EquitiesFirst(TM) Launches Asia Pacific Corporate Governance Initiative

HONG KONG,May 26,2021 -- Equities First Holdings,LLC,("EquitiesFirst") a global specialist in asset-backed financing today announced a strategic collaboration with Nasdaq Governance Solutions to launch a series of co-branded whitepapers,providing actionable insights on the latest in corporate governance best practice in Asia Pacific. This project aims to add value to investors and management as they pursue long-term value creation in their enterprises.

EquitiesFirst™,a global specialist in asset-backed financing,today announced a strategic collaboration with Nasdaq Governance Solutions to launch a series of co-branded whitepapers,providing actionable insights on the latest in corporate governance best practice in Asia Pacific.

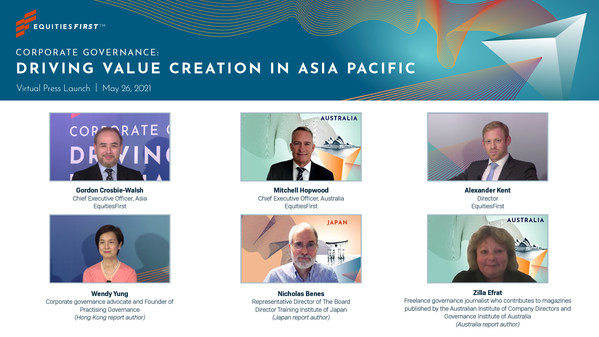

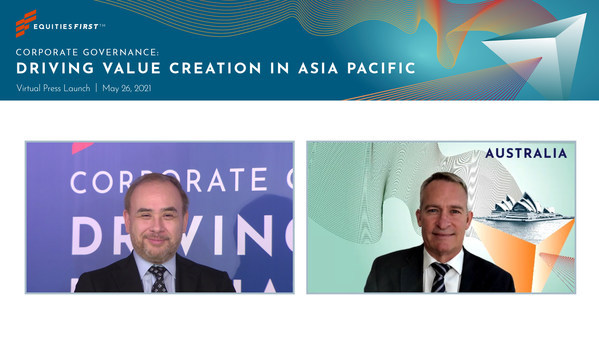

EquitiesFirst’s Chief Executive Officer,Asia,Gordon Crosbie-Walsh (Left) and EquitiesFirst’s Chief Executive Officer,Australia,Mitchell Hopwood (Right).

The partnership will see the launch of "Corporate Governance: Driving Value Creation in Asia Pacific". This will involve a series of reports being published throughout the year focusing on selected markets including Japan,Hong Kong,South Korea,Mainland China,Thailand,Singapore,Malaysia and India. A team of experts has been assembled to explore topics in corporate governance tailored to each market. The first three reports under the campaign include:

Japan:Findings show a strong correlation between the adoption of good governance practices and market outperformance,including the inclusion of female directors,independent directors and nomination committees. The market has compressed decades of corporate governance development into just a few years,amounting to a virtual revolution. Total market capitalisation and aggregate net income of TOPIX 1000 firms have grown by 2.3X and 2X respectively from 2012 to 2020,even amid the Covid-19pandemic. Despite the positive trajectory,more effort is needed to keep momentum going and unlock untapped value.

Hong Kong:Today's corporate governance landscape has a high degree of compliance with standards introduced 20 years ago. There is also an emerging trend for "corporate purpose" as a key consideration for rising generations and the implementation of new technology in the wake of the Covid-19 pandemic. However,the next phase of development will need to move beyond superficial compliance to embedding governance as a core element of business strategy. This view underlies recent regulatory initiatives,culminating in the latest corporate governance framework revisions. The latter focuses on instilling change in the mindset of listed boards,board independence,succession planning,and diversity.

Australia: Past corporate controversies have resulted in unprecedented responses from government and legislators in the market,most notably the Hayne Royal Commission into Misconduct in the Banking,Superannuation and Financial Services Industry established in 2017. This provided reform blueprints which fundamentally reshaped corporate governance in Australia. Many of the recommendations have been incorporated into legislation and the Hayne Report has also empowered two regulatory bodies,Australian Prudential Regulation Authority and Australian Securities and Investments Commission and informed a new set of corporate governance principles. The impact of these changes goes beyond the financial industry,affecting all companies currently listed or planning to be listed in the market.

The EquitiesFirst-Nasdaq Governance Solutions collaboration is built on a shared interest in good governance. As a global specialist in equity-backed financing,EquitiesFirst works exclusively with corporate leaders,founders and long-term investors to drive transformational change for companies worldwide. Its investment model positions EquitiesFirst as a co-investor alongside these partners with shared objectives of continued business stability and maturation. Nasdaq Governance Solutions offers an integrated suite of technology and solutions designed to advance governance excellence worldwide as well as streamline and manage boardroom processes and requirements. The two have joined forces to provide an open resource for corporate governance best practices,technological shifts,regulatory trends and more.

"We are pleased to partner with Nasdaq Governance Solutions,providing stakeholders in listed companies with the resources and insights needed to create long-term value," EquitiesFirst's Founder and CEO,Alexander Christy,Jr. said today. "These reports tackle topics and ideas which our partners engage with on a daily basis. Investors and management are focused relentlessly on value creation,so we wanted to share ideas that will help them grow,sustain and protect what they have built. This is one aspect of the wider Asia Pacific development story we have explored in major markets across the region."

On the Hong Kong report,EquitiesFirst's Chief Executive Officer,Gordon Crosbie-Walsh said,"As a leading international financial centre,Hong Kong attaches great importance to good corporate governance. We are now seeing a push by regulators,corporate leaders and consumers for companies to move beyond mere compliance and put corporate governance at the heart of their strategy."

On the Australia report,Mitchell Hopwood said,"Corporate governance has an increasingly prominent role in Australia's business environment. As a listing venue for both domestic and international companies,Australia wields outsized influence and is well positioned to promote best practices on a global scale."

The Japan,Hong Kong and Australia reports are available at www.equitiesfirst.com/int/corpgov/,while the remaining reports will be published monthly from June to October 2021.

About Equities First Holdings

Founded in 2002,EquitiesFirst is a global investor specialising in long-term asset-backed financing. EquitiesFirst's approach overcomes traditional limitations and redefines the financing experience through providing efficient access to capital for listed companies,entrepreneurs and investors against publicly traded securities. The total value of loans transacted stands at US$2.5 billion as of 1 December 2020.

Headquartered in Indianapolis,USA,EquitiesFirst maintains an international footprint of twelve offices in eight countries,including the United States,United Kingdom,Spain,China,Singapore and Australia. EquitiesFirst is appropriately licensed and/or registered in all jurisdictions.

EquitiesFirst is the pioneer of Progressive Capital – a partnership approach to investment,rooted in respect,mutual interest and understanding. EquitiesFirst delivers liquidity solutions that are vital,transformative and move partners forward.

For more information,please visit www.equitiesfirst.com/.

Disclaimer

This Document is intended solely for accredited investors,sophisticated investors,professional investors,or otherwise qualified investors,as may be required by law or otherwise,and it is not intended for,and should not be used by,persons who do not meet the relevant requirements. The content provided herein is for informational purposes only and is general in nature and not targeted to any specific objective or financial need. The views and opinions expressed in this Document have been prepared by third parties and do not necessarily reflect the views and opinions of EquitiesFirst. EquitiesFirst has not independently examined or verified the information provided herein,and no representation is made that it is accurate or complete.Opinions and information herein are subject to change without notice.The content provided does not constitute an offer to sell (or solicitation of an offer to purchase) any securities,investments,or any financial products ("Offer"). Any such Offer shall only be made through a relevant offering or other documentation which sets forth its material terms and conditions. Nothing contained in this Document shall constitute a recommendation,solicitation,invitation,inducement,promotion,or offer for the purchase or sale of any investment product by First Holdings,LLC or its subsidiaries (collectively,"EquitiesFirst"),nor shall this Document be construed in any way as investment,legal,or tax advice,or as a recommendation,reference,or endorsement by EquitiesFirst. You should seek independent financial advice prior to making an investment decision about a financial product.

This Document contains the intellectual property of EquitiesFirst in the United States and other countries,including,without limitation,their respective logos and other registered and unregistered trademarks and service marks. EquitiesFirst reserves all rights in and to their intellectual property contained in this Document.The Document should not be distributed,published,reproduced or otherwise made available in whole or in part by recipients to any other person and,in particular,should not be distributed to persons in any country where such distribution may lead to a breach of any legal or regulatory requirement.

EquitiesFirst make no representation or warranty with respect to this Document and expressly disclaim any implied warranty under law. You acknowledge that EquitiesFirst is not liable under any circumstances for any direct,indirect,special,consequential,incidental,or punitive damages whatsoever,any lost profits or lost opportunity,even if EquitiesFirst has been advised of the possibility of such damages.

EquitiesFirst makes the following further statements that may be applicable in the stated jurisdiction:

Australia: Equities First Holdings (Australia) Pty Ltd (ACN: 142 644 399) holds an Australian Financial Services Licence (AFSL Number: 387079). All rights reserved.

The information contained on this Document is intended for persons located in Australia only and classified as a Wholesale Client only as defined in Section 761G of the Corporations Act 2001. The distribution of information to persons outside this criteria may be restricted by law and persons who come into possession of it should seek advice and observe any such restriction.

The material contained in this Document is for information purposes only and should not be construed as an offer or solicitation or recommendation to buy or sell financial products.

The information contained in this Document is intended to be general in nature and is not personal financial product advice. Any advice contained in the Document is general advice only and has been prepared without considering your objectives,financial situation or needs. Before acting on any information,you should consider the appropriateness of the information provided and the nature of the relevant financial product having regard to your objectives,financial situation and needs. You should seek independent financial advice and read the relevant disclosure statements or other offer documents prior to making an investment decision about a financial product.

Hong Kong:Equities First Holdings Hong Kong Limited holds a Hong Kong Securities and Futures Commission Type 1 License and licensed in Hong Kong under the Money Lenders Ordinance (Money Lender's Licence No. 1839/2020).This Document has not been reviewed by the Hong Kong Securities and Futures Commission. It is not intended as an offer to sell securities or a solicitation to buy any product managed or provided by Equities First Holdings Hong Kong Limited and is only intended for Professional Investors. This document is not directed to individuals or organisations for whom such offers or invitations would be unlawful or prohibited.

Korea:The foregoing is intended solely for professional financial consumers,professional investors or otherwise qualified investors who have sufficient knowledge and experience in entering into securities financing transactions.It is not intended for,persons who do not meet that criteria.

United Kingdom:Equities First (London) Limited is authorised and regulated in the UK by the Financial Conduct Authority ("FCA").In the UK,this Document is only being distributed and made available to persons of the kind described in Article 19(5) (investment professionals) and Article 49(2) (high net worth companies,unincorporated associations etc.) of Part IV of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (''FPO'') and any investment activity to which this presentation relates is only available to,and will only be engaged in with,such persons. Persons who do not have professional experience in matters relating to investment or who are not persons to whom Article 49 of the FPO applies should not rely on this document. This Document is only prepared for and available to persons who qualify as Professional Investors under the Markets in Financial Instruments Directive.

©2021 Equities First Holdings Hong Kong Limited. All rights reserved