Manulife Hong Kong reports double-digit APE sales growth in first quarter of 2021

Agency sales continued to grow year-over-year in 1Q21 vs a strong 1Q20

Bank channel sales significantly rebounded with successful product drive

HONG KONG,May 10,2021 -- The Manulife group of companies operating in Hong Kong ("Manulife Hong Kong") today announced strong results across key financial metrics for the first quarter of 2021,including double-digit growth in annualized premium equivalent (APE) sales.

"We're very proud to deliver an outstanding first quarter,with double-digit growth across core earnings,APE sales,and new business value (NBV). Considering the constraints from the pandemic,these strong results demonstrate the underlying strength and resilience of our business," said Damien Green,Chief Executive Officer of Manulife Hong Kong. "As pandemic restrictions started to ease in February,we saw sales activities quickly rebound across our distribution channels,especially in banks and our highly productive agency force."

First quarter results overview:

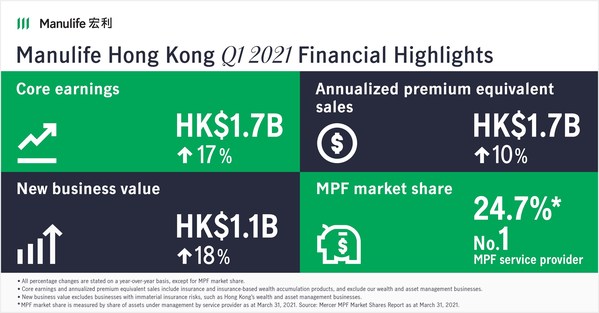

Core earnings up 17% to HK$1.7 billion

Annualized premium equivalent (APE) salesup 10% to HK$1.7 billion

New business value (NBV)up 18% toHK$1.1 billion

Number of agents:10,690 at March 31,2021,up 6% from the end of the first quarter of 2020

Mandatory Provident Funds (MPF) market share:Manulife Hong Kong was the largest MPF service provider with a record-high market share of 24.7% based on assets under management as at March 31,up 0.7 percentage point from the end of the prior year quarter. It had a 46.6% share based on estimated net cash flows for the period from January 1 to March 31,2021.

"There has been an increasing demand for our saving plans and critical illness products,in addition to tax-deductible solutions. Our key saving products,the ManuGrand Saver series,emerged as a popular option for customers to build their wealth. In this quarter,our critical illness sales also jumped by almost 40%. Clearly people have a genuine need for both protection and wealth offerings in times of uncertainty,and that's where we can serve customers better with our health and retirement expertise," added Mr. Green.

Core earnings rose 17% to HK$1.7 billion from HK$1.4 billion in the same quarter of 2020,driven by higher new business volumes,favourable new business product mix,and in-force business growth.

APE sales were HK$1.7 billion,up 10% from HK$1.6 billion in the first quarter of 2020,primarily due to sales growth in the bank channel. This quarter also saw stronger sales from saving products and investment-linked assurance schemes.

NBV grew 18% to HK$1.1 billion from HK$1.0 billion in the prior-year quarter,attributable to higher sales and product management actions.

"Agency force remains our future growth driver,and we are well on track with our plans to expand this channel. Our recent signing of Hong Kong's largest Grade A office leasing deal in the past 20 months[1]showcases our unwavering ambition to accelerate agency growth. The newly rented office space at the International Trade Tower in Kowloon East will mainly be used as our agency offices," continued Mr. Green.

On its digital transformation,Manulife Hong Kong launched an enhanced electronic point of sales tool in January 2021 to empower its agency force. This digital sales tool has gained traction among its agency force with an adoption rate of 70% at the end of the first quarter. Manulife Hong Kong will continue to enhance customer experience by investing in digital technologies,with a fresh customer website and a mobile app set to launch in the coming months.

[1]Based on statistics of CBRE Hong Kong

Manulife Hong Kong reports strong results across key financial metrics for the first quarter of 2021,including double-digit growth in annualized premium equivalent (APE) sales.

About Manulife Hong Kong

Manulife Hong Kong,through Manulife International Holdings Limited,owns Manulife (International) Limited,Manulife Investment Management (Hong Kong) Limited and Manulife Provident Funds Trust Company Limited. As a member of the Manulife group of companies,Manulife Hong Kong offers a diverse range of protection and wealth products and services to individual and corporate customers in Hong Kong and Macau.

About Manulife

Manulife Financial Corporation is a leading international financial services provider that helps people make their decisions easier and lives better. With our global headquarters in Toronto,Canada,we operate as Manulife across our offices in Canada,Asia,and Europe,and primarily as John Hancock in the United States. We provide financial advice,insurance,and our global wealth and asset management segment,Manulife Investment Management,serves individuals,institutions and retirement plan members worldwide. At the end of 2020,we had more than 37,000 employees,over 118,000 agents,and thousands of distribution partners,serving over 30 million customers. As of March 31,we had C$1.3 trillion (HK$7.8 trillion) in assets under management and administration,and in the previous 12 months we made C$31.3 billion in payments to our customers. Our principal operations are in Asia,Canada and the United States where we have served customers for more than 155 years. We trade as 'MFC' on the Toronto,New York,and the Philippine stock exchanges and under '945' in Hong Kong.

Notes:

i. Manulife Hong Kong includes all our Hong Kong businesses including insurance,insurance-based wealth accumulation products,and our wealth and asset management businesses.

ii. All percentage changes are stated on a year-over-year basis,except for MPF market share.

iii.Core earnings for Manulife Hong Kong include insurance and insurance-based wealth accumulation products,and exclude our wealth and asset management businesses. Core earnings is a non-GAAP profitability measure. For full definition of core earnings,see "Performance and Non-GAAP Measures" in Manulife Financial Corporation's 1Q21 Management's Discussion and Analysis.

iv. Annualized premium equivalent ("APE") sales are presented to provide consistency of scope for NBV disclosures and industry practice. APE sales consist of insurance and insurance-based wealth accumulation products,and exclude our wealth and asset management businesses. They comprise 100% of regular premiums/deposits sales and 10% of single premiums/deposits sales.

v. New business value ("NBV") is the change in embedded value as a result of sales in the reporting period. NBV is calculated as the present value of shareholders' interests in expected future distributable earnings,after the cost of capital,on actual new business sold in the period using assumptions that are consistent with the assumptions used in the calculation of embedded value. NBV excludes businesses with immaterial insurance risks,such as Hong Kong's wealth and asset management businesses. NBV is a useful metric to evaluate the value created by Manulife Hong Kong's new business franchise.

vi. MPF market share is measured by share of assets under management and estimated net cash flows by service provider. Source: Mercer MPF Market Shares Report as at March 31,2021.

https://www.manulife.com.hk/en/individual.html