CUHK Business Sustainability Indices Reveal Resilience Amidst the Pandemic and Launches Global and Real Estate Indices

HONG KONG,Sept. 23,2022 -- The Centre for Business Sustainability (CBS) of The Chinese University of Hong Kong's (CUHK) Business School announced results of the Business Sustainability Indices(BSI) and the launch of Global Business Sustainability Index (Global BSI) and Real Estate Business Sustainability Index (REBSI) today (23 September).

The Centre for Business Sustainability of CUHK Business School announced results of the Business Sustainability Indices and the launch of Global Business Sustainability Index and Real Estate Business Sustainability Index.

Since its launch in 2015,the BSI offers a framework that supports companies in driving their sustainability strategy and promotes business practices that contribute to positive social and environmental impact. This year,the BSI examines the sustainability performance of 285 companies listed in Hong Kong,Taiwan,Shanghai and Shenzhen spanning 12 industries,based on their Environmental,Social,and Governance (ESG) and Corporate Social Responsibility (CSR) performance during 2019-2020 fiscal year (or 2020 calendar year). The BSI covers three geographical locations (the Greater China region,the Greater Bay Area and Hong Kong),as well as the hotel industry in the region.

Generally speaking,despite the impact of the pandemic,companies remained resilient in their sustainability endeavours and achieved an overall increase in BSI score (up by 10.62% YOY).

The assessment period saw the emergence of COVID-19. To cope with the unprecedented challenges sparked by the pandemic,many companies shifted their focus to the bottom line and strengthened their interactions with primary stakeholders,such as deploying flexible working arrangements for employees. However,the score for practice and impact decreased moderately (down by 8.02-11.62% in Hong Kong,Taiwan and Shanghai).

In Hong Kong,four companies (up from two YOY) achieved the highest rank (exemplar) and topped the chart of individual scores in the region during the assessment period. Comparatively more advanced in sustainability development,Hong Kong companies worked towards delivering social and environmental impact and translating business inputs into tangible social values.

The most significant improvement in overall score by location was recorded in Shenzhen (up by 30.19% YOY) and Shanghai (up by 17.72% YOY),accounted for largely by the positive response to the regulatory requirements. Among the score drivers,environmental practices increased by 29.07% and 13.18% in Shenzhen and Shanghai respectively,attributed mostly to the considerable reduction in operations during COVID-19,and thus,reducing negative impacts on the environment. While both cities are in the earlier stages of their pivot to sustainability and therefore starting off a lower base,the two cities are quickly catching up and narrowing the gap with Hong Kong and Taiwan.

On average,Taiwanese companies remained top performers (average BSI score: Taiwan 68.68,Hong Kong 59.65,Shanghai 43.04 and Shenzhen 34.80) and outshone in sustainability engagement and reporting,including extensively crafted CSR reports and comprehensive online disclosure.

Representatives of the overall top performing companies received certificates for their outstanding performance in business sustainability

Launch of Global BSI and Real Estate Industry BSI (REBSI) in 2023

The Global BSI includes companies in major stock markets around the world to enable companies with global influence to annually assess their CSR endeavours factoring a broad range of stakeholder groups. It covers blue-chip companies in major stock markets and recognises remarkable performance in sustainability. The data-driven approach will enable companies to seek continuous improvement in their ESG management in a systemic way for the benefits of the environment,business and society.

The REBSI is CBS' second sector-based BSI alongside with the Hotel Business Sustainability Index (Hotel BSI),providing a holistic assessment of the listed real estate companies in the Greater China region. The constituent companies will include the properties and construction companies in major stock indices in the Greater China region,namely,the Hang Seng Index and the Hang Seng Stock Connect Hong Kong Greater Bay Area Index of the Hang Seng Index Company Limited,the FTSE TWSE Taiwan 50 Index of the Taiwan Stock Exchange Corporation (TWSE) and FTSE Group (FTSE),the SSE 50 Index of the Shanghai Stock Exchange,and top 50 constituents from the SZSE 100 index of the Shenzhen Stock Exchange in terms of their market capitalisation.

Prof. Carlos Lo,Director of CBS at CUHK Business School

Professor Carlos Lo,Director of CBS,articulates the vision for the BSI as it further expands,"We hope the BSI will enable the global business community to thrive on their trajectory towards sustainability. We hope this will be an effective tool for organisations to transform CSR,ESG and SDGs into an integral part of their business which fuels their activities at all levels."

Appendix 1

The Hong Kong Business Sustainability Index (HKBSI)

HKBSI aims to encourage companies in Hong Kong to adopt CSR as a progressive business model for them to achieve business sustainability. In the 7th HKBSI,58 Hang Seng Index (HSI) constituent companies were invited to complete the assessment.

Compared to the results of the 6th HKBSI released last June,the overall average score of the HSI constituent companies was 59.65 points (out of 100 points),up by 1.7%. Among the assessment aspects of VPI,"Impact" registered a significant increase from 37.68 points (6th HKBSI) to 45.17 points,yet,"Values" recorded a slight drop from 65.54 points (6th HKBSI) to 61.71 points. "Process-Management" and "Process-Practice" have remained stable,recording 69.95 points and 65.90 points respectively.

Among the companies assessed,four of them achieved the highest rank "Exemplar" with over 90 points,reflecting that these companies' business sustainability performance has reached an international standard. In terms of stakeholder analysis,companies showed significant improvement in responding to regulatory requirements such as Government (up by 31.1 % ) and Investor (up by 8.3%).

The Top 10 HKBSI Company Ranking

Ranking

Company Name

1

Hong Kong and China Gas Co. Ltd.

2

HSBC Holdings plc

3

BOC Hong Kong (Holdings) Ltd

4

Sun Hung Kai Properties Ltd

5

Hang Seng Bank Ltd

6

MTR Corporation Limited

7

CLP Holdings Ltd.

8

Henderson Land Development Co. Ltd

9

Sands China Ltd

10

New World Development Co. Ltd

Appendix 2

The Greater Bay Area Business Sustainability Index (GBABSI)

GBABSI covers Hong Kong listed companies with operations in GBA that are eligible for southbound trading under the Stock Connect scheme,aiming at encouraging and motivating companies in the GBA to adopt CSR as a progressive business model. A total of 72 companies participated in the 3rd GBABSI.

Compare to the 2nd GBABSI results (52.86 points),the overall average score this year (54.21 points) mildly improved this year by 2.6%,with a significant increaseby 7.7% in "Process-Management" score,mainly due to companies' efforts to set a more functional managerial structure for sustainability issues.Nevertheless,benchmarking against the 7th HKBSI results (59.65 points),the latest GBABSIaverage score was 10% lower.

Among the participating companies in GBA,four reached the highest rank "Exemplar". Many companies originally in "Explorer" stage with their scores below 50 points started to publish CSR reports and began to set up CSR departments. Similar to HKBSI constituents,there was a significant improvement (32.5%) in regulatory requirements in terms of stakeholder analysis.

In face of the challenges brought by the pandemic,many companies turned their focus to maintaining the bottom line. Besides,government regulations as well as health and safety concerns also led to reduced volunteering activities and community projects. As a result,the Community Practice and Impact scores decreased.

The Top 10 GBABSI Company Ranking

Ranking

Company Name

1

Hong Kong and China Gas Co. Ltd.

2

BOC Hong Kong (Holdings) Ltd

3

China Resource Power Holdings Co. Ltd

4

Sun Hung Kai Properties Ltd

5

Hang Seng Bank Ltd

6

MTR Corporation Limited

7

Sino Land Company Limited

8

Henderson Land Development Co. Ltd

9

Sands China Ltd

10

Kerry Properties Limited

Appendix 3

TheGreater China Region Business Sustainability Index (GCBSI)

To promote business practices that contribute to positive social and environmental impact in the Greater China region,CBS rolled out the inaugural GCBSI in 2021 to engage listed companies in Shanghai,Shenzhen,Taiwan and Hong Kong.

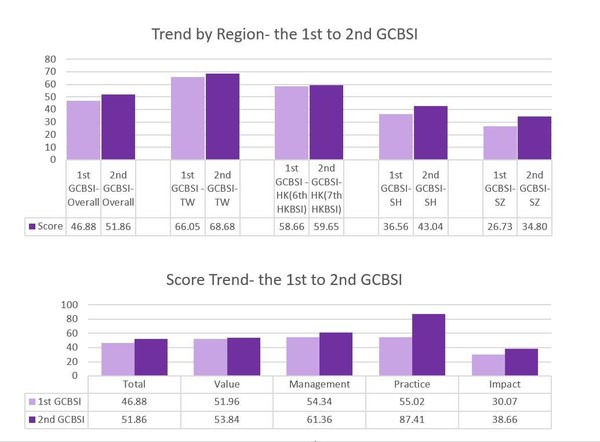

This year,the overall score (51.86 points) improved by 11% when compared to that of last year. The scores of companies in Shanghai and Shenzhen increased significantly,by 17.72% and 30.19% respectively,while that of the companies in Taiwan and Hong Kong achieved a slight increase of 3.98% and 1.69% respectively.

Specifically,listed companies from Taiwan achieved an average score of 68.68 which outperformed those in Hong Kong (59.65 points),Shanghai (43.04 points) and Shenzhen (34.80 points). Overall,companies in Taiwan were more instrumental in disclosing CSR information through multiple channels. For example,they were able to provide more comprehensive disclosure on their websites compared to companies in Hong Kong,Shanghai and Shenzhen.

Companies in Taiwan and Hong Kong followed a balanced stakeholder pattern that involved community,customers,employees,environment,government,investors and suppliers. On the other hand,companies in Shanghai and Shenzhen focused on compliance including the government and investors. On average,Shanghai,as a more mature market,showed better CSR performance.

Companies in Hong Kong engaged more with primary stakeholders (investor,customer,employee and supplier) than secondary stakeholders (community,government),indicating a more market-oriented sustainability strategy. More focus was placed on CSR strategies related to their value chain development rather than societal stakeholders.

Since 2020,due to the pandemic,many companies tried to cope with the new emergency and started to reduce community practice such as volunteering projects and community support projects – reduced by 8% in Taiwan,11.6% in Hong Kong and 9.4% in Shanghai (an increase of 25.9% was recorded in Shenzhen).

In terms of environmental practices,companies in Hong Kong and Taiwan reduced environmental practices by 9% and 3.9% respectively. Given the shrinking economy in 2020,many companies cut their budget for environmental donation and volunteering. Many companies also had to reduce or stop their production line and service,leaving less environmental footprint to be managed. On the other hand,companies in Shanghai and Shenzhen improved by 13.2% and 29% respectively,in response to China government's environmental pledges.

Overall VPI Scores – GCBSI

The Top 10 GCBSI Company Ranking

Ranking

Company Name

1

Hong Kong and China Gas Co. Ltd.

2

HSBC Holdings plc

3

BOC Hong Kong (Holdings) Ltd

4

Sun Hung Kai Properties Ltd

5

Taiwan Mobile Co.,Ltd.

6

CTBC Financial Holding Co.,Ltd.

7

Hang Seng Bank Ltd

8

MTR Corporation Limited

9

CLP Holdings Ltd.

10

Wan Hai Lines Ltd

Appendix 4

The Hotel Business Sustainability Index (Hotel BSI)

The tourism industry plays a crucial role in CSR advancement and hotel companies are integral to its success. Entering the second year of Hotel BSI,the Centre for Hospitality and Real Estate Research (CHRER)at CUHK School of Hotel and Tourism Management (SHTM) continues to encourage hotel companies to adopt CSR practices and recognise top CSR performers. This year,the number of indexed hotel companies has expanded to 29 – 20 of which are based in Hong Kong,Macau,Mainland China,and Taiwan,plus nine international hotel chains. Companies' performance for the financial year of 2019-20 is assessed based on publicly available information.

Overall,the average score of all indexed companies in the Hotel BSI improved from 45.83 points to 52.61 points,representing a 14.9% increase. Forty percent of the indexed hotel companies reached the "performer" level and scored 60 points or above compared with 17% in the first Hotel BSI. The improvement was contributed mainly by those in the Greater China region,Hong Kong (49.19 points,up by 13.5%),Mainland China (29.78 points,up by 8.1%),Taiwan (50.72 points,up by 30.4%) and Macau (70.11 points,up by 15.0%). Despite a slight decrease (- 2.1%) as compared to the previous index,the international chains still outperformed constituents based in Hong Kong,Mainland China and Taiwan with the highest average score of 63.99.

The tourism and hospitality industries were hard-hit by the pandemic. However,the setback did not stop hotel companies from advancing their CSR trajectory. According to the data,even hotel companies that fell behind in their CSR initiatives traditionally in the Greater China region have now started to gain momentum. In addition to the endeavours of individual companies and regions,the tremendous call for sustainable tourism by various stakeholders,including travellers,businesses,investors,NGOs,tourism organisations and governments also played a key role in driving the industry-wide improvement.

Top 10 list of 2nd Hotel BSI (in alphabetical order)

Accor SA

Galaxy Entertainment Group Limited

Hilton Worldwide Holdings Inc.

Marriott International,Inc.

Meliá Hotels International,S.A.

MGM China Holdings Limited

Miramar Hotel & Investment Company Limited

Sands China Limited

Sino Hotels (Holdings) Limited

Wynn Macau Limited

Overall Performance by Region

Mean Score

1st Hotel BSI

2nd Hotel BSI

% Change

All

45.83

52.67

+14.9%

Hong Kong-based

43.32

49.19

+13.5%

Mainland China-based

27.54

29.78

+8.1%

Taiwan-based

38.90

50.72

+30.4%

Macau-based

60.95

70.11

+15.0%

Non-Greater China-based

65.37

63.99

-2.1%

Overall VPI Scores

1st Hotel BSI

2nd Hotel BSI

% Change

Mean Score

Performance Level

Mean Score

Performance Level

Total

45.83

Explorer

52.61

Practicer

+14.79%

Values

47.75

Explorer

50.79

Practicer

+6.37%

Management

51.47

Practicer

64.50

Performer

+25.32%

Practice

54.61

Practicer

66.10

Performer

+21.04%

Impact

32.02

Explorer

32.40

Explorer

+1.19%

Performance by Level of Achievements

1st Hotel BSI

2nd Hotel BSI

Count

%

Count

%

Exemplar

90-100 points

0%

0%

Pace-setter

80-89 points

3

8%

3

8%

Achiever

70-79 points

1

3%

5

13%

Performer

60-69 points

2

6%

8

21%

Practicer

50-59 points

12

33%

4

11%

Explorer

Below 50 points

18

50%

18

47%

Total

36

100%

38

100%

Appendix 5

About the Business Sustainability Indices (BSI)

The BSI is a series of indices based on the assessments using the unique "Values – Process – Impact" (VPI) model developed and launched in 2015 by the Centre for Business Sustainability (CBS). Each index company is assessed in three main areas,namely Corporate Social Responsibility (CSR) values (Values),CSR management and CSR practices (Process),as well as the company's contributions to economic,social and environmental sustainability (Impact).

https://cbs.bschool.cuhk.edu.hk/research/

About the Centre for Business Sustainability (CBS)

The CBS is a collaboration between the Department of Management and the Department of Government and Public Administration at CUHK. Founded in June 2018,the CBS mission is to promote business sustainability as a viable and profitable business model through conducting innovative research on CSR and sustainability management practices in the region. CBS also aims to transfer the acquired knowledge of CSR applications to both academic and business communities. The centre's projects include Business Sustainability Indexes on listed companies and SMEs,local companies and corporations based in the Greater China Region.

https://cbs.bschool.cuhk.edu.hk/about/

About CUHK Business School

CUHK Business School comprises two schools – Accountancy,and Hotel and Tourism Management – and four departments – Decision Sciences and Managerial Economics,Finance,Management,and Marketing. Established in Hong Kong in 1963,it was the first business school to offer BBA,MBA and Executive MBA programmes in the region. Today,CUHK Business School offers 10 undergraduate programmes and 20 graduate programmes including MBA,EMBA,Master,MSc,MPhil,DBA and Ph.D. The School currently has over 4,600 undergraduate and postgraduate students from over 20 countries/regions.

In the Financial Times Executive MBA Ranking 2021,CUHK EMBA was ranked 19th in the world. In Financial Times Global MBA Ranking 2022,CUHK MBA was ranked 50th. CUHK Business School has the largest number of business alumni (over 40,000) among universities/business schools in Hong Kong – many of whom are key business leaders.

www.bschool.cuhk.edu.hk