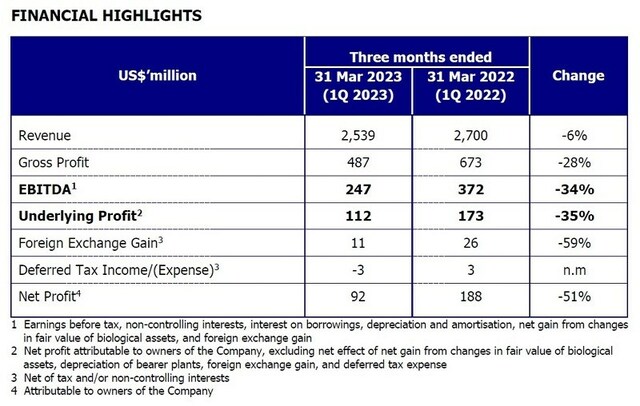

Golden Agri-Resources' Integrated Business Model Softens Impact of CPO Price Moderation on First Quarter 2023 Performance

Resilient first quarter 2023 EBITDA[1]of US$247 million,with net profit of US$92 million

Integrated business model helped to mitigate the impact of volatile markets

Financial position remained strong with a low gearing ratio of 0.54 times

SINGAPORE,May 12,2023 -- Financial performance for Golden Agri-Resources Ltd ("GAR" or the "Company") softened in the first quarter of 2023 followingarecord yearin 2022,impacted by normalisation of CPO prices.CPO market price (FOB Belawan) for the quarter droppedby 37 percent year-on-year,averaging US$990 per tonne compared to US$1,579 per tonne during the same period last year.Revenue decreased by six percent year-on-year to US$2.54 billion,with expanded sales volumepartly offsettinglower average selling prices.

GAR’s EBITDA remained resilient amidst volatile markets.

EBITDA stoodat US$247 million,maintaining a resilient margin of 9.7 percent,while underlying profit and net profit came in lower at US$112 million and US$92 million,respectively.

Overall,first quarter performance demonstrated the Company's resilience amidstlower CPO prices. The plantation business experienced a decrease in output and higher fertiliser costs,whichwas partly compensated by the higher merchandising volume of the downstream business,a testament to the ability of GAR's integrated business model to mitigatethe impact ofvolatile markets.

GAR's financial position remained strong. The Company maintained a gearing ratio of 0.54 times and a low net debt to EBITDA ratio of 0.08 times.

On the outlook,Mr Franky O. Widjaja,GAR Chairman and Chief Executive Officer, commented: "Global vegetable oil supply and demand dynamics remain tight. There are various factors that may slow down production recovery such as continuing geopolitical tensions and uncertain weather conditions. As for palm,production growth will be curbed by the industry's ageing trees,replanting activities,and the increasing chance of El Niño that is predicted to start in the second semester of the year. Global palmoil demand is sustained by a robust consumption of food,industrial,and bio-energy products. It is further supported bytheincreasing biodiesel mixture mandates in various countries,including B35 inIndonesia."

OPERATIONAL HIGHLIGHTS

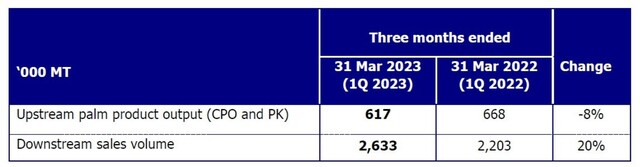

GAR’s downstream business recorded a substantial increase in sales volume for the period.

As of 31 March2023,GAR's planted area stood at over 536thousand hectares,of which 502thousand hectares were mature. Nucleus and plasma estates made up 421thousand and 115thousand hectaresof this area,respectively.

Fruit yield for the first quarter of 2023 decreased slightly year-on-year from 4.22 tonnes to 4.16 tonnes per hectare. Palm product output for the quarter was 617 thousand tonnes,compared to 668 thousand tonnes for the same period last year. The decrease was primarily due to preparation of old estates for replanting,smaller purchase volumes of third-partyfruits,and high rainfall in the Kalimantan area.

The downstream business recorded a substantial increase in sales volume in the first quarter of 2023,in line with more conducive market conditions compared to the same period last year.

GARremains cautious about dynamic market developments,includingthe uncertain global economic situation. Through continued investment in supply chain traceability and supplier transformation,the Company aims to capture growing demand for sustainable products while navigating regulatory changes,further strengthening the long-term viability of its integrated palm business.

The Company continued to move closer towards 100 percent Traceability to the Plantation (TTP) for its palm supply chain in Indonesia,achieving around 98 percent TTP. Having built close relationships with its suppliers through this process,GAR continues to assess their compliance with No Deforestation,No Peat,and No Exploitation (NDPE) requirements using the NDPE Implementation Reporting Framework (NDPE IRF).Under the Agriculture Sector Roadmap to 1.5°Cissued at COP 27,GAR aims to have all palm volumes in the "Delivering" category of the NDPE IRF by 2025.

GAR is also preparing for a challenging dry season,anticipating the return of El Niño weather patterns later this year. The Company has stepped up its fire monitoring efforts using the proprietary GeoSMART Fire-Hotspot Monitoring Site (GSF)app,which can detect fires three times faster than previous methods. Over 100 villages are also enrolled in GAR's community fire prevention programme,Desa Makmur Peduli Api,and the company will continue to work closely with local communities to minimise fire risk.

About Golden Agri-Resources Ltd (GAR)

GAR is a leading fully-integrated agribusiness company. In Indonesia,it manages an oil palm plantation area of 536,399 hectares (including plasma smallholders) as of 31 March 2023. It has integrated operations focused on the technology-driven production and distribution of extensive portfolio of palm-based products throughout its established international marketing network.

Founded in 1996,GAR was listed on the Singapore Exchange in 1999 and has a market capitalisation of US$2.7 billion as of 31March2023. Flambo International Limited,an investment company,is GAR's largest shareholder,with a 50.56 percent stake. In addition,GAR has several subsidiaries,including PT SMART Tbk,which was listed on the Indonesia Stock Exchange in 1992.

As an integrated agribusiness,GAR delivers an efficient end-to-end supply chain,from responsible production to global delivery. In Indonesia,its primary activities include cultivating and harvesting oil palm trees; the processing of fresh fruit bunch into crude palm oil (CPO) and palm kernel; refining CPO into value-added products such as cooking oil,margarine,shortening,biodiesel and oleo-chemicals; as well as merchandising palm products globally. GAR's products are delivered to a diversified customer base in over 100 countries through its global distribution network with shipping and logistics capabilities,destination marketing,on-shore refining and ex-tank operations. GAR also has complementary businesses such as soybean-based products in China,sunflower-based products in India,and sugar businesses.