Tickmill Group's 2018 Financial Performance Reaches New Heights

LONDON,May 29,2019 -- Tickmill Group ended 2018 by posting significant growth as evidenced by remarkable increases in all financial metrics.

Tickmill Group ended 2018 by posting significant growth as evidenced by remarkable increases in all financial metrics. The growth momentum is expected to gather pace in 2019.

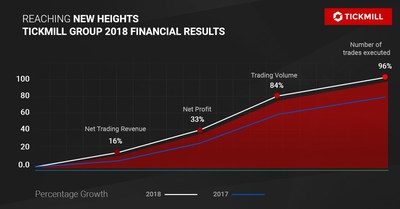

The consolidated net profit in 2018 stood at $19.67 million,marking a surge of 33% in relation to the corresponding figure of 2017 which amounted to $14.81 million. The Group's net trading revenue came in at $45.13 million,pointing to a 16% increase compared to the previous year.

Furthermore,the yearly trading volume stood at $1,368 billion notional value,recording a staggering increase of 84% compared to the previous year while also easily surpassing the projected $1,200-1,300 billion range. Interestingly,in October and November 2018,Tickmill witnessed the highest monthly trading volume figures of $145.5 billion and $136.0 billion respectively. For the full year,the Clients of Tickmill Group placed in total 83.56 million trades which represents a new record for the Group and an increase of 96% compared to previous year. Also,with a net capital base of $40.71 million as of the end of 2018,Tickmill Group is well positioned to look for attractive acquisition opportunities to further increase its geographic reach and market share.

Growth Momentum to Continue in 2019

Building on the positive performance of 2018,the first quarter of 2019 saw the Group onboarding a record number of new clients,a growth which is primarily fueled by its strong Introducing Broker network. Meanwhile,despite the low market volatility occurred in Q1 2019,the Group's net trading revenue was $12.94 million,up 8.8% compared to Q1 2018.

In the year ahead,Tickmill projects to reach a full-year trading volume of $1400-1500 billion based on organic growth in its key markets in South-East Asia,South America,MENA and GCC region,Africa and Europe.

Commenting on the results,Illimar Mattus,Group CFO,stated: "In 2018,our Group was nimble enough to further strengthen its financial performance despite the wave of restrictive regulatory measures that were introduced. We will continue to tap into our deep industry expertise and core values of integrity,transparency and professionalism to drive the long-term profitability of our business."

Group COO,Ingmar Mattus,commented: "We remain on track for achieving our strategic objectives aiming to become a stronger,more agile and competitive organisation capable of delivering sophisticated products and high-quality service to our global client base."

"Having broken new records of financial performance in 2018,we are certain 2019 will see us continuing to expand our market share and reinforce our position as one of the fastest-growing financial services providers in the world," said Duncan Anderson,CEO of Tickmill UK Ltd.

About Tickmill

Tickmill is a Forex and CFD trading services provider,authorised and regulated by the UK Financial Conduct Authority,the Cyprus Securities and Exchange Commission and the Seychelles Financial Services Authority,offering first-class trading products with competitive conditions and ultra-fast execution.

For more information,please visit: http://www.tickmill.com.

81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.