Euroclear H1 2021 - Strong growth in business income and continued investment

BRUSSELS,July 16,2021 --

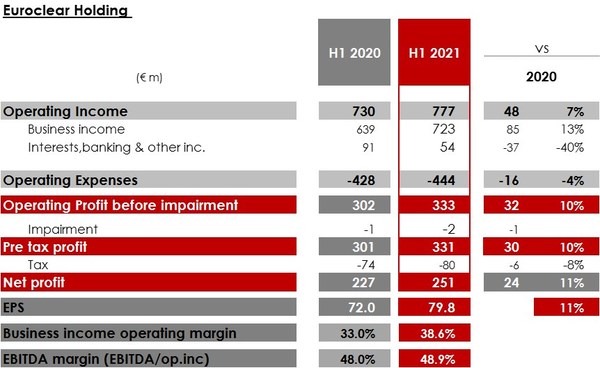

Operating income increased 7% to EUR 777 million (H1 2020: EUR 730 million) as a result of:

Business Income rose 13% to EUR 723 million (H1 2020: EUR 639 million)

Banking and Other Income decreased 40% to EUR 54 million (H1 2020: EUR 91) million),as a result of lower interest rates

Operating costs were up 4% to EUR 444 million (H1 2020: EUR 428 million) as technology investments continued to enhance business resilience and the customer proposition

Net profit rose 11% to EUR 251 million (H1 2020: EUR 227 million),EPS increased 11% to EUR 79.8 per share (H1 2020: EUR 72.0)

As previously announced,the Board intends to approve the dividend related to 2020 results for payment in September 2021. The dividend will be stable compared to the one of March

Key OperatingMetricsremainStrong

Assets under custody reached EUR 35.2 trillion at the end June (H1 2020: EUR 31.1 trillion,an increase of 13% year-on year

Record number of netted transactions settled in the Euroclear group of 149 million,an increase of 6% (H1 2020: 141 million)

Euroclear's Collateral Highway mobilised a record EUR 1.7 trillion (H1 2020: EUR 1.5 trillion),benefiting from fixed income securities growth

ContinuedprogressofStrategicPlans

AcquisitionofMFEXgroup

Ontrackto closeMFEXacquisitioninsecondhalf2021,asplanned.

Issuanceof€350m30-yearcorporatehybridbondbyEuroclearInvestmentsprovidesfundingtowardsMFEXtransaction

Integration streams established and progressing well

StrengtheningEuroclear's Network

Businessdriversremainstrongacrossassetclassesleadingtobusinessincomegrowthof13%,driven by business gains,increased volumes,record issuance infixedincomesecuritiesandincreasedequityvaluations

Fundassetsundercustody,up24%yearonyear,to€2.8trillion,beforethe inclusion ofMFEX financials

Continued investment in systems and infrastructure to enhance businessresilience

GrowingandReshapingEuroclear'sNetwork

Businessincomein"GrowandReshape"segments grewby15%yearonyear

CollateralManagementincludingsecuritieslendingandborrowingbusinessincomegrew,up12%yearonyear

Euroclear'sglobalandemergingmarketsnetwork,GlobalReach,increasedbusinessincomeby 18%yearonyear

Euroclear Bank and the Ministry of Finance of Chile have partnered to facilitate access to Chilean corporate debt through the market's Euroclearable link

ContinuedrolloutofInvestorInsightsolutionforissuers,includingshareholder identification services to support issuers' efforts to enhancecorporategovernance

Supportingprojectstoexplorecentralbankdigitalcurrencies,suchasproof of conceptwithBanque de France and a consortium of actorstotest use of central bank digital currency to settle the issuance of a French Government Bond by Agence France Trésor

Governancereformscompleted

Francesco Vanni d'Archirafi appointed as Chairman of the EuroclearHoldingandEuroclear SA/NV boards

Reforms have been implemented to strengthen Euroclear's corporate governance,includingalignmentof membershipofthe twoboards

Embracinghybridworking

Progressing implementation of a new hybrid working model,combiningattendancein Euroclear officeswithcontinued remoteworking

Gradually reopening offices in line with local government guidelines

Ensuring business continuity and the health and safety of employees remainimportantpriorities

Commentingontheresults,LieveMostrey,ChiefExecutiveOfficersaid:

"I am pleased to report that Euroclear achieved a record business performance in the first half of 2021. Our consistent strategy has delivered a growing financial performance,despite a business environment that remains uncertain.

By continuing to invest in our people and technology,we are supporting our clients' and the broader market's need for robust infrastructure,across asset classes,as they access our global network of financial market participants."

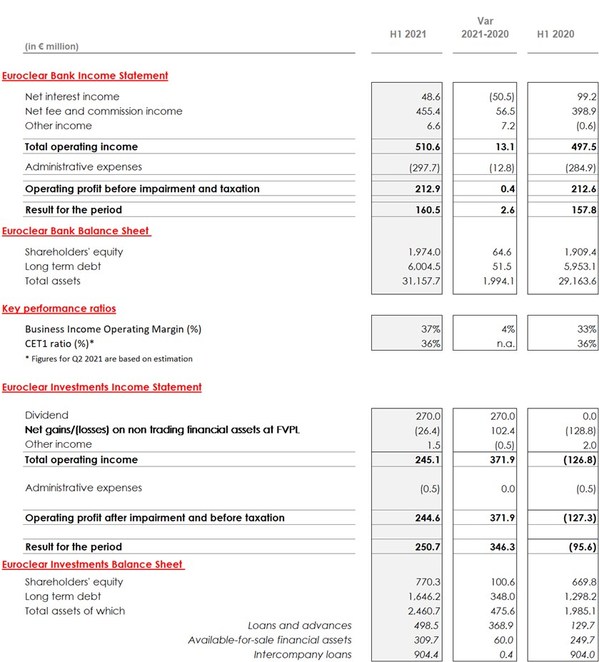

Abridged Financial Statements

Abridged Financial Statements

AboutEuroclear

Euroclear group is the financial industry's trusted provider of post trade services.Euroclear provides settlement and custody of domestic and cross-border securitiesfor bonds,equities and derivatives to investment funds. Euroclear is a proven,resilientcapital marketinfrastructurecommittedtodeliveringrisk-mitigation,automationand efficiencyatscaleforits globalclientfranchise.

The Euroclear group comprises Euroclear Bank,the International CSD,as well as Euroclear Belgium,EuroclearFinland,Euroclear France,Euroclear Nederland,Euroclear Sweden and EuroclearUK & Ireland. The Euroclear group settled the equivalent of EUR 897 trillion insecuritiestransactionsin2020,representing276milliondomesticandcross-bordertransactions,andheldEUR32.8trillioninassetsforclientsbyend2020.FormoreinformationaboutEuroclear,please visitwww.euroclear.com.