Hong Kong is poised to become an international securitisation financing hub, according to industry report

HONG KONG,Jan. 14,2020 -- TheAsia-Pacific Structured Finance Association (APSA),The Hong Kong Institute of Bankers (HKIB) and the Asian Academy of International Law (AAIL) jointly hosted a seminar yesterday to examine how Hong Kong can enhance its role as an international securitisation hub. Discussing how Hong Kong's strengths in finance and business can be leveraged to capture the opportunities in the Asian securitisation market,the seminar is part of the annual International Financial Week being held in Hong Kong between 13 and 17 January.

At the seminar,the three organising parties jointly launched an industry report titled "Hong Kong-- a Securitisation Financing Hub for Infrastructure and Small and Medium Enterprises",offering industry players specific recommendations on how to enhance the city's financial ecosystem to deliver institutional investment capital through securitisation to key sectors of the economy,such as infrastructure and small and medium enterprises (SMEs). The report discusses ways to capture the opportunities arising from various infrastructure projects across the region and to address the financing needs of SMEs.

The report suggests that Hong Kong needs to focus on three core areas in order to establish itself as an international securitisation hub,namely (i) making available data and information about prior successful securitisation transactions,(ii) creating a marketplace for professionals and (iii) implementing laws,regulations,tax rules and market infrastructure to support a robust securitisation market.

It also stresses that the path towards establishing Hong Kong as a securitisation financing hub requires the collaboration of multiple stakeholders including policy makers,regulators and professionals from the finance,legal,accounting,engineering,management and investment sectors.

Dr Anthony Francis NEOH,Special Advisor to this industry report and the Chairman ofAAIL,said,"These securitisation proposals will complete the last remaining elements which will make Hong Kong into the 'International Hub for Securitisation' of Asia,catering to international infrastructure projects and the securitisation of Small and Medium Enterprise Financing in the Greater Bay Area. That will create a revolution in at least the same scale as that of H Shares,if not more."

Speaking at the launch seminar,Susie CHEUNG,Co-Convenor of APSA,said,"It is to be hoped that the initiative could act as a rallying call to galvanise the support of all the relevant stakeholders in Hong Kong to work together with the policy makers and regulators,and drive forward the use of securitisation to deliver significant benefits to both the local and global economy which Hong Kong has the potential to do,beyond just infrastructure and SMEs. This is a great opportunity and one that we should all grasp with both hands."

Carrie LEUNG,Chief Executive Officer of the HKIB,"To ensure we can deliver a securitisation framework that reaches the highest international standards,we need to strengthen our local talent pool. Securitisation encompasses more than issuance and underwriting,and one of the next steps will be to set out best practices in key areas such as credit risk management and insurance in which local banking and financial services practitioners can actively participate."

Please download a full version of the report here.

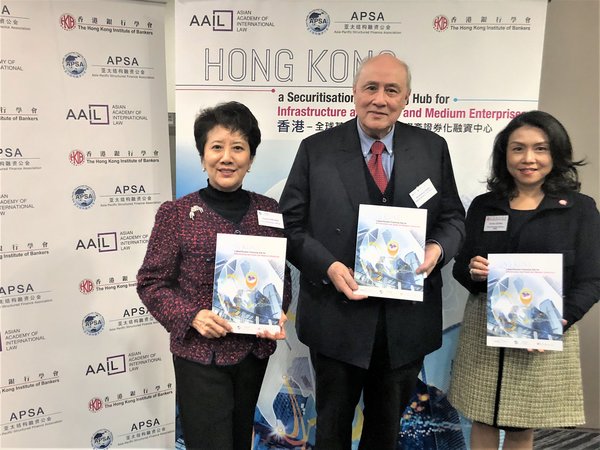

The Asia-Pacific Structured Finance Association (APSA),The Hong Kong Institute of Bankers (HKIB) and the Asian Academy of International Law (AAIL) today launched an industry report titled “Hong Kong – a Securitisation Financing Hub for Infrastructure and Small and Medium Enterprises”. In the photo are (from left to right) Susie CHEUNG,Co-Convenor of APSA; Dr Anthony Francis NEOH,Special Advisor to the Report and the Chairman of the AAIL and Carrie LEUNG,Chief Executive Officer of the HKIB.

Notes to editors:

About Asia-Pacific Structured Finance Association

Asia-Pacific Structured Finance Association (APSA) was formed in 2006 to promote the efficient growth and continued development of the structured finance and securitisation industry,identify and recommend standard market practices,and to forge links and the integration of industry players within Mainland China and other regional centres.APSA plays a facilitating role to bring together professionals from the banking,accounting and credit rating sectors with a view to keeping them informed of the current market trends and development on securitization. APSA has entered into a strategic partnership to help promote the sound and orderly development of the asset securitisation market in Asia Pacific,with the China Securitisation Forum,ASIFMA and the Australian Securitisation Forum. In light of the strong policy drivers around infrastructure,SMEs and trade,the volume of securitisation in Asia-Pacific is expected to grow rapidly. APSA could help develop the cross-border securitisation of China-based assets,as well as assets from around Asia-Pacific,by advocating for Hong Kong to become an issuance centre for securitisation.

Official website:www.apsa-asia.com

About The Hong Kong Institute of Bankers

The Hong Kong Institute of Bankers (HKIB) has been serving the local banking community as an independent organisation in the provision of education and professional training since 1963. The Institute also acts as an industry-recognised training and certifying hub for the local banking community. With an objective to maintain and further develop the territory's status as an international financial centre,the Institute works with the support of banks,regulators,financial institutions,academic institutions and various professional bodies to provide local banking practitioners with professional training and development opportunities. In view of the changing landscape of the banking and financial services industry in Hong Kong and mainland China as well as on a global scale,the importance of continuing to enhance the standards of professional development has gained increased attention. The HKIB endeavours to provide and enhance its training and development products in order to equip its members with essential knowledge and skills that meet the industry's needs.

Official website: https://www.hkib.org/

LinkedIn:https://hk.linkedin.com/company/the-hong-kong-institute-of-bankers

About the Asian Academy of International Law

The Asian Academy of International Law ("the Academy") is an independent and registered charitable body set up in Hong Kong to further the studies,research and development of international law in Asia. By organising conferences,seminars,workshops and specialised courses,the Academy aims to enhance and reinforce Asia's role and participation in the formulation of international law and international relations. In addition to promoting capacity building among Asian countries,the Academy also endeavours to facilitate collaboration among practitioners and academics. In 2018,the Academy has been granted observer status to UNCITRAL Working Group III.

Official website: www.aail.org

Photo - https://photos.prnasia.com/prnh/20200114/2691474-1?lang=0