Manulife Hong Kong reports solid growth in the first quarter of 2020

HONG KONG,May 7,2020 --The Manulife group of companies operating in Hong Kong ("Manulife Hong Kong") today announced solid growth for the first quarter of 2020.

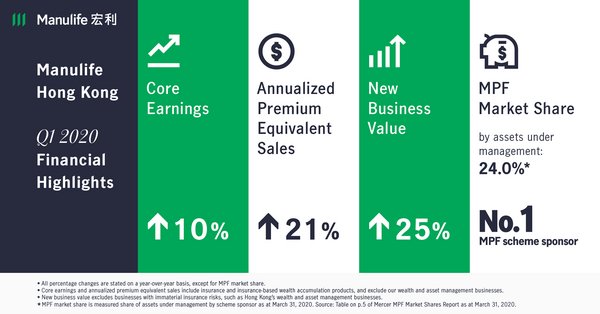

Results overview:

Core earnings up 10% to HK$1.4 billion

Annualized premium equivalent (APE) salesup 21% to HK$1.6 billion

New business value (NBV)up 25% toHK$1.0 billion

Wealth and asset management (WAM) gross flowsup 60% to HK$11.7 billion

Mandatory Provident Funds (MPF) market share:Manulife remained the largest MPF scheme sponsor with a market share of 24.0% based on assets under management as at March 31,2020 and 32.7% in terms of estimated net cash flows for the period from January 1 to March 31,2020

Agency force:10,104 agents,up 16% from 1Q19

Manulife Hong Kong 2020Q1 Results

"Considering the challenges brought by the COVID-19 pandemic,we are very pleased to report solid growth in the first quarter," said Damien Green,Chief Executive Officer of Manulife Hong Kong. "This achievement was made possible by the tireless dedication and resilience of our employees,agents and distribution partners,and the steps we have taken to provide customers with convenient electronic touchpoints and tailored solutions. Our complete and compelling suite of tax-deductible offerings has also made us the preferred financial-services partner for many of Hong Kong's working population and their families."

Core earnings was HK$1.4 billion,up 10% from HK$1.3 billion in the same quarter of 2019,attributable to in-force business growth and higher sales.

APE sales rose 21% to HK$1.6 billion from HK$1.3 billion in the first quarter of 2019. The increase in APE sales was driven by the continued success of our tax-deductible solutions including Voluntary Health Insurance Scheme (VHIS) and Qualifying Deferred Annuity Policy (QDAP) products sold by our growing and highly active agency force.

NBV increased 25% to HK$1.0 billion from HK$0.8 billion in the prior year quarter,due to strong sales of tax-deductible solutions including VHIS and QDAP products.

WAM gross flows surged to a new record of HK$11.7 billion,up 60% from HK$7.4 billion in the same period of the prior year. A large part of the growth was related to the significant amount of transfer-in assets from MPF personal accounts and new employer clients,as well as higher mutual funds sales.

In the first quarter,Manulife accelerated its digital capabilities and supported existing and new customers during the COVID-19 pandemic. The company's initiatives included the provision of additional benefits and policy coverage,simpler and faster claims processes,flexibility for premium payments,and remote purchase arrangements for VHIS and QDAP.

Manulife's VHIS product suite was enhanced with the addition of Manulife Supreme VHIS Flexi Plan,which offers full coverage for major medical expenses,including psychiatric treatment.Manulife also set up a specialized health business unit to accelerate the development of more customizable and innovative medical products and services to meet customers' increasing needs for protection.

In the retirement space,Manulife's QDAP and MPF Tax Deductible Voluntary Contributions (TVC)remained popular in the first quarter,with strong sales towards the close of the tax yearending in March 2020. BuySimple.hk,Manulife's online platform through which customers can buy VHIS plans and open TVC accounts,added a featurefor the creation of MPF Personal Accounts.

"With the uncertainty of the pandemic,we will stay focused on maintaining our strong business resilience,fast moving flexibility and prudent management as we work hard to deliver on our commitments to our customers and our ambitious growth agenda," added Mr. Green. "We'll continue to focus onthehealth and retirement of customers,leveragingourexpertise to help them with these important lifelong priorities and our robust product portfolio to provide them with the best available protection."

About Manulife Hong Kong

Manulife Hong Kong,through Manulife International Holdings Limited,owns Manulife (International) Limited,Manulife Investment Management (Hong Kong) Limited and Manulife Provident Funds Trust Company Limited. As a member of the Manulife group of companies,Manulife Hong Kong offers a diverse range of protection and wealth products and services to individual and corporate customers in Hong Kong and Macau.

About Manulife

Manulife Financial Corporation is a leading international financial services group that helps people make their decisions easier and lives better. With our global headquarters in Toronto,Canada,we operate as Manulife across our offices in Canada,Asia,and Europe,and primarily as John Hancock in the United States. We provide financial advice,insurance,and wealth and asset management solutions for individuals,groups and institutions. At the end of 2019,we had more than 35,000 employees,over 98,000 agents,and thousands of distribution partners,serving almost 30 million customers. As of March 31,2020,we had $1.2 trillion (HK$6.6 trillion) in assets under management and administration,and in the previous 12 months we made $30.4 billion in payments to our customers. Our principal operations are in Asia,Canada and the United States where we have served customers for more than 155 years. We trade as 'MFC' on the Toronto,New York,and the Philippine stock exchanges and under '945' in Hong Kong.

Notes:

i.

Manulife Hong Kong includes all our Hong Kong businesses including insurance,insurance-based wealth accumulation products,and our wealth and asset management businesses.

ii.

All percentage changes are stated on a year-over-year basis,except for MPF market share.

iii.

Core earnings for Manulife Hong Kong include insurance and insurance-based wealth accumulation products,and exclude our wealth and asset management businesses. Core earnings is a non-GAAP profitability measure. For full definition of core earnings,see "Performance and Non-GAAP Measures" in Manulife Financial Corporation's 1Q20 Management's Discussion and Analysis.

iv.

Annualized premium equivalent ("APE") sales are presented to provide consistency of scope for NBV disclosures and industry practice. APE sales consist of insurance and insurance-based wealth accumulation products,and exclude our wealth and asset management businesses. They comprise 100% of regular premiums/deposits sales and 10% of single premiums/deposits sales.

v.

New business value ("NBV") is the change in embedded value as a result of sales in the reporting period. NBV is calculated as the present value of shareholders' interests in expected future distributable earnings,after the cost of capital,on actual new business sold in the period using assumptions that are consistent with the assumptions used in the calculation of embedded value. NBV excludes businesses with immaterial insurance risks,such as Hong Kong's wealth and asset management businesses. NBV is a useful metric to evaluate the value created by Manulife Hong Kong's new business franchise.

vi.

Wealth and asset management ("WAM") gross flows is a new business measure comprised of all deposits into mutual funds and pension products. Gross flows is a common industry metric for WAM businesses as it provides a measure of how successful the businesses are at attracting assets.

vii.

MPF market share is measured share of assets under management and estimated net cash flows by scheme sponsor. Source: Table on p. 5 of Mercer MPF Market Shares Report as at March 31,2020.

Photo - /20200507/2797465-1-a?lang=0