Robust First Half 2023 Results for Golden Agri-Resources Despite Year-on-Year CPO Price Downturn

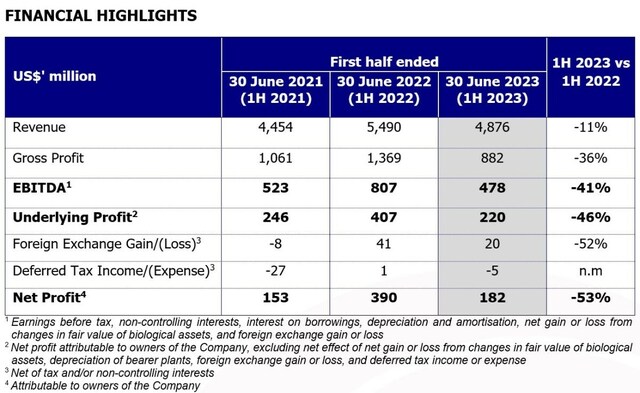

EBITDA for the first half of 2023 reached US$478 million,with net profit of US$182 million.

Integrated business model continued to help mitigate the impact of lowerCPO prices compared to last year.

SINGAPORE,Aug. 14,2023 -- Golden Agri-Resources Ltd ("GAR" or the "Company") recorded resilient results for the first half of 2023,despite the decline in CPO market price compared to last year's record levels. CPO market price (FOB Belawan) for the period fell by 40 percent year-on-year,averaging US$949 per tonne compared to US$1,595 per tonne for the same period last year. EBITDA stood at US$478 million,delivering a healthy margin of 9.8 percent,while underlying profit and net profit were US$220 million and US$182 million respectively.

GAR recorded resilient results for the first half of 2023,despite the decline in CPO market price compared to last year’s record levels

GAR's integrated business model helped to shield the Company from the worst impacts of volatile industry conditions. During the first half of 2023,the Company's downstream business continued to perform well,registering a substantial increase in sales volume which helped to partly mitigate weaker results from the plantation business that was directly impacted by the drop in market prices.

On the results,Mr. Franky O. Widjaja,GAR Chairman and Chief Executive Officer, commented: "We saw CPO price normalising from a record high last year,while our financial performance for the first half of 2023 remained robust. GAR's integrated business value chain has performed well and proved resilient against industry volatility. This is further sustained by our focus on pursuing higher value-added products and services that benefit our customers and consumers,including healthier product alternatives and traceability to the plantation.

"CPO price is expected to remain firm with the coming of El Niño conditions,which are forecast to peak in the next few months. Meanwhile,global demand is expected to continue to recover. Demand from the biofuel sector also continues to be strong,especially in Indonesia."

Segmental performance

Plantations and palm oil mills

As of 30 June 2023,GAR's planted area stood at 538,000 hectares,of which 500,000 hectares were mature. Nucleus and plasma estates made up 422,000 and 115,000 hectares of this area respectively.

Fruit yield for the first half of 2023 decreased by five percent year-on-year from 9.4 tonnes to 8.9tonnes per hectare. Palm product output for this period was 1.33 million tonnes,compared to 1.45 million tonnes for the same period last year. High rainfalls primarily in Kalimantan in the early part ofthe year,coupled with preparation of old estates for replanting,were the main drivers of this decrease.

During the first half of 2023,GAR's upstream business registered lower year-on-year EBITDA of US$219 million,mainly due to weaker CPO market prices,lower plantation output,and higher cost for fertilisers that were bought at higher price last year.

Palm,laurics and others

GAR's downstream business primarily consists of processing and global merchandising of palm and oilseed-based products comprising bulk and branded products,oleochemicals and other vegetable oils.

This segment achieved a notable increase in sales volume during the first half of 2023,recovering year-on-year following the lifting of Indonesia's temporary export ban in June 2022. The higher sales volume partly compensated for lower average selling prices,resulting in US$4.8 billion of revenue.

Segmental EBITDA in first half of 2023 reached US$258 million. While ten percent lower than the same period last year,this segment maintained a stable margin of 5.3 percent. Palm,laurics and others contributed over 50 percent to GAR's consolidated EBITDA,compared to 36 percent in the same period last year,demonstrating the efficacy of the Company's integrated business model.

Strengthening Sustainability Efforts

GAR placessustainability at the heart of its operations and is committed to operating responsibly to protect the environment and ecosystems that are vital to wildlife,whilesupporting local communities that arecrucial to itsbusiness. Continued investment in sustainability has allowed GAR to conserve almost 80,000 hectares of High Carbon Stock (HCS) forests and High Conservation Value (HCV) areason its concessions and support communities and suppliers to protect more than 160,000 hectares. Elsewhere,GAR has implemented initiatives to protect biodiversity,restore mangrove and peatlandareas,tackle climate change,and reduce waste and water use.

The Company is continuing its progress towards 100 percent Traceability to the Plantation (TTP) for its palm supply chain in Indonesia,having achieved 98 percent TTPto date. Through ongoing efforts to buildclose relationships with its suppliers,such as the Sawit Terampil programme,the Company will continue to assess compliance with itsNo Deforestation,No Peat,and No Exploitation (NDPE) requirements using the NDPE Implementation Reporting Framework (NDPE IRF),placing the Company in a strong position tohelp European customers comply with the upcoming EU deforestation regulation.

About Golden Agri-Resources Ltd (GAR)

GAR is a leading fully-integrated agribusiness company. In Indonesia,it manages an oil palm plantation area of 537,733 hectares (including plasma smallholders) as of 30 June 2023. It has integrated operations focused on the technology-driven production and distribution of extensive portfolio of palm-based products throughout its established international marketing network.

Founded in 1996,GAR was listed on the Singapore Exchange in 1999 and has a market capitalisation of US$2.3 billion as of 30June2023. Flambo International Limited,an investment company,is GAR's largest shareholder,with a 50.56 percent stake. In addition,GAR has several subsidiaries,including PT SMART Tbk,which was listed on the Indonesia Stock Exchange in 1992.

As an integrated agribusiness,GAR delivers an efficient end-to-end supply chain,from responsible production to global delivery. In Indonesia,its primary activities include cultivating and harvesting oil palm trees; the processing of fresh fruit bunch into crude palm oil (CPO) and palm kernel; refining CPO into value-added products such as cooking oil,margarine,shortening,biodiesel and oleo-chemicals; as well as merchandising palm products globally. GAR's products are delivered to a diversified customer base in over 100 countries through its global distribution network with shipping and logistics capabilities,destination marketing,on-shore refining and ex-tank operations. GAR also has complementary businesses such as soybean-based products in China,sunflower-based products in India,and sugar businesses.