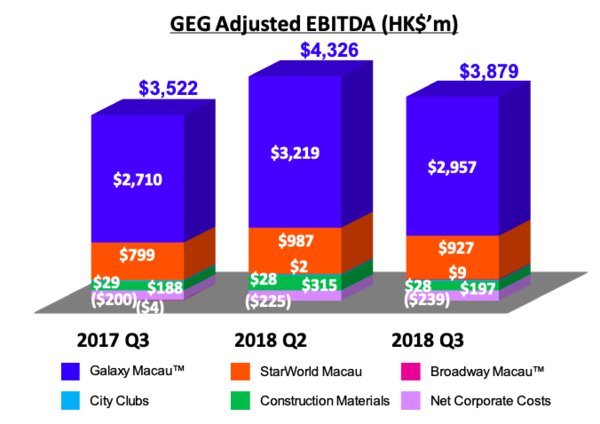

During Q3 2018,the Group's net revenue increased 6% year-on-year and decreased 7% quarter-on-quarter to $13.0 billion. Adjusted EBITDA increased 10% year-on-year and decreased 10% quarter-on-quarter to $3.9 billion. Galaxy Macau™'s Adjusted EBITDA increased 9% year-on-year and decreased 8% quarter-on-quarter to $3.0 billion. StarWorld Macau's Adjusted EBITDA increased 16% year-on-year and decreased 6% quarter-on-quarter to $927 million. Broadway Macau™'s Adjusted EBITDA was $9 million versus $(4) million in Q3 2017 and $2 million in Q2 2018.

Latest twelve months Group Adjusted EBITDA was up 29% year-on-year and up 2% quarter-on-quarter to $16.7 billion.

During Q3 2018,GEG played unlucky in its gaming operations which decreased Adjusted EBITDA by approximately $332 million. Normalized Q3 2018 Adjusted EBITDA grew 16% year-on-year and decreased 6% quarter-on-quarter to $4.2 billion.

GEG Adjusted EBITDA (HK$’m)

The Group's total GGR on a management basis[1] in Q3 2018 was $15.8 billion,up 6% year-on-year and down 8% quarter-on-quarter. Total mass table GGR was $6.6 billion,up 8% year-on-year and down 3% quarter-on-quarter. Total VIP GGR was $8.6 billion,up 5% year-on-year and down 12% quarter-on-quarter. Total electronic GGR was $0.6 billion,up 10% year-on-year and up 8% quarter-on-quarter.

Group

(HK$'m)

Q3 2017

Q2 2018

Q3 2018

Revenues:

Net Gaming

10,292

11,898

11,068

Non-gaming

1,262

1,270

1,358

Construction Materials

680

757

569

Total Net Revenue[2]

12,234

13,925

12,995

Adjusted EBITDA

3,522

4,326

3,879

Gaming Statistics[3]

(HK$'b)

Q3 2017

Q2 2018

Q3 2018

Rolling Chip Volume

235.0

289.3

264.5

Win Rate %

3.5%

3.4%

3.3%

Win

8.2

9.8

8.6

Mass Table Drop

14.9

16.4

16.7

Win Rate %

40.9%

41.8%

39.6%

Win

6.1

6.8

6.6

ElectronicGamingVolume

15.6

18.2

18.2

Win Rate %

3.6%

3.1%

3.4%

Win

0.6

0.6

0.6

Total GGR Win

14.9

17.2

15.8

Balance Sheet and Special Dividend

The Group's balance sheet remains liquid and healthy. As of 30 September 2018,cash and liquid investments were $43.3 billion and net cash was $34.7 billion. Total debt was $8.6 billion at 30 September 2018,same as at 30 June 2018. Our debt primarily reflects a treasury management exercise where interest income on cash holdings exceeds corresponding borrowing costs. Our healthy balance sheet combined with solid cash flow from operations allows us to return capital to shareholders via special dividends and to fund our development pipeline and international expansion ambitions. On 26 October 2018 the Group will pay the previously announced special dividend of $0.50 per share.

Galaxy Macau™

In Q3 2018,Galaxy Macau™'s net revenue was $9.3 billion,up 7% year-on-year and down 6% quarter-on-quarter. Adjusted EBITDA was $3.0 billion,up 9% year-on-year and down 8% quarter-on-quarter. Adjusted EBITDA margin under HKFRS was 32% (Q3 2017: 31%).

Galaxy Macau™ played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $323 million in Q3 2018. Normalized Q3 Adjusted EBITDA was $3.3 billion,up 14% year-on-year and down 2% quarter-on-quarter. The combined five hotels registered occupancy was virtually 100% in Q3 2018.

Galaxy Macau™

(HK$'m)

Q3 2017

Q2 2018

Q3 2018

Revenues:

Net Gaming

7,617

8,869

8,181

Hotel / F&B / Others

857

820

888

Mall

222

260

268

Total Net Revenue[4]

8,696

9,949

9,337

Adjusted EBITDA

2,710

3,219

2,957

AdjustedEBITDAMargin%

31%

32%

32%

Gaming Statistics[5]

(HK$'m)

Q3 2017

Q2 2018

Q3 2018

Rolling Chip Volume

164,876

208,506

189,607

Win Rate %

3.6%

3.5%

3.4%

Win

5,854

7,304

6,354

Mass Table Drop

9,619

10,390

10,723

Win Rate %

43.3%

44.4%

41.4%

Win

4,169

4,610

4,434

ElectronicGamingVolume

11,708

13,311

13,026

Win Rate %

4.1%

3.6%

4.0%

Win

482

473

527

Total GGR Win

10,505

12,387

11,315

StarWorld Macau

StarWorld Macau's net revenue was $2.9 billion,up 7% year-on-year and down 5% quarter-on-quarter in Q3 2018. Adjusted EBITDA was $927 million,up 16% year-on-year and down 6% quarter-on-quarter. Adjusted EBITDA margin under HKFRS increased to 32% (Q3 2017: 29%).

StarWorld Macau played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $5 million in Q3 2018. Normalized Q3 Adjusted EBITDA was $932 million,up 24% year-on-year and down 6% quarter-on-quarter. Hotel occupancy was virtually 100% in Q3 2018.

StarWorld Macau

(HK$'m)

Q3 2017

Q2 2018

Q3 2018

Revenues:

Net Gaming

2,599

2,938

2,794

Hotel / F&B / Others

113

109

110

Mall

12

13

12

Total Net Revenue[6]

2,724

3,060

2,916

Adjusted EBITDA

799

987

927

AdjustedEBITDAMargin %

29%

32%

32%

Gaming Statistics[7]

(HK$'m)

Q3 2017

Q2 2018

Q3 2018

Rolling Chip Volume

66,891

79,703

73,750

Win Rate %

3.4%

3.0%

3.0%

Win

2,292

2,407

2,191

Mass Table Drop

3,569

4,092

4,034

Win Rate %

39.9%

41.6%

41.7%

Win

1,425

1,704

1,680

ElectronicGamingVolume

1,570

1,920

1,945

Win Rate %

2.6%

2.4%

2.1%

Win

41

46

41

Total GGR Win

3,758

4,157

3,912

Broadway Macau™

Broadway Macau™ is a unique family friendly,street entertainment and food resort supported by Macau SMEs,it does not have a VIP gaming component. Broadway Macau™'s net revenue for Q3 2018 was $145 million,up 38% year-on-year and up 11% quarter-on-quarter. Adjusted EBITDA was $9 million,versus $(4) million in prior year and $2 million in Q2 2018.

Broadway Macau™ played unlucky in its gaming operations which decreased its Adjusted EBITDA by approximately $4 million in Q3 2018. Normalized Q3 Adjusted EBITDA was $13 million,versus $(4) million in prior year and $4 million in Q2 2018. Hotel occupancy was 96% in Q3 2018.

Broadway Macau™

(HK$'m)

Q3 2017

Q2 2018

Q3 2018

Revenues:

Net Gaming

47

63

65

Hotel / F&B / Others

49

58

69

Mall

9

10

11

Total Net Revenue[8]

105

131

145

Adjusted EBITDA

(4)

2

9

AdjustedEBITDAMargin%

(4)%

2%

6%

Gaming Statistics[9]

(HK$'m)

Q3 2017

Q2 2018

Q3 2018

Mass Table Drop

184

223

242

Win Rate %

26.1%

26.2%

25.7%

Win

48

59

62

ElectronicGamingVolume

183

516

509

Win Rate %

3.1%

2.4%

2.1%

Win

6

12

11

Total GGR Win

54

71

73

City Clubs

City Clubs contributed $28 million of Adjusted EBITDA to the Group's earnings for Q3 2018,down 3% year-on-year and was flat quarter-on-quarter.

City Clubs

(HK$'m)

Q3 2017

Q2 2018

Q3 2018

Total Net Revenue[10]

29

28

28

Adjusted EBITDA

29

28

28

Gaming Statistics[11]

(HK$'m)

Q3 2017

Q2 2018

Q3 2018

Rolling Chip Volume

3,274

1,109

1,134

Win Rate %

2.3%

3.0%

5.2%

Win

76

33

59

Mass Table Drop

1,661

1,678

Win Rate %

29.4%

27.9%

25.8%

Win

462

463

432

ElectronicGamingVolume

2,177

2,493

2,722

Win Rate %

1.8%

1.7%

1.6%

Win

38

41

42

Total GGR Win

576

537

533

Construction Materials Division

The Construction Materials Division contributed Adjusted EBITDA of $197 million in Q3 2018,up 5% year-on-year and down 37% quarter-on-quarter.

Development Update

Cotai-- The Next Chapter

GEG is uniquely positioned for long term growth. We continue to move forward with Phases 3 & 4,which will include approximately 4,500 hotel rooms,including family and premium high end rooms,400,000 square feet of MICE space,a 500,000 square feet 16,000-seat multi-purpose arena,F&B,retail and casinos,among others.We look forward to formally announcing our development plans in the future.

Hengqin

We continue to make progress with our concept plan for our Hengqin project. Hengqin will allow GEG to develop a low density leisure destination resort that will complement our high energy resorts in Macau.

International

On 20 July 2018 the Japanese Diet passed the Integrated Resort ("IR") Bill. We are very pleased with the recent passing of the IR Bill in Japan. We view Japan as a great long term growth opportunity that will complement our Macau operations and our other international expansion ambitions. GEG,together withMonte-Carlo SBM from the Principality of Monaco and our Japanese partners,look forward to bringing our brand of World Class IRs to Japan.

Selected Major Awards in Q3 2018

Award

Presenter

GEG

Asiamoney Asia's Outstanding Companies Poll --

MostOutstandingCompanyinHongKong-ConsumerDiscretionarySector

Asiamoney

Outstanding Corporate Social Responsibility Award

Mirror Post

Galaxy Macau™

Asia's Leading Casino Resort 2018

The 25th World Travel Awards

StarWorld Macau

Selected Restaurant

-Feng Wei Ju

- Jade De Jardin

Ctrip Gourmet List 2018

Construction Materials Division

Grand Award-Excellence in Environmental Disclosure

Hong Kong ESG Reporting Awards

17th Hong Kong OSH Award

Safety Performance Award - Other Industries

Occupational Safety and Health Council

Outlook

We will continue to focus on driving every segment of our business and allocate resources to the highest and best use,whilst at the same time we will continue to exercise prudent cost control.Our philosophy is to manage the business over the medium to longer term horizon,but we are always conscience of shorter term impacts.

Our healthy balance sheet allows us to return capital to shareholders through special dividends and fund both our local development pipeline and explore international expansion opportunities.These include Phases 3 & 4,Hengqin and Japan.

Mainland China has significant demand for leisure,tourism and travel and GEG is well positioned to capitalize on this demand.The continuing expansion of the high speed train network and the opening of the Hong Kong - Zhuhai - Macau Bridge will further improve access to Macau.We believe that these infrastructure projects combined with the integration of the Greater Bay Area will continue to drive longer term growth in Macau.

However in the shorter term we are conscience of the potential impact of international trade tensions,rising interest rates and currency fluctuations.Additionally we continue to plan for the introduction ofthe full smoking ban,with the introduction of additional and upgraded smoking lounges early next year.

GEG with its world class portfolio of resorts,healthy balance sheet combined with ourintegrated resort development pipeline in Macau is well positioned for the future. GEG is committed to support the Macau Government's vision to develop Macau into a World Center of Tourism and Leisure.

[1] The primary difference between statutory gross revenue and management basis gross revenue is the treatment of City Clubs revenue where fee income is reported on a statutory basis and gross gaming revenue is reported on a management basis. At the group level the gaming statistics include Company owned resorts plus City Clubs.

[2] Total net revenue is reported under the new accounting standard and the corresponding figures for past periods are restated.

[3] Gaming statistics are presented before deducting commission and incentives.

[4] Total net revenue is reported under the new accounting standard and the corresponding figures for past periods are restated.

[5] Gaming statistics are presented before deducting commission and incentives.

[6] Total net revenue is reported under the new accounting standard and the corresponding figures for past periods are restated.

[7] Gaming statistics are presented before deducting commission and incentives.

[8] Total net revenue is reported under the new accounting standard and the corresponding figures for past periods are restated.

[9] Gaming statistics are presented before deducting commission and incentives.

[10] Total net revenue is reported under the new accounting standard and the corresponding figures for past periods are restated.

[11] Gaming statistics are presented before deducting commission and incentives.

About Galaxy Entertainment Group (HKEx stock code: 27)

Galaxy Entertainment Group ("GEG" or the "Group") is one of the world's leading resorts,hospitality and gaming companies. It primarily develops and operates a large portfolio of integrated resort,retail,dining,hotel and gaming facilities in Macau. The Group is listed on the Hong Kong Stock Exchange and is a constituent stock of the Hang Seng Index.

GEG is one of the three original concessionaires in Macau with a successful track record of delivering innovative,spectacular and award-winning properties,products and services,underpinned by a "World Class,Asian Heart" service philosophy,that has enabled it to consistently outperform and lead the market in Macau.

GEG operates three flagship destinations in Macau: on Cotai,Galaxy Macau™,one of the world's largest integrated destination resorts,and the adjoining Broadway Macau™,a unique landmark entertainment and food street destination; and on the Peninsula,StarWorld Macau,an award winning premium property.

The Group has the largest undeveloped landbank of any concessionaire in Macau. When The Next Chapter of its Cotai development is completed,GEG's resorts footprint on Cotai will double to more than 2 million square meters,making the resorts,entertainment and MICE precinct one of the largest and most diverse integrated destinations in the world. GEG is also planning to develop a world class leisure and recreation destination resort on a 2.7 square kilometer land parcel on Hengqin adjacent to Macau. This resort will complement GEG's offerings in Macau,and at the same time differentiate it from its peers while supporting Macau in its vision of becoming a World Centre of Tourism and Leisure.

In July 2015,GEG made a strategic investment in Societe Anonyme des Bains de Mer et du Cercle des Etrangersa Monaco ("Monte-Carlo SBM"),a world renowned owner and operator of iconic luxury hotels and resorts in the Principality of Monaco. GEG continues to explore a range of international development opportunities with Monte-Carlo SBM including Japan.

GEG is committed to delivering world class unique experiences to its guests and building a sustainable future for the communities in which it operates.

For more information about the Group,please visit www.galaxyentertainment.com

Photo - https://photos.prnasia.com/prnh/20181025/2279370-1-c